Personal finance

Here’s why you need a tax-free investment

The Quick Take

- The perks of a tax-free investment are manifold

- The most obvious benefit is that you pay zero local tax on your interest income, dividends and capital gains

- Yet, the real value lies in understanding how to make the most of your tax-free opportunity

- Our analysis shows how four key strategies could help you double the returns from the same taxable investment over the long term

The perks of a tax-free investment make it a no-brainer, but you can maximise its value if you are strategic about managing it. With the tax year ending on 28 February 2023, now is the time to invest and maximise your benefits.

The most obvious perk of a tax-free investment is that you don’t pay any local tax on your investment returns – both while invested and when your investment pays out. That’s zero local tax on your interest income, dividends and capital gains.

While this is a fantastic benefit made available to all South Africans by the government, we believe the real value lies in understanding how to make the most of your tax-free opportunity. Our analysis shows that four key strategies could help you double the returns from the same taxable investment over the long term.

STRATEGY 1: STICK TO THE FIRST-IN/LAST-OUT PRINCIPLE

By ‘first-in’, we mean start by using your tax-free allowance before choosing any other form of investment. With Coronation, you can start investing from as little as R250 per month or a lump sum of R5 000 per year, up to the maximum contribution of R36 000 per year.

By ‘last-out’, we imply remain invested for the long term. The power of compounding means that your investment has the potential to grow exponentially for every additional decade that you remain invested. We believe you can harness the full power of tax-free investing by resisting the temptation to access or withdraw your money invested in a tax-free investment. In other words, don’t use it as an emergency fund or a savings account for holidays and big-ticket items like a car.

STRATEGY 2: INVEST IN A GROWTH-ORIENTED MULTI-ASSET FUND

It’s important to understand that geographical or asset class constraints do not bind tax-free investments, meaning that long-term investors could consider being fully invested in equities. This asset class provides the highest expected returns over time.

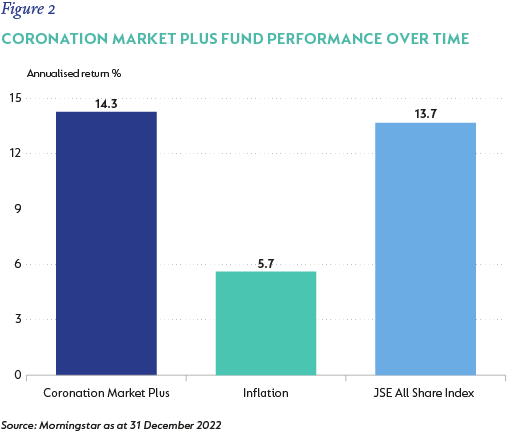

However, for most investors, a less volatile experience may be the preferred route to navigating market ups and downs over multiple decades. As such, choosing a growth-oriented multi-asset fund such as Coronation Market Plus is the most likely option to help you remain invested while achieving returns well in excess of inflation.

Since its inception in 2001, Coronation Market Plus has met the needs of aggressive investors aiming to build long-term capital outside of their retirement portfolios. As shown in the diagram below, Coronation Market Plus has delivered an annualised return of 14.3%, well ahead of inflation at 5.7% per year. Worth noting is that, over this period, despite never being fully invested in equities, the Fund has outperformed the JSE All Share Index’s performance of 13.7%. (All performance figures quoted are as of 31 December 2022).

STRATEGY 3: AIM TO REACH YOUR LIFETIME LIMIT AS SOON AS POSSIBLE

A proven track record shows that you should prioritise taking advantage of your annual tax-free investment allowance, which is currently R36 000 per year and R500 000 per taxpayer in total, as early as possible. Doing this allows the taxes you save to remain invested for the long term so you can reap the benefits of compound growth over the longest possible period.

What makes a tax-free investment so much more powerful than an investment in a taxable unit trust is that the compound growth on your tax-free investment is higher. Over the longest possible period of time, this can double the value of your investment nest egg as described in Strategy 4 below.

STRATEGY 4: BUILD WEALTH ON BEHALF OF YOUR MINOR CHILDREN

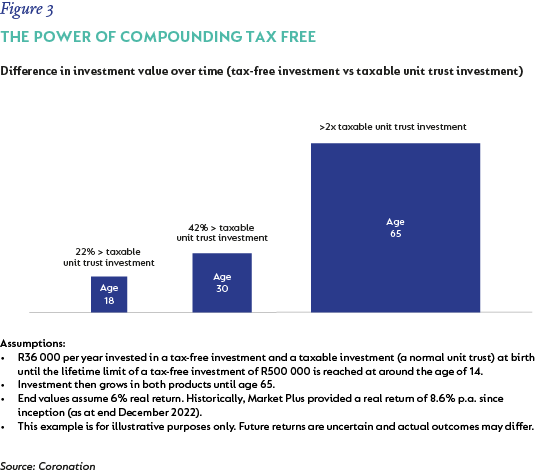

The best way to understand the life-changing effect a tax-free investment can have on your child’s lifetime is through a theoretical example (Figure 3) that illustrates its potential if harnessed on their behalf as early in life as possible.

Imagine that you invest the maximum annual amount (R36 000) in a tax-free investment for your child from birth. If you continue doing so, you will reach the lifetime limit of R500 000 before your child turns 14.

Our analysis, based on certain assumptions, shows that if you keep the money in the tax-free investment until your child turns 18, the value of the tax-free investment will be 22% greater than the equivalent taxable unit trust investment. By age 30, this difference widens to 42%, and by age 65, the investment would be more than double the value of the same taxable unit trust investment.

These results show that by resisting the temptation to disinvest from a tax-free investment, their nest egg is built up and would keep your child in good stead by either financing tertiary education, buying a first home or, ideally, investing in their retirement, depending on when your child decides to disinvest.

This theoretical exercise also shows the incredible power of compounding over long periods. For example, investing R500 000 spread out over 14 years and then doing nothing for 41 years can result in an investment worth R17 million in today’s money by age 65.

IF YOU DON’T HAVE A TAX-FREE INVESTMENT, START YOUR JOURNEY WITH CORONATION TODAY

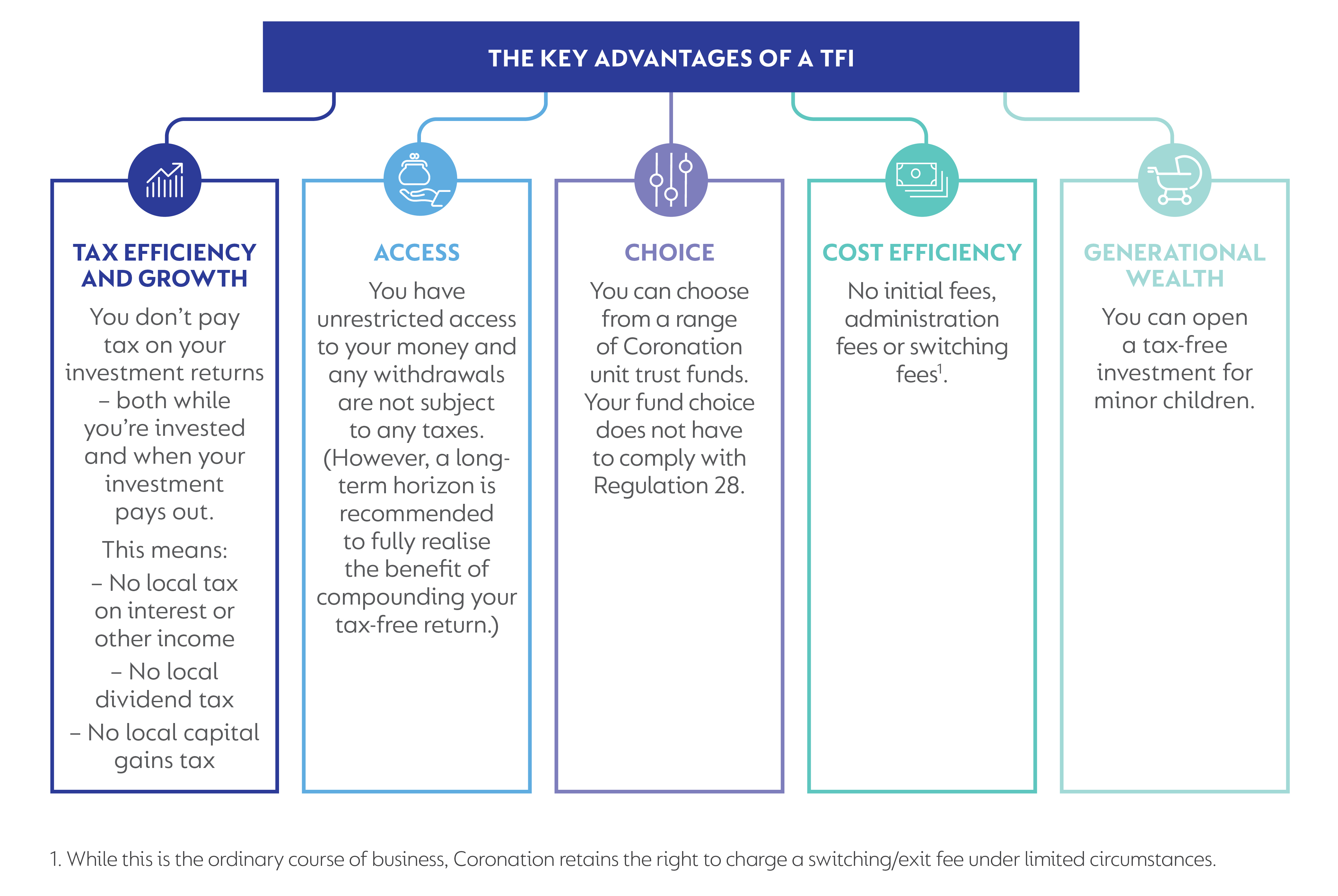

We can see that a tax-free investment comes with a long list of perks (see Figure 4 below). But what really matters is that you consider the above strategies to make the most of your investment. So why choose Coronation?

- There are no initial or admin costs attached to opening a tax-free investment with Coronation.

- You can start investing with us from as little as R250 via a monthly debit order, or you can make lump-sum investments from R5 000 to R36 000 per year.

To select the funds that suit your needs, speak to your financial adviser if you have one, or go to our tax-free investment page before the end of February 2023.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal