NOTES FROM MY INBOX - April 2017

“You can change the weatherman, but that won’t change the weather.” – Attributed to SA Reserve Bank Governor Lesetja Kganyago

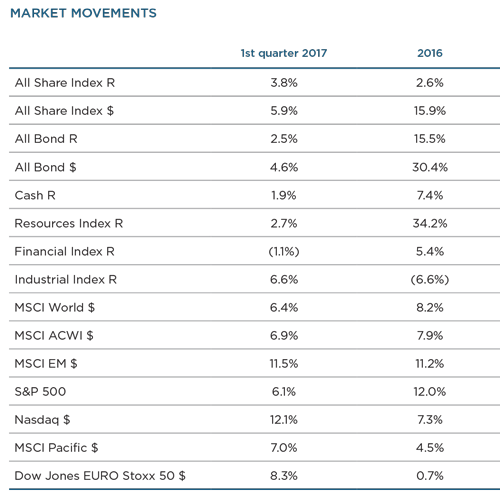

If this were a normal quarter-end, this report-back would have focused on a pleasing period of both absolute and relative returns across our fund range. I may have spent a paragraph on why the Top 20 Fund’s year-to-date return is much better than the previous quarter’s, or how the Balanced Plus Fund’s recent robust performance bolstered its five-year compound growth rate. Unfortunately, this quarter was anything but normal, and we remain in a period of profound political and economic change around the world.

At home, the last few weeks have felt surreal (and not in a good way). SA again finds itself in crisis. The midnight hour cabinet reshuffle at the end of March dented confidence and triggered ratings downgrades, the effects of which will be felt for years to come. Attaining investment grade credit ratings was a significant achievement of the first democratically elected government, secured through great discipline 17 years ago. Government’s commitment to fiscal discipline benefited all South Africans by lower borrowing costs, boosting economic growth and achieving greater redistribution through a progressive tax system. Recent political choices make it likely that at least some of these benefits will be lost.

In the near term, these events have most likely delivered a ‘knockout blow’ to the signs of economic recovery that emerged earlier this year. A deteriorating outlook has the most serious consequences for the poor, who have little defence against the economic fallout unleashed by infighting in the ruling party. A culture of corruption and patronage, dressed up in the language of radical economic transformation, will cause much harm.

The potential for increasingly populist, but ultimately self-defeating, policy choices in SA is echoed by global developments. The political shocks of 2016 continue to shift the ground under our feet. The new US president keeps on upsetting geopolitics, while the UK premier, Theresa May, recently triggered Article 50, bringing the UK a step closer to formally exiting the EU. Throughout the world, ordinary people are expressing their discontent with the established world order. Many developed-world citizens are simply fed up with the feeling of being left behind, which they blame on globalisation. Understandably, they want to see economic prosperity that does not only benefit a few. However, their discontent is channelled towards solutions (protectionism, anti-immigration, nationalism) that will not necessarily serve their own interests, or those of the broader society, in the long run. Reducing inequality by making everybody – including yourself – poorer, does not seem to be a sound strategy.

Against an unsettled background, this bumper edition of Corospondent contains our analysis of the concerning events unfolding around the world. In the lead article, Neville Chester dissects the impact of the recent developments in SA and the aftershocks that await investors and the economy. Our economist, Marie Antelme, examines the causes and economic ramifications of the rise of populism.

It is in turbulent times like these that we are continually reminded that risk is an integral and unavoidable part of life.

And the first rule of investing is to ensure that you allocate capital in a manner that will appropriately reward you for the risk you have taken. Most of us like to just talk return: it’s simple and, let’s face it, easier to understand. In his article, our CIO, Karl Leinberger, takes a closer look at the vital role that risk management plays in investments. This is a timely read for this new era of uncertainty.

Great investment opportunities continue to present themselves despite deteriorating politics, and as always, we continue to invest in long-term holdings that we believe will unlock value for our clients. In this issue, you will find our views on opportunities in a Russian banking behemoth and in the local mobile telecommunication group MTN.

History has taught us, time and time again, that our ability to forecast the immediate future is limited. Our focus remains on building diversified portfolios of undervalued assets that can withstand the shocks that seem to keep coming our way. We remain steadfast in our focus and commitment to deliver investment excellence for our clients.

While the nature of our subject matter this quarter means that I cannot guarantee you a pleasant read, I do hope that you find our insights useful, providing you with some security and clarity in these pressured times.

As always, do not hesitate to let us know in case we have failed to live up to your expectations.

South Africa - Personal

South Africa - Personal