PERFORMANCE AND FUND POSITIONING

The Fund increased by 6.2% in USD in the third quarter of 2025 (Q3-25). This is a continuation of the strong recent absolute performance, which is now filtering into the medium-term numbers, with the Fund up 22.4% p.a. in USD over the past three years.

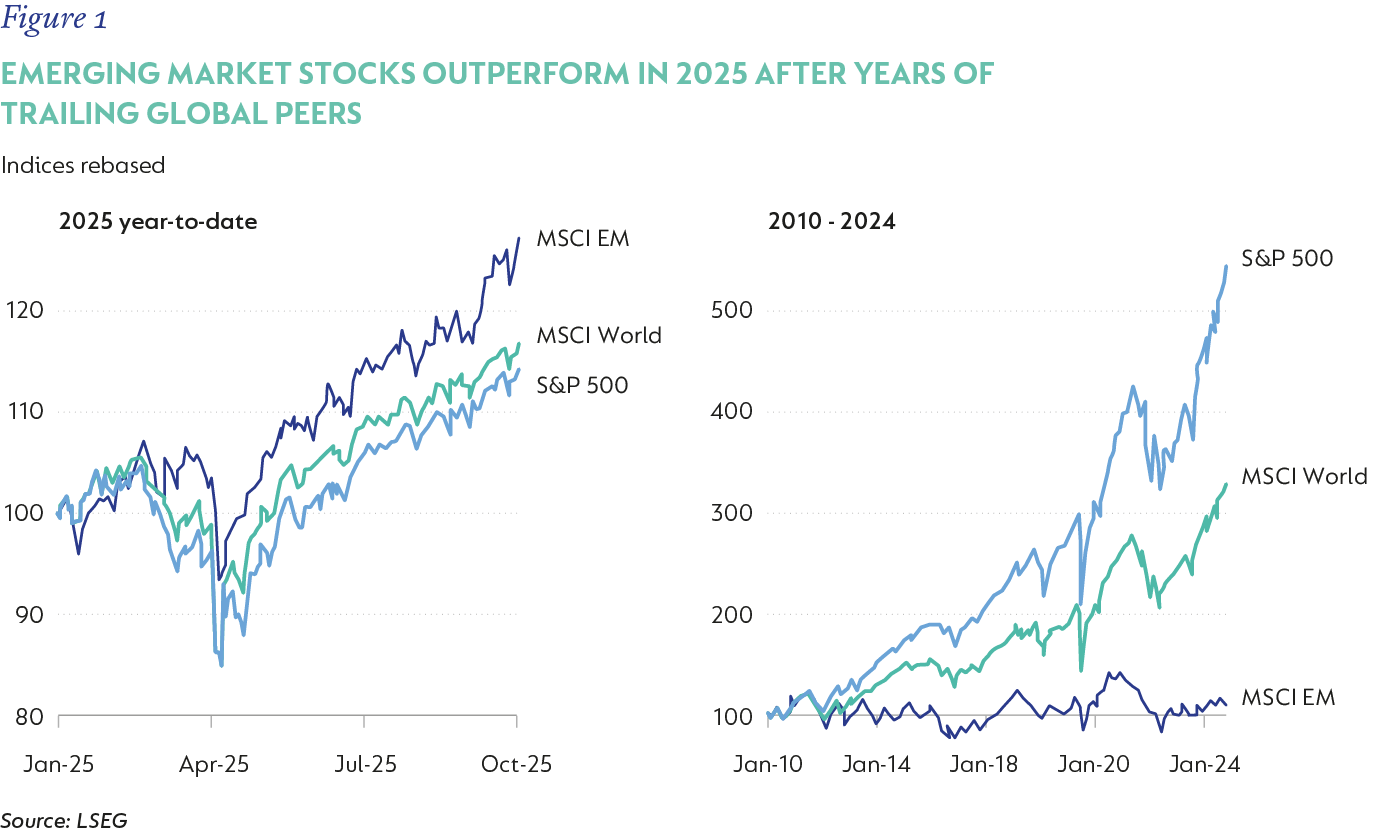

For the last 15 years, the US stock market has outperformed nearly all other markets, but this trend appears to have started to shift in 2025. Still, the Emerging Markets (EM) Index has a lot of catching up to do:

This does not spell the end of the US, and there remain attractive stocks that the Fund owns, and EMs will continue to command a higher risk premium, especially countries with volatile currencies and fiscal and/or political issues. What is encouraging, though, is that the breadth of returns is improving, with investors starting to look beyond just the US. We feel this positions the Fund well due to Coronation’s deep research capabilities (including 20 individuals dedicated to global markets), which span the entire globe.

The flexibility of the Fund allows us to allocate capital to where we deem the highest risk-adjusted returns to be on offer. While we are pleased with the medium-term results delivered by this approach, the Fund still contains what we consider very attractive investments across a diverse set of geographies and asset classes. To put this in context, the weighted average equity upside of the Fund at the time of writing is 49%, with the weighted equity five-year expected internal rate of return being 15% supported by attractive valuations as the weighted equity free cash flow yield for stocks owned is just over 4%. Over the past three years, the Fund has generated a positive return of 22.4% per annum (p.a.), 6.4% p.a. over five years, over 10 years a return of 8.7% p.a., and, since inception more than 26 years ago, 9.0% p.a.*

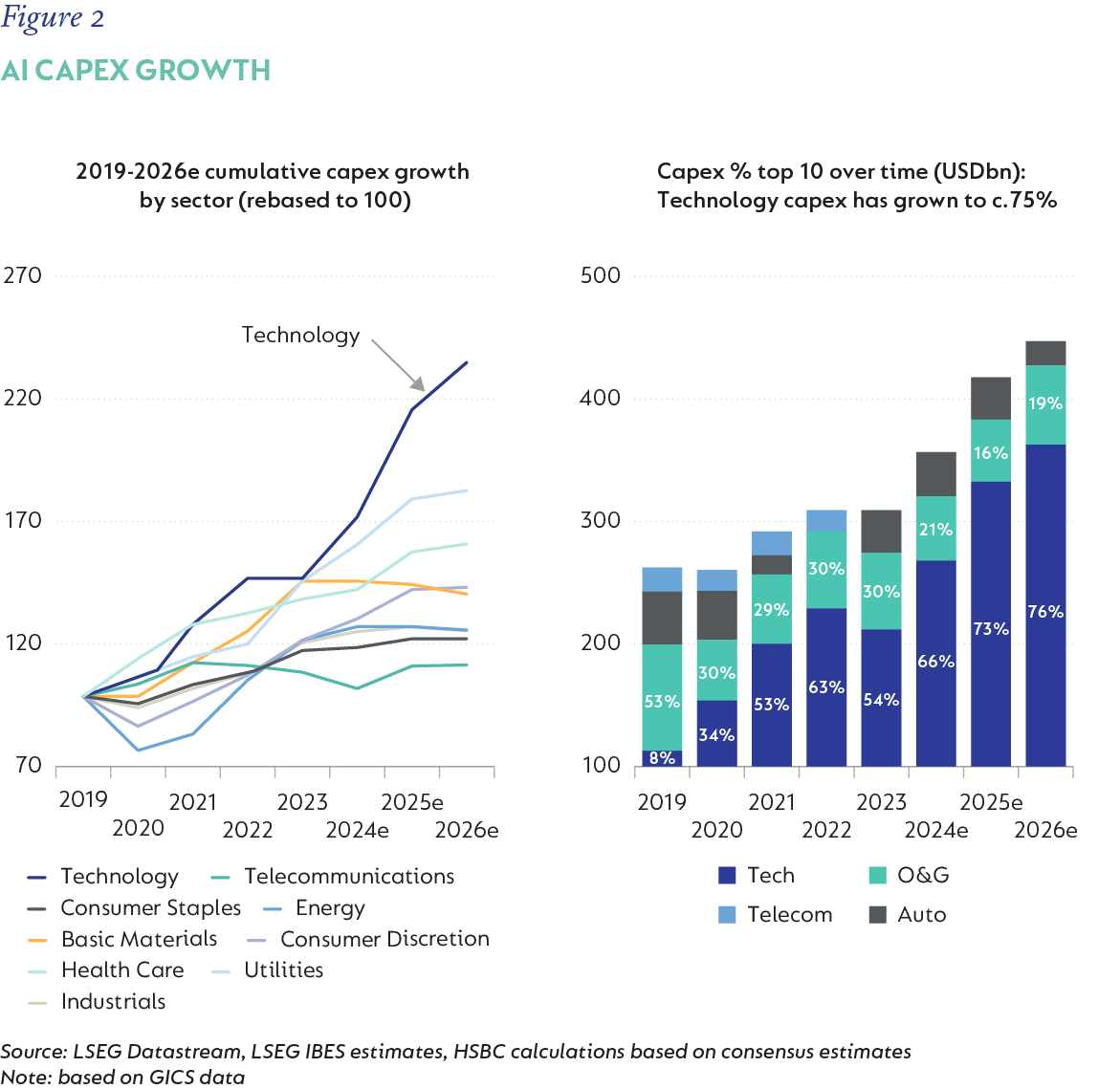

Global markets remain relatively buoyant, despite a backdrop of numerous risks. This is evident in the sustained rise in the gold price – up around 51% year to date in US dollars – reflecting heightened geopolitical tensions and fiscal concerns. These risks are compounded by a more inward-looking United States that appears to be stepping back from some traditional alliances. At the same time, a counter-narrative is taking shape. The rapid adoption of artificial intelligence (AI) is driving a surge in capital expenditure (capex), with AI-related investment now beginning to dominate corporate spending across many sectors.

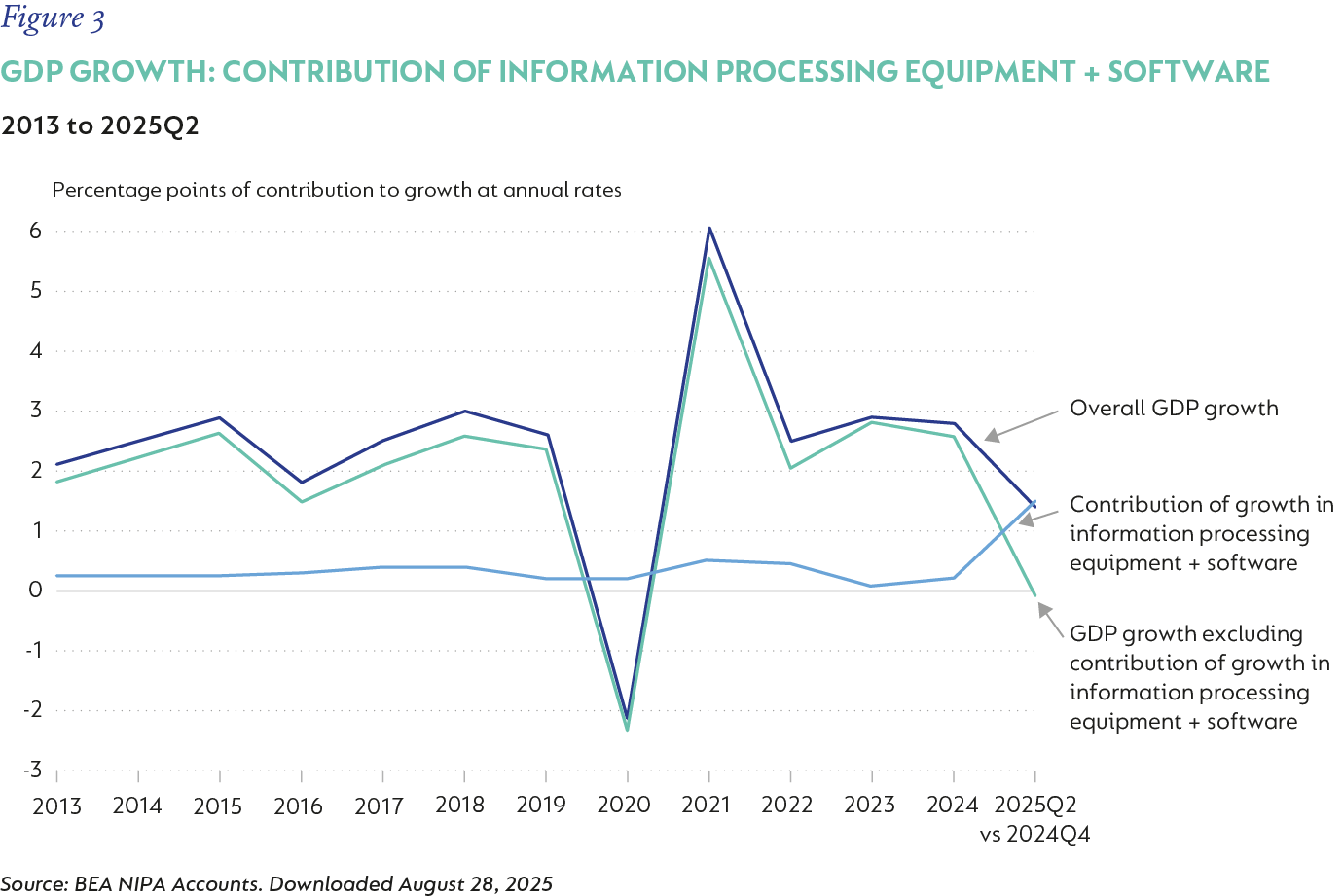

This is also having a macroeconomic impact – the following graphic (see chart below) disaggregates US GDP growth, and if you remove this spending, then the US is close to recession. The sustainability of this spend is a fiercely debated topic. Still, in just the last three months you have had OpenAI committing to spend an additional ~$1.5 trillion over the next few years, with the big question mark being how they will ultimately fund these commitments, especially considering that between Amazon, Microsoft, Google and Meta they are on track to spend a combined $320bn this year (for context), which is already 5 times larger compared to what they spent in 2019. AI is undoubtedly a revolutionary technology that is, and will have increasing real applications, but this level of spending does make one pause to apply a level of scepticism, as when such large amounts of capital are deployed into a space in a relatively short space of time, this does generally have fairly profound implications for subsequent returns.

During the quarter, the largest positive contributors were CATL, the dominant Chinese battery manufacturer (+57%, 0.81% positive impact), Naspers/Prosus (+23%, 0.69% positive impact), and AngloGold (+52%, 0.62% positive impact). The largest negative contributors were London Stock Exchange (-23%, 0.39% negative impact), Elevance Health (-20%, 0.39% negative impact), and LPL Financial (-14%, 0.35% negative impact).

The Fund ended the quarter with 73% net equity exposure, roughly 700bps lower than the prior quarter as we started to reduce equity exposure into a market that can be contextualised as very buoyant, with emerging signs of bubble-like behaviour in certain segments. While there remain numerous attractive stocks that continue to be held by the Fund, we are assessing each stock carefully while retaining a high valuation discipline, which becomes even more important in bull markets to achieve effective risk control. As has been a feature of the Fund since inception, having the flexibility to both increase and reduce equity exposure has allowed value to be added when equities are depressed or when valuations are elevated, making equities less attractive. This process remains driven by our valuation-focused investment philosophy, which is based on bottom-up research to determine a fair value of a business that can then be compared to its publicly quoted price.

Notable new buys within our equity holdings or increases in position sizes were Adidas and MercadoLibre. Adidas is the second-largest global sportswear company with ~6.5% market share. The global sportswear market has grown at 4.5% p.a. (USD) from 2009 to 2024, and it is forecast to continue to grow at this rate, driven by structural tailwinds (continuation of the athleisure trend, increasing awareness of the health benefits, and consequently increased participation in sports, rising purchasing power in EM). Under the leadership of Bjørn Gulden, who took over in 2023, the company has made impressive progress in turning around its operations and positioning for sustainable growth. We forecast high single-digit revenue growth over the next few years, with EBIT margins expected to expand from a low of 7.6% to around 12%. This should drive mid-20% EPS growth, which, given the starting valuation of 17 times earnings, appears highly attractive.

MercadoLibre is a business we have owned for many years at varying position sizes. They are a Latin American-based business operating in both the ecommerce and fintech markets, led by an exceptional management team that has continually grown the business ecosystem, thereby expanding their total addressable market and, in effect, the growth duration associated with the business. The share has recently come under pressure due to Argentine macro jitters (again) and some evidence of increasing competition in ecommerce in Brazil. Neither of these factors derails the fundamental investment case, and they have navigated them before. The business is rapidly expanding margins as years of heavy investment are harvested in their ecommerce business, which, combined with a growing and highly profitable fintech segment, has them trading on ~10 times earnings in five years’ time. We consider this very attractive, considering the growth runway at that point will remain robust, with the business being far from mature.

The Fund continues to hold bond exposure, which now sits at just over 9% at the time of writing, split between sovereign and corporate bonds. This bond exposure is up ~200bps compared to the prior quarter, with the main factor driving this being our purchase of TIPS (Treasury Inflation Protected Securities), which effectively protects against inflation coming in ahead of expectations. The thesis is that the market appears to have become too sanguine on inflation risks, notwithstanding tariffs starting to slowly filter into consumer prices. We continue to hold our bond exposure to Brazilian government bonds, which now represent 3.2% of the Fund at the time of writing and still yield approximately 14% in Brazilian Real, which remains attractive as Brazil sits with one of the highest real yields globally. Outside of the Brazilian government bonds held, we continue to hold a collection of foreign corporate credits, which, in aggregate, is providing us with a weighted yield in hard currencies of just over 5%, which remains attractive. We have limited exposure to real estate, with the balance of the Fund invested in cash, largely offshore.

2025 has been a very eventful year, marked by significant stock market volatility, which has largely benefited the Fund as it has leaned into its flexibility and varied equity exposure to take advantage of market dislocations while adhering to the long-held philosophy of being valuation-driven. There is now increasing evidence of bubble-like behaviour in certain segments of the market, which has increased our level of caution and driven equity exposure down. Notwithstanding this, we remain excited about the Fund’s prospects as we continue to uncover and own attractive stocks and bonds. Things can change quickly, and thus our focus remains on uncovering attractively priced assets versus trying to time markets, a core principle of Coronation and how the Fund has been run since its inception more than 26 years ago.

South Africa - Personal

South Africa - Personal