Investment views

Can you invest successfully in SA companies and funds?

The Quick Take

- Despite a very tough operating environment in SA, many locally run businesses have demonstrated resilience and good business sense

- Small caps are generally more exposed to SA than large caps, but have still managed to keep pace over most time periods

- There are many very attractively valued shares in the small- and mid-cap space

It feels like South Africa (SA) has been a tough place to run a company for the past five years. We have been beset by many challenges, most of which are unique to our country. These include:

- Unprecedented levels of loadshedding

- The civil unrest/rioting in 2021

- Severe flooding in KwaZulu-Natal in April 2022

- Constant political upheaval

- Corruption and state capture

- Decaying service delivery in many cities

- High levels of organised crime, such as the so-called construction mafia

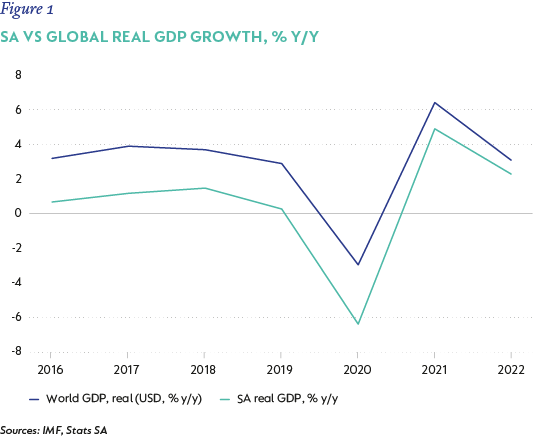

The significant impact of these challenges is borne out by the numbers. Figure 1 shows real GDP growth in SA relative to global GDP growth. Worth noting is that the SA series is in rands, while the global series is in US dollars, which flatters the SA numbers. There is not one year in this period when SA has outperformed the World.

With this in mind, it is natural that investors would be reluctant to invest in companies who do business in SA (or SA-focused funds). It is thus fair to ask the question: is it possible for a business to thrive in our country and to deliver decent investment returns, especially relative to globally-focused companies? Surprisingly, the answer is: yes, it is possible.

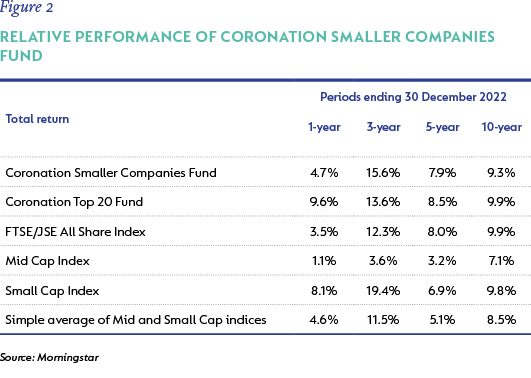

Figure 2 shows the performance of the Coronation Smaller Companies Fund relative to the Coronation Top 20 Fund, the FTSE/JSE All Share Index (ALSI) and the Mid- and Small-Cap indices. This is an interesting comparison because Top 20 invests in the large, globally-focused companies listed on the JSE – the likes of Naspers, British American Tobacco, Anheuser Busch Inbev, Richemont, Anglo American and BHP Billiton, which are also dominant in the ALSI. Conversely, the Smaller Companies Fund invests in companies outside the Large-Cap Index and can therefore be viewed as a SA Inc. proxy, as c.72% of the Fund is invested in SA industrial companies and another 23% in SA financials, with the balance in smaller resource companies.

It is noteworthy that the Smaller Companies Fund has been able to keep pace with both Top 20 (which is 71% invested in ‘non-SA’ businesses) and the ALSI over most time periods for the past 10 years. We think this illustrates a few things.

- New businesses started from scratch by entrepreneurs that become dominant in a particular field are rare, but they do exist. These always start off as small caps.

a. Companies like OUTsurance and Transaction Capital have been built in the past decade to become dominant in their sectors through innovation and disruption. Capital Appreciation could become something similar. - Despite being an extremely difficult environment in which to run a business, many SA businesses have been very well run.

a. As mentioned earlier, running a business in SA is not for the faint hearted. Despite this, there are many companies in SA which have risen to the challenge.

b. Companies like Advtech and Dis-Chem identified many years ago that there was a huge opportunity in the industries in which they operate (education and pharmacy retail, respectively) to grow aggressively. In Advtech’s case this was due to a weak state competitor (the public education system), and in Dis-Chem’s case this was due to the highly fragmented nature of the retail pharmacy landscape in SA.

c. There are a handful of companies (like Hudaco and Mpact) that have added huge value to shareholders by just doing the right things – astute capital allocation (share buybacks, clever acquisitions, special dividends), and running an efficient business.

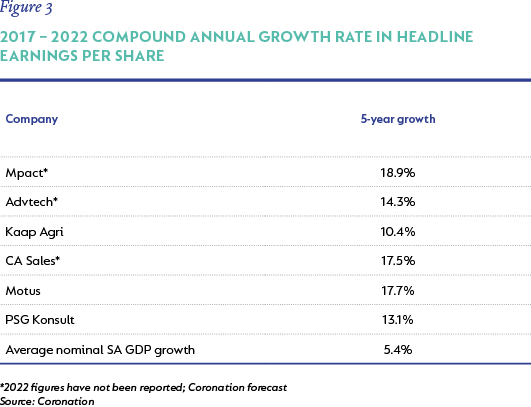

c.i. Hudaco is a 100% SA-focused business, selling its products to a multitude of customers in the industrial and mining spaces. It has grown its earnings by 7.3% per annum for the past five years, relative to an average SA nominal GDP growth of 5.4% over the same period, despite paying out some 22% of the current share price in dividends. In this period, Hudaco has resisted the urge to make expensive and risky offshore acquisitions and has instead been ruthlessly focused on business basics.

c.ii. In the past two years, Mpact bought back 15% of its shares in issue at an average price of R13.71 per share (the share price today is R29.35). This has been materially value enhancing to the remaining shareholders.

d. Figure 3 shows how some SA-focused companies have been able to thrive despite the tough economic circumstances. These companies have grown well ahead of the overall economy.

- It is possible to eke out reasonable returns from investing in undervalued companies in a challenged environment.

a. Just because SA is a difficult environment in which to operate a business, it doesn’t mean one can’t still make reasonable investments. In fact, the difficulty of the circumstances in SA often means that shares trade on very low multiples and, if the business is well run or the business environment improves marginally, the rating the market places on the business can improve. A re-rating from a five to a seven price-to-earnings ratio translates into a 40% return. - Just because it’s a big global business doesn’t mean it has no risks attached or is a good investment.

a. The vast majority of Naspers’ value is its holding in Tencent, which is a Chinese business and subject to the risks of that country. This year past we have seen that investing in China comes with significant risk due to the concentration of power in the political leadership and Premier Xi Jinping in particular, and his pursuit of common prosperity.

b. Anheuser Busch has been a terrible investment for the past seven years. It’s late 2016 listing price was above R1 800 per share. Today, the share price is a touch over R1 000. In hindsight, the business was overvalued back then at around a mid- twenties price-to-earnings multiple (P/E), and is now far more sensibly valued. Not only was Anheuser overvalued seven years ago, but the company probably made a few poor decisions, none less so than overpaying for SAB Miller and then taking on debt funding that looked excessively risky for years afterwards. This was in terms of both the quantum of debt and the fact that most of the debt was denominated in hard currency, while the majority of Anheuser’s revenues derive from emerging markets.

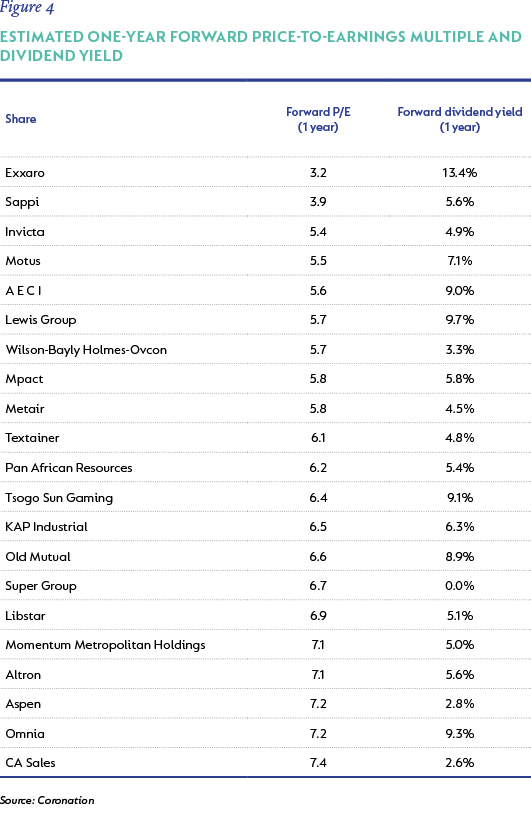

The exciting prospect for investors over the next few years is that not only have many SA companies been able to grow earnings ahead of our overall economy, but that many of these companies are very modestly rated by the market. Figure 4 shows the estimated one-year forward PEs and dividend yields of a basket of mid and small caps. PEs of five, six and seven times are not uncommon, nor are 6%,7% and 8% dividend yields.

It is often said of South Africans that despite the hardships we face, we are often able to find workable solutions and to rise above many of our challenges. Perhaps this is the result of lots of practice, or perhaps from the resourcefulness and spirit of our people. We think that this same characteristic is evident in many of our listed companies. We therefore urge investors not to write off pure SA-focused funds or investment opportunities. They might surprise you!

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal