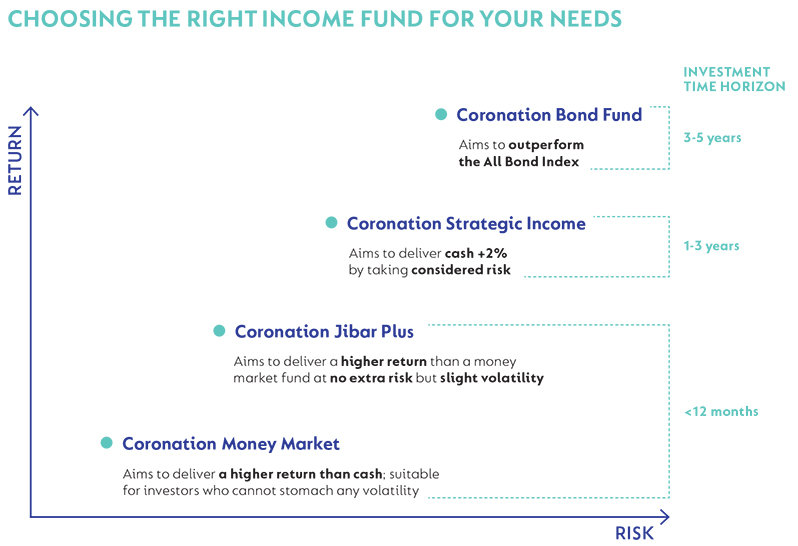

If you are a conservative investor looking for alternatives to a bank deposit, or if you want to keep a portion of your savings in a portfolio with a higher yield than cash, you have a wide variety of investment funds from which to choose. To identify the right one for your specific need, it’s important to have realistic return expectations and to understand what level of risk you are willing and able to take.

Understanding risk profiles within the income fund category

Money market funds

Money market funds, such as the Coronation Money Market Fund, deliver slightly higher returns than cash and offer the lowest risk of capital volatility of any unit trust fund. Because the assets that these funds can invest in are very tightly regulated, it’s the only type of fund in the industry where the net asset value (NAV) remains constant, making them appropriate for you if you can’t stomach any kind of volatility in the capital amount invested.

Cash-plus funds

Cash-plus funds, such as Coronation Jibar Plus, are also low-risk funds but offer a little more yield (income returned on your investment) by investing in slightly longer-dated instruments, and, as such, don’t have a constant NAV. In the case of Coronation Jibar Plus, investors can expect an annual yield pick-up of around 0.5% compared to our Money market Fund, but achieved with a very similar credit risk profile. In other words, to deliver more yield, we do not take on more counterparty risk, but rather lend to the same banks and large companies for slightly longer periods (on average, for 6 months vs 3 months in Coronation Money Market). These funds are well-suited to investors drawing an annual income from their portfolio and looking to keep the next year or two’s expected income withdrawal in a portfolio with cash characteristics.

Managed income funds

Managed income funds are appropriate for you if you want to beat cash over the medium term (1-3 years) and can stomach a little more volatility than that of a cash-plus fund. Note that there is much more flexibility allowed in this fund category, meaning that different fund managers offer managed income funds with very different risk and return profiles. In the case of the Coronation Strategic Income fund, we manage the fund to have a high probability of beating cash by 2% per annum (p.a.) by making use of considered risk-taking within the fixed interest universe, coupled with active diversification into alternative sources of return. To ensure the fund remains appropriate to medium-term investors, we manage it with significantly less interest rate sensitivity than a bond fund and are typically more conservative in our management of credit risk than many other funds in the category. (Read more about how we manage this fund here.)

Bond funds

Bond funds provide exposure to longer-dated debt instruments, and, as such, are best viewed as an alternative to 5-year fixed deposits, or as a building block allocation in a diversified portfolio strategy. Bond investors typically earn a much higher yield than income fund investors as they provide longer-term funding, but as a result are also exposed to much higher interest rate risk.

Having realistic return expectations from income funds

Our recently concluded annual client survey showed that a considerable expectation gap has emerged between the return of 9% p.a. that investors expect from income funds and what they are likely to achieve going forward. This expectation is consistent with historical returns from managed income funds through much of the 2010s, but is too high given current market conditions, given that cash yields are at multi-decade lows.

While we expect short-term interest rates to increase marginally over the next year or so, it is unlikely that we will see pre-pandemic returns on cash for some time. As such, in the next few years, you are more likely to achieve 4-5% from a money market fund, 4.5-5.5% from a cash-plus type fund and 6-7% from a managed income fund such as Coronation Strategic Income (which aims to deliver cash +2%).

Better ways to meet your return target

As it is still possible to achieve a yield of 9% or more from a bond fund, income fund investors may be tempted to take a little more risk and switch their exposure up the risk curve. However, we think there is a more efficient strategy available to utilise a slightly larger risk budget in the quest to earn a higher return. Rather than expose your full investment to a single asset class with common risk drivers (the domestic interest rate cycle and the creditworthiness of government), we think it would be better to invest in a more diversified portfolio (beyond the fixed income fund categories) with the same expected return. Coronation Balanced Defensive is a conservative multi-asset class fund that still gives you exposure to higher bond yields, plus considered diversification through attractively valued and often high-yielding local equities, as well as carefully selected global shares.

It’s about aligning your expectations with your tolerance for risk

We understand that identifying which fund type works best for you isn’t easy, particularly at a time when the future remains unclear. So, we hope that explaining the risk-return profile of each option above is helpful. The next step in choosing which type of fund is appropriate for you is to consider your own return expectations and how much risk you are willing to take, and then match those needs to the most appropriate fund type.

Coronation is an authorised financial services provider.

South Africa - Personal

South Africa - Personal