IT HAS ONLY been 12 months since you last read about the UK-based retail landlord Hammerson in Corospondent, but what a year it has been for retail-focused property stocks around the world.

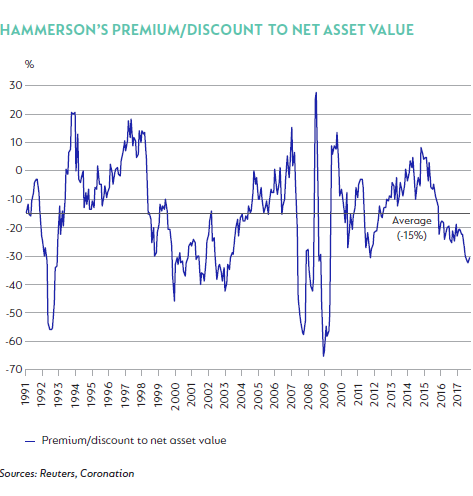

Amid continued growth in online retailing, a sharp increase in retailer bankruptcies in the US triggered feverish media coverage that predicted the demise of physical stores. Led by a sell-off in US retail-focused property stocks, companies in Europe and the UK also saw losses of up to 30% from the start of 2017. Shares were trading at discounts to their underlying net asset value of between 20% and 50%. This disconnect between the actual value of underlying properties and the value implied by the share prices offered the appropriate time for a myriad of consolidation opportunities across these regions, including cross-Atlantic portfolio mergers. Some publicly listed companies were also taken private. Towards the end of the year, share prices recovered by 10% to 30% as these boardroom discussions were announced.

One of the transactions announced in recent weeks was Hammerson’s intended takeover of Intu Properties. Previously known as Liberty International or Capital Shopping Centres, Intu is a retail landlord with a large UK national footprint. It owns nine of the UK’s top 20 shopping centres and has recently also gained exposure to the resurgent Spanish retail property market.

On behalf of our clients, we have been a long-standing shareholder of Intu, recognising the value of this footprint and dominance in the UK retail landscape. We believe the tie-up between Hammerson and Intu is important for both sets of shareholders.

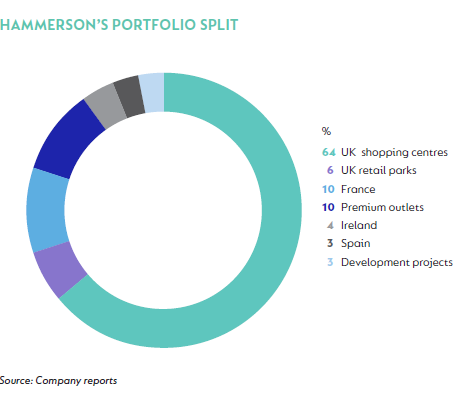

As a reminder, 60% of Hammerson’s portfolio is exposed to the UK, split between shopping centres, retail parks and outlet centres, with the remaining 40% providing exposure to mainly French and Irish shopping centres and a selection of outlet centres in major European cities.

The investment case for Hammerson, which we presented 12 months ago, still stands. In this article, we focus on two important considerations relating to its prospects after the proposed transaction has been implemented.

PORTFOLIO DOMINANCE

An enlarged Hammerson portfolio will have an estimated value of £21 billion, making it one of the three biggest European retail property groups, with 18 centres above 90 000m² in size. This enlarged portfolio will introduce two major differences.

First, its exposure to UK shopping centres will increase from 36% to 64%. This should have a growing positive impact on the company, as Hammerson has proven that it can manage shopping centres through different cycles; over the last nine years, which included extremely tough years for retail landlords, it experienced only one year of negative like-for-like net rental income growth in its UK shopping centre portfolio.

Hammerson is well positioned to weather the uncertainty of the current consumer environment and could even benefit from it as retailers gravitate towards proven retail locations and landlords. With exposure to 17 of the top 25 UK shopping centres, Hammerson enjoys a very enviable position for any landlord. Retailers have embraced the concept of flagship units – they spend more money on these units in strong locations, using them as key points of engagement with customers.

The importance of a flagship retail unit cannot be overemphasised. It is now estimated that a retailer can achieve a national footprint in the UK with as few as 25 to 50 stores, compared to 100 to 200 stores in the past. This is all due to the increase in online retail. In addition, in a world where retailers have no choice but to embrace e-commerce, maintaining omnichannel customer interaction becomes important. (Omnichannel refers to using various channels of seamless client interaction, from a physical store to pure online shopping.)

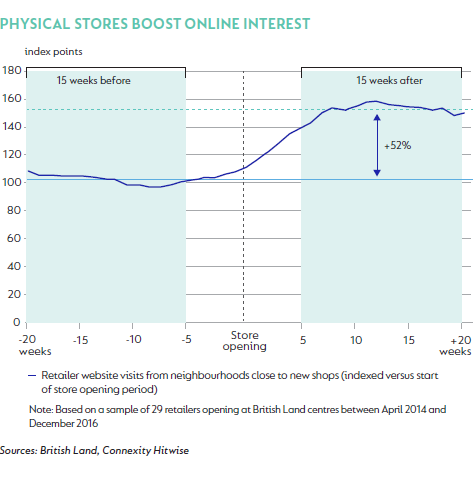

The interplay between a physical presence and a retailer’s online strategy is very important in the current retail environment, which is dominated by the omnichannel approach. A study conducted by Hammerson peer British Land and Connexity Hitwise found that when a new store opens, the traffic to such a retailer’s website from that location increases by 52% from the 15 weeks prior to opening to the 15 weeks post opening. This increase is even more pronounced when a retailer has a footprint of fewer than 30 stores.

UK department store John Lewis has been a pioneer in embracing omnichannel retailing and is reaping the rewards; an omnichannel customer spends on average much more compared to either a pure physical store or online customer. UK retailers have been much earlier adopters of omnichannel retailing: the e-tailing shake-up currently witnessed in the US has been raging on for the past five to ten years in the UK due to its high internet retailing penetration.

PORTFOLIO DIVERSIFICATION

The second major difference between the current and the enlarged Hammerson portfolio is the decrease in non-UK European exposure, from 40% to 27%. The enlarged portfolio presents a healthy balance between the benefit of a stronger, more defensive portfolio in the UK and still being sufficiently diversified into Europe. We anticipate that the portfolio will regain a higher exposure to Europe over the medium term, and management has confirmed that this is part of its strategy.

Hammerson’s European exposure, especially its premium outlet centre segment, has been driving earnings over the last few years. Although the Intu takeover initially decreases the exposure to this growth segment, the larger prospective balance sheet provides an opportunity to speed up gaining further exposure to these segments in the medium term.

As part of the integration of the two portfolios, management anticipates that at least £2 billion of UK assets will be sold. Not only will this result in a natural portfolio reweighting towards Europe, it will also create balance sheet capacity for development projects in the pipeline which are earmarked for higher-growth regions, including Ireland and Spain. The money may also be used to buy (or extend) potential premium outlets.

STRATEGIC MANAGEMENT

The benefits of portfolio dominance and diversification can only be reaped if management can extract this value, both strategically and operationally. The anticipated deal should drive operating cost synergies and result in potential lower debt refinancing, which is where the calibre of Hammerson’s management team should shine through.

Since Hammerson’s move to focus only on retail assets, the company has consistently delivered a better operational performance than Intu. Its UK shopping centre portfolio achieved on average a 3.5% outperformance in like-for-like net rental income per annum since 2009 against the Intu portfolio. In the more recent past, it also consistently outperformed Intu on leasing versus estimated market rental levels, by 5% to 6% on average per annum. We believe the Intu portfolio offers latent rental growth prospects; by combining the portfolios under Hammerson’s management, this should be unlocked at a faster pace.

Strategically, Hammerson has proven itself a good allocator of capital, often confounding initial market skepticism relating to acquisitions or disposals.

Its recent entry into Ireland is a prime example where growth earned from its exposure more than compensated for initial concerns over the entry price into the country. Gaining exposure to the high-growth premium outlet business proved to be a stroke of genius. Hammerson read the evolving consumer shopping patterns correctly. Its management will be able to strategically tap into that which is best in class in the Intu portfolio, enhance it and apply it across the enlarged portfolio.

CONCLUSION

Independent from the takeover offer for Intu, Hammerson continues to focus on its core portfolio. Capital from smaller mature assets is recycled for investments into growth assets and regions. Through these sales, the company is strengthening its balance sheet, and positioning itself to placate investors who continue to be concerned about the large capital requirements of its development pipeline. The retail market is polarising, and retailers who benefit from either dominance or convenience are proving to be the winners. Hammerson is now in an even better position to benefit from this trend. The enlarged portfolio is a clear market leader in the UK, and the accompanying benefits of this position should surely allay the fears of investors who are concerned about the potential negative impact of Brexit on property values. Although there are signs of a marginal repricing in shopping centres due to this uncertainty, the discount to net asset value at which Hammerson trades remains unjustified, especially since the proposed takeover of Intu should enhance both earnings and net asset value. We therefore believe that Hammerson remains a sound investment opportunity, which is being mispriced by the market.

United States - Institutional

United States - Institutional