Personal finance

Two-pot reform: Resist the urge to access your retirement annuity savings unnecessarily

Understand that any withdrawal is a costly advance on your ultimate retirement benefit

The Quick Take

- For the first time, retirement annuity investors will have the opportunity to get early access to a portion of their retirement savings

- This is thanks to the two-pot retirement system that comes into effect in September this year

- While it is great to have this option in the event of genuine financial hardship, we believe investors need to understand the actual cost of access

- Depending on the amount of time before retirement, every R1 accessed early could cost you up to R30 at retirement in nominal terms

South African investors with personal pension plans, called retirement annuities (RAs), have historically not been able to dip into their savings before retirement. Currently, these investors must wait until age 55 unless particular circumstances apply.

However, for the first time, RA investors will have early access through an annual withdrawal option when the two-pot retirement system comes into effect in September this year. While the catalyst for allowing early access to one’s retirement savings was the economic hardship caused by the Covid-era lockdowns, utilising this option will be costly. It should ideally be reserved for periods of genuine financial hardship. We urge investors to ensure they understand the implications of early access, as we detail below.

RAs HAVE TECHNICALLY BEEN A TWO-POT SYSTEM ALREADY

Investors retiring from their RAs have technically become accustomed to two separate pots in their retirement plans already. This is because when you retire from your RA (at the age of 55 or later), you have the option to take one-third of your accumulated savings in cash (think of it as your lump sum pot), while the remaining two-thirds must be used to buy a regular retirement income such as a guaranteed or living annuity (your retirement income pot).

WHAT CHANGES FOR RA INVESTORS UNDER THE TWO-POT REFORM?

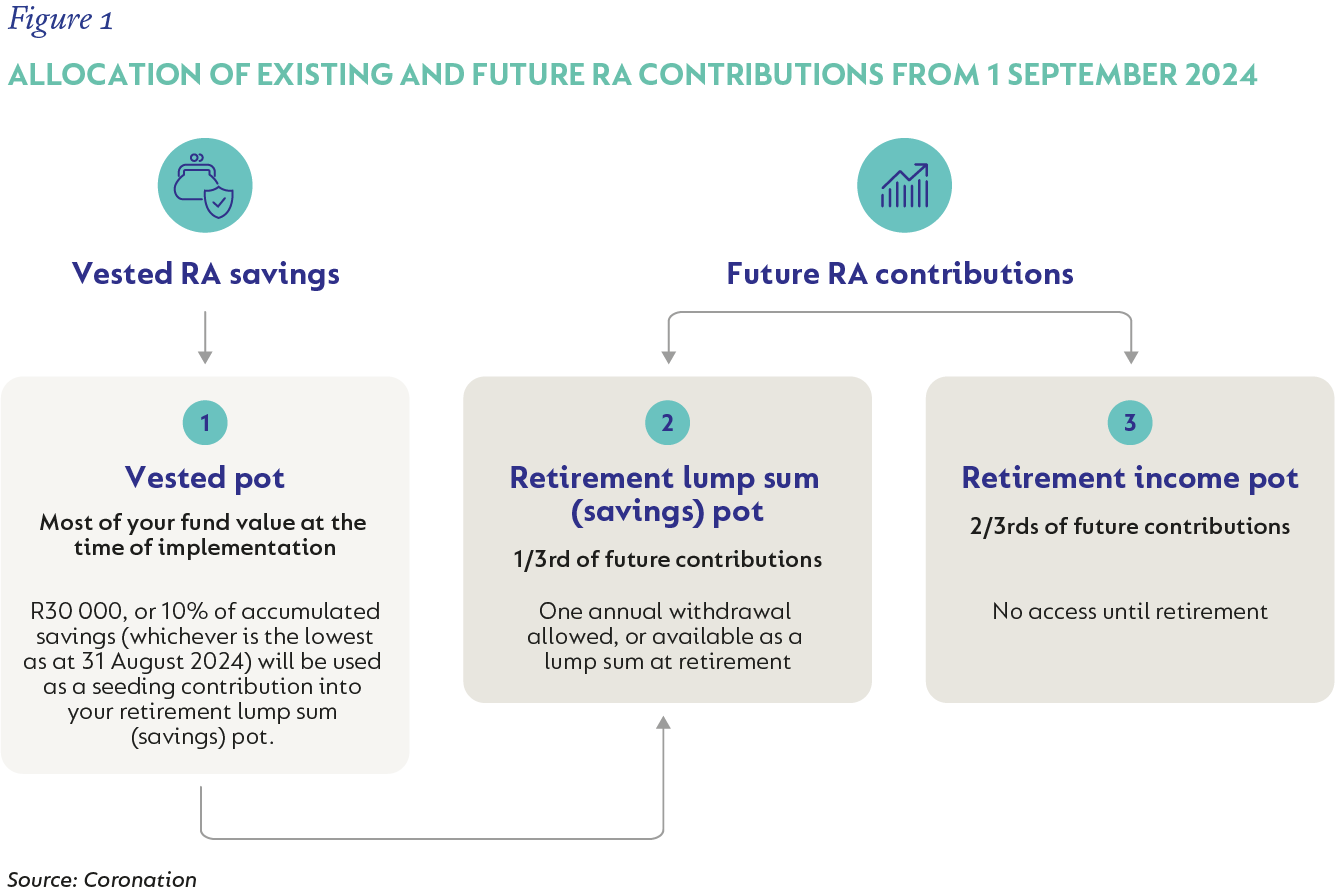

The two-pot reform that comes into effect on 1 September this year formalises this ‘split’ of your retirement plan into separate pots by somewhat confusingly introducing three formal components into RA investors’ accounts:

- A vested pot (representing most of your RA fund value at the time of implementation);

- A retirement lump sum pot and

- A retirement income pot.

As of 1 September 2024, we will split your RA account into these three components in all the reporting that we make available to you.

The most significant change under the new system is that you will be allowed one annual early withdrawal from your retirement lump sum pot (or savings pot as it is called in the legislation). The value in your savings pot will initially be seeded by R30 000 or 10% of your fund value at implementation (whichever is the lowest), transferred from your vested pot. One-third of your future contributions (from 1 September) will also be allocated to this savings pot.

The following table shows the allocation of vested savings and future contributions from 1 September 2024.

AN OPTION BUT NOT AN OBLIGATION

Once every year, you will be able to access the entire balance available in the savings pot, but you don’t have to exercise this option.

The significant change is that, in future, you will have the option, but not the obligation, to make one annual withdrawal from the entire balance in your savings pot. It’s vital to understand that this new liquidity option comes with an important health warning. Early access is costly and can seriously reduce your standard of living in retirement. You are effectively borrowing money from your future self over a fixed term, and you will essentially lose the tax benefits you received from the government when you contributed towards your RA. Let’s unpack this a bit further.

EXERCISING YOUR ACCESS OPTION IS TAX-DISADVANTAGED

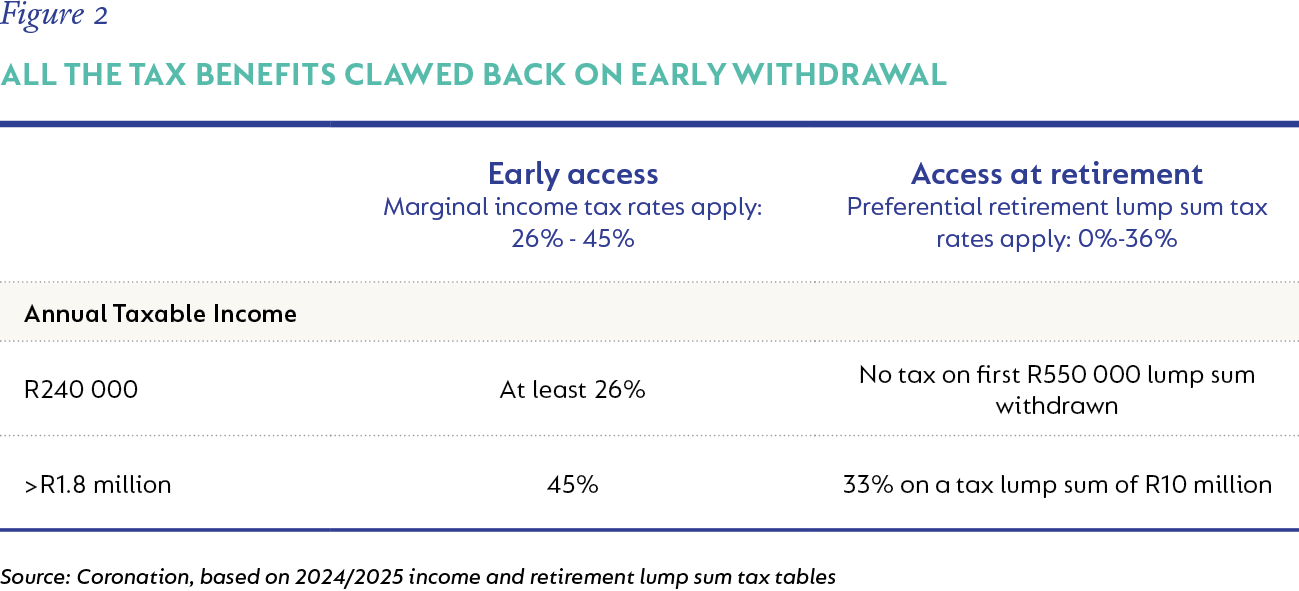

If you wait until retirement (i.e., anytime after 55 for RA investors) before withdrawing your money, the preferential retirement lump sum tax tables will apply. However, if you withdraw early, the more punitive marginal tax rates will be deducted from your withdrawal. This can significantly impact your retirement.

Let’s assume your annual taxable income is R240 000. Whatever withdrawal you make from your savings pot will be taxed at a rate of at least 26% or more than a quarter of the money you access. This compares to zero tax on the first R550 000 lump sum withdrawn at retirement age. The principle also holds at the higher end of the income scale. For a R10 million lump sum withdrawal at retirement, your effective tax rate will be 33% compared to the early withdrawal rate of 45%, assuming you earn more than R1.8 million in that tax year. This is a 12-percentage point difference in tax payable.

EARLY ACCESS IS BORROWING FROM YOUR FUTURE SELF

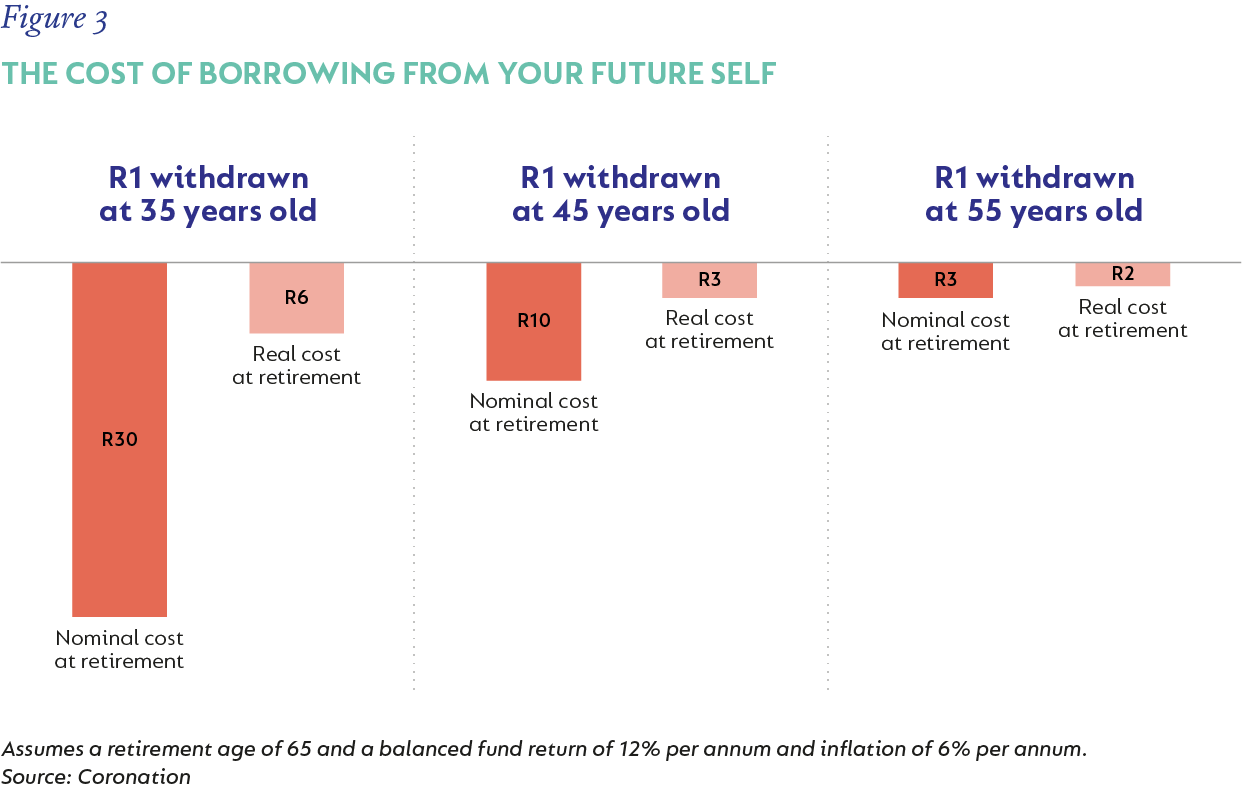

Withdrawing early effectively means that you are borrowing from your future self over a fixed term at your expected rate of return on your RA investment. To illustrate this, let’s assume you are 35 years old and intend to retire at age 65. Any R1 accessed through an early withdrawal may cost you R30 in lost retirement benefits at the time of retirement. In other words, by resisting the urge to access your savings early, your money could have multiplied by a factor of 30 over the three decades until retirement. While the numbers become less dramatic when you shorten the period between early access and retirement, they remain retirement-defining.

Even for an individual making an early withdrawal 10 years before their intended retirement date, it would still cost them R3 in lost retirement benefits for every R1 taken out early.

THE BOTTOM LINE

A single decade of missed compounding means that you have effectively halved the purchasing power of the money taken out as part of your early withdrawal. The bottom line is that to avoid a significantly reduced standard of living in retirement; you must resist the temptation to make regular early withdrawals to fund discretionary spending today. By not accessing your retirement savings early, you allow the powerful effect of compound growth to work to your full advantage.

A REMINDER OF WHAT THE TWO-POT SYSTEM AIMS TO REMEDY

Introducing the two-pot retirement system aims to address a fundamental weakness in the employer-sponsored part of the South African retirement system: the accidental early access to your retirement savings when changing jobs. More than 10% of all contributing members of workplace retirement funds utilise this accidental access opportunity each year to cash in their full pension pots. According to National Treasury, the net result of this leakage is that more than 60% of retirement fund members had accumulated pension pots of less than R50 000 in 2020. Put another way, the average fund member resets their retirement savings balance to zero every eight years in a system that enables compound growth to do its magic over three or four decades.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal