Investment views

Bond Outlook

"That men do not learn very much from the lessons of history is the most important of all the lessons of history." – Aldous Huxley, novelist, critic, and philosopher

The Quick Take

- Financial markets have stood firm in the midst of escalating geopolitical turmoil and political and governance concerns closer to home

- In SA, monetary and fiscal policy adjustments, while welcome, are but a band-aid over the structural fissure of low growth

- Flows into emerging market and SA bonds remain strong in the short term, but long-term fundamentals continue to weigh

- Long-term risks suggest a neutral weighting of SAGBs, and 5y ILBs offer attractive valuation and downside protection should the tide turn

The third quarter of 2025 (Q3-25) highlighted the delicate balance between geopolitics and markets. Rising tensions in the Middle East, renewed US trade protectionism, and South Africa’s governance challenges underscored persistent political risks, yet financial markets remained resilient. Global bonds rallied as the Federal Reserve Board (the Fed) cut rates for the first time this cycle and inflation trended lower. Emerging market bonds continued to benefit from structural resilience and ongoing policy rate cuts, with several central banks extending their easing cycles to support growth. Locally, South African (SA) assets displayed resilience despite lingering concerns around fiscal consolidation and the pace of inflation target reforms. This can be attributed to a more stable investor sentiment on the back of improved clarity from the Government of National Unity (GNU), contained inflation data, and increased expectations of further interest rate cuts.

The FTSE/JSE All Bond Index (ALBI) gained further ground in Q3-25, delivering a 6.94% return for the quarter and extending its 12-month performance to 14.51%. The SA 10-year bond yield tightened by a further 50 basis points (bps) during the quarter; however, performance was strongest in the maturities of greater than 12 years as the yield curve flattened (bonds in the 20-30-year area rallied by 10bps to 20bps more than the 10-year bond). Inflation-linked bonds (ILBs) staged a modest recovery, gaining 5.11% over the quarter, bringing their one-year return to 7.66%. This is still well behind nominal bonds but at least ahead of cash (1.76% quarter to date [qtd] and 7.56% over 12 months). The rand remained volatile but continued to strengthen against the US dollar, slightly outperforming its peers over the quarter. Continued US dollar weakness has bolstered returns from emerging market fixed income assets, which has helped local bonds outperform developed market bonds (the MSCI World Government Bond Index returned -2.32% qtd and 1.52% over 12 months in rands).

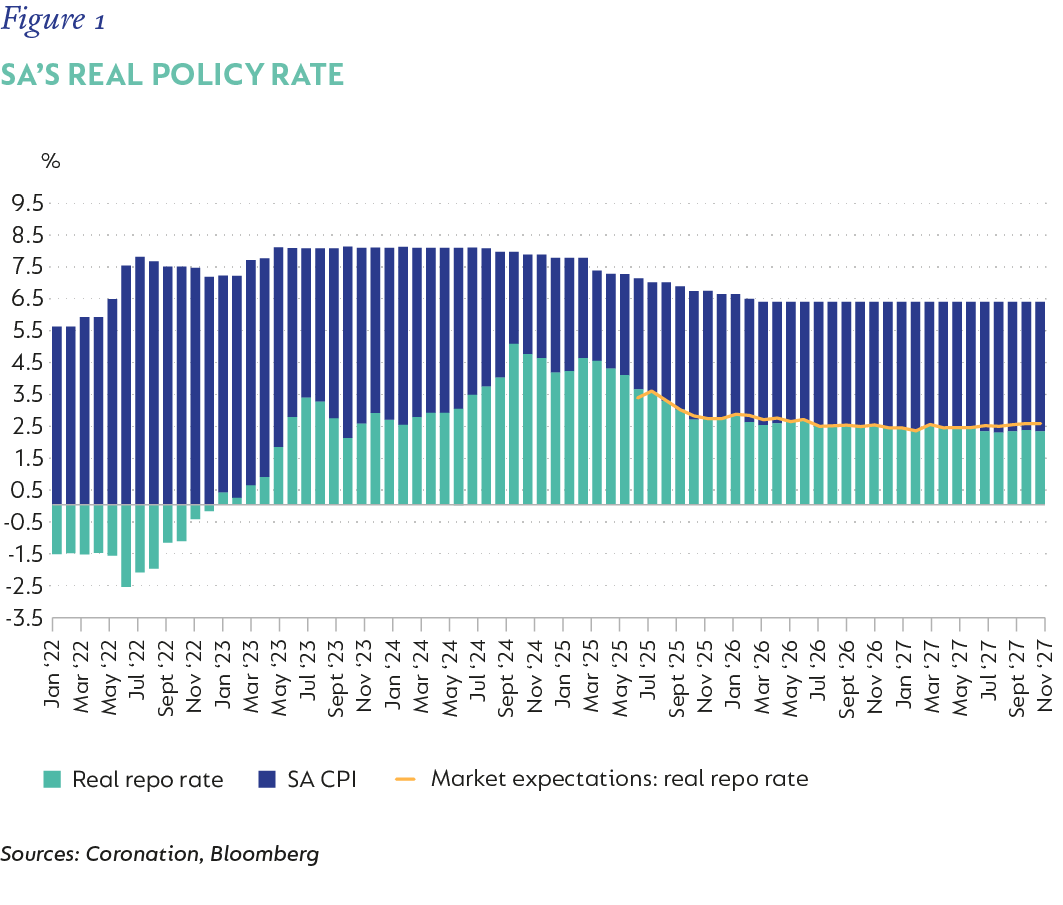

SHORT-TERM MEASURES ARE COLD COMFORT

In addition to external factors, local bond performance was helped by the South African Reserve Bank (SARB) Monetary Policy Committee’s July announcement that it was now targeting inflation closer to the lower end of the target band – i.e., inflation at 3%. This was made without the endorsement of National Treasury but was still well within the constraints of its mandate. We were hoping for a joint announcement, but the SARB seemed to believe that the time to act was now, given that inflation was closer to its preference; and it softened the blow with a further 25bps easing, bringing the repo rate to 7%. Since then, inflation has stayed close to the 3% level, surprising again to the downside in August, mainly due to weak demand-side pressure and softer food and rental inflation. This has caused much excitement in cash markets, which initially moved towards discounting a full 100bps of further cuts, before settling at a more gradual 50bps over the next year. Our own forecasts for inflation have moderated. We expect the peak in inflation at 4% (4.5% previously) in the first quarter of 2026, which we believe will give the SARB room to ease a further 50bps over the next year (in line with the market). We still expect inflation to average 4% over the next two years; however, even at 6.5%, the real repo still remains quite restrictive at 2.5%, which should assist the SARB in meeting its 3% inflation objective.

The longer term (> 3 years) outlook for government finances remains unchanged. Over the next year or two, we might have better fiscal outcomes as the GNU acts to reduce slippage by clamping down on governance; higher tax revenue, due to better SARS collections; and increased mining revenue, due to high metals prices. National Treasury has also started to embrace new funding strategies that include more floating rate note funding and introducing new bonds along the curve to reduce the funding discount. This is an improvement on the previously inefficient funding loop of tapping bonds trading at a discount, which generated less cash than the face value of the nominal bond issued, resulting in the need for increased bond issuance. More can still be done in order to encourage the recent curve flattening by reducing fixed rate issuance in lieu of more floating rate issuance, which might help lower the cost of funding. This will be especially beneficial if the SARB continues to ease the repo rate as it moves closer to anchoring inflation at 3%. In addition, National Treasury has built significant cash balances by overissuing in the current fiscal year, which could provide even more room for an outright reduction in issuance, further motivating lower long-term funding rates. Unfortunately, these measures are just a fiscal stopgap and simply buy time in the interim to stave off our day of reckoning. Higher real economic growth above 3% is what is really needed to arrest debt accumulation and right the ship. This requires structural reform and quick implementation thereof.

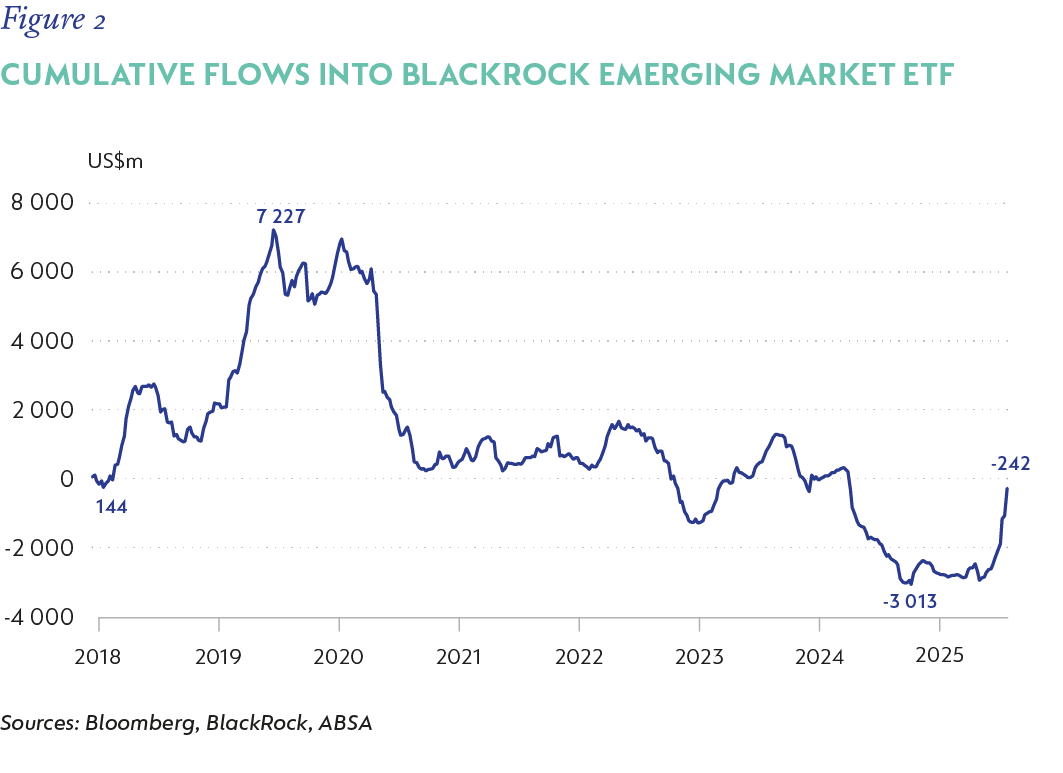

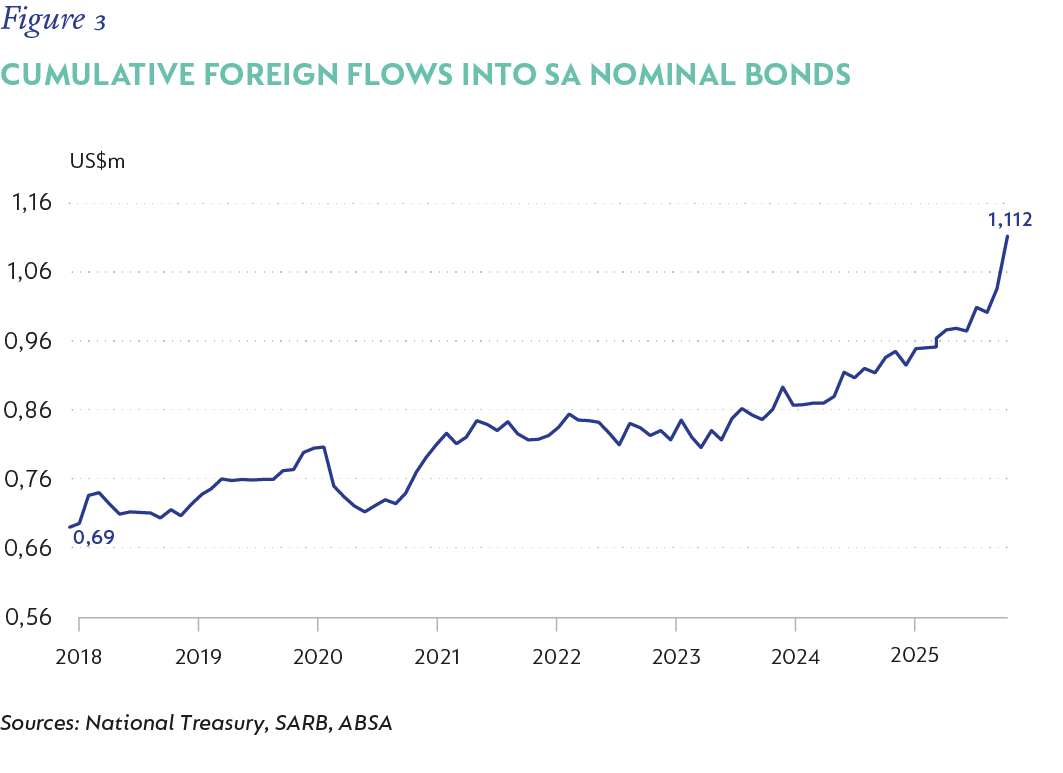

GLOBAL DISLOCATION, LOCAL GAIN

SA bond yields already had an impressive rally as at the end of the second quarter of this year, given all the uncertainty permeating global markets at the time. However, since then, the rally has gathered steam, with the SA 10-year government bond now sitting close to 9%. Part of this has been a result of local concerns around politics and policy, which have subsided but not disappeared. However, in large part, the last rally was primarily due to external factors. Around the beginning of September, J.P. Morgan cut the weight of the largest bond issuers in the J.P. Morgan EMBI Global Diversified Index – its flagship emerging market index – capping issuers at 9%. SA bonds were a major beneficiary as the reweighting saw c. R50 billion worth of passive flow into SA government bonds (SAGBs). This came at an opportune time, as flows into emerging-market dedicated funds from global capital allocators saw the most significant increase since Covid. (Figure 2 shows flows into a generic BlackRock exchange-traded fund as a proxy). SA’s benefit was twofold, as foreign holdings of SA bonds soared over the last few months, and, although foreign holdings as a percentage of outstanding SA nominal debt remain lower than its peak (26.8% versus 49%), cumulatively these flows are at their highest levels since the Covid outbreak.

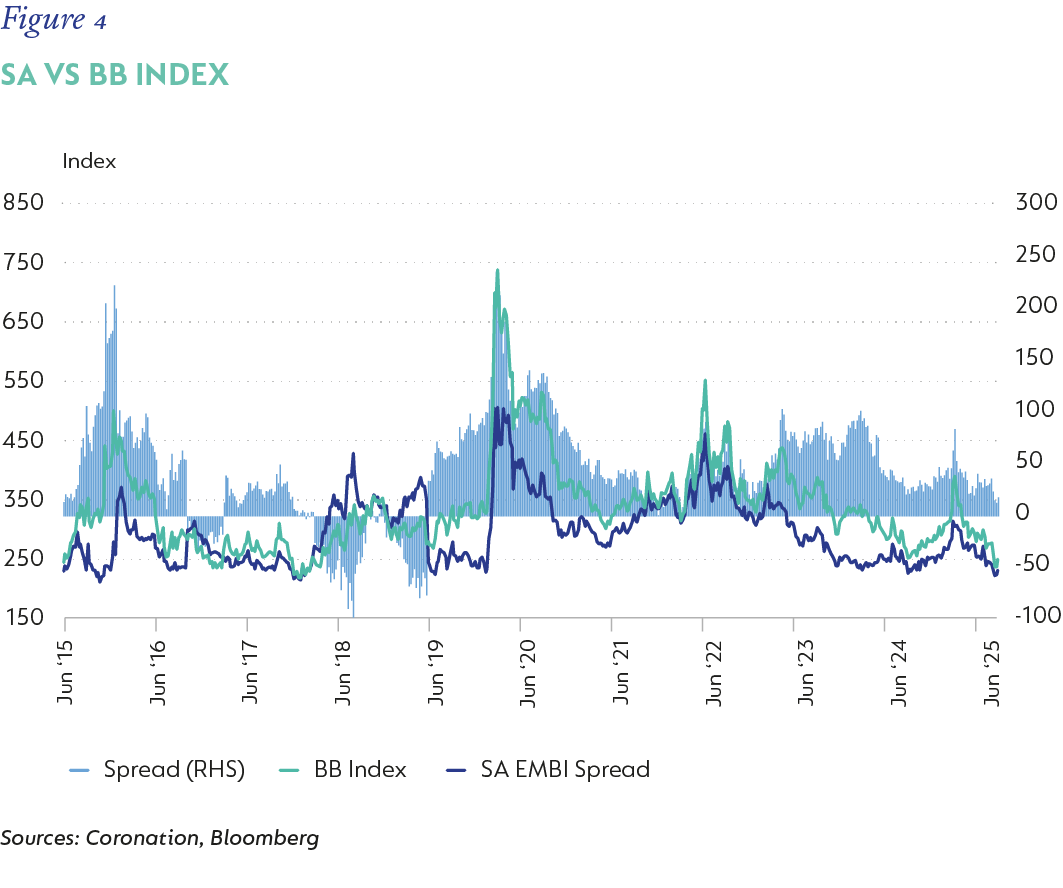

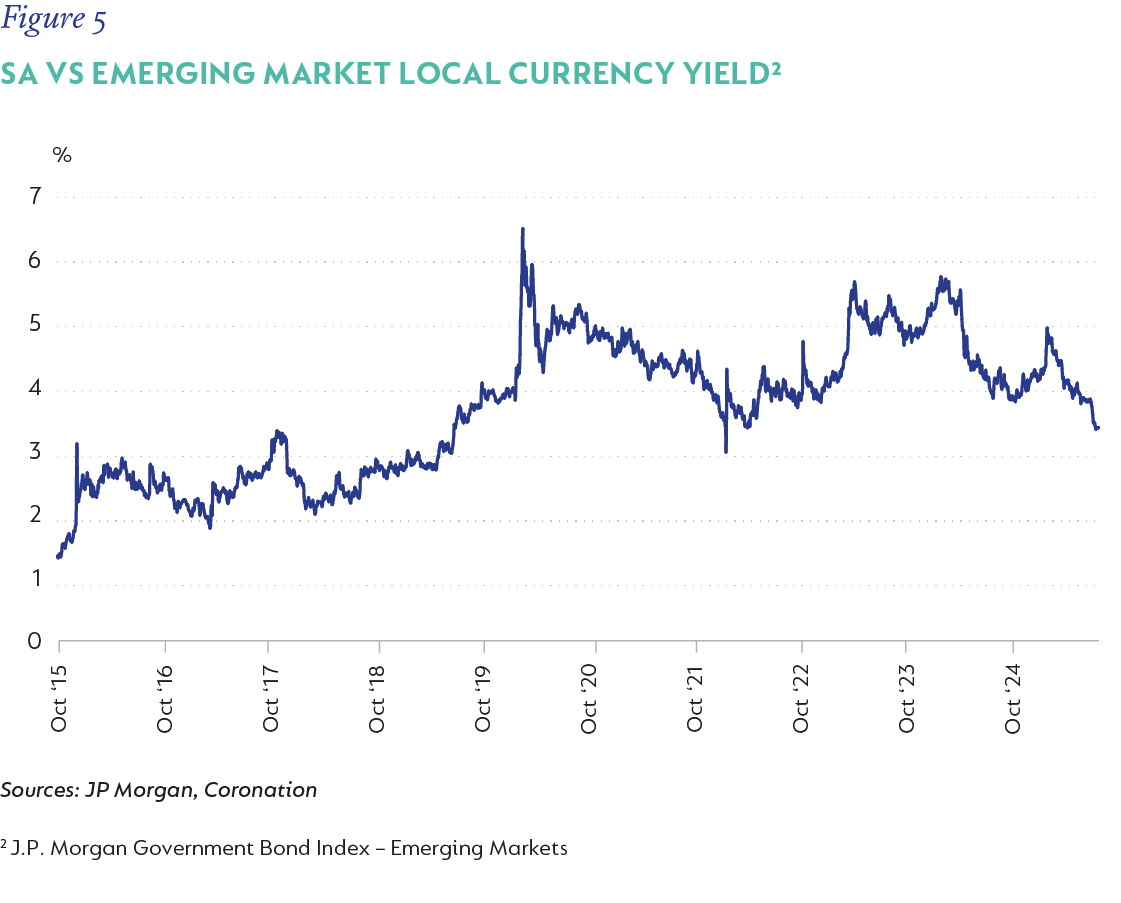

These indiscriminate flows into emerging market debt and other spread products[1] has resulted in a significant tightening in spreads. The BB Index (Figure 4) is now at its tightest/lowest spread in 10 years, dragging SA’s sovereign spread down with it. SA has also continued to outperform its emerging market and Bloomberg (BB) peer group. The spread between SA and the Bloomberg Global Aggregate Bond Index (BB Index) is almost as tight as it was when SA was an investment-grade (IG) country (SA is now rated sub-IG). SA’s local bond yields, which, although still high from an absolute perspective, have seen outsized compression relative to its peers, and the spread (Figure 5) is now as tight as it was pre-Covid.

WHAT IS REALLY GOING ON?

When market exuberance is as high as it is, it is worth taking a step back to help provide a sober perspective on the current yields on offer. In support of lower bond yields are:

- A conducive global environment in which central banks, including the Fed, are moving towards a more accommodative monetary policy.

- Uncertain US policy direction and poor fiscal backdrop that is supporting a weaker dollar and, hence, increasing the attractiveness of emerging market local currency debt.

- A change in local inflation targeting that would support a lower repo rate over time.

- High metal prices, which could support higher revenue and a better fiscal deficit over the next one to two years.

However, on the negative side are the following:

- Global spread products, including emerging market spreads, are at historically tight levels.

- SA inflation will average closer to 4% than the targeted 3% over the next two years, making a sustained move to a lower 3% target difficult to achieve, hence keeping the repo rate above the new lower neutral.

- SA growth will struggle to breach 2% over the next three years and remain well short of the 3% required to stabilise debt and create employment.

- The GNU will face a major test going into the local government elections in 2026 and could destabilise if the ANC loses further ground.

- There is still significant uncertainty around a possible successor to Cyril Ramaphosa in 2027, with all current candidates embroiled in some corruption scandal or another.

- The valuations of SAGBs are not cheap, and they are trading through their long-term fair value, having already significantly outperformed peers.

The momentum behind the current flows into emerging markets and SA is quite strong, and it is almost impossible to consider what would reverse it. This suggests that the current momentum could sustain for a bit longer. However, although shorter-term indicators suggest more room for a rally, the longer-term fundamentals that drive structural shifts in bond markets remain unsupportive.

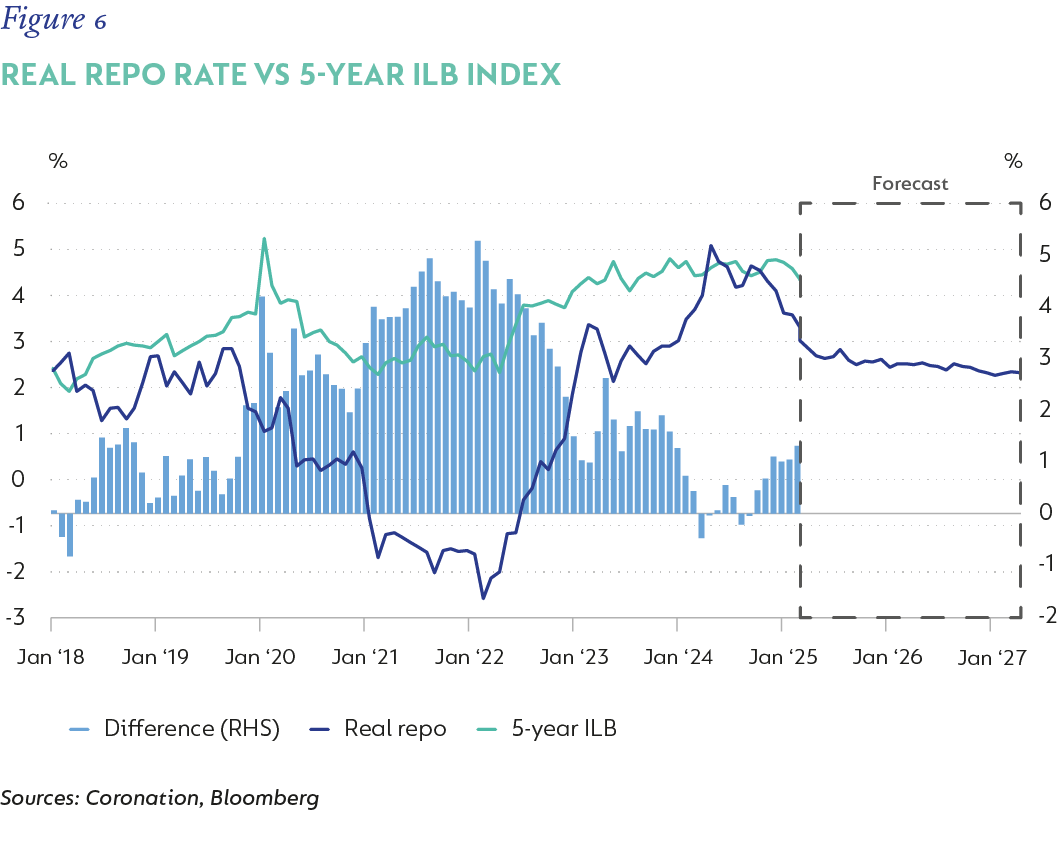

Despite the recovery in ILBs over the last quarter, they still remain poor performers relative to cash and bonds over the long term. The general assumption is that the lower inflation target should result in a poor outcome for ILBs. However, it is important to differentiate between the various parts of the ILB curve and their sensitivity to policy rates. The 5-year ILB is very sensitive to the real policy rate. Over the last few years, as the SARB has maintained the real policy quite high to force inflation lower. This has acted as a floor for how low 5-year ILB yields can go. Our expectation is for the real policy rate to move lower from here over the next year as the SARB reduces the repo rate and inflation heads slightly higher, and 5-year ILBs (or shorter) could likely track lower as well (Figure 6).

The current 5-year ILB is at 4.3% versus the coincident real policy rate at 3%. If the real policy rate does decrease to 2.5% as we expect, it makes sense for the 5-year ILB (or shorter) to track lower by at least 50bps. This will put the total return at 9%, even if inflation averages 3% over the period (9.5% if inflation averages 3.5% over the period), which will mean the 5-year nominal bond will have to rally by more than 50bps in order to keep up. This is unlikely given that we only expect the repo rate to move lower by another 50bps over the next year. Therefore, 5-year ILBs still make an attractive alternative to allocating to shorter dated nominal bonds. They also provide portfolios with inherent protection in the event of a risk-off environment, due to their lower correlation to nominal bonds during these periods.

The global landscape remains uncertain; however, emerging markets have continued to outperform developed markets. SAGBs have flourished as local anxiety has eased and expectations for a lower inflation target has bolstered prospects for a lower repo rate. They are now trading slightly below fair value. Global bond flows have turned more supportive of emerging markets, given their relatively cleaner balance sheets, and could support further compression in bond yields if that trend sustains its momentum. The stack up of risks suggests some caution is warranted in allocating more capital to SAGBs at current yields; however, shorter maturity ILBs offer an attractive allocation alternative, given the possibility of a lower real policy rate. As such, we would advocate for a neutral position in SAGBs, weighted more towards the 10- to 12-year area, with a decent allocation to shorter dated ILBs in bond portfolios.

[1]Spread products: fixed income securities that trade at a yield spread over sovereign bonds, e.g. emerging market debt and corporate bonds

South Africa - Personal

South Africa - Personal