Economic views

Valuing South African debt

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese proverb

- Local economic woes and policy inertia continue to weigh on SA bonds

- Monetary and fiscal policy, as well as global cost of capital, drive local yields

- The administration must urgently make some hard decisions, such as cutting the public wage bill

- Our analysis supports the inclusion of SA bonds in a portfolio.

THE LAST YEAR of the past decade, 2019, was the Chinese Year of the [Earth] Pig. Despite the images that might spring to mind, in Chinese astrology the pig represents wealth and treasure. Considering the amount of turbulence that was injected into financial markets by geopolitical game changers such as Brexit, the US-China trade war and the Hong Kong protests, the fortunes of the Earth Pig did shine on global equity markets as they closed 2019 up more than 25% in US dollars (as measured by the MSCI World and All Country World indices).

Global bond markets were no exception, as most bond markets saw their yields compress over the course of the year, driven by a slowdown in global growth and a dovish twist by global central banks. Emerging market bonds provided a total return of c. 14% in US dollars as the hunt for yield intensified in a world where $11.2 trillion worth of debt now trades at a negative yield.

This year is the Chinese Year of the [Metal] Rat, which symbolises renewal. For South Africans, this is both auspicious and apt, as few economies need renewal more than South Africa’s. Despite the rally in global equity and bond markets, South African bond and equity markets underperformed their global peers. The local economy continued to slow due to concerns about deteriorating government finances and State-owned enterprises (SOEs), and specifically Eskom, as bouts of loadshedding continued to intensify. The All Bond Index (ALBI) produced a total return of 10.3% in rands (13.1% in US dollars), which was driven by a rally in the three- to 12-year area of the curve, as expectations of further interest rate cuts continued, given the low growth and contained inflation environment. The slow pace of policy change and implementation, and the requisite tough decisionmaking, will continue to weigh on the country into 2020. That said, the flower that blooms in adversity is the most rare and beautiful of all, so let’s hope South Africa can learn and heal from its damaged past, rather than run from it.

FINDING THE SWEET SPOT

The only way a leopard can change its spots is by going from one spot to another. In 2020, the spotlight will be on South Africa’s policymakers and their ability to change the course of the local economy and show marked progress in the right direction. As long-term investors, our key objective is to make sure that we price risk correctly and that our clients’ portfolios are robustly positioned. We do this by ensuring that they are well diversified, avoiding the risks that accompany positioning towards a single-market outcome.

This implies that a great deal of time is spent on understanding the fundamental drivers of asset prices and whether the assets we hold on behalf of our clients are adequately priced with a sufficient margin of safety to buffer against short-term adverse volatility. For South African government bonds (SAGBs), this implies understanding the fundamental direction of the local economy and ensuring that they are priced to reflect prevailing and expected conditions.

THE ECONOMY OF SOUTH AFRICAN YIELD

There are three key drivers of SAGB yields:

1. Monetary policy expectations

Monetary policy is driven by inflation and the growth outlook. Inflation is expected to average close to 4.5% over the next two years, which is at the midpoint of the inflation targeting band, while growth is not expected to reach 1.5% until 2021 (South Africa’s growth has averaged sub-1% since 2015), while global growth is expected to average just above 3%. The Monetary Policy Committee (MPC) has reiterated that it wants inflation to maintain the midpoint so that it can use monetary policy more effectively during times of crisis.

South Africa’s economy is struggling to grow, and although monetary policy is a blunt tool, it can be used to boost confidence and relieve some consumer pressure. Currently, real policy rates are above 2% and, if the repo rate does not move, the real policy rate will average 1.7% over the next two years. In previous cycles, when growth was this low, the real policy rate averaged close to zero. This suggests that there is room for the MPC to move policy rates at least 50 basis points (bps) lower over the next year.

2. Fiscal policy expectations

In South Africa, fiscal policy has been on a slippery slope since the Global Financial Crisis, as the administration has struggled to narrow the fiscal deficit and government debt has ballooned. The reasons for this are well known, but in recent years the slowdown in growth has decreased tax revenue, while expenditure has continued to increase to rescue ailing SOEs (Eskom, SAA and Denel). Eskom has been and remains the biggest risk to the local economy. Turnaround plans have been tabled and key personnel have been replaced, but due to the extent of a decade-plus of maladministration and corruption, operational turnaround has been slow. It is inevitable that financial support will be ongoing, and government will need to cut expenditure in other areas to keep the nation’s ailing power supplier online.

The February 2020 Budget will be another watershed moment, as investors will again look to policymakers to make the hard, shorter-term decisions, such as freezing or cutting the government wage bill despite union objections. Most ratings agencies have given up hope on South Africa and moved us into subinvestment territory.

Moody’s is the only agency that has retained South Africa at investment grade, which keeps us in the FTSE World Government Bond Index (WGBI). However, given the deterioration seen over the last year, it is very likely that they will downgrade South Africa in 2020, which should see outflows from the local bond market of between R70 billion and R120 billion. This seems like the end of the world, but we should not forget that:

- South Africa has a very deep and liquid bond market.

- The local savings industry is very large and sophisticated.

- The fundamental deterioration and risks around it have been well flagged over the last two to three years, so investor positioning has adjusted accordingly.

- South Africa comprises less than 1% of the WGBI, so at current valuations, investors might choose not to exit.

While we are likely to see some fiscal effort in the budget and some tough stances regarding SOEs, keeping the policy trajectory headed in the right direction, that doesn’t rule out an exit from the WGBI. In the worst-case scenario, government doesn’t manage to paint a better scenario in 2020 and South Africa exits the WGBI, but that does not mean the end of the world for SAGBs, given the current risk premium embedded in assets (refer to 3. below).

3. Global cost of capital

Global bonds are trading close to all-time lows due to the slowdown in global growth, the flight to safe-haven assets because of geopolitical uncertainty, and the dovish twist seen by global central banks in 2019.

It is inevitable that bond yields will move higher over the next five to 10 years; however, in the next two to three years, they could also move lower before moving higher. Global inflation remains low, with global growth set to remain sluggish.

Central banks around the world have continued to inject large amounts of liquidity into financial markets to keep crises at bay and will continue to engineer a soft landing for the global economy. This might not be the goldilocks economy of the early 2000s for emerging markets, but it will definitely be less turbulent than what we have seen previously. Until we see a turn in global inflation, one should not expect a ramp-up in global policy rates, which means that global bond yields should see only moderate fluctuation.

The backdrop for SAGBs is therefore mixed. Monetary policy should be supportive, fiscal policy will remain in the spotlight and the global cost of capital, although it should remain supportive in the short term, might be unfriendly over the longer term.

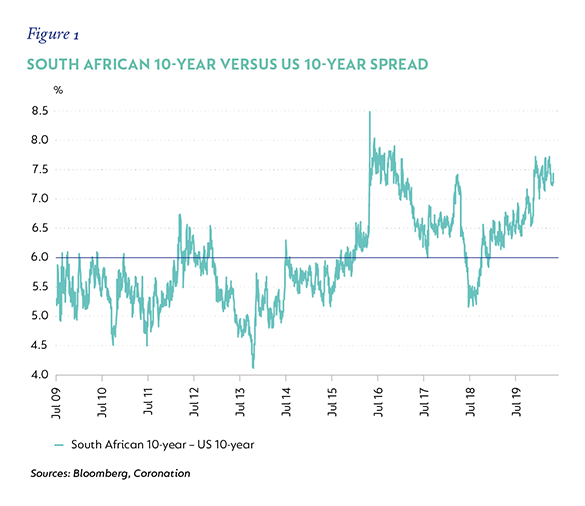

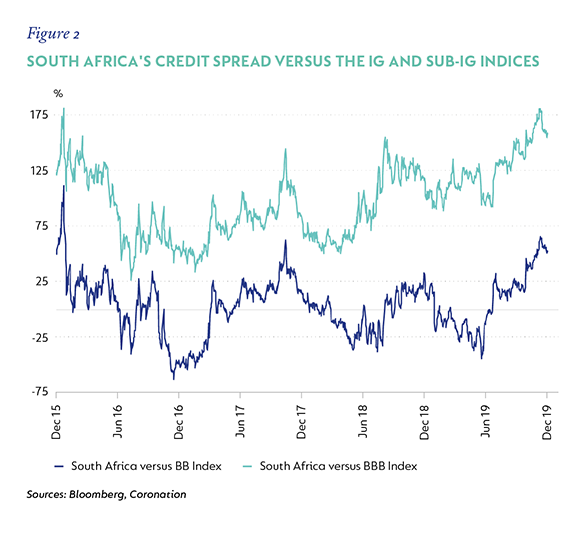

However, from a valuation perspective, these risks seem to be adequately priced. First, SAGBs’ spread over the US 10-year (global risk-free) rate is quite extended (see Figure 1). This suggests enough room for SAGBs to absorb a move higher in global bonds. The follow-on question would surely be: if South Africa continues to deteriorate, should the breadth of the spread represent credit-worthiness? At current levels, however, South Africa’s credit spread already trades very wide relative to both the investment grade (IG) and sub-IG indices (Figure 2), suggesting that further deterioration away from even sub-IG norms is being priced.

THE RIGHT PRICE?

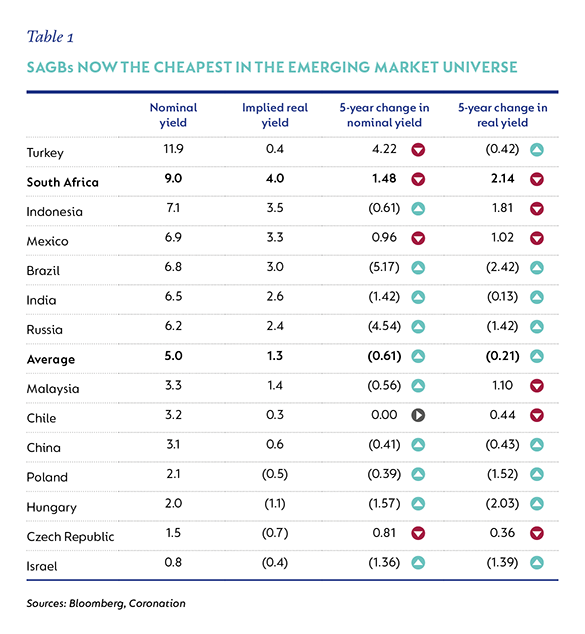

Despite what might seem like an impressive return relative to cash in the local context, SAGBs have underperformed their peers considerably over the last five years due to a fundamental deterioration in South Africa. In the last five years, SAGB nominal yields have risen by 148bps, while the implied 10-year real yield has risen by over 200bps. This compares to the emerging markets average of a 61bps compression in nominal yields and a relatively small compression in implied real yields. As such, SAGBs are now the cheapest in the emerging market universe from an implied real yield perspective and the second cheapest from a nominal bond perspective (see Table 1).

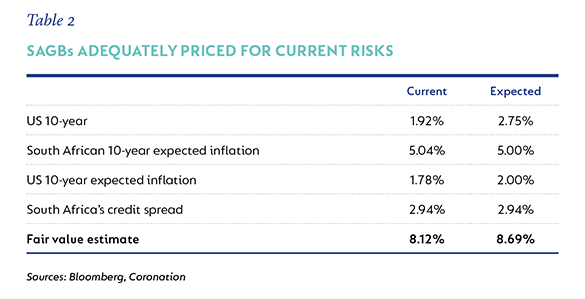

Constructing a fair value for SAGBs using the global risk-free rate, inflation differentials (the difference between South African and US expected 10-year inflation – see Table 2) and a measure of credit-worthiness for South Africa (the South African credit spread) also suggests that the South African 10-year bond, currently trading at 9%, is at inexpensive levels. Even adjusting current variables for expectations around a rise in the global risk-free rate brings one to a similar conclusion. The confluence of this evidence suggests that SAGBs are adequately priced for current risks.

FINDING VALUE

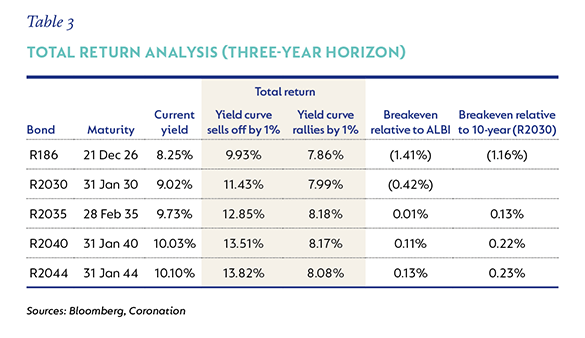

We believe that bonds at the longer end of the curve continue to offer the best value. To ascertain which point on the SAGB yield curve is the most attractive, we use a total return analysis with a three-year horizon period across various bond maturities. Table 3 shows how these bonds will perform if:

- The yield curve moves parallel up 1%;

- The yield curve moves parallel down 1%;

- How much each bond can sell off before it breaks even with the ALBI; and

- How much each bond can sell off before it breaks even with the 10-year bond (R2030).

The previous analysis, taken together with the fact that the difference between the 30-year and 10-year areas of the SAGB yield curve is close to the widest it has ever been (1.39% during the taper tantrum of 2013), suggest that bonds at the longer end of the curve continue to offer the best value in our view.

PORTFOLIO ALLOCATION

Inflation-linked bonds (ILBs), once again, underperformed nominal bonds in 2019, with a return of 2.6%. Only shorter-dated inflation-linked bonds provided a positive return, albeit below cash. A five-year ILB trades at a real yield of 3.6%. Using expected inflation of 4.5%, if one holds this bond for the next three years, the nominal return would be in excess of 8%, which compares very favourably to equivalent maturity nominal bonds.

In addition, with expectations for the real policy rate to move closer to 1%, it makes the carry-on shorter-dated ILBs even more attractive. At current levels, shorter-dated ILBs therefore do warrant a position in a bond portfolio.

The South African economy has been plagued with low growth, ballooning government finances and a volatile global geopolitical environment. Low growth and well-contained inflation suggest the trajectory for South Africa’s policy rates to be lower over the next 12 months.

In addition, South African bonds have continued to underperform relative to their global and emerging market counterparts, suggesting an increased risk premium, given South Africa’s precarious economic backdrop. At current levels, SAGBs seem adequately priced relative to underlying risks, which suggest a neutral allocation in portfolios.

South Africa - Personal

South Africa - Personal