Investment views

Addendum 6: Stress testing worst-case scenarios

- assessing asset class performance in weak state regimes

LEBANON

Lebanon’s economic and financial crisis ranks among the worst globally since the mid-19th century. This has been a multipronged crisis, commencing in 2019 and then exacerbated by Covid and the Beirut port explosion later in 2020. In the same vein as Venezuela, this is another example of extreme state failure. A lethal combination of a banking crisis, sovereign debt default, hyperinflation, and a 98% collapse in the value of the Lebanese pound (LBP) caused a severe plunge in economic activity and the imposition of austerity measures, with a devasting social impact in the form of widespread civil action – the 17 October Revolution. The effects continue to play out within a non-functioning political system.

Indeed, it is important to emphasise the severity and speed of the collapse of Lebanon as a functioning, albeit fragile and poorly run, State. The extent of the economic trauma experienced here is more akin to that associated with a ruinous war – well beyond the order of magnitude typically associated with country banking, currency, or debt crises.

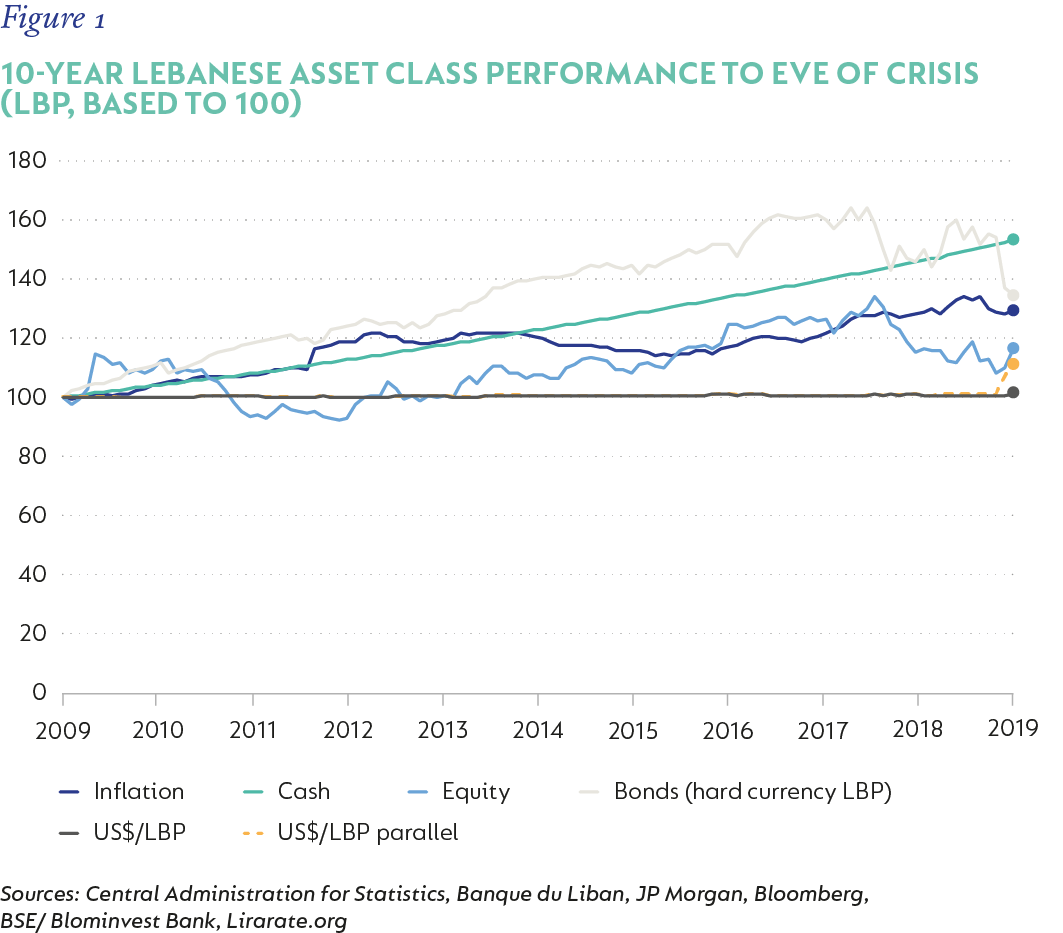

The following charts show the total return performances for the primary Lebanese asset classes from December 2009. Figure 1 shows the prior cumulative performance up until the eve of 17 October (the dark blue line denoting inflation = internal currency value; while the orange line = external currency value). This configuration of a struggling private sector economy and positive real returns in domestic currency terms only provided by interest rates is typical for the scenario, but also illusionary. With the subsequent (complete and still unresolved) sovereign default and banking sector collapse (even now this only endures as a segmented payment system) together with the complete atomisation of the Lebanese pound (LBP), nominal instruments have become, for all intents and purposes, completely worthless.

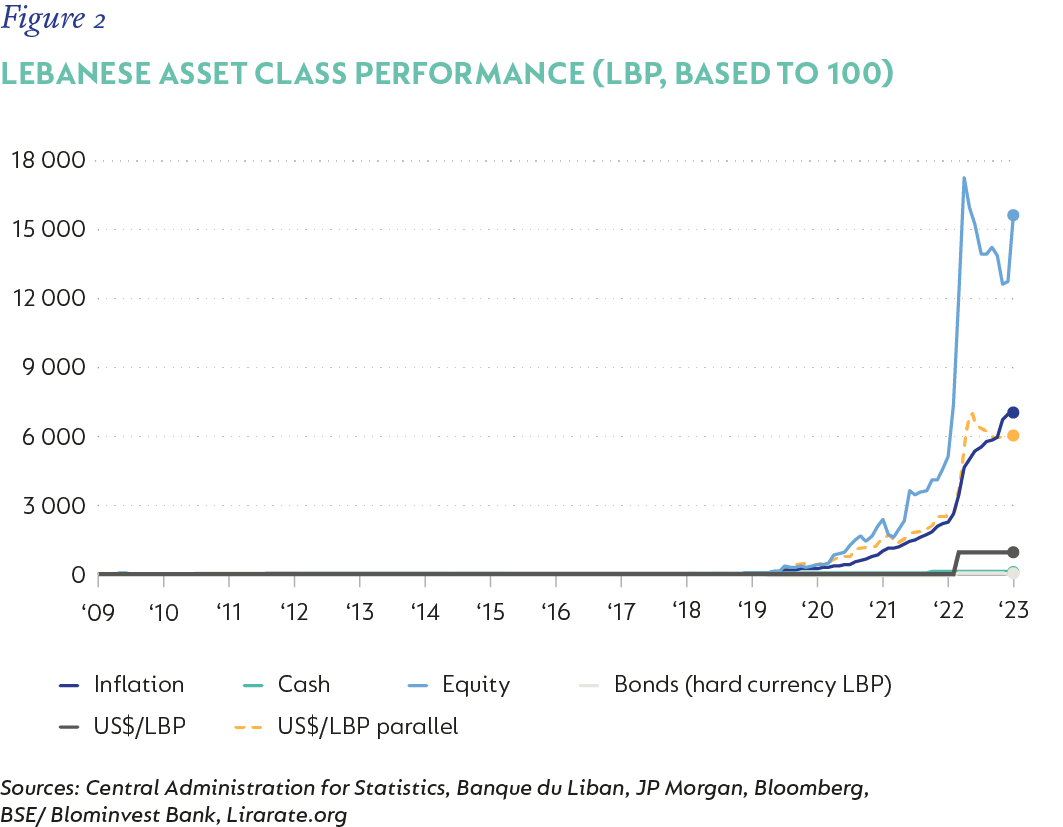

Figure 2 shows the full performance history to the end of 2023, including that of the parallel exchange rate. Only the asset class with a direct real economy link – equity – has managed to sustain any real value, as seen by the positive gap between the cumulative increase in inflation and the genuine exchange rate level. With extreme capital controls, hyperinflation (inflation has averaged c. 170% year on year over the past three years), deepened dollarisation, and a non-functioning banking system, there are limited stores of value left within the domestic economy. Indeed, while the survivorship skew of the Beirut Stock Exchange is substantial, this likely aids the attractiveness of domestic equities as a repository for capital preservation. This additional premium can potentially be seen in the cumulative US dollar returns of the Beirut Stock Index: +0.3% p.a. between December 2009 and September 2019 (MSCI Emerging Market Index: +2.8% p.a.) versus c. +24% p.a. from September 2019 to December 2023 (MSCI Emerging Market Index: +3.3% p.a.).

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal