Brexit: The economic and political impact - July 2016

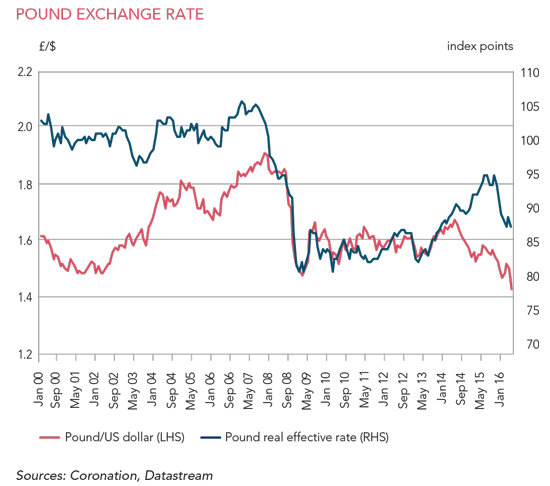

The UK referendum vote was a shock to politicians, markets and much of the populace. Poll data in the run-up to the referendum showed growing support for the leave campaign but it seemed that markets, and indeed most people, thought the rational outcome was to remain. The early repercussions of the vote were dramatic: the pound saw its largest drop ever in intraday trade, the FTSE 100 initially tumbled almost 9%, and both European and emerging market assets responded negatively.

The referendum outcome certainly raises more questions than it answers. It has injected a new measure of complexity into the current global political environment and economic outlook, which remain inextricably interlinked.

The first observation to make is that the international political environment has changed dramatically since the end of the global financial crisis (GFC). There has been growing support for political parties on the extremes of the political spectrum. In Europe, Marine Le Pen’s National Front has gained ground in France, while support for both right-wing and left-wing groups in Spain has grown meaningfully, and increased polarisation was also seen during the municipal elections in Italy. Hungary voted for the conservative Fidesz in 2010 and, more recently, Poland backed the right-wing national-conservative PiS. (Donald Trump’s bid to become the US president is arguably also part of this trend.)

These political parties’ main platforms are less about advocating specific policy actions, and generally more focused on either a particular social philosophy, or specific groups in society. The increased attraction of this kind of politics seems to reflect a social climate of dissatisfaction, with roots in the weak economic recovery post-GFC. For many households the crisis had a material impact on incomes and wealth. The recovery in Europe has been the most uneven, and arguably remains the most fragile. Many households are still worse off than they were before, and the promises made by the moderate politicians and the policymakers, who supported and implemented moderate policies, were not met. This fuelled the appeal of parties or policies which reject the status quo. The example of the UK’s leave campaign reflects this unhappy reality most clearly. Voters who chose to exit had no real understanding of what they voted for (and given the immediate resignations of the senior leave campaigners it appears they had no idea either). It was more a vote of unhappiness with the status quo than a decision that leaving will deliver specific benefits.

The popular response following the vote suggests that many simply did not fully understand the potential repercussions of their vote. The calls by other parties in the EU for referendums in their own countries could yield similar risks. A precedent has been set by citizens being able to opt out of the EU through a referendum (with the debate often fuelled by spurious claims and misinformation). This is very negative for the future of the EU. While no other moderate EU government is likely to make the mistake of calling for a similar referendum, any election will now become a proxy for this type of referendum, with the fringe parties campaigning vigorously on the exit card.

There are a number of important elections looming in other large economies – the US (8 November 2016), France (April/ May 2017), Germany (October 2017) – which are now also much more uncertain, and perhaps also much more vulnerable to more extreme political outcomes than before.

While markets will take a dim view of a move towards isolation and reversing the benefits of global free trade, they hate uncertainty even more. In a fragile world, the shock of the Brexit vote result has created further uncertainty over the outlook for global growth. Yields on the ten-year US government bond fell dramatically after the Brexit result, indicating a flight to safety and a concern that global growth will remain weak as companies withhold investment and consumers withhold spending while the details of what Brexit means are finally ironed out.

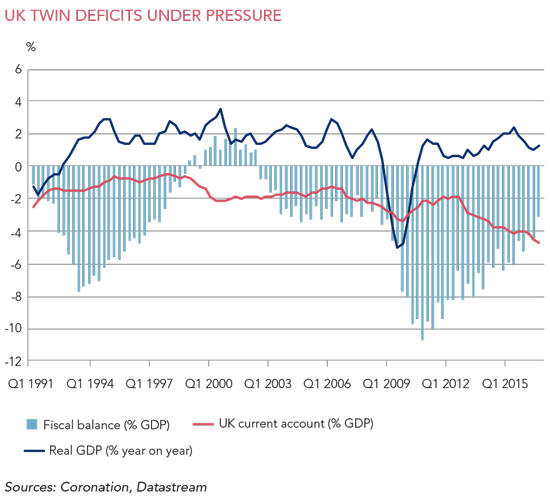

Growth in the UK is expected to slow, and may contract next year, depending on how long political uncertainty continues and how EU negotiations evolve. Growth momentum is already moderating and the UK has large twin deficits, with the fiscal balance -4.4% in 2015, and the current account -6.8% in the first quarter of 2016. General expectations are for real GDP growth of about 1.3% in 2016 and just 0.5% in 2017. The impact on confidence and investment is expected to be more significant than the immediate impact on trade, but unemployment may also increase, and a weaker pound implies higher inflation than would have been the case otherwise. Taken together, this is not good news for UK consumers, and consumer spending is expected to be materially weaker.

European growth and policy expectations have also been affected by the referendum vote, but the most immediate risk is that the continent’s fragile recovery is also derailed by uncertainty. Much will depend on whether the EU moves towards greater integration or disintegration over the longer term. The biggest initial impact will likely be on investment, with trade less vulnerable in the short term. The European Central Bank is also expected to remain a visible and responsive support for growth and will likely extend its current quantitative easing programme beyond March 2017, if necessary.

It is hard to disentangle the spider’s web of interconnected issues and potential repercussions of the UK referendum vote, especially in a world where economic growth is fragile, and politics increasingly uncertain, and extreme. The end game for the UK and Europe may not be all bad, but a lot depends, first, on the internal political outcomes in the UK and then on the timing and manner in which negotiations between Britain and the EU evolve. The speed with which the Conservative Party has nominated a new prime minister is the first vaguely positive sign emanating from the vacuum that followed the referendum. The political credentials of Theresa May have brought some stability to the market amid the expectation that a better result will be achieved in negotiations with the EU than if one of the exit campaigners led the country. In time, new trade relations and a greater degree of flexibility over policy setting may prove beneficial for the UK. For Europe, the stark warning of strong member dissatisfaction may spur reform from Brussels that leads to greater integration and reform which they have failed to implement in the period following the global financial crisis. If Europe fails to respond to this warning it is likely to see more discontent brewing among the weaker member states and ultimately more pressure to leave, precipitating in the break-up of the EU. This would have major economic consequences for the world, on a scale far greater than Brexit.

South Africa - Personal

South Africa - Personal