Quarterly Publication - October 2017

Notes from my Inbox - October 2017

Our big news this quarter is a meaningful fee cut across our international and lower-risk funds. We are simplifying the fee structure across our flagship multi-asset funds to the same flat fee – regardless of risk budget or geographical profile. This change follows a comprehensive fee review in 2015 that has already added significant value to our clients’ portfolios.

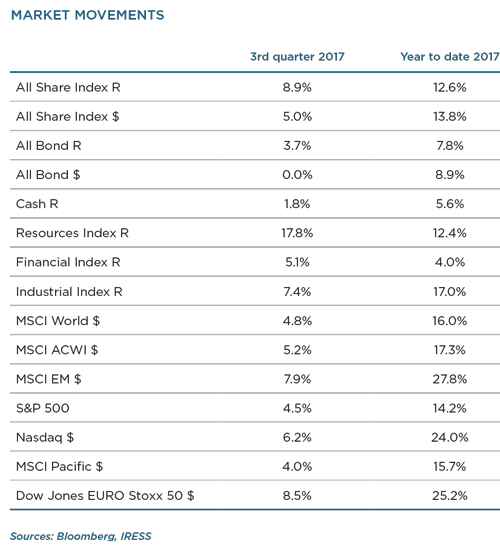

Equity market returns recovered strongly since June. At the time of writing, the FTSE/JSE Capped All Share Index recorded a 15% return in the year to date, compared to just more than 2% at the end of June. The MSCI All Country World Index showed a similar gain, with a 17% year to date rand return. Equity markets often move quickly, as we have seen recently. If you are not there, you end up missing out. The recent gains follow a roughly three-year period of mediocre returns from local shares, which motivated especially more conservative investors to switch from low-risk multi-asset funds with some equity exposure (for example, Coronation Balanced Defensive) to even more stable managed income funds (for example, Coronation Strategic Income). This is an understandable but unfortunate trend, which we unpack in more detail on page 6.

We also want to draw your attention to an overhaul of our approach to client reporting. We will start implementation with new transaction confirmations and statements that will be rolled out during November. Our aim is to simplify the documents we send you and provide you with more meaningful and relevant information. We hope that you will like the changes.

RETIREMENT DEFAULT REGULATIONS

I was pleased to read that the latest Nobel prize in economics was awarded to professor Richard Thaler, whose research in behavioural economics uncovered the importance of ‘nudging’ people into making better decisions for the long term without removing their individual freedom of choice. You can see the influence of his thinking in the new retirement default regulations which were recently adopted in SA. This initiative is a rare example of enlightened policymaking, which is likely to help many South Africans to retire more comfortably.

The core idea shaping the regulations is to make sure that retirement fund trustees provide more guidance to fund members at the most important decisionmaking points, without limiting their ability to make different choices if they deem such choices to be more appropriate to their specific needs. It requires all retirement funds to have a default investment portfolio; to make it the default to preserve retirement benefits when changing employers; and to have access to a trustee-endorsed retirement income option at the point of retirement. The regulations will come into effect on 1 March 2019 to give funds adequate time to implement the necessary changes.

IN THIS EDITION

Unfortunately not all the news is good. This issue of Corospondent examines some of the concerning geopolitical headlines that have dominated the news for some time. To give context and analysis, we turned to the chief foreign affairs commentator at the Financial Times, Gideon Rachman, for his insights. On page 13 is his exclusive assessment of the current Korean crisis. In a sobering read, he warns of the risk of nuclear attacks if the North Korean leader is faced with the prospect of the collapse of his regime.

While the global environment seems overcast, Europe is shakily emerging as an unexpected bright spot. Our economist Marie Antelme explores the reprieve granted to the continent after the latest round of elections. She argues that Europe should embrace this window of opportunity for economic reform.

Bitcoin has become an unavoidable topic. When the Financial Times runs a headline confirming that the CEOs of the world’s largest asset manager and the US’s largest bank agree on the need to ‘crush’ Bitcoin, you know that the topic has taken on supernova status. On page 8, Neville Chester dissects and destroys the investment case for the current batch of cryptocurrencies. While we remain excited about the possibilities of blockchain technology and expect reputable digital currencies soon, we do not believe one of the current contenders will play this role.

There is no shortage of true investment opportunities in this edition, and we include analysis of the SA retail group Spar and of Airbus, the European aircraft manufacturer. Airbus has long been an unloved stock and may look like an unexpected addition to our portfolios, especially our Global Emerging Markets Fund. But our extensive research shows that Airbus is trading well below our estimate of its fair value, and that the company has a long runway (yes, pun intended) of growth.

This is a bumper edition – we hope you enjoy the read.

To view this edition, click here.

South Africa - Personal

South Africa - Personal