Investment views

The Covid-19 Crisis – a chance to add good quality businesses to your portfolio

A chance to add good quality domestic businesses to your portfolio

- Markets rebounded off their lows rapidly, despite lingering uncertainty. We remain committed to investing where there is long-term value, regardless of current market sentiment.

- The quality of the domestic stocks held in the house portfolio has meaningfully increased. We believe the market is underpricing the resilience of these businesses.

- Covid-19 has reset prices and expectations across asset classes, creating investment opportunities.

WAS IT JOHN F Kennedy who said, ”In a crisis, be aware of the danger, but recognize the opportunity”? For Coronation’s portfolios, the Covid-19 crisis has meant an ongoing search for mispriced opportunities across asset classes. And we have found value.

At the start of 2020, many of the global asset classes were reasonably fully valued. The broad sell-off in March gave us an opportunity to rebuild offshore equity exposure across our multi-asset and house equity portfolios. The risk diversification and more resilient economic outlook of developed markets should benefit these portfolios in the years ahead.

The crisis also reset inflationary expectations very low, which enabled the multi-asset funds to buy well-priced local protection (in the form of South African inflation-linked bonds) against the medium-term risks of a rise in inflation.

The JSE did not escape the turmoil, with many domestic stocks now trading materially below their year-end levels. While the past few years have not been easy for South African companies, the outlook has further deteriorated. Already-fragile South African consumers and businesses will not experience the financial support offered to those in more prosperous nations.

With this hard truth in mind, we have selectively added to companies whose strong business models should deliver earnings resilience in what will be an even more challenging environment than we expected as we headed into 2020. As a result, our equity portfolios currently have higher exposure to quality local stocks than previously. This is not an uncontentious statement, given the subjectivity of ‘quality’.

RESETTING VALUE

Defining a quality stock requires a combination of numeric and qualitative assessment. High- quality businesses should grow over time by using their strong free cash flows to reinvest in their businesses and generate good returns on capital invested. A huge amount of judgement is involved in assessing a business’s ability to grow and sustain these high levels of returns going forward. Given that disclaimer, we think the overall quality of the equity portfolio has meaningfully increased.

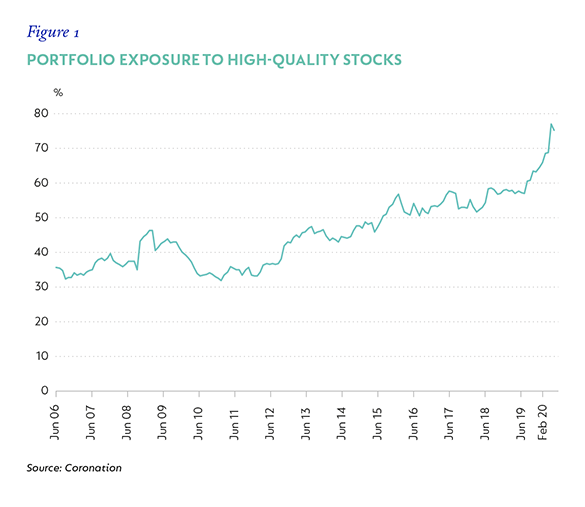

Figure 1 reflects the percentage of the portfolio invested in quality stocks today. It would include the investments in high quality, international businesses listed in South Africa and which we believe continue to offer good value, such as Naspers, Quilter and Bidcorp. It also includes our increased exposure to several domestic businesses during this period of economic constraint.

Coronation may be seen to have a bias in quality. We concede that we are happy owners of a good quality business, but only where we are able to acquire it at the right price. While quality has been a winning strategy in the past few years, many of these businesses were trading on lofty multiples at the start of the year. The Covid-19 crisis provided investors with an opportunity. It reset prices, enabling investors to increase portfolio quality at a reasonable price. This is especially true in South Africa where we believe the testing times ahead will cause a divergence in performance. Good quality businesses are best poised to navigate the choppy waters ahead.

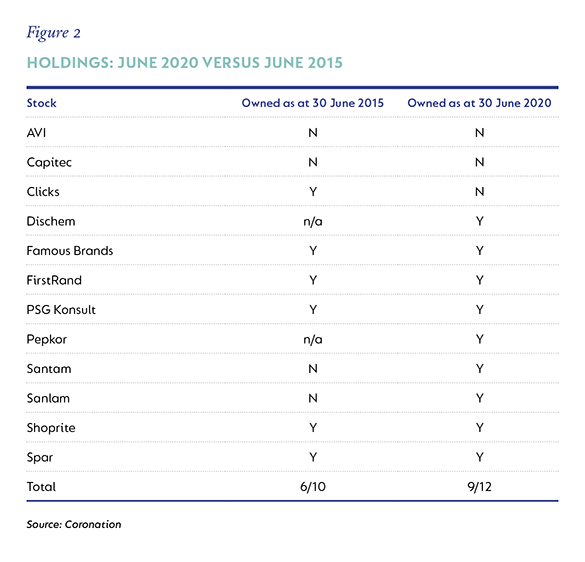

Five years ago, we owned very few South African domestic stocks, as expectations and valuations were high. A dramatic reset in investor expectations and price means that today we can own more of these.

Figure 2 provides a comparison of quality stocks held in the house portfolio five years ago versus our holding at 30 June 2020, and shows that of the 12 best local businesses, we own 75% of these names versus 60% in 2015. Within the context of the house portfolio, our holdings of the names below have grown from 5.5% to 16%.

STOCK ANALYSIS

This is a brief overview of the characteristics that should support the resilience of our quality domestic holdings:

Shoprite

Shoprite’s financial metrics over the past few years understate the true quality of the business. This is a business that has invested heavily in fixed assets (distribution centres, property and stores), expanded its working capital and consistently added new stores. All this was achieved while profitability collapsed in its African operations. Under a new CEO, we expect a reduction in capital intensity to improve free cash flow and returns. New accounting standards will partly disguise this (International Financial Reporting Standard 16 [IFRS16] is brutal for retailers with large leased-store portfolios), but, looking through this, Shoprite trades on 10.8 times our assessment of normal IFRS-adjusted earnings.

Spar

Spar has a long track record of delivering strong like-for-like growth as its franchised stores are run by entrepreneurs who are focused on delive-ring store-level growth. The business has a long history of generating returns on equity in excess of 30%, while delivering above-average free cash flow conversion. Spar’s international expansion has been successful in Ireland where it owns a dominant convenience retailer, while the Swiss and Polish acquisitions are still a work in progress. The business trades on 10.8 times normal earnings.

Famous Brands

The franchise business model is attractive for the high returns it generates on invested capital due to low capital intensity and good profitability. This profitability is converted to cash at a high rate, with Famous Brands boasting a long-run average free cash flow conversion ratio of 92%. This places it among the highest in our investable universe. Famous Brands has a portfolio of recognised and trusted brands, which builds a strong moat against competitors. The quality of its offering has been further improved by backward integrating up the value chain through logistics, and manufacturing enables the company to offer franchisees world-class support and low prices, while capturing a full margin on sales to the end-consumer. Return on equity (ROE) is well above the cost of capital, averaging 31% over the past decade.

FirstRand

Within the banking sector, we have built a position in FirstRand, which has delivered high ROEs over the past decade. Its attractive customer proposition has achieved strong asset growth resulting in a dominant ‘main bank’ market share in the middle-to upper-income market. FirstRand has leveraged its position of strength, diversifying its sources of non-interest revenue, reinvesting in its digital offering and driving down its cost to income ratio. These actions stand it in good stead to continue gaining market share even in a tough economy. FirstRand trades on 7.7 times our assessment of normal earnings.

Pepkor

Pepkor is a value retailer offering consumers everyday products at affordable prices. A culture of low costs and the reinvestment of excess margins ensure prices remain low. The large store base is conveniently located near transport nodes, with flexible store sizes allowing it to trade profitably in small towns where competitors typically struggle. In a tougher economy, Pepkor’s low prices should benefit from downtrading, while defensive everyday items (kidswear and babywear) represent approximately 60% of PEP and Ackerman’s sales. Over the past decade, this business has delivered double-digit sales growth and currently trades on 9.7 times normal earnings.

Sanlam

Sanlam is an insurance business with an enviable track record. Management has allocated capital well over time and there is a long history of conservatively stating earnings. Earnings are underpinned by cash due to fully expensing new business costs. Operating variances are positive, reflecting the conservative assumptions underpinning profit recognition.

Santam

Santam is a short-term insurer that has consistently grown premiums above GDP. It has navigated the challenges of direct insurance on its intermediated business while successfully launching a direct insurer, MiWay. It has done this through constant reinvestment in its business while maintaining an ROE in the 20% range.

Dischem

We like the pharmacy sector where the listed pharmacy players have successfully grown their revenues by rolling out stores and taking market share for a decade. In a not uncompetitive sector, Dischem is an entrepreneurial business focused on offering consumers low prices. They continue to innovate and expand their consumer offering into primary care and via Baby City.

PSG Konsult

PSG Konsult is an advice-led financial services group focused on wealth management, short-term insurance and asset management. It has a track record of delivering good profitability with high free cash flow conversion (five-year average: 89%) and attractive returns (five-year average: ROE 23%). This, while continuing to grow in a tough economy. The wealth business boasts the largest independent advisor network in South Africa and should continue to benefit from further consolidation of the network.

LOOKING AHEAD

We believe our holdings represent quality businesses in South Africa that trade at prices that understate the relative resilience of their prospects. As a result, we expect them to deliver attractive returns in the years ahead. We remain vigilant of current market conditions and committed to our long-term valuations-based investment philosophy that helps us to look through the noise to identify the prevailing risks and opportunities. +

Disclaimer

South Africa - Personal

South Africa - Personal