Many happy returns - July 2016

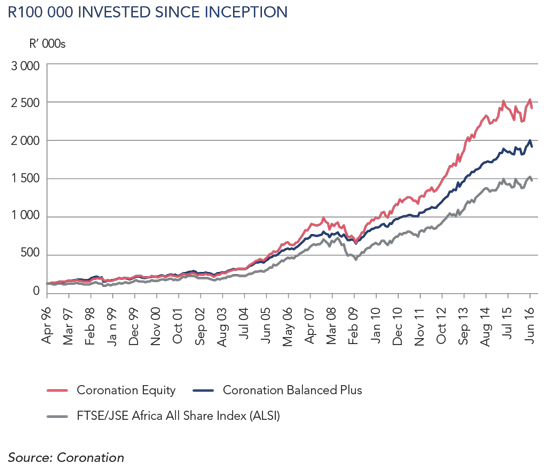

In April 1996, Coronation, then a fledgling investment firm, launched two new funds from its small office in Cape Town.

The Coronation Equity Fund aimed to give investors the best possible returns over the long run by investing in a wide range of equities. The fund is fully invested in shares, which offer the highest expected growth over the long run. Its investments are predominantly in SA, with an allocation of up to 25% in international equities, plus a further 5% in Africa (outside of SA).

The Coronation Balanced Plus Fund was a pioneering investment product, one of the first to invest in a wide variety of assets, such as shares, bonds, listed property and cash (both in SA and abroad) to achieve investment growth for retirement savers. The fund complies with Regulation 28 and has a strong bias towards shares. This investment is carefully balanced with other less volatile assets (including cash and bonds) to manage risk and provide a smoother return path.

Both funds remain the top-performing funds in their respective categories since launch. Over the years, the funds have delivered market-beating investment returns for our clients who chose to remain invested during the various market ups and downs.

One investor, a 60-year old woman, invested R20 000 in the Balanced Plus Fund and R30 000 in the Equity Fund on 12 June 1996. Twenty years later, her initial combined investment of R50 000 is now worth more than R1 million. She did not invest another cent and never withdrew money; she simply stayed the course and reinvested her distributions every six months.

A family with two small boys invested R16 666 for each of them in the Equity Fund on 16 April 1996. They contributed a R500 debit order for each of them for another 17 months. Tim and Steve are now 23 and 25 years old, and that initial investment has grown to just shy of R568 000 for each.

Many of our other long-term clients have seen similar investment growth. They are living proof that if you remain invested in the equity markets for extended periods, and stick with a judicious fund manager for the long haul, the power of compounding will do extraordinary things for you. Money invested generates returns that can be reinvested to achieve further returns. Over time, this can create enormous wealth.

Unfortunately, most investors capture only a fraction of this combination of market and active return over time. They move in and out of funds in reaction to news events and talk around the braai. We believe that jumping from fund to fund to chase the best return will erode wealth over time.

The fact is, the short-term focus of markets means that the long-term prospects of financial assets often diverge from current prices. Overreactions to short-term ‘noise’ will push prices to unjustified levels. This is where we believe we can add value: through exhaustive research we actively seek out undervalued shares that could achieve strong investment growth over the long run.

For example, both funds have pursued select opportunities created by the brutal sell-off following the Brexit referendum. The funds have increased their exposure to a number of shares that have been sold down to compelling levels. More market volatility is expected and it may take some time for these investments to unlock value. However, patient investors in our funds are comfortable with periods of short-term underperformance in the service of substantial results over the long term.

We are in the business of creating wealth over many years, and we encourage our investors to only make changes in their portfolios when their needs have changed, and not in response to recent market movements or short-term performance experience.

South Africa - Personal

South Africa - Personal