It’s now over a year since the world fell into the grips of a global pandemic. Looking back, it’s clear that, when it comes to investing, it’s time in the market, not timing the market that matters.

Consider that equity markets had already bottomed one day into lockdown

Just one day after South Africa went into lockdown and the world as we knew it shut down, equity markets bottomed after experiencing the quickest and steepest descent into bear market territory in history. So while many of us were still figuring out how to buy groceries online and starting to hoard essential goods as we watched Covid-19 cases increase daily, very few of us could have realised that global markets would go on to stage a staggering recovery.

Markets move faster than you can

If investors sold out of their investments at the All Share’s dizzying 34% fall from 18 February 2020 to 24 March 2020, they would have missed out on the subsequent 81% equity market rally over the following 12 months. Rand-denominated offshore returns were almost as impressive, with the MSCI All Country World Index and the S&P 500 gaining 50% and 51% in rand terms, respectively, by the end of March 2021.

It’s not surprising that one of the first emotions investors would have experienced in the face of such a sudden selloff would be panic, particularly given the unprecedented nature of the crisis and huge uncertainty of the future that it invoked. However, these emotions were not reflected in market sentiment. By the time the dust had settled, and investors were able to assess their portfolios and consider getting back into the market, or increasing their stakes, they would have missed out on the first part of the recovery.

Investors who remained invested benefited handsomely

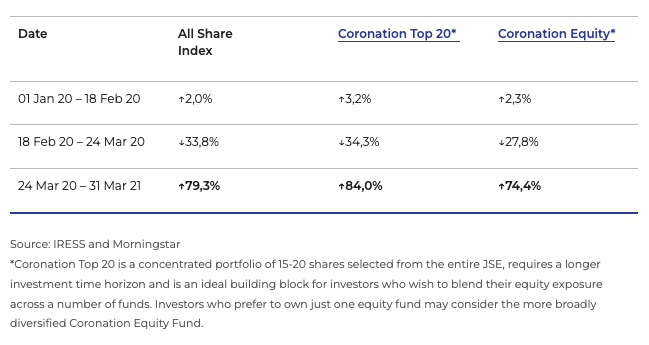

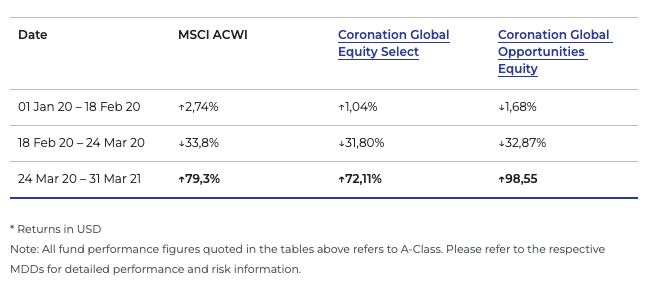

So Covid-19 has again shown that time in the markets is better than trying to time the market. As a demonstration, the tables below illustrate how quickly our equity funds (local and global) bottomed and how strongly they rebounded.

Local Market

Global Market

Taking a long-term systematic approach to investing through crises

At Coronation, notwithstanding the unprecedented global events brought on by the pandemic, we continue to look through the short-term noise and use valuation as our anchor point when investing, selecting assets where we believe the market is mispricing the long-term fundamentals. The pandemic has proven again that it is not events that drive long-term returns but rather company earnings and the ability to act decisively with skill and discipline on these fundamentals.

While uncertainty and volatility are still likely to prevail going forward, investors should strongly consider staying the course (if they are in a position to do so) as long as they are invested in line with their ability to take risk.

South African equities are still attractively valued because they haven’t been subject to the speculative froth and overexcitement that you are seeing in pockets in some other markets. Global markets may be more expensive, but they do offer selective opportunities. (You can read more in our respective fund commentaries included in the latest edition of Corospondent.)

Remember this going forward

The onset of Covid-19 affirmed the valuable lesson that it is indeed time in the markets, not the timing that matters. Investment markets simply move quicker than individual investors can. To build wealth over time, a systematic long-term approach is encouraged.

Coronation is an authorised financial services provider.

South Africa - Personal

South Africa - Personal