Extract from Portfolio Manager Commentaries – Sept 2022

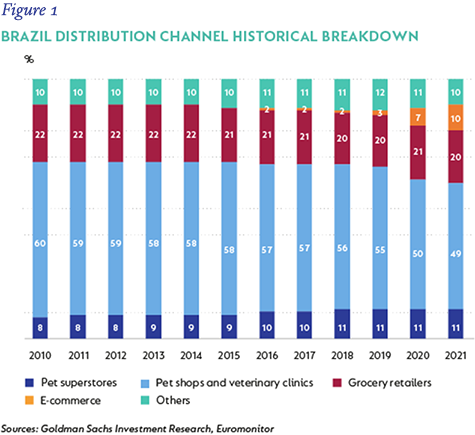

Pet Center Comercio “Petz” is a specialist retailer focused on the pet care industry in Brazil, which is the fourth largest pet care market globally. The company is focused on the premium segment of the industry, which is less exposed to competition from ecommerce and supermarkets, who focus on mass market products. The pet care industry is highly fragmented, with small pet shops accounting for half of the retail market compared to 25% and under in developed countries like the United Kingdom and USA, where small shops are only 6% of the market. In Brazil, these small shops have been consistently losing share to other formats, including pet superstores, which is Petz’s offering.

We are attracted to the defensive nature of the business, with 85% of sales from essential products, and the very compelling store economics of 30%+ return on invested capital. The founder-led management team (we met with the founder CEO in recent months) has delivered operationally on a consistent basis and we believe the structural drivers will allow them to continue to gain share in a profitable way. Between store growth and maturation of existing stores, Petz is likely to be able to deliver annual earnings growth of around 15% for the next several years, in our view. We have followed the stock for several months waiting for an attractive entry point and this quarter provided such an opportunity with the forward earnings multiple having fallen to 25x, compared to 90x at the post-IPO peak.

South Africa - Personal

South Africa - Personal