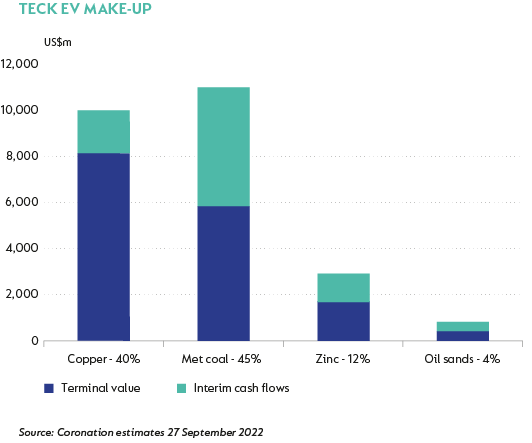

Teck is a large Canadian diversified mining group. The bulk of their current cash flows derives from their Canadian metallurgical coal, but they are also on the cusp of completing a new large copper mine in Chile that will contribute around half of long-term cashflows. We like both metallurgical coal and copper, but for different reasons. Metallurgical coal is used in steelmaking, and demand is expected to be anaemic; however, a renewed focus on ESG has reduced the appetite for new projects and we believe there has been underinvestment in new and replacement mines. Teck is the world’s second-largest exporter of metallurgical coal, and their Canadian mines are well placed to supply this critical ingredient for many years to come.

The new Chilean copper mine should enter the lower half of the industry cost curve. Copper demand will be boosted by the world’s ongoing electrification and receive a boost from a transition to greener energy and electric vehicles.

Teck trades on a 15% free cash flow yield.

South Africa - Personal

South Africa - Personal