Economic views

Budget 2022: The Quick Take

Key take-outs from the Budget announcement and your annual tax incentives reminder.

- No tax rate increases in the 2022/3 tax year

- Third consecutive year of adequate bracket-creep relief

- No inflationary adjustment for investment-related tax breaks

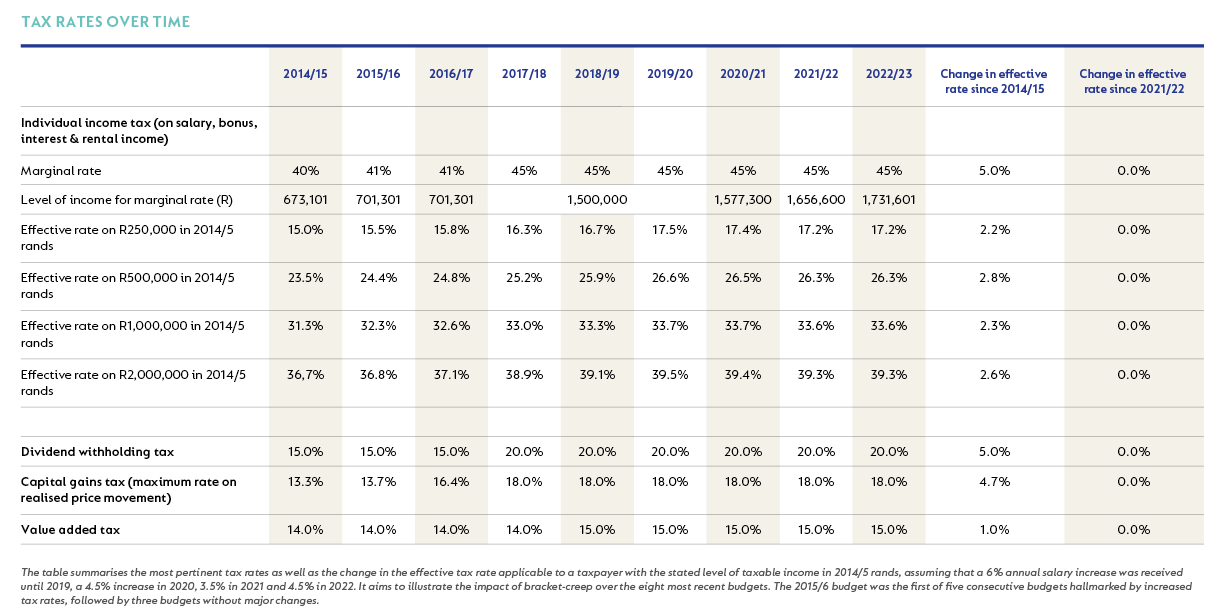

Government finances benefited from a R200 billion revenue overrun compared to the 2021 Budget, primarily thanks to the windfall of elevated commodity prices. Tax revenue was also supported by higher company, income and value added taxes in response to recovering economic activity as lockdown restrictions eased. Given this outcome, no new taxes impacting investors were announced and all the key tax rates were left unchanged. In addition, tax brackets were adjusted by an in-line-with-inflation 4.5%, preventing additional fiscal drag across the income curve (see the table below for more detail). In addition, the company tax rate will decline from 28% to 27%, and in a reprieve for motorists bracing for further fuel price hikes, the fuel levy was left unchanged for the first time in more than 30 years.

While this is the third consecutive budget without increased tax rates and with appropriate bracket-creep relief, the relatively good news follows on material tax hikes between 2015 and 2019. The marginal income tax rate was stepped up twice, dividend tax and capital gains tax increased by a third, and bracket creep was not addressed over this period. This leaves most taxpayers with an effective tax rate around 10% higher than in 2014. In addition, most of the other investment-related tax breaks mentioned below have not been adjusted for inflation since 2014.

Retirement annuity and preservation fund members should note that Treasury remains committed to finding a way to preserve their taxing rights on retirement fund assets on ceasing to be a tax resident, as first mooted during 2021. The likelihood and timing of implementing this change remain uncertain, as government has acknowledged that this change will require a renegotiation of multiple tax treaties with other countries.

TAX ALLOWANCES FOR INVESTORS

As a reminder, investors qualify for the following investment-related tax breaks:

- Marginal tax

Individuals pay a lower marginal tax rate on capital gains (maximum 18%) and dividend income (20%) compared to interest, property rental income and salary income (45%). This means that investors not using tax-advantaged vehicles are, all other things being equal, better off holding equities in their portfolios than other assets. - Tax-free investments

Tax-advantaged contributions to tax-free investment accounts remain unchanged at R36 000 per year. This arguably remains the best tax break available to individual investors with long time horizons. While you use after-tax money to invest in a tax-free investment, all income and growth earned from the underlying funds are not subject to local tax, and all proceeds at the time of withdrawal will also not be taxed. There are no investment restrictions for tax-free investments, allowing a full allocation to growth and/or offshore assets. Just do not over-contribute – contributions that exceed the annual limit are taxed very punitively (40%). - Retirement funds

Tax-deductible contributions to retirement funds remain at the lower of 27.5% of taxable income (excluding retirement benefits and capital gains) or R350,000 annually. Your capital and reinvested income will grow tax free while it remains in the retirement fund, and you will only pay tax on the way out when you start to withdraw from your retirement fund (at the then-prevailing tax rate). The first R500 000 of any lump sum withdrawn at retirement is tax free. Your underlying investments must comply with Regulation 28 of the Pension Funds Act, which sets a limit on the level of exposure you can have to equity, property and offshore assets. - Interest exemption

The general interest exemption remains R23 800 for investors younger than 65, and R34 500 for investors older than 65. At the current yield of around 6.2% on managed income funds such as Coronation Strategic Income, this means that you can invest approximately R380 000 if you are under 65 or R560 000 if you are over 65 before starting to pay tax on interest earned. - Capital gains

The annual capital gains exclusion of the first R40 000 of realised gain is unchanged. This exclusion makes it more efficient to stagger the realisation of capital gains over different tax years. - Endowments

Endowment policies also remain attractive for certain long-term investors. Individual investors in these investment policies currently pay effective tax rates of 30% on interest and property rental income, 20% on dividend income and 12% on capital gains.

Disclaimer

South Africa - Personal

South Africa - Personal