Investment views

Poor capital allocation and the green economy unseat the PGMs

We explain why we don't hold PGM shares in our portfolios.

The Quick Take

- PGMs equities saw exceptional price appreciation following the lows of 2018 as demand outstripped supply and markets tightened

- Instead of returning capital to shareholders, poor capital allocation decisions were made, which have destroyed value

- The long-term outlook for the PGM sector is bleak, driven by the rise of the battery electric vehicle

- Tough decisions need to be made by PGM management teams in the coming years

At the bottom of the platinum group metal (PGM) cycle in 2018 we held overweight positions across our client portfolios in both the direct equities as well as through Anglo American and its PGM subsidiary, Amplats. Strong demand growth finally whittled away the surplus above ground inventories, which increased prices by more than 400% in the following years. This appreciation was even more pronounced in the individual equities, with Impala Platinum’s trough-to-peak up 18 times.

We have been underweight the sector since December 2020 and have held zero direct PGM exposure as of March this year. Despite the share prices having fallen c.70% off their recent highs, we do not feel they represent compelling value for our client portfolios. While there is the potential for short-term sector rallies, we believe that in its current form the sector represents a value trap for investors.

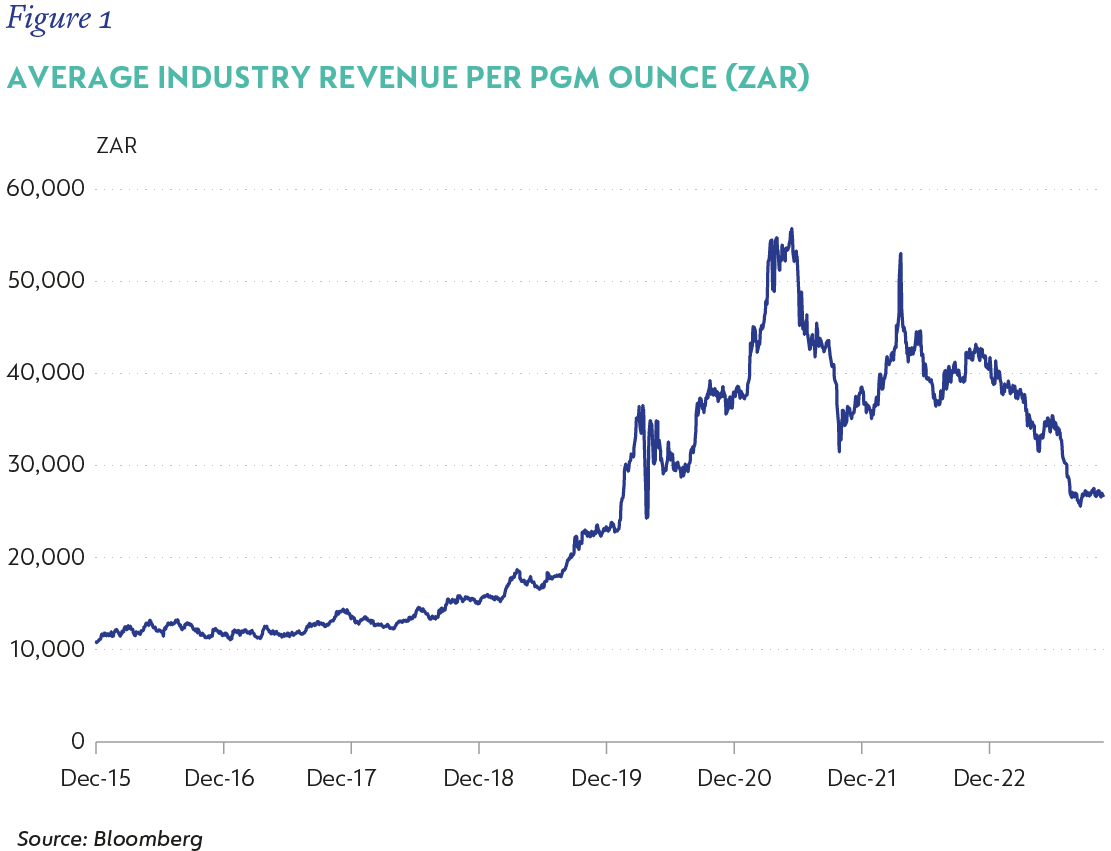

Figure 1 shows that over the last five years the PGM prices enjoyed more upside than anyone could have anticipated. Demand rose as tightening global emissions legislation necessitated more PGMs in internal combustion engine (ICE) vehicles and supply was largely unable to keep pace due to many years of underinvestment. Basket prices rose by 416% from trough to peak and some spectacular individual metal price increases were experienced, with rhodium increasing 48 times to US$29 800 within a single decade. At its peak, rhodium contributed 56% to miners’ revenues despite only making up 7% of mined output. As metal prices extended well beyond normal and the equity valuations followed suit, we began reducing our exposure.

CAUSE FOR CONCERN

A key element driving our decision to disinvest was the capital allocation decisions made by management teams during the boom years. Initially we had hoped that the PGM windfall would be returned to shareholders in the form of dividends or buybacks, especially in the context of shareholders having supported the industry with capital during the bear market. In the main, we have been disappointed here with the PGM sector only returning an average of 53% of its cash generated in the last five years. This free cash flow was generated after companies dramatically increased their capital budgets and cost bases in an attempt to recover from a decade of underinvestment. Anglo American Platinum was a lone standout in the sector having paid out ~100% of cash generated in the boom years.

We continued to see companies announcing new projects, even as the longer-term outlook started to deteriorate. Some destroyed tens of billions of rand’s worth of shareholder money in pursuit of ill-fated acquisitions; much of which has since been impaired and with more to come. As an investor in a commodity company, if you do not receive cash in hand at the top of the cycle, then the through-the-cycle return you earn will be mediocre unless you buy and sell at exactly the right time.

Cost and capital inflation have been so great that now that prices have come off the boil, the sector finds itself facing both cash losses and the need to fund committed projects. Given our view on the long-term outlook for PGM markets, we believe that the companies should be decommissioning producing mines and shuttering projects. This is, however, incredibly hard to do in South Africa, given how labour intensive these assets are and how many lives would be impacted as a result. The decision to shut a mine will never be purely financially driven and we believe that unprofitable mines are likely to stay operating for longer than they should, thus providing the market with more metal it does not need. Management teams have very tough decisions to make going forward, which increases the risk of further capital allocation missteps as some attempt to diversify away from their core markets.

BATTERY ELECTRIC VEHICLES DRIVE BLEAK MARKET OUTLOOK

We believe that the long-term fundamentals for the PGM industry are incredibly poor, with growing surplus markets into the future. 73% of PGM demand is comprised of use in catalytic converters, which are components of the exhaust treatment systems of ICEs, the current dominance of which is under threat. Battery electric vehicles (BEVs) have been around since the 1990s, but only with the launch of the Tesla Model S in 2012 did they begin to enter the mainstream. Environmental groups and most governments have seized on the technology in an attempt to clean up inner city pollution and reduce overall emissions versus those of the ICE.

BEVs have been receiving massive government subsidies for years and this has helped develop the industry to where it is today. Initially, BEV penetration growth was measured and the impact on PGM markets was thus immaterial. But the pace of growth has been faster than was initially anticipated and rising BEV production is now starting to significantly impact the PGM markets; an impact we expect to keep intensifying.

The primary hurdles to BEV adoption are all being addressed or have already been overcome. Range anxiety, lack of infrastructure, high costs, long charging times, manufacturing capacity and commodity availability are now manageable. Consumers are now able to choose from a proliferation of well-priced BEVs with several 100km of range, charging times have been reduced and charging networks are being developed through massive government subsidies.

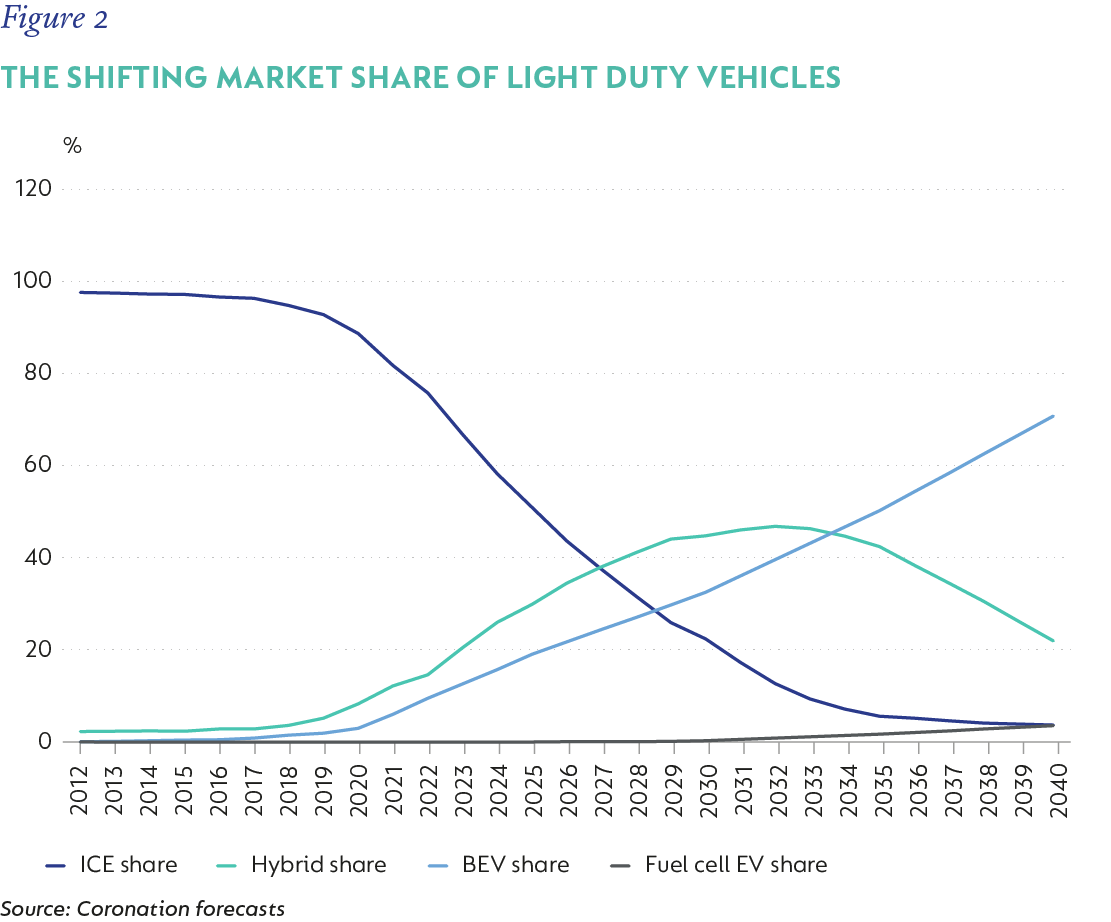

Government support has been crucial in developing the BEV market, as they have incentivised both the production and purchasing of electric vehicles. It is now clear that where hybrids were initially seen as bridge technology to a BEV world, the length and height of that bridge are much lower and BEVs are taking more of the market (Figure 2). Original equipment manufacturers (OEMs) are steadfastly committed to developing BEVs and splitting research and development teams so they can focus on an interim solution is highly inefficient in a skills-scarce environment. This is particularly important for PGM markets because hybrids are a “PGM neutral” technology from a demand perspective as they have similar PGM loadings to ICEs. A world where hybrids dominated would still have been a good environment for PGMs in contrast to a BEV dominated world, which represents pure demand destruction.

BEV PRODUCTION HAS SURPRISED ON THE UPSIDE

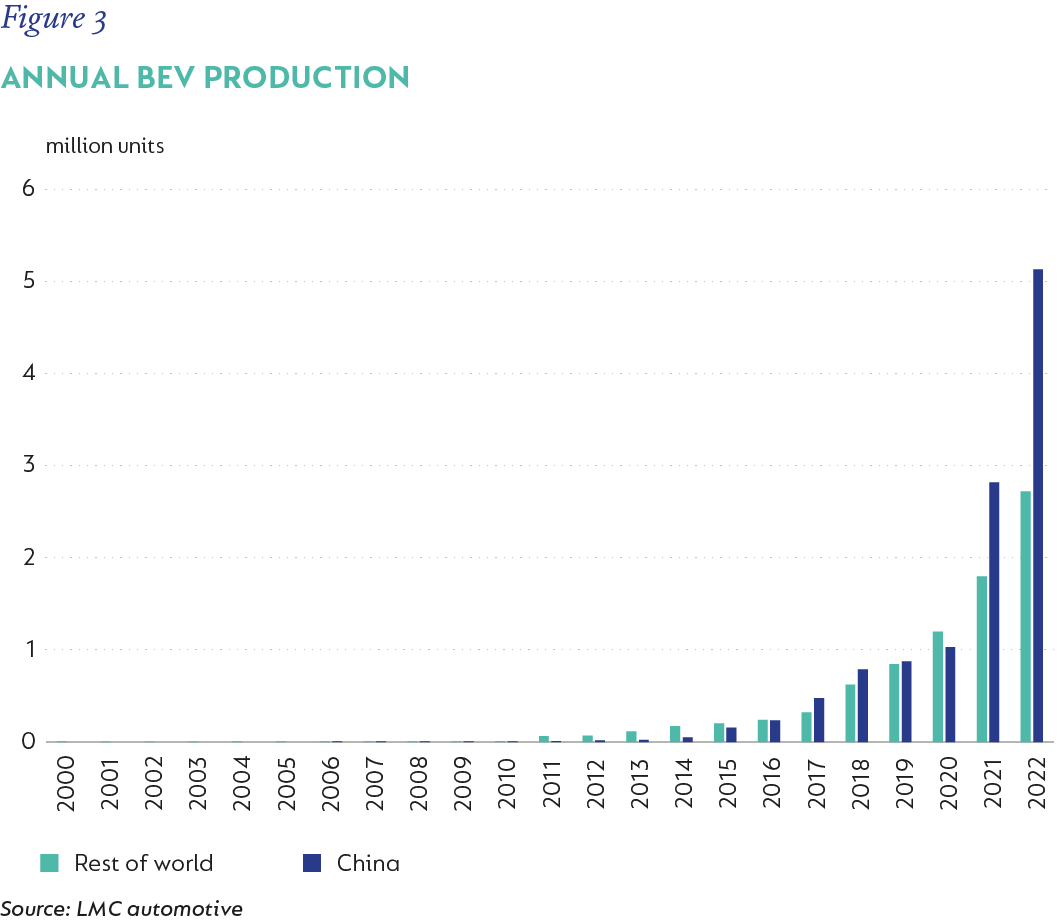

A key hurdle to BEV adoption is the availability of commodities as well as the ability of the automotive and battery sectors to increase manufacturing capacity. In a show of manufacturing force, China has demonstrated its ability to dramatically increase output in a short period of time and is now supplying its local market and exporting BEVs to the world. In recent months, Chinese BEV penetration has been north of 25%!

Governments and companies across the world are now responding aggressively to China’s BEV dominance, with the result that global manufacturing capacity is set to increase at breakneck speed. In two years, China went from producing around one million BEVs a year to over five million; an unbelievable rate of increase. Figure 3 shows how China now dominates the world market producing nearly two thirds of the world’s BEVs in 2022.

Commodity availability is not yet solved, but we believe the height of the hurdle for the OEMs and battery producers has been reduced. Through discussions with OEMs and global battery players, we gained an understanding of the capital committed to ensure raw material supply. Companies have secured long-term offtakes from miners and, in many instances, have committed capital to build or buy new projects. Importantly, especially in mining, things never go according to plan, so there will surely be some hiccups along the way.

In the main, though, we anticipate BEV demand to be sufficiently covered from a commodity perspective until at least the end of the decade. Beyond this we will need to see a continued increase in mined supply to meet the markets and we expect price signals to incentivise this in the 2020s. Battery technologies will continue to change as manufacturers shift from scarce metals to those that are more abundant. The big increase in the lithium-ion phosphate market share and future manganese-containing batteries are two great examples of this. We have increased confidence that BEV producers will be able to source the commodities they need and that conventional consumers of commodities will have to compete for the residual. This will be positive for the prices of the metals concerned.

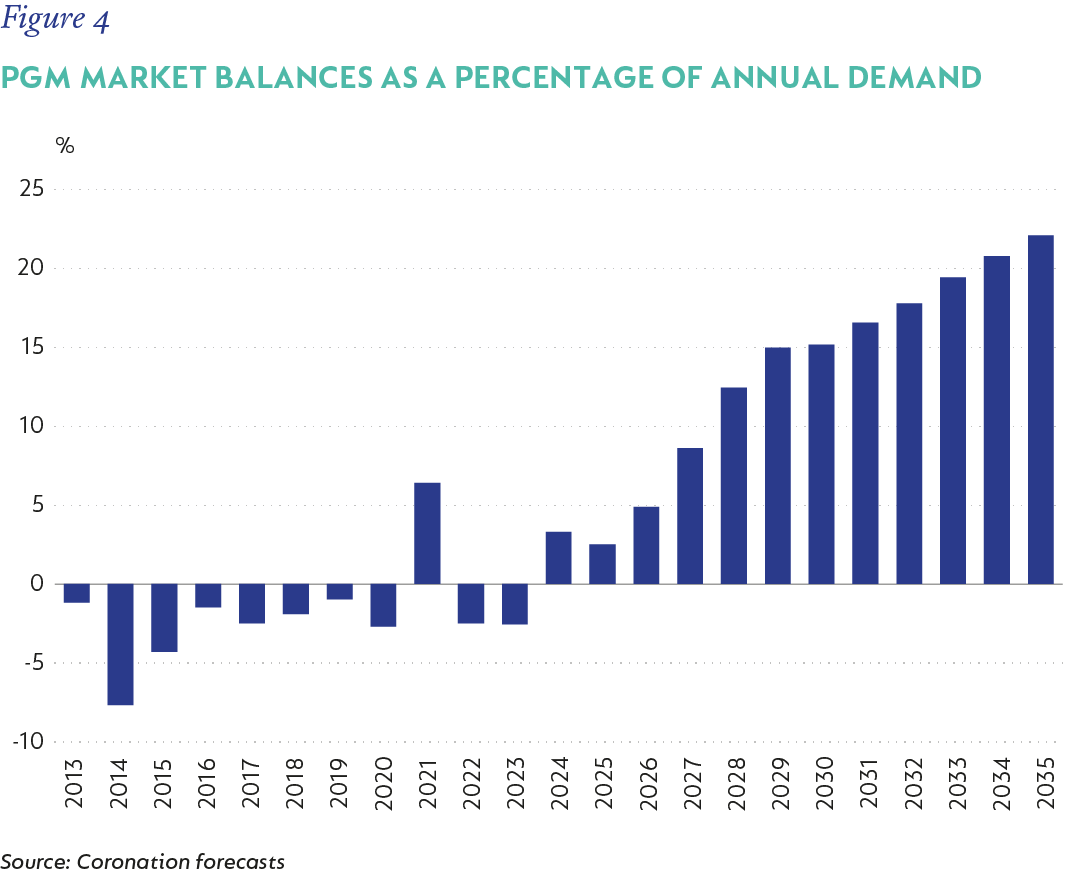

Longer term, there is the potential for the hydrogen economy and fuel cells to provide an incremental leg of demand for PGM miners. Similar to hybrids though, we have already seen fuel cells lose out to BEVs on many of their applications. We feel there is a reasonable probability that fuel cells will take market share in heavy duty vehicles as well as some light duty markets where the policy support is extremely favourable. When we look at the PGM markets in the 2030s, we anticipate that hydrogen fuel cells and their adjacent technologies could contribute 10% to 20% of total PGM demand, up from below 1% today (Figure 4). Despite this, we expect to see growing surplus markets from 2024. A wildcard could be what happens to Russian supply given the geopolitical situation and sanctions on the country. Russia makes up 18% of total PGM supply, and we assume that it will remain flat for the rest of this decade before shrinking.

CONCLUSION

As a result of a higher level of BEV production over the forecast period and a slower adoption of fuel cell vehicles, we anticipate that the PGM markets will be in large surpluses going forward; signalling the need for supply to come out of the market. Closing mines in South Africa has proven to be incredibly hard in the past given the socioeconomic implications, and we expect that PGM miners will hold on to loss making shafts for longer than is viable. With growing surpluses and unfavourable capital allocation, we believe that the PGM sector is a value trap and that any rallies in the interim will be short lived.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal