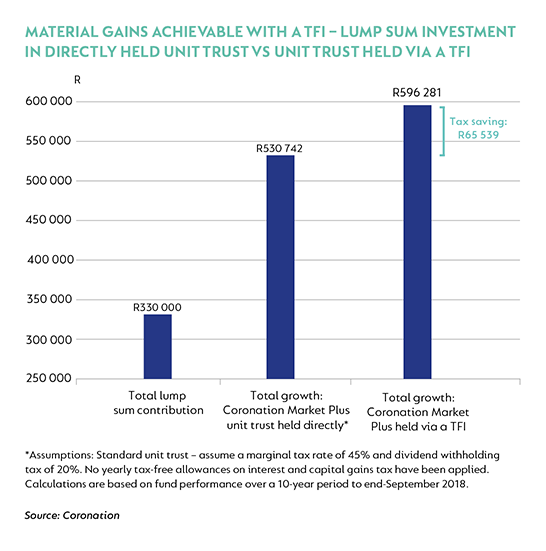

September marked the third anniversary of our tax-free investment (TFI) product, the advantages of which we have consistently advocated over the years.

Whether you are investing R500 or R5 000 via a monthly debit order, it is a no-brainer that up to the first R2 750 should be invested into a TFI. Or if you have a lump sum on hand, you can invest up to R33 000 per tax year, and up to a maximum of R500 000 tax free over your lifetime. Importantly, the sooner you invest your lifetime tax-free allowance, the more you will reap the rewards of long-term investing and the power of compounding.

IS IT REALLY TAX FREE?

One of the big financial planning debates is whether contributing to a retirement annuity (RA) fund or a TFI will produce better results. To arrive at a conclusion, it helps to understand the taxation models on each of the products.

RAs are taxed on an EET basis (exempt contributions, exempt investment returns, taxed withdrawals). Your retirement savings are given a head start, as government effectively subsidises your savings. The downside is that you do not know what the applicable tax rate will be at that time when you eventually start withdrawing. Additionally, you cannot access your funds until the age of 55, and your investment choice is limited to Pension Funds Act-compliant funds.

TFIs, on the other hand, operate on a ‘TEE’ basis. This means that contributions are made from money that is already taxed, no tax is accrued during the investment period and all proceeds taken from the investment are tax free. It therefore gives you complete tax certainty, as your investment will not be subject to future changes due to tax rates.

The other major benefit of an investment in a TFI is that you have complete investment freedom. If you have a long time horizon, you can invest in a portfolio with a larger risk budget and a higher expected return. The main downside to a TFI is the limit on the amount that you can invest.

With TFIs now transferable, you can also move them from a deposit-linked TFI investment typically offered by a bank to a unit trust-based TFI, where you can maximise the benefits of your investment without losing the existing tax-free status.

At Coronation, our domestic flagship funds are available as investment options within our TFI product. We have also added a number of our rand-denominated international flagship funds to the selection. You can switch between funds, or withdraw money, without incurring any costs or penalties. Just be mindful that all amounts invested will count towards your annual and lifetime limits regardless of any withdrawals you make – you cannot ‘replace’ the money you withdraw with a new investment. In other words, if you have already committed R33 000 to a TFI this tax year and then withdrew some, or the entire amount, any further investments into your TFI during this tax year will be taxed at a rate of 40%. To find a fund that is suitable to your needs, visit www.coronation.com/tax-free

South Africa - Personal

South Africa - Personal