About Unit Trusts

What Are Unit Trusts?

A unit trust (also known as a ‘fund’) pools money from many investors to invest in assets like shares, bonds and property. Instead of having to pick individual investments yourself, a unit trust offers you exposure to a range of assets, which are selected and managed by investment professionals. Each fund is divided into equal units. The price of each of these units is based on the value of all the investments in the fund. As an investor, you own a number of units in a fund. Over time, the price of these units will track the value of the underlying investments. Some funds invest in the shares of companies, which may pay out a part of their profits in the form of dividends. Other investments – like government or corporate bonds – make periodic interest payments. You can choose to receive these distributions, or use the money to buy more units and grow your investment.

How It Works:

You invest R10 000 in a unit trust. In return, you receive a number of units, which will be determined by the daily price of the fund on the date of investment.

If a unit in the fund is priced at R10 on that day, you will receive 1 000 units for your R10 000.

The price of unit trusts can go up and down, driven by the price of investments held by the fund.

For example, the unit price may increase to R12, resulting in the value of the 1 000 units growing by R2 000, to R12 000. If the assets fall in value, the unit price will also reduce. Thus if the unit price decreases to R9, the value of 1 000 units will be R9 000.

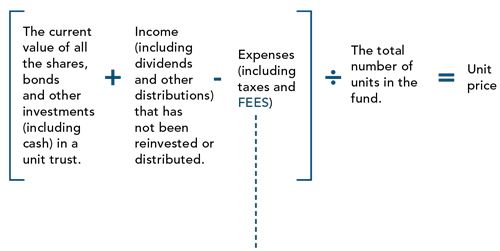

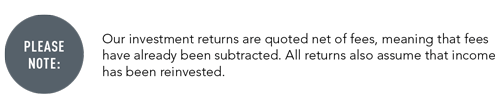

How Are Unit Trusts Priced?

All the investments in a unit trust are valued at a set time every business day (typically 15h00, Monday to Friday), at which point the daily unit price is fixed. All transactions are based on this daily price.

OUR FEES

Coronation does not charge any initial or upfront fees to invest in our unit trust funds. Your full investment amount is invested to purchase units. Our unit trusts charge an annual management fee which is calculated daily. Certain funds may charge a performance fee which is accrued daily and paid monthly for all funds, except the Coronation Optimum Growth fund which is paid annually on 30 September. For more information, please view our Fee Schedule in the forms section on Coronation.co.za.

- If you have authorised us to deduct advice fees payable to your financial adviser, your investment amount will be reduced by the agreed initial and/or ongoing fee as and when these fees become due.

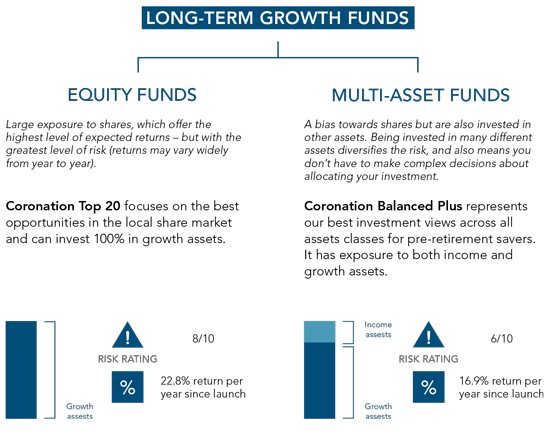

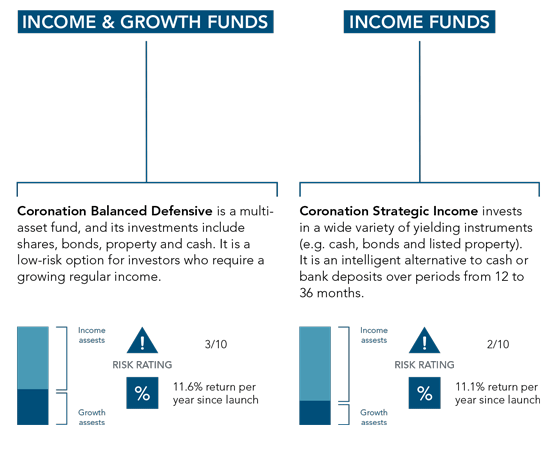

OTHER FUNDS TO CONSIDER:

Illustrations indicate the funds’ maximum allowed exposure to growth assets. Returns calculated as at end-June 2014.

Should Your Fund Be Domiciled In South Africa, Or Offshore?

Many of Coronation's flagship domestic unit trusts currently hold close to the maximum allowable offshore allocation on behalf of investors.

Investors who want additional international exposure can opt for a rand-denominated offshore fund, or a fund that is denominated in another currency and domiciled abroad. Your decision would depend largely on financial and tax planning considerations, which a professional financial adviser could assist you with.

South Africa - Personal

South Africa - Personal