Personal finance

Corolab Investment Guide: Long-term investing

How to invest your long-term money for growth in a tax-efficient manner

Overview

When you invest for the long term, you’re usually working with one of two pools of money:

> Retirement savings: money intended to fund your life after you stop working. You generally cannot, or should not, access it before retirement. This typically sits in your employer’s pension or provident fund, or in a retirement annuity (RA) you contribute to yourself.

> Discretionary savings: additional long-term money you choose to invest beyond your retirement contributions. This pot is flexible and can support goals like a child’s education, early retirement, or building generational wealth.

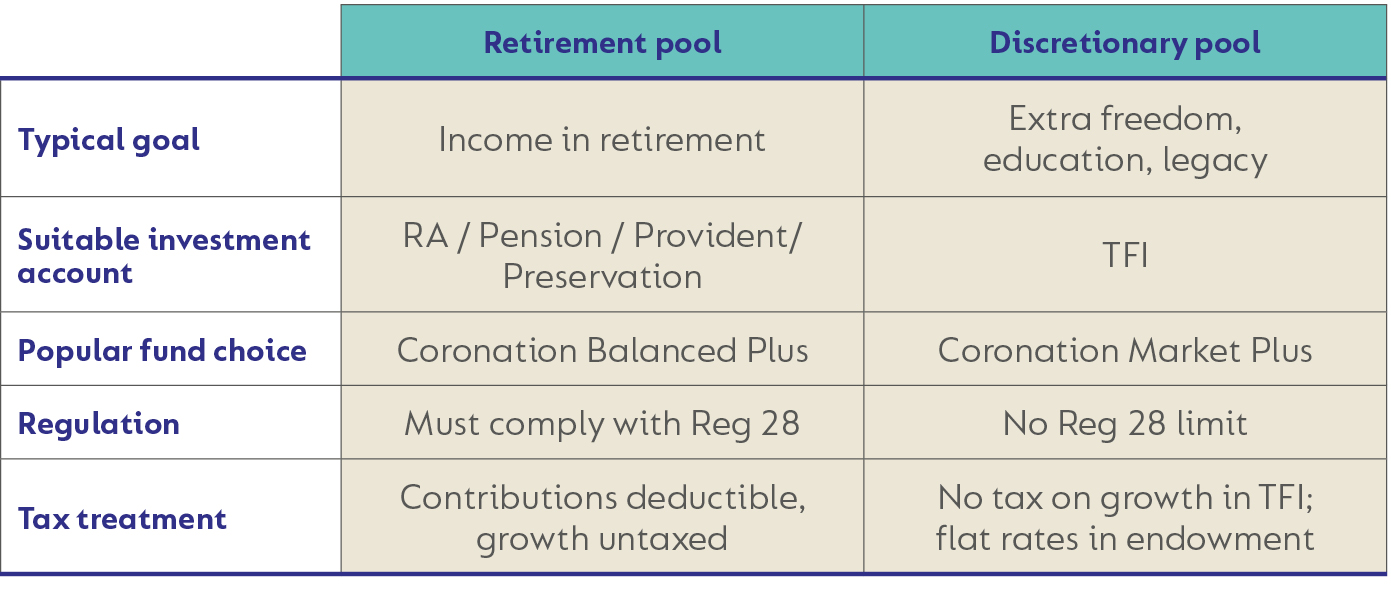

In this Corolab, we explore how to invest both pools of long-term money for growth, using two of Coronation’s multi-asset funds. For your retirement savings, we focus on using Coronation Balanced Plus inside an investnent retirement account such as an RA. For your discretionary savings, we look at Coronation Market Plus, held in a tax-efficient investment account such as a Tax-Free Investment (TFI).

Two types of long-term money

Both of these pools of money (retirement savings and discretionary savings) need the same basic ingredients to succeed: they must grow faster than inflation over time, and they should be invested as tax-efficiently as possible so that more of the return stays in your hands. But the rules, investment accounts, and trade-offs are different.

- Retirement savings are governed by specific legislation and asset class limits and offer attractive tax benefits in exchange for locking money away until retirement.

- Discretionary savings are not subject to those same limits and are generally easier to access, but you have to pay more attention to the impact of tax on interest, dividends, and capital gains along the way.

The principles of long-term investing

Whether you’re investing retirement money or discretionary money for the long term, the investment principles are the same: you need growth assets, time, and a skilled asset allocator.

Equities as the growth engine

If your investments only keep up with inflation (rising prices), you will not be building real wealth – you will simply be breaking even. Over decades, inflation quietly but relentlessly erodes the purchasing power of your savings.

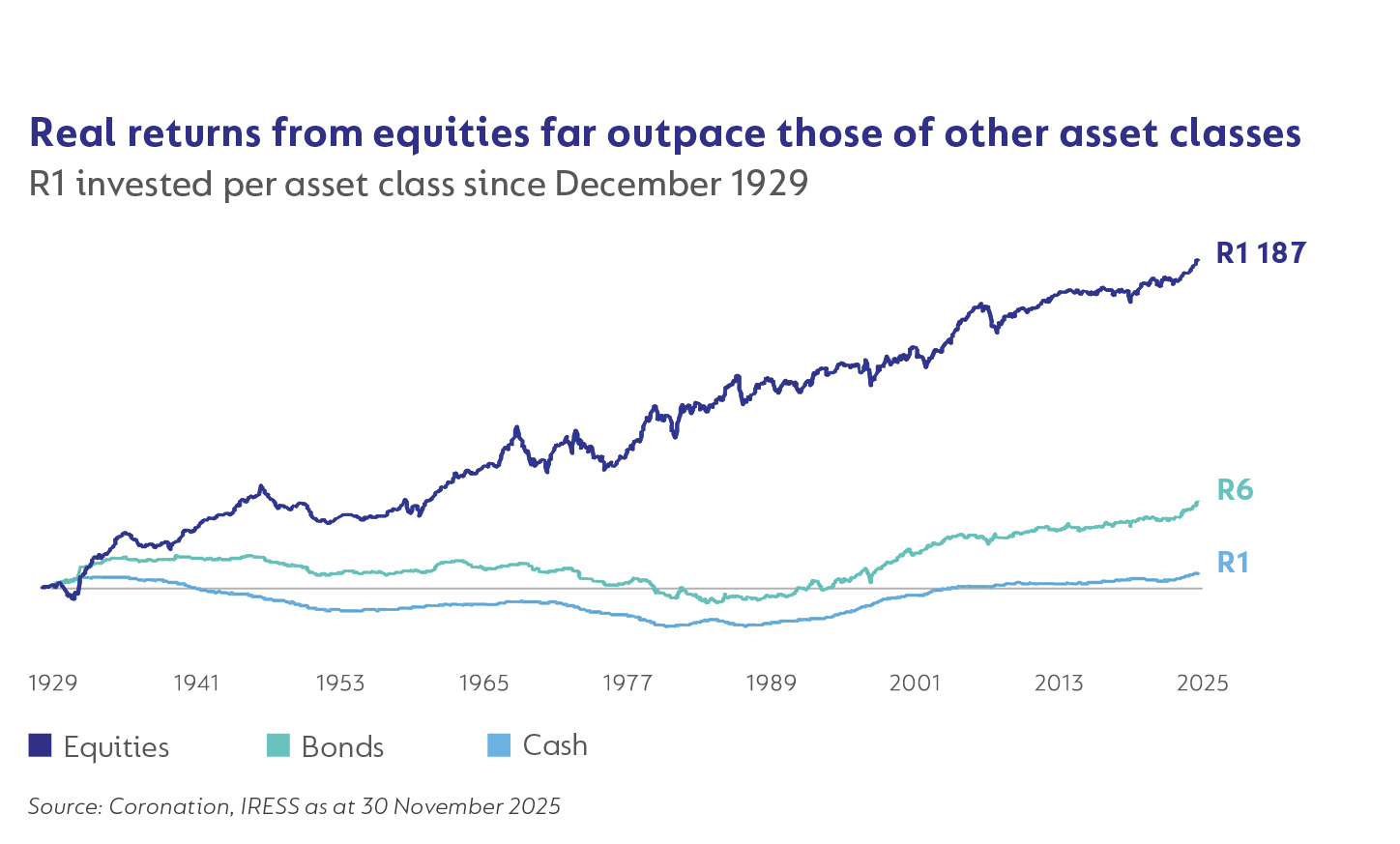

But history is clear on one point: over long periods, equities (shares in companies) have done the heavy lifting in growing investors’ wealth. In South Africa, shares have delivered significantly higher returns than bonds or cash after inflation over many decades. Bonds have tended to offer only modest real returns, and cash even less.

This outperformance does not come for free. Equities are volatile. They will give you strong years and weak years, sometimes back-to-back. That can be unsettling if you only look at your investments in one- or two-year intervals. But if your goal is still many years or decades away, the volatility is the short-term price you pay for the higher expected long-term return that equities can offer.

For both your retirement and discretionary money pools, this means including a meaningful allocation to shares. Without that growth exposure, it becomes very difficult to outpace inflation in a way that materially improves your future outcomes.

Think in decades, not years

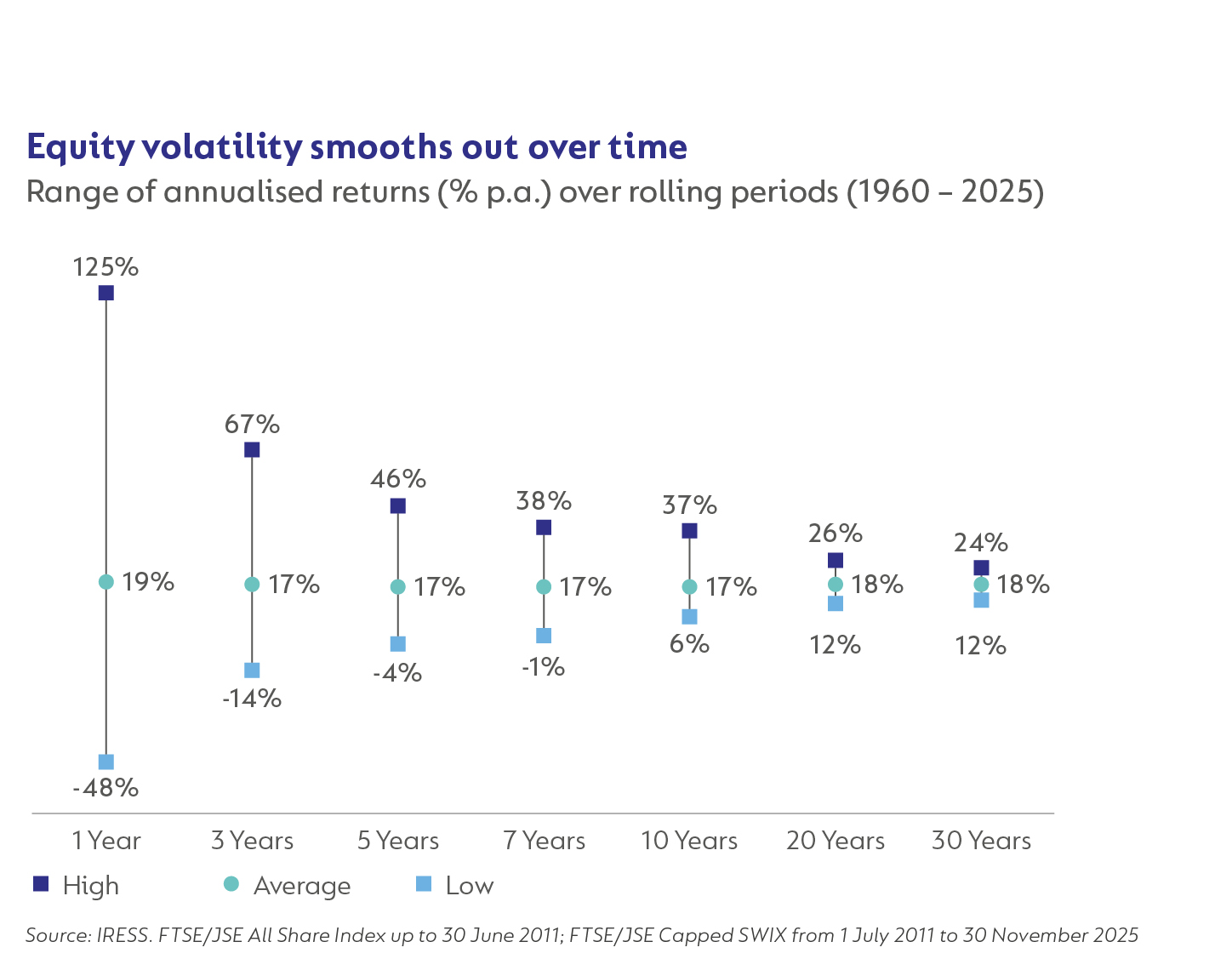

In the short term, markets move around for all kinds of reasons: economic data, politics, interest rates, sentiment. Over a single year, equity returns can be extremely wide – strongly positive, or sharply negative. As you lengthen your time horizon, however, the picture changes. The range of possible outcomes narrows, and the risk of a negative real return falls substantially.

Thinking in decades rather than years is one of the biggest mindset shifts a long-term investor can make. If you know that your goal is 20 or 30 years away, you can treat short-term market swings as noise rather than as a signal to change course. That makes it easier to stay invested through the inevitable ups and downs, and that discipline is often where much of the ultimate reward comes from.

Staying invested with multi-asset growth funds

For most investors, sitting in a fully invested equity portfolio is emotionally challenging, even if the long-term picture looks attractive. At the same time, locking everything away in cash or low-risk income assets almost guarantees that you will struggle to outperform inflation meaningfully.

Multi-asset growth funds offer a compelling middle ground. Funds like Coronation Balanced Plus and Coronation Market Plus invest across shares, bonds, listed property, and cash, both locally and offshore. They aim to deliver inflation-beating returns over time, while smoothing out some of the extremes of pure equity investing. Our global investment team can tilt between different asset classes worldwide as valuations and opportunities change, rather than being forced to stay fully invested in one jurisdiction regardless of conditions.

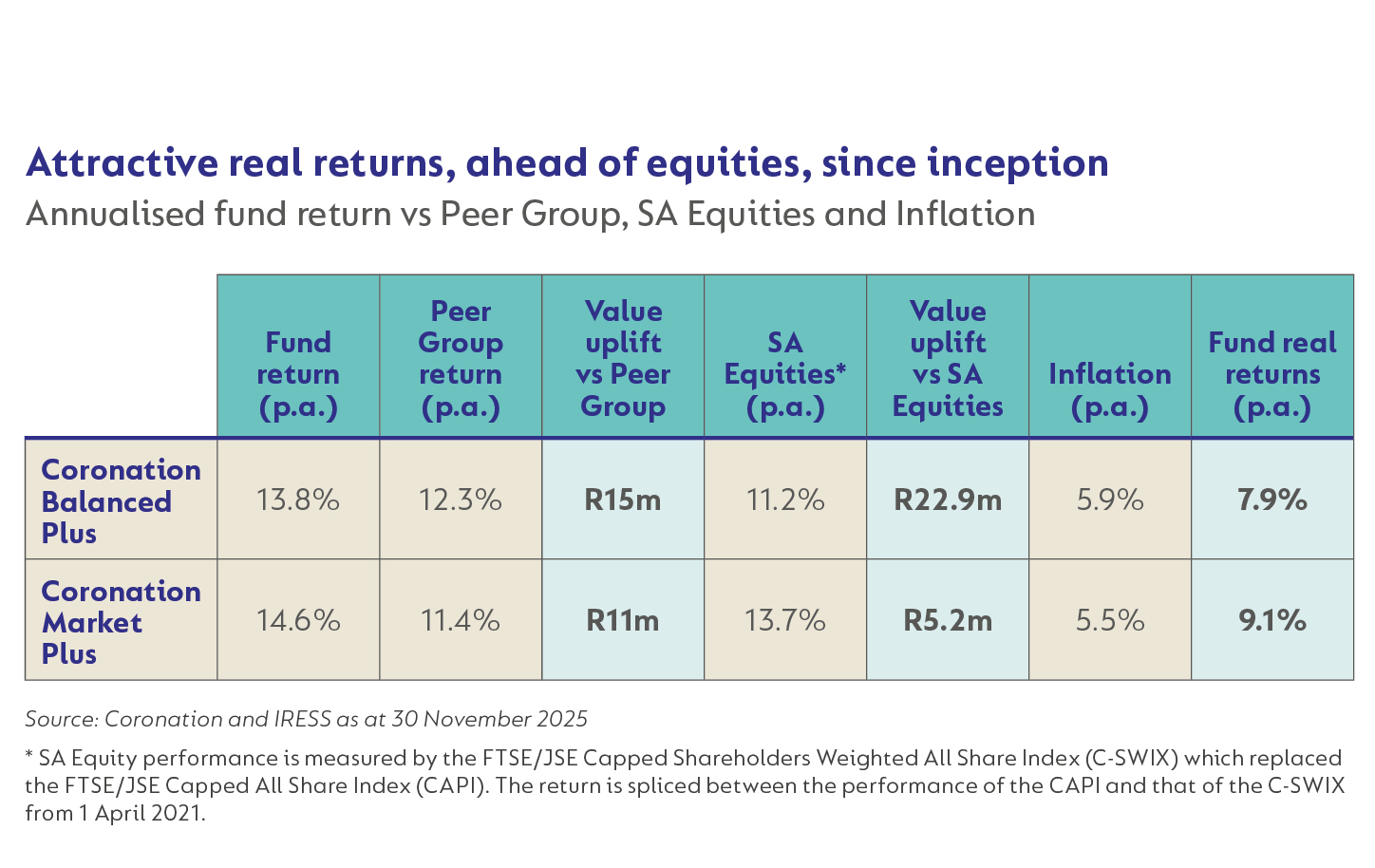

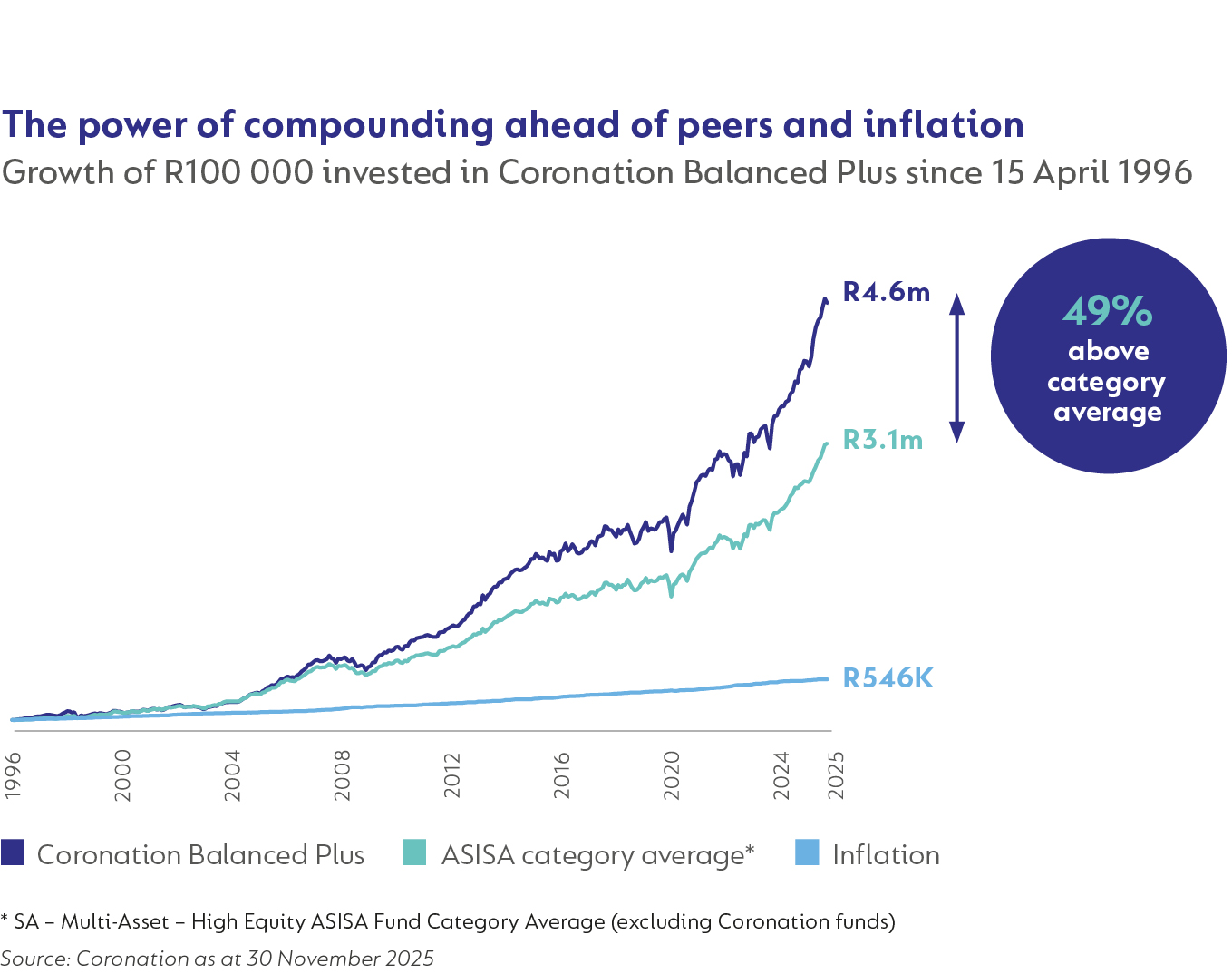

Over the long term, this combination of growth assets, diversification, and active asset allocation has added meaningful value for investors. The specifics will differ by fund and period, but the principle remains constant: a carefully managed multi-asset portfolio can help you stay invested and capture long-term growth in a more balanced way. This outcome is highlighted in the table below.

Investing your retirement savings

Your retirement savings is usually the single most important asset you will ever build. It is the money that must one day pay for your rent or bond, groceries, healthcare, and whatever gives your life joy and meaning in retirement. Because of that, getting both the investment choice and tax efficiency right can make an enormous difference.

Coronation Balanced Plus as the core retirement engine

For investors saving for retirement, Coronation Balanced Plus is designed to serve as a core long-term holding. It is a growth-oriented multi-asset fund that complies with Regulation 28, which governs how retirement savings may be invested. Within these limits, the fund aims to maximise long-term returns by investing in a blend of local and global shares, bonds, listed property, and cash.

The Fund can hold up to 75% in equities, while still maintaining meaningful diversification and risk management. It also has the flexibility to invest offshore up to the prevailing Regulation 28 limits, which not only gives your investment access to a much broader opportunity set but also improves overall risk.

Over almost three decades, Coronation Balanced Plus has delivered real returns ahead of inflation and ahead of the average fund in its high-equity category. Beating the peer group by just over 1% per year may not sound significant, but compounded over nearly 30 years, it is the difference between your money growing 31-fold vs 46-fold before inflation – a powerful illustration of what consistent added value can do over time.

In short, Coronation Balanced Plus is intended to be a well-diversified, actively managed growth portfolio suitable for the long-term needs of retirement savers.

Using a retirement annuity to boost tax efficiency

Choosing the right fund is only part of the story. The investment account you use to hold that fund also matters. This is where Retirement Annuities (RAs) come in.

An RA is a personal retirement savings account that allows you to invest for retirement in a tax-efficient way. If you are self-employed or do not belong to an employer retirement fund, an RA may be the main vehicle you use to save for retirement. Even if you already contribute to a pension or provident fund through your employer, an RA can be used to top up your retirement savings and take further advantage of the tax benefits.

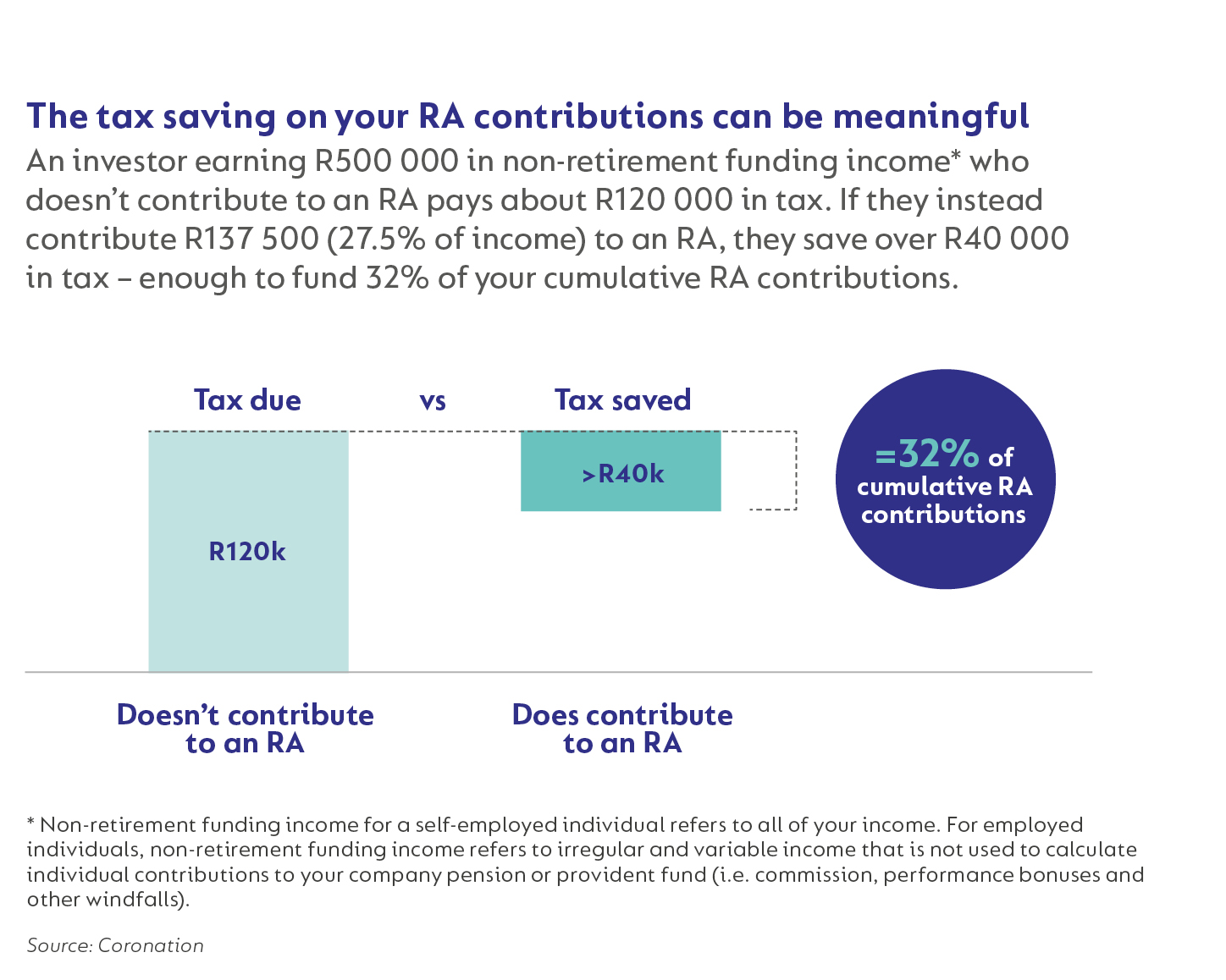

The key advantage of an RA is that contributions are generally tax-deductible up to certain limits. This means that by contributing to an RA, you can reduce your taxable income and, in turn, your tax bill. In practical terms, SARS is effectively funding part of your retirement contribution. Inside the RA, your investment grows tax-free on interest, dividends, and capital gains, allowing compounding to work on the full gross return rather than the after-tax remainder.

There are trade-offs. Money in an RA is meant for retirement, and access before then is very limited, subject to the two-pot rules and guidelines. The investments underlying an RA must also comply with Regulation 28, which sets maximum exposure levels to different asset classes, including equities and offshore assets. Coronation Balanced Plus is managed within those limits, which makes it a natural fit for an RA.

A simple example can be powerful here. Consider an investor who makes a sizeable RA contribution and compares the tax payable with and without that contribution. Showing the difference in rand terms – the amount of tax saved – helps bring home the point that the tax system is effectively contributing to your retirement pot when you use an RA wisely.

Putting it together

When you invest your retirement savings, you want two things working for you simultaneously: a proven growth engine and a tax-efficient investment account. Coronation Balanced Plus provides a diversified, actively managed portfolio designed to deliver long-term real returns within the rules that govern retirement money. An RA offers tax advantages on the way in and on the growth accumulated while you are invested. Together, they can materially improve your chances of reaching a comfortable retirement, provided you contribute enough and stay invested through cycles.

Investing your discretionary long-term money

Your discretionary savings is the money you invest by choice, not because a rule or employer requires it. It may be earmarked for specific long-term goals like education, supporting family members in the future, buying a second property, or simply ensuring that you have more options available later in life. You might also use this money pool to build wealth that can be passed to future generations.

Because this money sits outside formal retirement products, it is not constrained by Regulation 28. That gives you more flexibility – but it also means you need to pay attention to the tax implications of where and how you invest.

Coronation Market Plus as a high-conviction long-term solution

For discretionary long-term investors who prefer a single, diversified, actively managed portfolio, Coronation Market Plus is designed to fill that role.

Like Coronation Balanced Plus, Coronation Market Plus is a multi-asset growth fund investing across South African and global shares, bonds, property, and cash. The key difference is that Coronation Market Plus is not bound by Regulation 28 limits. This means it can allocate more to growth assets, such as equities, and increase offshore exposure when our global investment team believes the opportunities justify it. The aim is to generate strong, inflation-beating returns over the long term for investors who are comfortable with some volatility along the way.

Coronation Market Plus is intended to be a complete discretionary portfolio – not just a building block. For many investors, it can serve as the main home for their long-term discretionary savings.

Amplifying compounding with a tax-free investment

Even in your discretionary pool of money, investment account choice matters. One of the most powerful tools available to South Africans is the Tax-Free Investment (TFI).

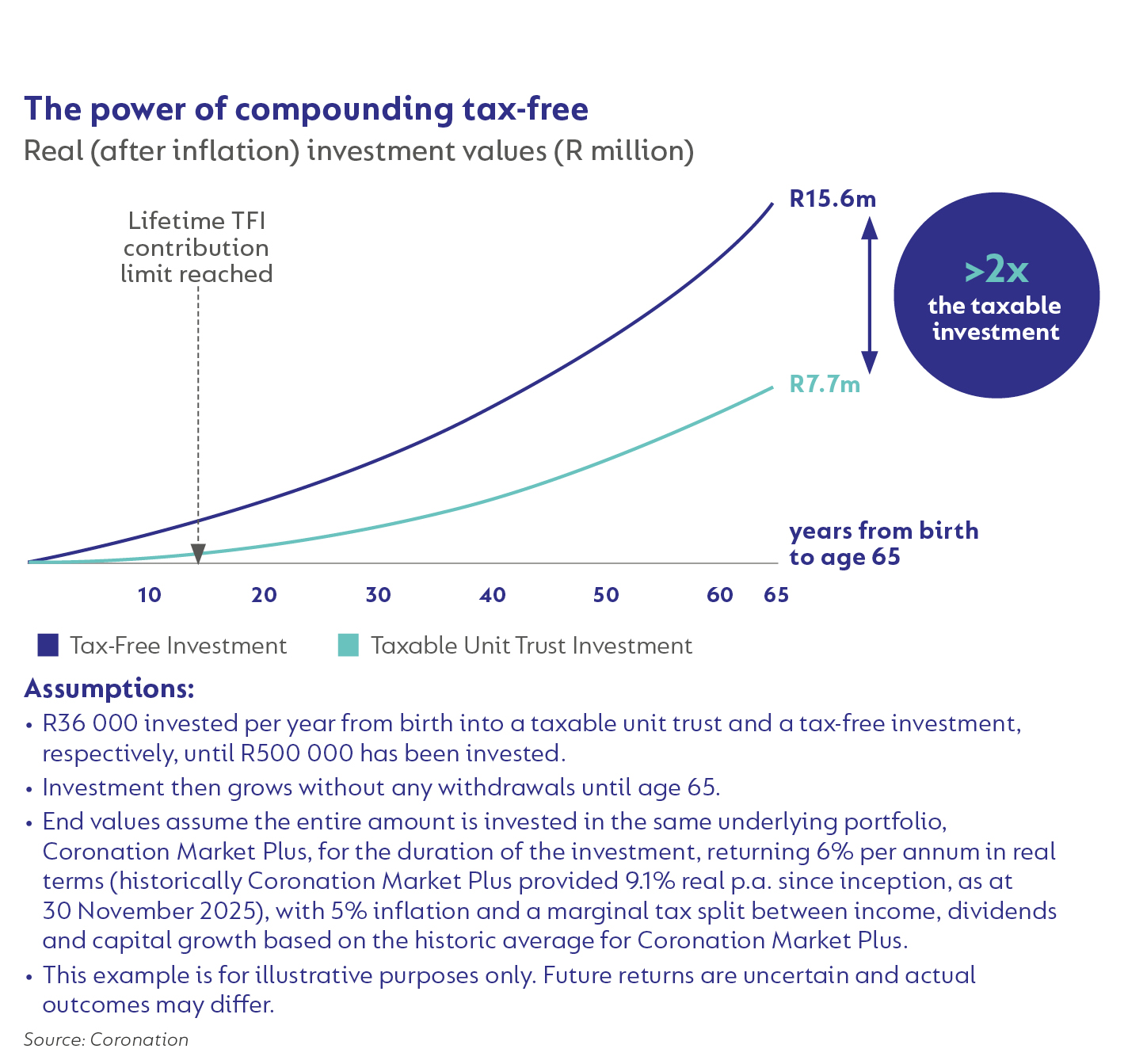

Within a TFI, you do not pay tax on interest, dividends, or capital gains. That means every rand of return can stay invested and keep compounding, rather than being reduced by annual tax. Over long horizons, the difference between compounding on a pre-tax versus after-tax basis can be very large.

There are, however, contribution limits. National Treasury sets the maximum you can invest each year (R36 000) and over a lifetime (R500 000). Withdrawals do not reset these limits: once you have used your annual or lifetime allowance, you cannot contribute more. That is why a TFI is best used for money you can genuinely leave invested for the long term.

A practical way to use a TFI is to house a growth-oriented fund like Coronation Market Plus inside it. You then get the benefit of the fund’s multi-asset growth strategy plus the tax advantages of the TFI wrapper.

An illustrative example shows how powerful this can be. Imagine a parent or grandparent investing the maximum annual TFI allowance for a child from birth until the lifetime limit is reached, and then leaving that investment untouched until the child reaches retirement age. Under reasonable assumptions about investment returns, inflation, and the tax drag in a regular taxed investment, the TFI investment could end up worth roughly twice as much in real (inflation-adjusted) terms as the same portfolio held in a fully taxable unit trust. The exact numbers depend on market returns and tax rules over time, but the principle is clear: removing tax on growth and when you withdraw significantly boosts long-term outcomes.

It is important to stress that this is a patient and disciplined scenario designed to illustrate the power of tax-free compounding. Most people will not be able to invest from birth or leave money untouched for that long. The point is that even if you start later and contribute for fewer years, a TFI can still materially improve the outcome of your discretionary long-term savings.

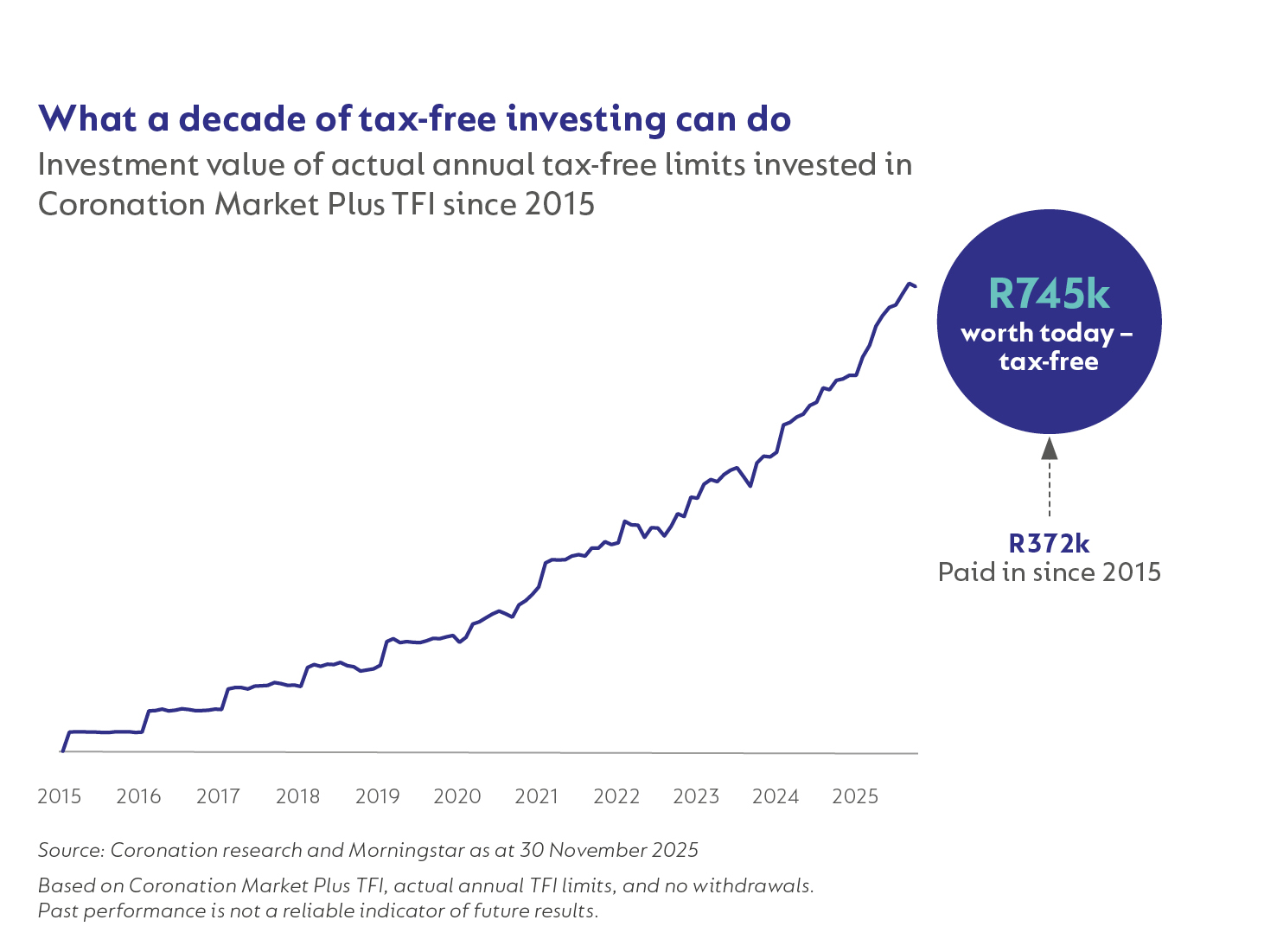

A real-world case study

While the very long-term TFI example is simply illustrative, we can also look at a real-world case using actual fund performance since TFIs were introduced. If an investor had used the available TFI limits each year from 2015, investing in Coronation Market Plus from the launch of our first TFI, they would have made cumulative contributions of about R372 000. Based on the Fund’s actual returns over this period, that investment would be worth roughly R745 000 today – almost double the money contributed, with no tax paid on the growth along the way. This is, of course, a backward-looking example, and future returns and TFI rules may differ, but it gives a concrete sense of how powerful a growth-oriented fund inside a tax-free wrapper has already been over a single decade.

When an endowment may make sense

There are also further tax-efficient options beyond an RA and TFI. Investors may be maxing out retirement contributions and fully utilising the annual TFI allowance, yet still have additional long-term discretionary money to invest. In those circumstances, an endowment can be worth considering.

Endowments are investment policies that pay tax inside the product at flat rates. For investors in the top marginal tax brackets, those internal rates on interest and capital gains may be lower than what they would pay in their own names. This can make the endowment a more tax-efficient place to hold a long-term discretionary investment.

An endowment, however, is not as flexible as a TFI or a straightforward unit trust. There is typically a minimum five-year term before you can access the full value without restriction, and there can be limitations on early withdrawals. For that reason, endowments are best suited to genuinely long-term money that you are confident you will not need in the near future.

Investors’ underlying fund options are not restricted by any regulation. As such, you can invest in any of our long-term growth-oriented funds.

Putting it together

For your discretionary pool of money, the sequence usually looks like this: make sure your retirement funding is on track, then use a Tax-Free Investment as your first port of call for long-term discretionary savings. Using a robust multi-asset growth fund like Coronation Market Plus can keep the investment side aligned with your long-term goals.

Conclusion

Long-term investing gets complicated quickly if you try to juggle every detail at once. It becomes easier when you break it down into a few clear decisions.

First, identify which money pool you are working with. If the money is earmarked for retirement and is subject to pension rules, you are working with your retirement savings. If it is extra money you are investing by choice outside your retirement products, it belongs to your discretionary savings pool.

Second, make sure each savings pool has an appropriate growth engine. For retirement, that might be Coronation Balanced Plus inside an RA or other retirement fund. For discretionary long-term savings, it might be Coronation Market Plus in a TFI, or basic unit trust, depending on your needs and tax position.

Third, use the available tax advantages sensibly. Take advantage of the tax deductions and tax-free growth available in retirement funds. Use your TFI allowance for long-term discretionary investments whenever possible. If you are a high earner who has already maximised these options, consider an investment account like endowments with the help of a financial adviser.

Finally, accept that markets will move up and down and that there will be years when things feel uncomfortable. The goal of long-term investing is not to avoid every bump in the road; it is to stay on the road long enough, in an appropriate portfolio, that the combination of time, growth assets and tax-efficiency can do its work.

If you are unsure where to start or how these choices fit into your overall plan, speaking to a qualified financial adviser can be extremely helpful. They can help you decide how much to allocate to your retirement and discretionary pools, which account options and funds suit your situation, and how to adjust your strategy as your life evolves.

Long-term investing is not about predicting the next year. It is about setting yourself up well for the next decade and beyond.

South Africa - Personal

South Africa - Personal