LONG-TERM INVESTING - January 2016

The defining feature of Coronation’s investment philosophy is its commitment to long-term investing. We have consistently emphasised this point over the years, regardless of whether recent performance has been good or bad. Why do we make such a big deal about it? Is it nothing more than a weak attempt to defer accountability and ‘buy time’ in periods of poor investment performance?

We all know that patience and discipline are essential if one is to succeed in investments. The point has been made so often, and by so many, that I think it’s fair to say it’s become trite. Perversely, this almost does the practice of long-term investing a disservice – many readers understandably feel they’ve heard it all and just skip the preamble on long-term investing to get to the interesting stuff …

But the case for long-term investing is, in fact, anything but trite. I believe that the supporting arguments are profound and that long-term investing presents the only enduring competitive advantage that exists in financial markets. In what follows, I will explore the reasoning and attempt to build the case from the bottom up:

1. A high percentage of long-term returns comes from a surprisingly few months

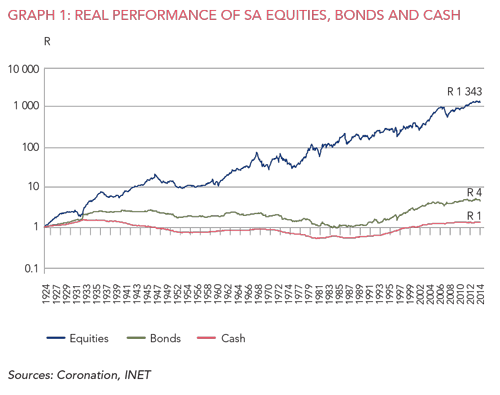

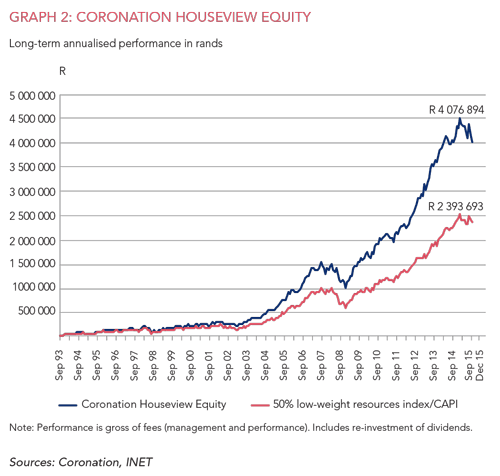

The graphs below show the compelling results that are available to those investors who are prepared to put money in the equity market for very long periods of time (regardless of the sentiment of the day) and then let the power of compounding work for them. Graph 1 shows the performance, in real terms, of SA equities, bonds and cash over the very long term. Graph 2 shows the performance (before fees) of the Coronation Houseview Equity portfolio versus the return of the equity market over the full period of Coronation’s history.

The conclusion is as simple as it is compelling. Invest in the equity markets for long periods of time, stick with winning fund managers for the long haul, and the power of compounding will do extraordinary things for you. As the market adage goes: ‘It’s time in the markets that counts, not timing the markets.’

And yet the evidence is overwhelming that most investors capture only a small fraction of the market return over time. For some reason, very few investors are prepared to put their money in equities, and with the fund managers they back, for the long haul. Why would that be?

A large part of it is due to momentum investing. Many believe they ‘can ride the wave’ and successfully avoid equities (or fund managers) while they are performing poorly and then buy when the tide turns and they start performing well. It’s a seductive notion that many fall for. In practice, however, the vast majority end up buying and selling at precisely the wrong times. They sell when the newsflow is bad (and prices are inevitably low) and buy when newsflow is good (and prices are inevitably high). And so they end up buying high and selling low – when the primary objective of investing is to do the converse.

Momentum investing is made all the more hazardous by the fact that the inflection points in cycles typically come when they are least expected. This is the case with both financial markets and the alpha cycle of a fund manager. Typically, the moves are large and, for that reason, a high percentage of the returns that patient investors earn over the long term are made in a surprisingly few trading sessions:

Since 1960, investors who were not invested in the SA equity market for 13% of those trading months got zero return over the 55-year period.

Over Coronation’s entire history as an investment house, investors who missed out on only 9% of our trading months received zero alpha over that 22-year period.

2. Financial returns accrue in a geometric manner

At some point in first-year university statistics, the difference between a series of arithmetic (linear) and geometric (non-linear) numbers is explained. Interestingly, the human brain is wired to think in a linear way. While this serves us well in most endeavours, it can be a hindrance in investing, given the fact that financial returns accrue in a non-linear manner. My favourite illustration of the power inherent in a non-linear sequence of numbers is the story of what happens when a piece of paper is repeatedly folded in half. At the first fold, the paper doubles in depth. At the second fold it doubles again, to be four times as thick as it was at the starting point. The astonishing point is how few folds it would take for that imaginary tower to get halfway to the moon. The answer is a mere 41 folds. And from there, all it would take for that tower to reach the moon is one more fold. Not easy to get your mind around!

Many of the first principles in long-term investing stem from the fact that financial returns are path-dependent and accrue in a geometric (or non-linear) manner. Two of these investing principles are relevant here:

a. The power of compounding – why small numbers get big on you over long periods of time.

South African equities have delivered a real return of 8.7% per annum since 1925. This may not sound like a big number but, as shown in Graph 1, this annual return would have grown any capital invested at that time by a breathtaking 1 343 times (in inflation-adjusted terms). It is often said that diversification is the only free lunch you get in investments. I would rate the power of compounding (over long periods of time) even higher …

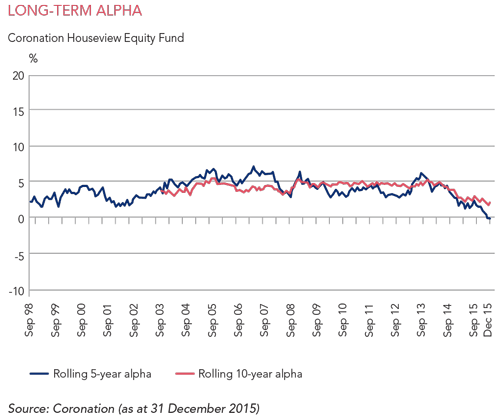

The power of compounding is just as relevant for market returns as it is for the alpha that successful fund managers deliver over long periods of time. History clearly shows that over multiple decades only a handful of managers can do as much as 3% alpha per annum (before fees). Over Coronation’s 22 years as a fund manager, our Houseview Equity portfolio has outperformed the market by 2.8% per annum. Once again, this does not sound like a big number. And yet, outperforming the market by 2.8% per annum over that period delivered a 41-bagger, compared to the (already remarkable) 24-bagger that the SA equity market returned¹. Meaningful by anyone’s standards …

We are all in the business of creating wealth over the multidecade timeframe that is implicit in managing retirement capital. Financial markets can be intimidating and the world is an uncertain place. In this context it seems crazy to me that so few investors use the one advantage they have: the power of compounding over long periods of time. The answer is to keep it simple: allocate capital to equity markets and to the fund managers that you back to deliver over the long term, and let the magical powers of compounding work for you.

b. The importance of avoiding negative returns and focusing on long-term cumulative performance.

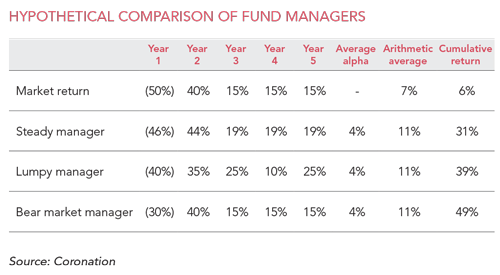

The following table shows a hypothetical case study in which the market delivers a cumulative return of only 6% over five years. In the first scenario, ‘steady fund manager’ delivers the holy grail: consistent outperformance of 4% every single year.

In the second scenario, ‘lumpy fund manager’ delivers the same aggregate alpha over the five years (20%), but its performance is lumpier. In the third scenario, ‘bear market manager’ delivers the same aggregate alpha, but does it all in the first year (which happens to be the only down year in the period).

In the performance assessment process our brains are wired to:

- weigh recent performance more heavily than earlier performance;

- penalise losses more heavily than gains; and

- appreciate alpha that is more steady than lumpy.

The entire field of behavioural finance is devoted to analysing these flaws in our reasoning process. Suffice to say that the evolutionary process did not equip homo sapiens to manage capital over multi-decade periods! We are just too guilty of instant gratification and loss aversion (we put two to two and-a-half times the weight on a rand loss as on the same rand gain!).

Over the full period, the steady manager delivered a compelling return of 31%, the lumpy manager did even better with 39% and the bear market manager did best with 49%. These outcomes are fascinating. All three managers delivered the same aggregate outperformance over the period (20%) and yet the final outcomes for their clients are so very different. Not only are the outcomes materially different from one another, but they are also at odds with what we intuitively would have expected (because our brains don’t easily compute compound returns).

They demonstrate that as much as we desire consistent alpha year in and year out, it was the steady manager that ultimately delivered the lowest value-add. The steady manager was beaten by the ‘inconsistent’ manager whose alpha was lumpier. And the manager who did best was the one that delivered in a down year and then delivered no alpha for the next four years.

This case study talks to some of the pitfalls in assessing investment performance. We instinctively place too much emphasis on recent performance as well as the consistency of alpha, and we don’t give enough credit to managers who can preserve value in downmarkets.

As observers, our expectations of cumulative performance are often very different from reality. This is why Coronation so consistently argues that it is the cumulative, long-term performance of an investment house that matters. Assessment periods of less than five years have little value. They usually reflect only one part of a market cycle and don’t capture what really matters: the actual capital accumulated by clients over the full period of their investment with that fund manager.

3. Markets are becoming less efficient, not more

The efficiency of markets has been the topic of countless academic papers over many decades. I could write pages on the issue, but will simply make the point here that the more years I spend in financial markets the less efficient I believe them to be. A good example would be the performance of a commodity stock like Anglo American, which was pushed to absurd extremes (the share went from $10 to almost $70) in the commodity up-cycle before collapsing to even greater extremes (currently $3.50) in the current down-cycle. I would be surprised to hear anyone make the argument that these extremes reflected the underlying, long-term value of a share in Anglo over that relatively short period of time.

The dissemination of information in markets is becoming fairer and more efficient all the time. As a result, I think that markets are extremely efficient at pricing in the short-term prospects of financial assets. But, in doing so, (by implication) they cannot price in their long-term prospects. One can argue that they do one or the other, but not both.

In addition, passive investment vehicles have gained significant market share across the globe and, as forced sellers of assets whose prices have declined and forced buyers of assets whose prices have increased, they tend to render markets less efficient. To add fuel to the fire, the investment industry seems to be increasingly geared to rewarding good shortterm performance over time (regardless of that manager’s cumulative long-term performance). The incentive structures in the industry (be they remuneration, performance surveys, media surveys or quarterly client report-backs) all drive home the same message: what matters is how you perform this year!

This is the great opportunity that financial markets offer the patient investor. Markets are atrocious at pricing the long-term prospects of financial assets because short-termism is on the increase. In an industry full of smart people, a surprisingly small percentage of money is genuinely managed for the long term.

This is why we so consistently argue that a long time horizon is the only enduring competitive advantage in financial markets and why it is a cornerstone of Coronation’s investment philosophy. If I go back to all the defining calls in our portfolios over our history, I would credit all of them to the insights and conviction that a long time horizon provides.

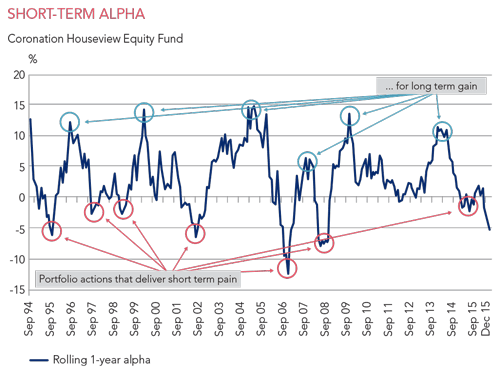

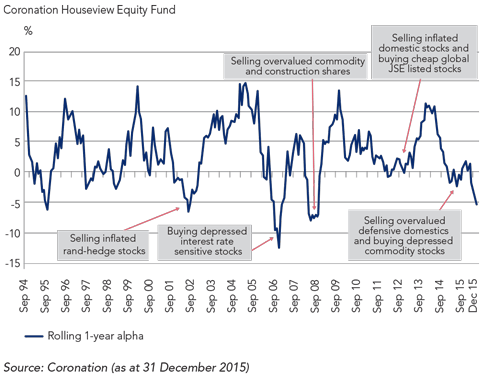

The graphs below show the alpha of the Coronation Houseview portfolio over its full history. They clearly show how misleading short-term alpha is. Notwithstanding consistent and compelling delivery on a long-term, cumulative basis, our portfolios have underperformed the market in one out of every three years.

However, in every one of those periods, the portfolio actions that caused short-term pain (buying dramatically undervalued assets that were falling, while selling overvalued assets that were rising) were the very same actions that delivered compelling results when the cycle turned.

The investment industry never ceases to amaze me. We all understand that we are managing long-term retirement capital. We all understand that it is the long term that matters. And yet the collective temptation to focus myopically on the short term seems irresistible. If one believes that financial markets misprice assets, then one should expect, not just tolerate,periods of underperformance (as long as the fund manager has a demonstrable track record of delivering over the long term).

Perversely, this groundswell of short-termism is ultimately helpful to our cause. More short-termism means there will be more mispriced assets out there for the patient, long-term investor to profit from.

Whatever the sentiment of the day, our clients can get comfort from the knowledge that we will stay the course. Long-term investing has delivered compelling results for us over long periods and we believe that it will continue to do so in the future.

¹ Our Houseview Equity portfolio represents our longest institutional track record. Our longest-running unit trust, the Coronation Equity Fund, was launched in April 1996, meaning it has a track record of almost 20 years. Over this period, it turned a market return of 12x original capital into a return of nearly 22x original capital, after taking into account all management fees and other portfolio costs.

South Africa - Personal

South Africa - Personal