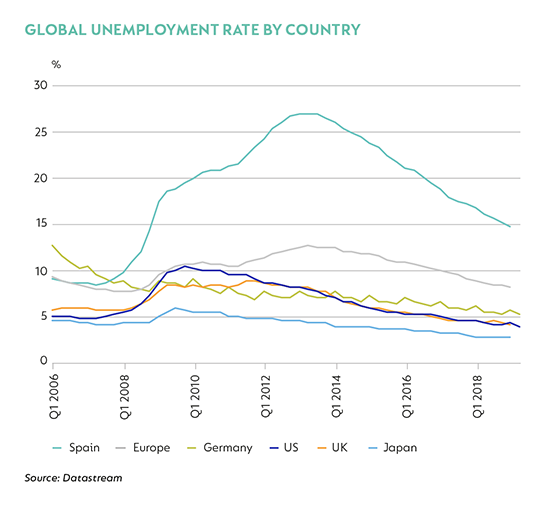

IT’S HARD TO judge whether global growth is bottoming out, or on the brink of a sharper, more aggressive moderation. After slowing for most of 2018 and into the first quarter of 2019 (Q1-19), global growth momentum seemed to be showing signs of stabilising early in the second quarter (Q2-19). Activity indicators remain mixed but, in general, developed economies continue to benefit from durable domestic demand, underpinned by tight labour markets with low unemployment and positive real wage growth and, in some cases, more supportive fiscal policies. This source of resilience is, however, increasingly challenged by a considerably weaker external environment, broadly reflecting a combination of weak Chinese economic activity, the escalation in trade tensions globally (not limited to the US and China) and the ever-increasing associated uncertainty that threatens to undermine domestic demand.

The outlook for global growth for the remainder of the year and into 2020 will depend on the balance of these two forces – can domestic demand and supportive monetary and fiscal policies offset the drag on growth that weak global trade and pervasive uncertainty exert?

In the face of weaker activity data, global central banks have committed to ongoing monetary support. The clearest message has come from the European Central Bank (ECB), which has not only guided that the policy rate will remain low well into 2020 but has also announced an extension of its quantitative easing programme.

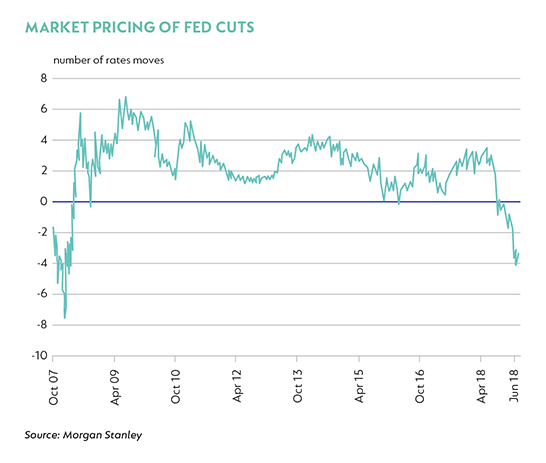

The US Federal Reserve’s (Fed) communication turned more dovish early this year (after having hiked the policy rate 25 basis points [bps] to 2.5% in December 2018), but recent policy meeting minutes suggest actual easing is in fact imminent. Consensus expectations have built for a 25bps to 50bps cut at the July Federal Open Market Committee meeting, while the market pricing is for aggressive easing of a full 100bps over the next year.

In Europe, ECB policy rate guidance appears to be in line with what is becoming a more prolonged period of European growth weakness. As trade comprises a large proportion of Europe’s GDP, especially in countries such as Germany, and supply chains are highly integrated, the region is more broadly exposed to trade tensions.

The outlook at this stage for US interest rates is less clear, given more mixed domestic data, particularly in the case of recent employment and investment indicators. Global risk assets have nonetheless been well supported by falling rate expectations, and we expect this dynamic to remain in play for now, as growth remains soft in larger developed economies, with downside risk.

TRADE TENSIONS REMAIN CENTRE STAGE

Looking ahead, the suspension of planned tariff increases agreed to at the G20 Summit in Osaka in June has provided some temporary relief and pushed out the more immediate and damaging risk that would have been posed had they come into effect now.

The economic impact of trade wars is addressed by Professor Eichengreen in a guest article in this edition of corospondent, but it is nonetheless pertinent to mention here too. The tariff increases implemented since early 2018 have raised the weighted-average US tariff from c. 1.8% to 4.5%. While the next step would have elevated this significantly, the tariff increases alone have already diverted traditional trading arrangements, disrupted supply chains, raised the cost of intermediate goods (as well as some end-products) and are more likely in the short term to have undermined new activity supporting orders and longer term, investment plans.In addition, the ancillary effect of tighter financial market conditions compounds the economic impact and will continue to do so as issues arise, as we expect them to, over time.

The US economy has been relatively resilient through this period of rising uncertainty. GDP growth accelerated in Q1-19 to 3.1% quarter on quarter, seasonally adjusted and annualised (q/q, saa), from 2.9% in 2018, despite higher policy rates. Strong inventory building contributed positively to growth, with a solid underpin from consumer spending and relatively good capital formation, outside of housing. Net trade benefited from lower intermediate goods imports (reflecting higher tariffs). Despite some weaker data which followed in Q2-19, including a weak jobs report for May, most recently available data point to healthy employment gains, stronger housing activity and healthy durable goods orders. US GDP growth is expected to moderate to about 2.7% in 2019 from 2.9% in 2018, and to trend at about 2% in 2020.

European growth has suffered both idiosyncratic shocks and a general drag from weaker global trade. Germany, Europe’s largest economy, suffered a contraction in growth in Q3-18 as new emissions regulations disrupted motor and other manufacturing activity. This was compounded by weak growth out of China and the general deterioration in global trade volumes. With strong supply chain links to broader Europe, GDP growth was 1.6% q/q, saa in Q1-19, from 1.8% in 2018. Strong labour markets have been a solid support of consumer spending, but some cracks are emerging. Where the services sectors have shown strong growth and relatively little impact from weak trade (which has severely impacted manufacturing), forward-looking indicators have deteriorated, and some labour indicators are less strong. Broadly, growth expectations have been revised lower as trade uncertainty persists and risks of a broader economic contagion increase.

The UK economy, after a period of relative resilience despite the messy Brexit process, is now also showing stronger signs of slowing. GDP growth was 1.9% q/q, saa in Q1-19, from 1.4% in Q4-18, but is expected to slow to 1.2% by 2020. Politics will continue to dominate economic outcomes in the UK. Following the resignation of Prime Minister Theresa May, the Conservative Party must now elect a new leader to navigate an increasingly chaotic Brexit process, with Boris Johnson currently the front-running candidate. Mr Johnson’s seeming willingness to deliver a no-deal Brexit should new terms not be agreed is a meaningful threat to UK growth. At this time, it is hard to see what political agreement can possibly be reached, given the actors involved, and even less likely that the EU will be open to further negotiations under new UK leadership.

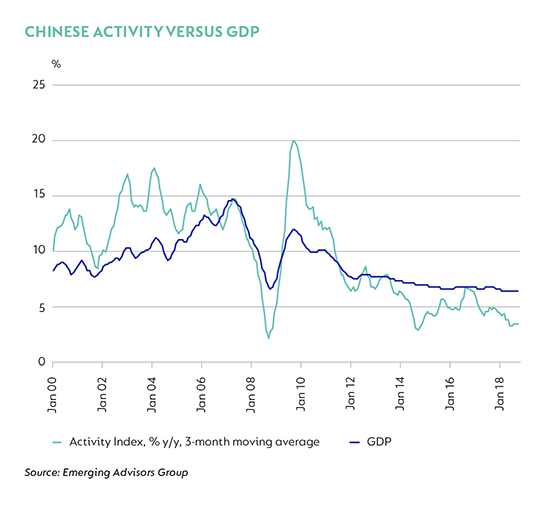

GDP growth in China remains subdued, hostage to the changeable and fraught trade negotiation process. Chinese policymakers have intervened to bolster demand by cutting the reserve requirement ratio 350bps since March 2018, in an increasingly responsive manner. Total tax and fee cuts amounting to an estimated 2% of GDP have also started to be implemented, and there has been an acceleration in both credit availability and social funding. Official GDP growth was 6.4% in Q1-19, from 6.6% in Q4-18, but most activity data remain well below this. While activity is no longer slowing, for now there seems little evidence that interventions have helped boost demand yet.

Given the ongoing economic impact of the prolonged period of credit tightening which started in 2017, we expect the Chinese economy to continue to grow slowly through 2020. Elsewhere in emerging markets, the impact of higher tariffs and the threat of further escalation remains a drag on growth. Some improvement in GDP growth in Turkey and Argentina after recessions in 2018 helped lift the aggregate, but the external risk is likely to remain a dominant drag on growth.

In closing, an ongoing, escalating risk to global economic outcomes is the loosening of traditional geopolitical alliances and an escalation in regional tensions, any number of which could have a significant impact on markets in coming months. The recent intensification of hostility between the US and Iran is almost certainly not over, but the longer game remains the strategic tension between the US and China, which we expect will continue for the foreseeable future.

Disclaimer

South Africa - Personal

South Africa - Personal