Bond outlook - January 2017

VOLATILE BACKDROP

The political earthquakes of 2016 have caused shock waves that will continue to reverberate across financial markets for much of the new year. Brexit and the election of Donald Trump as the new US president reflected a deep disdain and discontentment with the status quo among voters, who expressed their unhappiness with current regimes and policies. It was a stark reminder that eight years since the great financial crisis, growth in many countries has remained undesirably low, while income inequality has seen a marked increase.

Volatility remained elevated throughout last year, contributing to high levels of uncertainty and weighing on investor sentiment and conviction. Locally, although the shock of Nenegate was behind us, the political landscape remained volatile.

Despite the volatile local and global backdrop, SA bonds managed to perform much better in 2016. This was primarily due to bonds starting the year at quite elevated yields. After starting at 9.71%, the local 10-year benchmark bond traded in a range of 9.83% to 8.40%, settling at 8.91% at year-end. The All Bond Index (ALBI) delivered a total return of 15.5% for 2016, far ahead of cash at 7.4% (Short-o Term Fixed Interest Composite Index) and inflation-linked bonds at 6.1%.

As one would expect, with 60% of the ALBI weighted towards the 12-year and longer range of the local bond curve, these bonds delivered the biggest contributon to overall performance: 17.5% – compared to 10.1% for bonds over 1 to 3 years; 13.4% (3 to 7 years) and 15.4% (7 to 12 years). Key to note here was that despite the absolute move lower in bond yields from their low starting point at the start of the year, the bulk of returns still came from the yield they provided. The ALBI’s return of 15.5% was composed of a 5.85% capital return (return due to an appreciation in bond prices) and a 9.65% interest return (return due to yield earned from the underlying bonds).

INFLATION

Over the medium to longer term, domestic inflation will continue to direct local bond yields, as will the pricing of country-specific risks and developments in the global yield environment. The performance of local bonds will therefore depend on whether current yields provide a sufficient margin of safety against adverse developments in any of these drivers, or other unforeseen events.

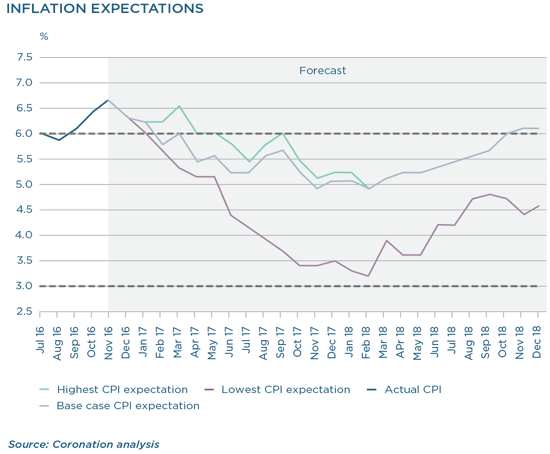

The outlook for local inflation has improved, primarily due to the deceleration in food inflation. This is illustrated in our following base case scenario, which includes an assumption of average food inflation of 3.4% for 2017 and 4% for 2018. Even if we shock our inflation forecasts (as illustrated by the green line in the graph below) by including a move in oil to $65 per barrel and a rand slump (to R15.50/$ in the first quarter of 2017), it is still difficult to see a sustained breach of the top end of the SA Reserve Bank’s (SARB) inflation band. In fact, inflation over 2017/2018 under our stressed scenario only averages 5.75%, compared to 5.45% under our base scenario.

The bottom line is that it is very hard, without a sustained shock to food inflation, to see the CPI persistently above target over 2017/2018, with the risk very much skewed to the downside (indicated by the purple line in the graph above). This is due to the abundant rainfall over much of SA during October to December 2016, as well as early indications that planting could increase by 15% in 2017 (measured even before the rainy period), providing a favourable environment for local bonds. Following on from this, it is very likely that we have seen the end of the interest rate hiking cycle in SA, with real policy rates expected to drift up to above 2% as inflation comes down next year. This will limit the SARB’s ability to increase policy rates further and, if anything, shift expectations towards the start of a cutting cycle in late 2017 or 2018.

RISK PREMIUM

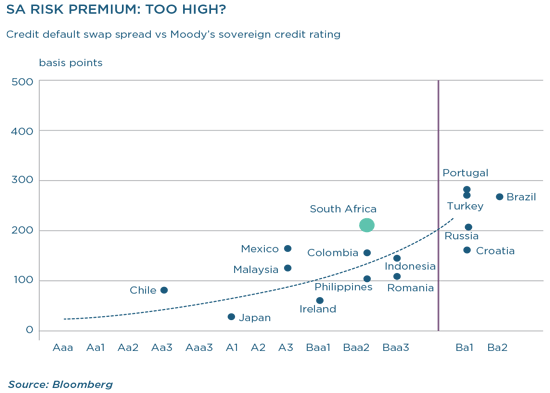

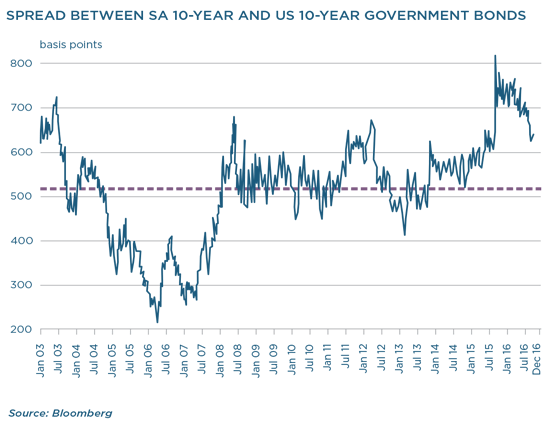

The local risk premium can be represented by two key measures: the SA credit default swap (CDS) spread, which measures the sovereign’s riskiness as an issuer, and the spread between SA’s 10-year bond yield and the US 10-year bond yield.

SA’s current CDS spread sits at a level of 209 basis points (bps). Our local budget deficit, although still wide, is projected to contract meaningfully over the next three years (by approximately 1.5%), which should reduce financing needs and costs. In addition, the weaker rand and the stable mining and manufacturing environment should also continue to promote a strong trade recovery, which should reduce our current account deficit back towards -3%. The reduction in budget and current account deficits indicates that our twin deficit problem will become more manageable over time. Our expectations of a favourable inflation outlook further implies an increase in household disposable income, thereby suggesting stronger local consumption and a more stable underpin for growth. These improvements, although by themselves not sufficient to avoid a downgrade to below investment grade, do suggest that the risks are definitely tilting towards a more positive outcome on the ratings front, implying our CDS spread is somewhat too aggressively priced.

The spread between the SA 10-year government bond and the US 10-year government bond is representative of two factors, namely, the inflation differential between the two countries and the SA-specific risk premium:

(SA 10-year bond yield - US 10-year bond yield) = (SA inflation expectation - US inflation expectation) + SA risk premium

Currently, the spread sits at 645 bps, well above the longterm average of 525 bps. But more important is its implication for SA’s risk premium. The implied breakeven inflation rate for the US 10-year bond is 2%, in line with the US Federal Reserve’s (Fed) target. Our expectation of average SA inflation over the next two years is 5.5%. Using these values and the formula above, the implied SA risk premium is 295 bps, compared to current market pricing of 209 bps. This suggests that the implied risk premium between the SA 10-year and the US 10-year bonds provides a decent buffer in terms of risk premium expectations, making local bonds particularly attractive on this basis.

One could argue that the elevated SA-specific risk premium is due to the volatile local political landscape. However, the major local events of 2016, such as the reappointment of Pravin Gordhan as finance minister, the former public prosecutor’s report on state capture, the ruling of the constitutional court against president Zuma and the results of the local government elections, suggest that political volatility is starting to abate and the perceived risk premium is too high.

GLOBAL BOND YIELDS

Global yields pushed higher after the shock result of the US election in November last year. However, to call this the start of a global bond bear market seems extreme. The prospects for EU inflation and growth have improved, but the need for monetary policy accommodation will remain for some time, as indicated by the extension of the EU quantitative easing programme. Even after the end of the programme, it will be a long time before base rates move materially above the zero level again, keeping bond yields anchored. German bond yields rose by 40 bps from their lows last year but remain at 0.2% – hardly a level that strikes fear into the heart of an SA government bondholder, who earns 9%! The Fed has a target on core inflation of 2% and on keeping unemployment below 6.5%. As history has shown, it is not likely that the Fed will allow inflation to spiral out of control, causing an inflation-driven yield sell-off. In addition, with steadily decreasing levels of productivity and an effective floor in the unemployment rate due to gains in technology, US real rates will be required to remain relatively low when compared to history, around the 1% to 1.5% level. This puts the medium-term nominal rate on a US 10-year bond at around 3% to 3.5% (assuming the 2% inflation target is met and maintained). We have long argued that yields of below 2% for the US long bond were too expensive and fair value was somewhere around 2.5% to 3.5% over the medium term. As such, we do not believe that this is the start of a multi-decade sell-off in US bonds, but merely a move towards levels that are more reflective of the underlying fundamentals and risks.

PROSPECTS FOR 2017

The combination of a more favourable inflation outlook in SA (with risks to the downside), flat local policy rates, an SA risk premium that prices in a good deal of conservatism and a global bond environment that should remain relatively stable, suggests a more encouraging environment for SA government bonds. SA’s 10-year and 20-year government bonds trade close to 9% and 9.6% respectively, which, when taken against an inflation expectation of 5.5% to 6%, suggest a range of real returns of 2.8% to 3.9%. This is a very attractive level both from a historical and absolute perspective, enhancing the appeal of SA government bonds. The main risk to this outlook remains a resurgence in local political volatility that negatively influences the country’s ability to implement policy effectively. While political uncertainty has forced a more tempered approach over the previous year as well as the very near term, we maintain a more positive and constructive view on medium- to longerterm outcomes.

South Africa - Personal

South Africa - Personal