SBERBANK - April 2017

Investing in some shares can be like owning fine wine. They may be expensive, but are worth every cent. The finest can be kept for years, are velvety smooth, elegantly balanced, perfectly rounded, immensely satisfying to drink and continue to get better with age.

Sberbank is not that. Some would argue that owning Sberbank is more akin to drinking vodka, an experience conceivably filled with remorse, hangovers and new lows. Common misperception is that Sberbank is cheap and nasty Stoli vodka being downed on the streets. A more intimate knowledge of the company reveals something much more sophisticated. Founded in 1841, with 139 million customers, Sberbank is much more Grey Goose (steeped in heritage) or Smirnoff (the largest vodka brand globally) than it is Russian Bear!

Let us put this in context. With 139 million retail customers, Sberbank is …

- twice as big as Wells Fargo, the largest retail bank in the US;

- nearly five times the size of Lloyds Bank, the largest retail bank in the UK; and

- over 10 times as big as Standard Bank, the largest retail bank in SA.

In addition to its massive retail base, Sberbank manages 1.5 million corporate customers through 15 700 branches, 82 000 ATMs and 328 000 employees.

Sberbank has a market share of almost 40% of retail loans and 46% of retail deposits. On the corporate banking side, it has a 32% share of corporate loans and almost 23% of corporate deposits. Its nearest peer, VTB, holds only 10% of retail deposits and 22% of corporate deposits. Outside of these two players, the market is very fragmented. Consequently, Sberbank is the dominant bank in the Russian market by an order of magnitude.

Sberbank enjoys a number of competitive advantages over its peers, including a lower cost of funding and superior digital capabilities. Not only are retail deposits a higher proportion of its funding base than its peers’, but it also pays less on these deposits due to the perceived safety of the bank. On the digital side, the Sberbank behemoth is managed through one centralised IT system. Yes, one. Since 2008, it has invested heavily in their IT platform, rationalising its IT infrastructure from over 2 500 systems to a single system today, a phenomenal feat by any global standards.

As a result of its scale and its IT system, Sberbank has one of the lowest cost-to-income ratios of any universal bank at only 39.7% (its peer group would be immensely proud of a number sub-50%). Consequently, Sberbank is able to price loans substantially lower than competitors to earn the same return on assets, resulting in positive selection for themselves and negative selection for the peer group.

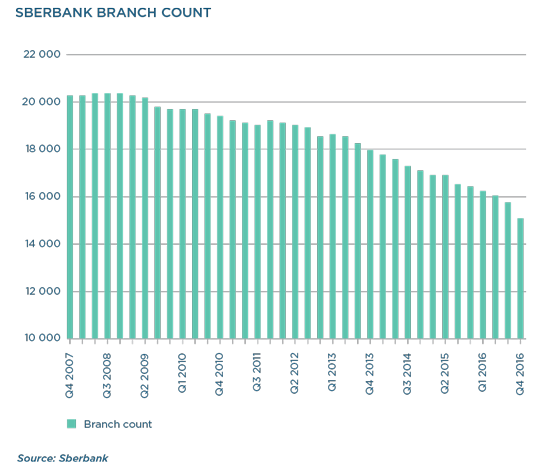

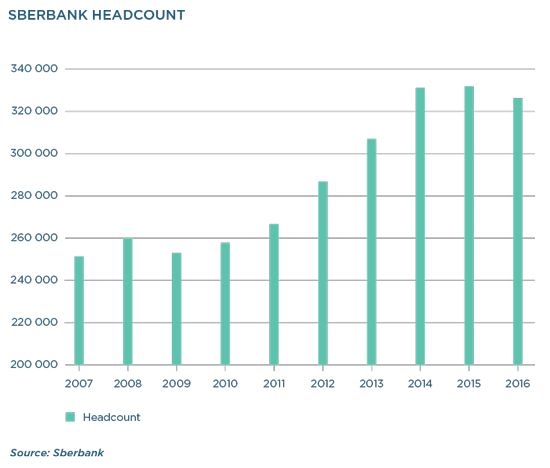

In addition, big data analytics have resulted in significant time savings in decision-making, and a 98% reduction in processing time. Almost 34 million customers are using the web or the Sberbank app as their primary banking channel and a staggering 91% of all transactions are now conducted via digital channels or ATMs. As a result, Sberbank are able to begin reducing and rationalising both their branch footprint and their staff headcount.

In the fullness of time, management believe they can reduce the number of branches by 25% and reduce the headcount by at least 50%. This then becomes a virtuous circle, reducing their cost-to-income ratio further, rendering peers even less competitive.

This world-class cost-to-income ratio is one of the primary reasons Sberbank enjoys one of the highest returns on equity (ROE) of any bank globally, currently almost 21%. There is scope to increase this ROE further, yet the share trades at only 1.1 times forward book, well below its fair value.

In addition, Sberbank carries optionality via a potential joint venture with one of the world’s internet giants. Yandex, Mail.ru (Naspers) and AliExpress.ru (Alibaba) have all engaged in discussions with Sberbank to serve as the backbone of their e-commerce platform in Russia. To date, none of these negotiations has resulted in a deal; however, should such a deal emerge, this would represent significant upside that we are not paying for at the current price.

As banks increasingly become indistinguishable from technology companies, we believe we are backing a winner. Over and above a superior cloud-based IT system, Sberbank is already piloting blockchain, machine learning and artificial intelligence ‘bots’, each of which could make a significant positive impact both to the customer experience and to the cost to serve. Many of their products such as the Smart-Kassa have changed the way small businesses operate, offering online payments, card payments, accounting, reporting, customer relationship management and other banking services in a single point-of-sale device.

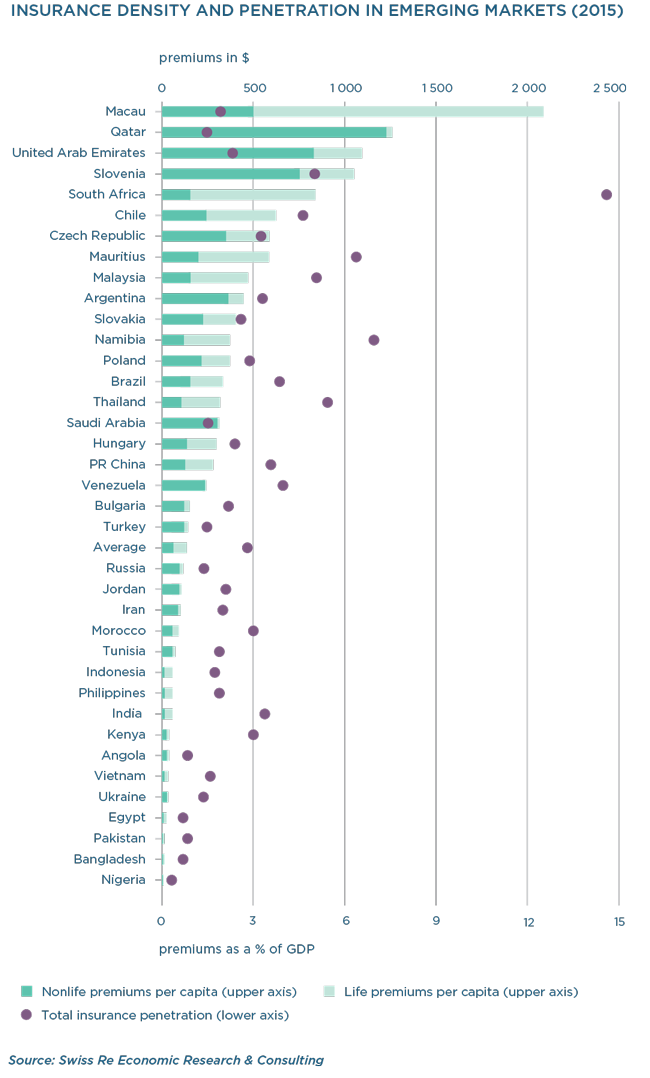

The bank has a very long runway for growth, evidenced by Russia’s low banking penetration by global standards – domestic credit is 59.3% of GDP compared with the OECD average of 109% of GDP. In addition, the nonbanking financial services market (insurance, wealth management and pension management) is in its infancy. Sberbank has plans to capture market share in the underpenetrated mortgage market and with respect to the nonbanking financial services industry, will likely create a market that currently is almost nonexistent. By way of comparison, Sberbank currently operates the largest asset manager in the country with a market share of 24%, yet manages only $15 billion of assets. To put this in perspective, Coronation Fund Managers has more assets under management than all of Russia. Also, Sberbank is the largest life insurer in Russia with a market share of 29%, yet premium income was only $1 billion in 2016. Total insurance premiums represent only 1% of GDP, extraordinarily low even for emerging market countries, as per the International Monetary Fund data below.

We believe Sberbank is best placed to capture these opportunities.

Still, we acknowledge the risks involved in being a minority shareholder in a state-owned bank, especially in Russia. However, under the capable leadership of Herman Gref, CEO since 2007, minority shareholders have been fiercely protected. The macro environment, while always prone to shocks, is improving and the likelihood is that sanctions against Russia will be eased over time. Nevertheless, we factor these risks into our valuation. The share is currently trading at 5.5 times our estimated 2017 earnings, 1.1 times our estimate of 2017 net asset value, and carries a dividend yield of almost 4%. On this basis, we believe the share is very attractively priced and we are optimistic that future returns will be cause for celebration. Na zdorov’ye!

South Africa - Personal

South Africa - Personal