PERFORMANCE

The Fund returned 8.3% in the final quarter of 2023. This strong absolute performance was also 0.4% ahead of the 7.9% return of the benchmark MSCI Emerging Markets (Net) Total Return Index. For the year as a whole, the Fund returned 9.2%, which was 0.6% behind the benchmark. We recognise that there is still much room for improvement in performance as some of the longer-term numbers remain well below our expectations. Since inception over 15 years ago, the Fund has outperformed the benchmark by 0.3% p.a. We believe that our investment process and philosophy of buying undervalued businesses with a margin of safety/attractive 5-year IRR should be able to deliver outperformance in excess of 3% p.a. (before fees) over meaningful periods, as it has done for most periods since launch, and we continue to work towards delivering these returns in future. The asset class (Emerging Markets) has lagged its developed market benchmarks by some distance over most longer-term periods, and we believe it is substantially undervalued as a result. More importantly, the Fund currently offers around 75% upside to fair value on a weighted average basis, which is well in excess of the long-term average of around 40%. We therefore continue to be very positive about returns on a forward-looking basis.

FUND POSITIONING

The biggest contributor to relative performance (alpha) in the quarter was Pepco Group, which returned 42% and contributed 0.6% to alpha. In our prior commentary, we highlighted the group’s challenges that caused the share price to decline significantly in September 2023 and which led to the departure of the CEO. It is pleasing that the share price has rebounded so quickly since then, partly helped by results not being quite as poor as was hinted at in the group’s September trading update. Gross margins have started to improve after coming down by around 5% over the last few years, helped by a normalisation of shipping and freight costs. In the final quarter of the company’s fiscal year (30 September), gross profit margins were 3% higher than for the year as a whole, which shows the direction of profitability is strongly positive. The greater focus on capital discipline and the slowing down of their aggressive store expansion plan have also helped allay concerns that Pepco’s debt profile would worsen over time. Pepco’s main shareholder announced they would not be selling any shares as they consider the company to be significantly undervalued. This removes a potential overhang that would come from the main shareholder selling down.

The second largest positive contributor was the Brazilian financial services group StoneCo, which returned 70% in the quarter and contributed 0.5% to alpha. Great results for the year to date to end-September kickstarted the run in its share price, with close to 30% revenue growth for the nine-month period (year on year [yoy]), around 50% growth in Earnings Before Interest Tax Depreciation and Amortisation (EBITDA), and 320% growth in Earnings Before Tax (EBT). The new management team has really turned this business around, strengthened corporate governance, improved disclosure, and changed remuneration to align properly with shareholders. The company announced a R$300m ($62m) share buyback in September and completed it by the time the results were published in mid-November. They subsequently announced a further R$1bn buyback ($206m), which is ongoing. On the company’s investor day, soon after the results release, StoneCo shared its view on the long-term opportunities available in the markets in which it operates (payments, banking, credit, and software). Arguably, the most meaningful metric was their expectation for net income to reach R$4.3 billion ($885 million) in 2027. Even with the share price movement, the company’s market capitalisation is only $5.5 billion, putting it on six times earnings for 2027 (four years away). Our numbers are below that of management (implying around eight times 2027 earnings), largely due to a more conservative take rate assumption. Few peer businesses in any geography trade at single-digit multiples like this, so while there is execution risk in achieving these targets, the risk-reward balance warrants retaining the position (of 1.5% of Fund) in our view.

Pinduoduo, the ecommerce group, and Tencent Music Entertainment (no.1 in online music and audio streaming in China) were the only holdings from China that contributed meaningfully to relative performance in the quarter. Pinduoduo returned 50% and provided 0.5% alpha, and Tencent Music returned 41% and contributed 0.4% alpha. In Pinduoduo’s case, the driver of the share price was exceptional results, significantly outperforming the broadly stagnant ecommerce market in China. Revenues for the third quarter (Q3) almost doubled compared to the previous year, operating profit was up 60% yoy despite heavy investment in their international operation (Temu), and cash conversion was very strong. Temu’s success has exceeded our expectations and having attached very little value to it previously (Temu is loss-making currently), we now contemplate an outcome where it could be a significant part of their business in future. The success of the Pinduoduo investment has helped counter the impact of JD.com, its competitor in ecommerce, which was the biggest detractor in the Fund for the calendar year. Tencent Music rallied strongly as it managed to grow quarterly earnings by 11% yoy in Q3 despite a 50% decline in what was previously its largest revenue source – social entertainment. Online music is now 70% of the business, and two-thirds of this is subscription revenues. There are now over 100 million paying users for online music, each spending an average of RMB10.30 a month for the service. There is room to grow both these headline figures significantly in our view.

The Chinese equity market as a whole did not have a good quarter (or year) as concerns over property, a slowing economy, and economic policies weighed on share prices. As a result, three of the biggest positive contributors to relative performance for the quarter were stocks we do not own that are material in the benchmark. Alibaba and Tencent Holdings contributed 0.5% alpha each, and Meituan Dianping contributed 0.4%. Tencent’s positive contribution was, however, largely cancelled out by our Naspers and Prosus position combined, which detracted 0.4% from relative performance. Chinese authorities also spooked the market in late December by publishing potentially negative draft gaming regulations for comment. Tencent and NetEase, the two largest online gaming operators in the country, both reacted negatively to the announcement. Given that NetEase is far more exposed to high-paying features (its games are more complex and long running), we took the view to sell the position given the potential increased risk. We retained our indirect Tencent exposure via Naspers and Prosus as the potential impact of these regulations is very different compared to NetEase. For a start, Tencent is less exposed to these regulations as it has a very different game catalogue/genre and its gamers are not anywhere near NetEase levels in terms of being “heavy spenders”. Additionally, gaming represents less than half of Tencent’s overall business, which further mitigates the risk. Finally, Naspers and Prosus trade at a substantial (40%) discount to the value of the Tencent stake alone (ignoring all other assets). The impact of NetEase cost the Fund 0.3% in the quarter, while that of Prosus and Naspers (-0.4%) is highlighted above. Within days of the original announcement, there was an apparent U-turn by the regulator, emphasising that the regulations were in draft format and that they were open to making changes after listening to the companies’ views. A large batch of online games (including games from both Tencent and NetEase) were also unexpectedly approved. The official responsible for publishing the draft regulations was also fired.

The biggest detractor in the quarter was Li Ning, the Chinese local sportswear brand. Li Ning returned -36% and took off 1.1% from performance. Li Ning endured a very difficult operating environment in 2023: they set unrealistic sales targets for the year, produced too much inventory, and then had to cut prices to clear stock. Distributors also worsened matters by selling on unauthorised channels, damaging brand equity. The company compounded these operational missteps by announcing (in December) the purchase of a building in Hong Kong for $280 million (about 4% of its market cap at the time) to house their international expansion. In our view, this was a very poor use of capital given that the share price had already halved since the beginning of the year prior to the announcement. We (and presumably many other long-term shareholders) strongly lobbied the board to do a share buyback, which they announced (equivalent to 6% of shares in issue) soon after the property purchase. Li Ning trades on around 9 times this year’s (depressed) earnings, which we believe is very attractive for what remains one of the strongest sportswear brands in China.

The second largest detractor was 3R Petroleum in Brazil, which returned -14% and cost 0.5% alpha. 3R was weak in the quarter due to falling oil prices, but also because they have scaled back their production forecasts for this year by around 15% to 55 000 barrels of oil equivalent per day (boe/d). Melco Resorts returned -11% in the quarter and also cost 0.5% of performance. The gambling market in Macau is taking longer to return to pre-pandemic levels despite China’s reopening, with flight and ferry availability still being lower than in 2019, and, in the case of flights, travel costs being significantly higher. China’s clampdown on capital leaving the country over and above the small official travel allowance has further soured sentiment toward Macau gambling stocks as they are somewhat reliant on unauthorised/unofficial channels for gamblers to exchange their Renminbi (China’s currency) into local currency. Melco Resorts now trades on around a 20% free cash flow yield on our estimates of 2024 free cash generation and we believe the stock is substantially undervalued.

JD.com cost the Fund 0.4% in the quarter, making it the biggest detractor for the year with a 3.3% negative contribution. JD.com’s share price halved in the year as their own growth, and that of the ecommerce market as a whole, slowed, with Pinduoduo and Duoyin (owned by ByteDance, the parent company of TikTok) being the only meaningful players to show strong revenue growth. The company trades on eight times this year’s forecast earnings, and this valuation ignores their significant net cash balance (over 40% of current market capitalisation) and potential stakes in listed subsidiaries.

BUYS AND SELLS

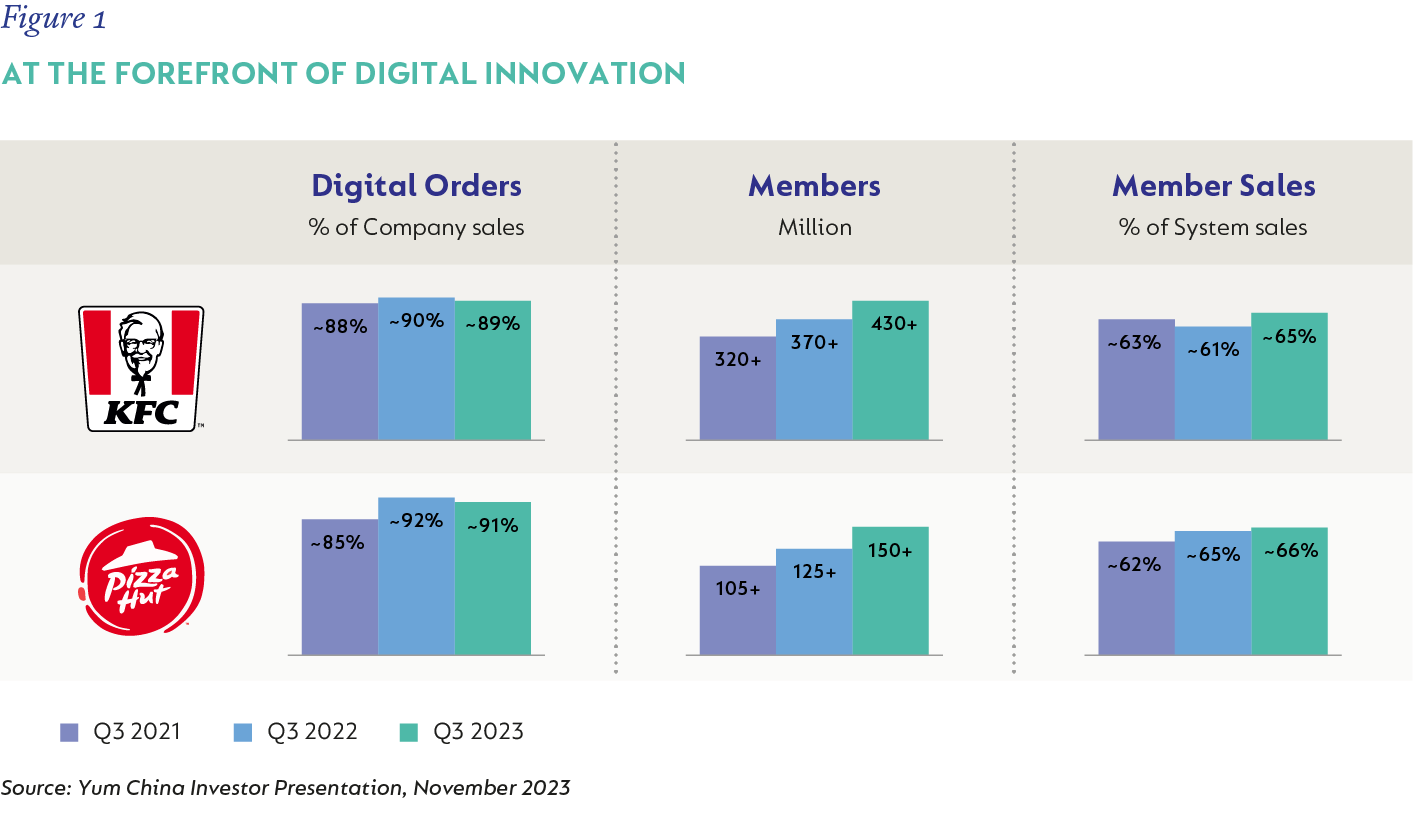

There were a few new buys in the quarter, the most material of which was Richemont (1.6% of Fund at year-end). The share price reacted negatively to interim results released in November, with the key disappointment being a slowdown in the growth rate for its specialist watchmakers division. However, the bulk of the business is in Jewellery Maisons (Cartier and Van Cleef & Arpels), which saw 16% constant currency revenue growth yoy. Richemont now trades on around 14 times one-year forward earnings (excluding cash). At these multiples, Richemont is trading well below the 20-year average multiple of 19 times. Other new buys were all 50-60 basis points positions. In Mexico, we bought Quálitas (insurance) and Walmart de México, whilst in China we bought Kweichow Moutai (spirits) and Yum China, the operator of KFC, Pizza Hut and other brands in that country. Yum China fell almost 25% in November after reporting poor results and highlighting intensified competition in the restaurant sector. We believe this reaction was overdone and the long-term structural opportunity for the various franchises/brands in China is multiples of the current size. The company continues to be at the forefront of digital innovation, with orders now representing almost 90% from digital sources (delivery apps, their own app or touchscreen in restaurants). Their membership base is closing in on half a billion people (more than a third of the country’s population), and members account for around two-thirds of sales.

Management is also very shareholder-friendly, with over $210 million returned via dividends and share repurchases in Q3. Our team met the company in November and came away impressed, and with the conclusion that this is one of the best assets in China. The store base is currently 14 000 stores, and they are targeting 20 000 by 2026. The lower-tier cities have huge potential for new stores and most new stores break even within three months. They have also committed to return $3 billion in capital to shareholders (relative to a $16 billion market capitalisation).

We exited a number of small positions to fund the new purchases. In Brazil, we exited Petz (pet store operator) due to poor execution and a far more competitive environment. In China, we sold out of Li Ning’s peer Anta Sports and Bosideng, a maker of premium down jackets. We also sold out of Diageo, largely putting the proceeds into Kweichow Moutai, as mentioned above.

South Africa - Personal

South Africa - Personal