Investment views

Shoprite

The price is right (or at least it feels that way)

- The decision to invest in a business isn’t arrived at neatly

- Despite poor GDP numbers, Shoprite SA has defended its earnings base admirably

- Shoprite Africa’s fixes will take time, but we are happy to sit and wait for them

- As one of SA’s best businesses, Shoprite is a great stock to own at this point in time

“We are not so brazen as to believe that we can perfectly calibrate valuation; determining risk and return for any investment remains an art not an exact science.” – Seth Klarman, Baupost Group CEO

WHEN IT COMES to having your favourite cake or dessert, you typically choose between taking a trip to the shops or, if you’re feeling a bit of MasterChef inspiration, you may decide to make it yourself. If it’s the latter, you’ll know that a quick online search will result in any number of recipes with accurate measurements for each ingredient, the order in which they should be mixed together, and the precise amount of time it should be in the oven.

Unlike baking, the decision to invest in a business isn’t arrived at so neatly, and often hinges on a blend of tangible and intangible elements, the interpretation of which could easily make one person a buyer and the next person a seller. The Shoprite investment case is one such example in today’s market, and we’ve positioned ourselves in the Buy camp within our South African portfolios within our South African portfolios.

A LOT OF BAD NEWS BAKED INTO THE PRICE

Shoprite’s share price peaked on 7 March 2018, closing at R275.50 – today it trades at R122 a share. While it has more than halved over the past 18 months, this precipitous decline isn’t enough to conclude that the stock will generate a market-beating return over our investment horizon.

This price move must be contextualised by the underlying earnings power of the company and/ or the value of the assets underpinning the operations. Figure 1 attempts to do just this.

Using 7 March 2018 as a reference point, the chart highlights how our assessment of normal earnings has since declined 40%. It also shows that the stock has de-rated significantly, with the market saying it is willing to pay a lot less (around 35% less) for R1 of earnings a year out versus at the peak.

On a price-to-earnings basis, it’s only been cheaper than it is today 6% of the time over the last 10 years.

NOT JUST A SHOPRITE STORY, BUT A BROADER SOUTH AFRICA INC. STORY

This development of big share price declines, on the back of large earnings disappointments, is quite broad based and has presented several investment opportunities in companies with operations facing the local environment. After all, companies deliver earnings based on what they’ve been able to do in the real economy. And the real economy has not been supportive.

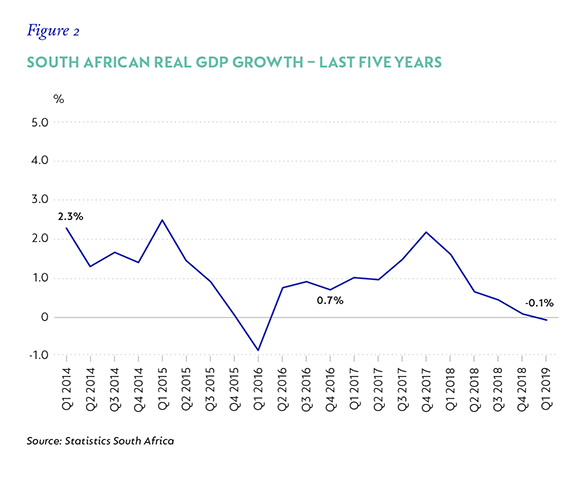

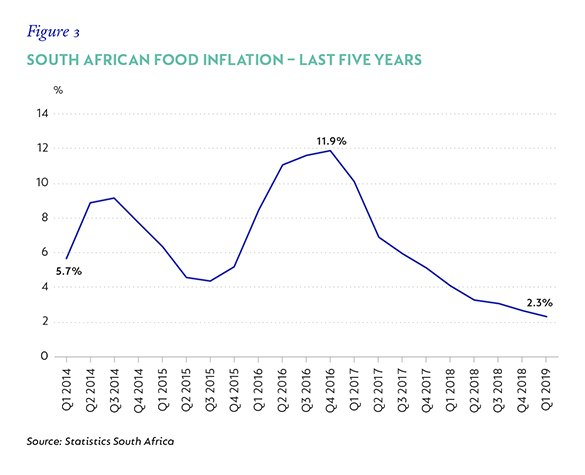

Figure 2 shows how South African GDP has failed to show meaningful growth on a sustained basis over the last five years and has actually been slowing down. At the same time, the cost of living – electricity, rates and taxes, fuel and services – has gone up a lot and income hasn’t kept up. For many businesses, the ability to pass on inflationary price increases has not been there, and the food retailers in particular have seen this come off spectacularly (especially in the last three years), as shown in Figure 3.

DESPITE THIS, SHOPRITE SOUTH AFRICA HAS PROVED QUITE RESILIENT

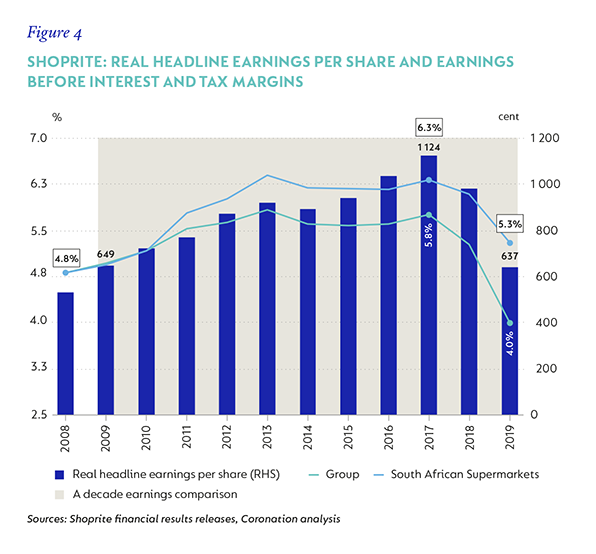

Although group earnings have been materially reset from the highs of two years ago, the South African Supermarkets division has defended its earnings base admirably (down 15% in real terms) and achieved trading profit margins above 5%, despite real revenue in 2019 only being a percent higher than it was in 2017.

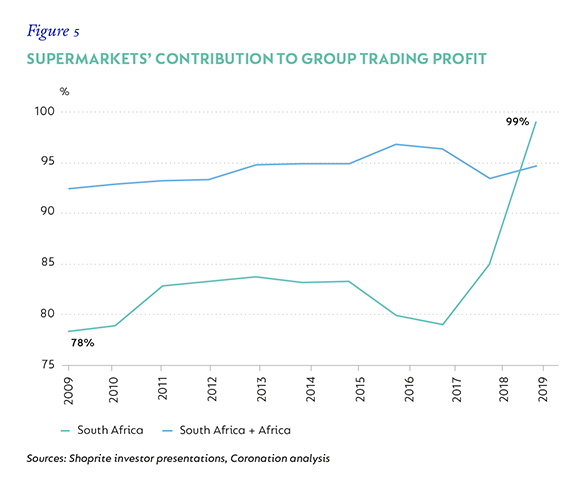

Having historically been 80% of group trading profit, South African Supermarkets were responsible for all the profit reported in the last set of results – Africa Supermarkets’ earnings are down 115% and currently lossmaking (see Figure 5).

In thinking about the current tough climate, and the group’s ability to defend today’s earnings base going forward, we see this particular development as positive, and are of the view that there is limited downside to the last reported earnings – and good upside potential.

Given the difficulty of the last year for the group, it’s easy to forget just how excellent an operation Shoprite’s local business is. It owns a third of the South African food market, has the biggest footprint in three distinct brands, boasts the longest heritage and runs the most refined operation in centralised distribution, with a good management team that’s been in the business for years.

These virtues don’t simply disappear over a 12- to 18-month period, which, by the way, was plagued by a combination of once-off disruptions, including a troubled SAP implementation and a strike at its main distribution centre (that handles more than half of Shoprite’s volumes), while having higher exposure than its peers to the low-end consumer who has felt the brunt of the weak economy.

Over the last six months, Shoprite has reasserted its sales growth leadership among the three majors (Shoprite, Spar and Pick n Pay), delivering growth of nearly 10% (admittedly off a soft base), which has come with an increase in both volumes and inflation during that time. Industry players we’ve been speaking to confirm that they are experiencing similar trends, with the sense that demand for food staples has stabilised somewhat.

It is our view that as things like the new minimum wage start to filter through to cash-strapped consumers and the country gets a bit of policy direction (and action!) from the recently elected government, we’ll start to see sales growth trends match nominal GDP growth and then accelerate ahead of it. Before any discretionary spending starts to come through, the basics have to be taken care of first.

FIXING AFRICA

After being the main, positive differentiator versus its peers over much of the last decade, Shoprite’s 14-country operation has turned into a decidedly negative differentiator. The cluster generates nearly a fifth of South African Supermarkets’ sales, on 40% of the South African asset base, and just made a trading loss of R265 million (from a R1.4 billion profit just two years ago). The going has been very tough.

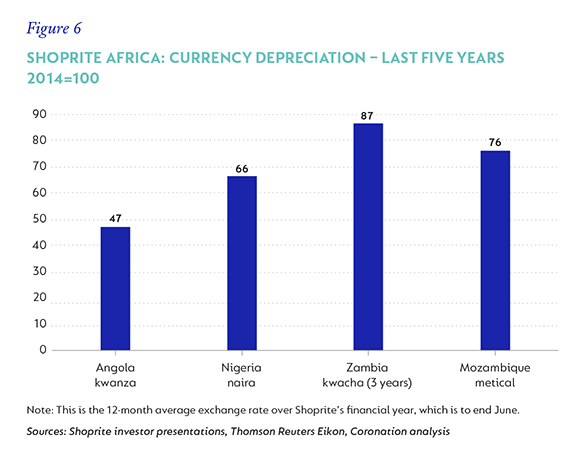

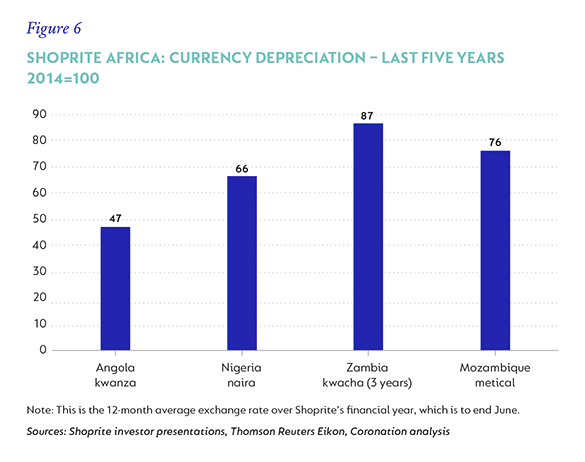

Figure 6 highlights the extent to which local currencies have depreciated against the South African rand, with the major revenue and profit contributors, Angola and Nigeria, losing half and a third of their purchasing power, respectively.

Note: This is the 12-month average exchange rate over Shoprite’s financial year, which is to end June.

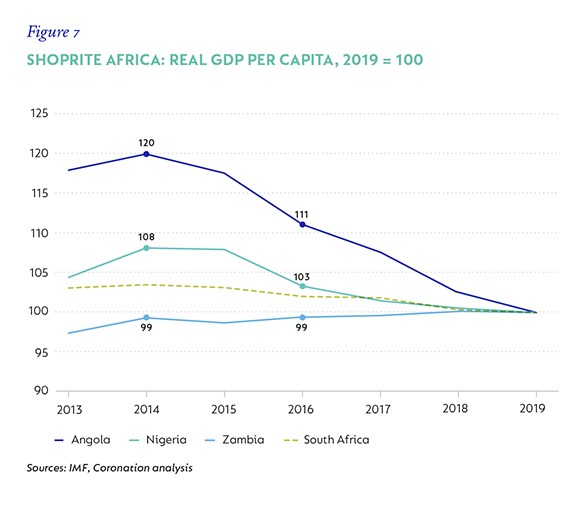

This has had a material impact on the underlying economies and the ability of individuals to hold their real incomes (Figure 7).

Exacerbating the deterioration in affordability is the increased complexity of trading in these markets. Selling food in increasingly hard-to-reach places, in more challenging regulatory regimes (in response to the currency situation) has now resulted in a large amount of invested capital generating negative returns, while the cash-flow generation ability versus peers is structurally lower at the group level. But this can change, and we think it will.

The executive management team appreciates the fact that the current operating model is inefficient and needs correcting. Conversations with them suggest that they are scrutinising all areas of spend within the business, and that no option is off the table. This includes selling off excess real estate and limiting further new investment into the detracting countries, thereby limiting the extent to which the operations are being subsidised. There is also the possibility of exiting some markets if they see no turnaround prospects over the medium term.

However, whether or not Shoprite puts these actions into effect does not affect our base case. We have taken a harsher view on the value of the African operations – which have declined by two thirds – by reducing optimism around sustainable margins (down from 6% to 4%), cutting revenues four years out (by 35%) and lowering the fair multiple used to value the operation (by 20%).

If management executes half of the actions within its control, a lot of value will be unlocked in Africa. However, these fixes will take time, and we’re happy to sit and wait for them. Encouragingly, the company has demonstrated its seriousness here by introducing return and bottom-line earnings growth hurdles (at group level) as performance criteria for incentive remuneration in its latest integrated report.

CONCLUSION

In the end, the call to invest in Shoprite on behalf of clients remains a valuation-based decision.

The share price has meaningfully retraced, and the earnings base is no longer high (and is a lot more defendable than two years ago). We have arrived at our assessment of the fair value of the business using conservative assumptions – many of which will likely need to be relaxed a year or two from now. Despite this, the share trades on 13 times what we view as the normal earnings per share for the group and offers valuation upside.

The current sentiment around the business is very negative, but this doesn’t change the fact that Shoprite remains one of South Africa’s best businesses. You would want to own such businesses at most points in the investment cycle, but particularly in times such as these.

Disclaimer:

United States - Institutional

United States - Institutional