WHY DOING WHAT FEELS COMFORTABLE MAY NOT BE WHAT IS RIGHT

Published January 2020

When investing, our behaviour tends to be defined by our recent experiences.

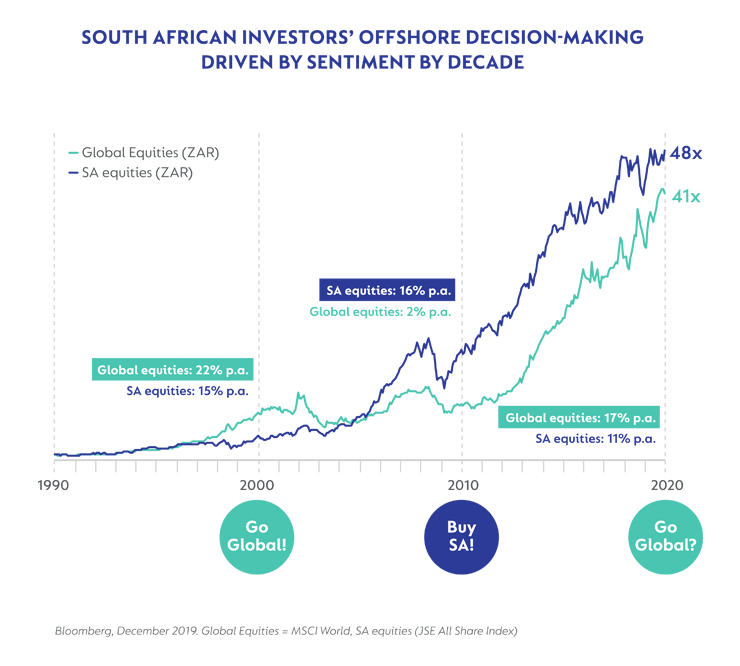

As an example, in the current environment it may feel intuitive, or right, to conclude that you should be investing all of your money offshore. This view is likely being informed by the fact that global equities delivered an annualised return of 17% p.a. over the last decade. Adding further to this would be the prevailing narrative that you cannot beat inflation by investing in South African businesses given the dire outlook for the local economy, and if you do decide to invest locally, that you should invest conservatively in the best performing funds over the last three to five years, which in this instance would be the domestic income funds.

History doesn’t necessarily repeat

The important point to remember is that you cannot blindly extrapolate the past and expect more of the same. For instance, investing in global equity funds 10 years ago may not have been the intuitive thing to do (see Figure 1), as the prevailing sentiment at the time favoured investing in South African assets, which returned 16% p.a. in the prior decade (2000 – 2010). This was because the period commenced shortly after the global financial crisis in 2008, when global equity market returns were poor, but as a result, valuations were undemanding.

Today, conditions are very different. Global equity valuations are stretched and the outlook more challenging than at the start of the 2010s. It is difficult to see global financial markets getting much further support from a monetary policy perspective and the significant corporate tax cuts in the US that helped their equity market realise strong returns is also less likely to be repeated in the next decade. In fact, 2019 marked the 11th year of the US market’s bull run and was the best return year since 2009.

So where to from here if you want to invest offshore?

We believe the wrong way to approach investing offshore is to decide whether to invest all or none of your money in global assets, as shown in Figure 1. Instead, investing offshore should be a journey, not an event.

To us, it’s always a good time for investors to consider the long-term benefits of owning a balanced portfolio of both international and domestic assets, no matter the current market sentiment.

However, what often happens when we talk about investments is that we forget what investing is really about: a slow, long-term process of compounding where you want to be prudent and ensure that you manage risk.

Being exposed to an appropriate level of risk is by far the most important issue for an investor and one of the best ways to achieve that is to diversify your portfolio across multiple economic-, jurisdictional-, currency-, industry-, and company-specific risks.

Quite clearly the question is not about when you should be investing offshore. The real question should be: How do you appropriately structure your portfolio between a combination of both local and offshore assets?

How does one go about structuring your portfolio to include offshore assets?

Investors who are already invested in one of Coronation’s domestic multi-asset class funds, will already have a considerable international allocation by way of direct and indirect offshore exposure. In the case of our funds with long-term growth objectives such as Coronation Balanced Plus and Coronation Market Plus this is typically more than 50% of the portfolio. Each of these funds provide the easiest way to gain hassle-free international exposure, as you mandate us to manage the scope of international allocation on your behalf.

The reality is that by living, working and owning a home in South Africa, you already have significant country-specific risk, arguing for an additional international allocation. Investors who want to achieve greater diversification of risk can consider investing in one of our rand-denominated international funds.

These funds, such as Coronation Global Managed and Coronation Optimum Growth, allocate all or most of their assets to international investments, while remaining easy to use and access, as the funds are established in South Africa. However, while they provide full economic diversification, they still operate under the laws of South Africa and therefore do not diversify jurisdictional risk (such as exchange control).

Investors who have a substantial amount to invest offshore and who wish to diversify their jurisdictional risk, can externalise their rands and invest in a fund incorporated in another country, most often in the EU. In this case, the laws of the country of incorporation govern your investment.

Coronation offers a range of funds incorporated in Ireland with the same economic exposure as our rand-denominated international funds, but with the added benefit of jurisdictional diversification. This route may require clearance from the South African Revenue Service if you want to invest more than the annual R1 million general offshore allowance.

To find out more about investing offshore with Coronation, search or Siri Coronation Offshore.

The information contained in this article is not based on the individual financial needs of any specific investor. To find out more, speak to your financial adviser.

Coronation is an authorised financial services provider.

South Africa - Personal

South Africa - Personal