Investment views

The dangers of headline investing

Only deep, proprietary research sharpens analysis, providing the necessary focus to look through the noise

- ‘Headline investing’ is a risky approach, and patient investors can take advantage of market disruption.

- The interaction between supply and demand is the most important variable for pricing and earnings.

- Continued underinvestment in supply has created good value in perceived ‘sunset’ sectors.

- Investing where sentiment is the most positive carries the risk of permanent capital loss.

It is perilously easy for investors to get caught up in the sentiment of the day and buy into ‘story stocks’. Not wanting to miss out on the next big thing, the market often drives up the price of favourably positioned assets, far beyond their underlying intrinsic value, and pushes the perceived losers far below theirs.

At these times, there is often considerable emotion involved, and the disconnect between price and value can be extreme. At a time when headlines scream ‘buy’ or ‘sell’, almost regardless of price, only detailed analysis can give one the kind of conviction needed to take an alternative view and go against the tide. The following three commodity markets serve as useful case studies.

UNCOATED FINE PAPER

For at least a decade, paper has been written off as an attractive investment, with most observers expecting a relentless and brutal decline in demand. Despite this bleak outlook, Mondi has grown earnings before interest and taxes from its uncoated fine paper division almost three-fold since 2007. This surprising outcome is due to a combination of constrained supply (a consequence of underinvestment) and demand proving to be more resilient than most expected. Mondi’s low-cost assets and excellent management team have thrived through more than a decade of declining demand. The clear learning in this case is the danger of obsessing over one variable without giving due focus to the interaction between supply and demand, which is fundamental to the price discovery process in any market.

THERMAL COAL

This is another commodity market in which most observers agreed that demand would decline as renewable energy took market share. As a consequence, many investors wrote off coal assets as an investment. What this negative thematic view once again failed to consider is the intersection between supply and demand. Although thermal coal demand will decline over time, it is likely to remain more resilient than many expect. In addition, underinvestment in supply has, and will likely continue to, lead to constrained supply. This has resulted in supply deficits and price increases (over 140% from trough to peak). We expect constrained supply to endure and would therefore not be surprised to see prices remain elevated above incentive prices in the years to come.

ELECTRIC VEHICLE COMMODITIES

When the Volkswagen emissions scandal (‘Dieselgate’) broke in September 2015, it coincided with the rise of Tesla as an automaker and battery electric vehicles (BEVs) as an alternative drivetrain. Tesla’s share price has risen sevenfold in the last seven years and its market capitalisation is comparable to that of traditional automakers such as General Motors (GM) and Ford, despite the fact that the company has struggled to turn a profit and produces only 3% of the vehicles that GM produces. At the time, headlines announcing the death of the internal combustion engine were everywhere.

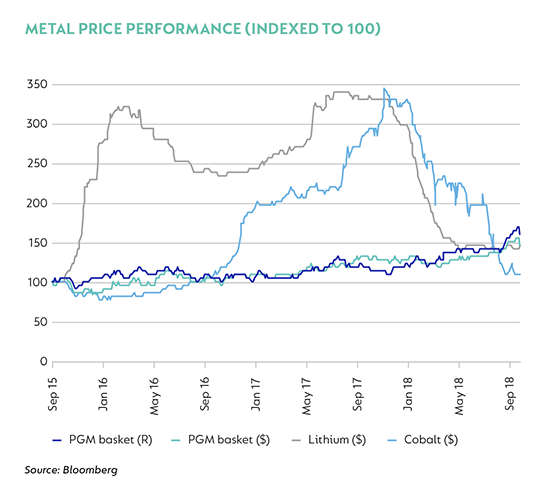

Within six months of ‘Dieselgate’, the price of lithium, a key component of BEVs, went up over three times. Cobalt, another key component, started to rally a year after the scandal broke and went up threefold in the following two-and-half years. Prices of lithium and cobalt rose to multiples of their incentive prices and existing producers were enjoying super profits. In contrast, when cobalt and lithium hit their peaks in March 2018, the platinum group metals (PGM) basket price was trading well below marginal cost, and up to half of the South African industry was burning cash.

The BEV thematic was everywhere as investors chased the long-term opportunity and shunned the technologies that they stand to displace. Fast forward 12 months and the rand PGM basket is up 43% – close to lifetime highs – while lithium and cobalt prices are down 56% and 68%, respectively. As we have noted before, we are believers in BEV technology in the long term, but expect the process to be evolutionary rather than revolutionary because the hurdles to mass adoption are significant and they will likely take decades to overcome.

After an enormous amount of detailed work on the future of the drive train and ridesharing, we have concluded that demand for PGMs will be more resilient than most expect. We are of the view that mass adoption will take decades and that hybrid vehicles with similar, and in some cases higher, PGM content than standard cars will bridge the gap between today’s cars and BEVs.

Regulatory tightening supports PGMs

In the medium term, we also expect PGM demand to surprise positively as a consequence of tightening emissions standards globally. In addition to this ‘Dieselgate’ placed the auto industry under the microscope and exposed the industry’s collusion and manipulation of emissions testing. Car manufacturers will soon have to meet far tougher standards than in the past. Vehicles in the EU and China will have to pass emissions tests that cover the first 160 000 km to 200 000 km of a car’s life, as opposed to previous testing simply at the point of production; and that assess emissions in real-world driving conditions, as opposed to in a laboratory. The tightening of emissions legislation has large benefits for the broader climate as well as local air quality; PGMs are a key enabler of this while the slow mass adoption of BEVs takes place.

In addition to this, material underinvestment in mine supply over the last decade means it will take many years before supply can meet current demand. We therefore expect structural PGM market deficits to persist for at least the next decade. Although prices may appear elevated with the rand PGM basket up 45% off 2018 lows, we estimate that prices are only now close to incentive prices, enabling PGM miners to earn no more than a fair return on their invested capital. This is in sharp contrast to the lithium and cobalt price rallies, where prices last year hit multiples of incentive prices for both commodities.

CONCLUSION

Scrutinising what is in the price is a critical consideration for making any investment decision. When the market gets overly negative on a story, an opportunity is often provided for investors who can cut through the almost deafening noise and take the long-term view.

At peak negativity in the PGM sector last year, Impala Platinum (Implats) and Royal Bafokeng Platinum both touched price-to-book lows of 0.15 times. Impala’s market cap hit R11.7billion, down 94% from peak levels and roughly equal to the cost of just one shaft at the Implats lease (compared to their 11 shafts and four additional mines). Although Implats was the extreme case in the sector and its peers traded at less depressed levels, they also offered significant opportunity (with less risk).

As a counterweight, investing where sentiment is extremely positive and prices are already high can be dangerous and often carries the risk of a permanent loss of capital.

South Africa - Personal

South Africa - Personal