It’s just over a year since South Africa went into national lockdown to contain the spread of Covid-19. And living through a global health and economic crisis over this extraordinary time has taught us not to take anything for granted.

Many South Africans have suffered deeply, but one thing that can’t be taken away from us is how we respond in times of crisis.

Focusing on doing the best we can with what we have, and planning ahead to secure our futures, is something we can do to regain control of our lives. And investing your hard-earned money tax free is an opportunity to do just that.

Now is the time to take full advantage of your annual tax-free allowance

The new tax year began on 1 March. And each tax year you get a valuable perk from government to encourage you to save - an annual allowance of R36 000 that you can invest tax free.

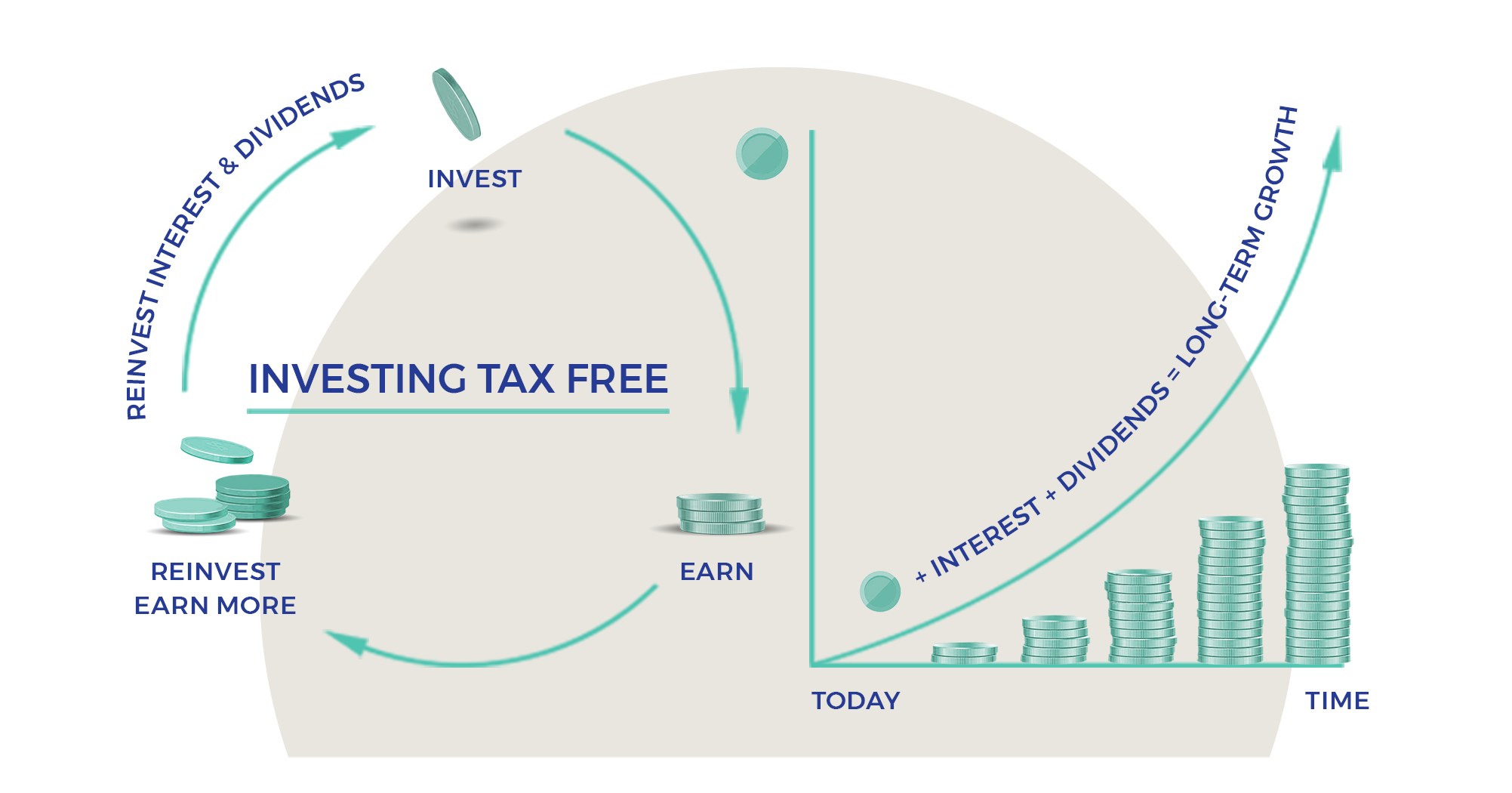

When you invest tax free, you pay no income, dividend or capital gains tax on your investment returns, which boosts your future capital value.

In this low interest environment, it’s better to invest tax free than to save tax free

You could choose to save tax free through a bank, but then your money can only ever earn a predictable level of interest. And given how low interest rates are currently, you have a better chance at beating inflation and growing your money over time through investing in a market-linked tax-free investment (TFI). This way, your money is managed by investment professionals and exposed to assets with a higher expected rate of return, such as shares, bonds and listed property. It gives you the potential to grow your wealth over time through the power of compounding. While returns are not guaranteed, history has shown that long-term investors are better off investing in the stock market than saving in a bank account.

Caption: Wise investors know that the more patient you are, the harder compounding will work for you

The smart approach is to invest for the long term

You want your money to work as hard as it can for as long as possible and be exposed to the best growth potential over time. Investing over multiple decades, and leaving your money invested, enables it to comfortably withstand the effects of the occasional periods of market volatility that is typical of the financial markets. Over the long term, the bumps smooth out and the overall trend is for your money to grow more over time than it would if it were just earning interest in a bank.

But looking beyond the challenges of today to keep thinking long term is easier said than done, especially during a global crisis. It’s sometimes hard to stay committed to future goals and many investors do not invest for long enough to experience the full benefit of staying the course. Many South African unit trust investors hold their investment for less than the recommended five-year minimum before withdrawing, achieving less than optimal results by consistently selling the most recent ‘losers’ and buying the most recent ‘winners’.

It’s easier to stay committed if you choose a tax-free multi-asset class fund

If you make your own investment decisions, you may find it difficult to make consistently good decisions over time. The key to sticking to your financial goals over time is to take a simple, manageable approach.

A solution is choosing a tax-free multi-asset class fund. They are managed on your behalf by skilled investment professionals who identify the best long-term opportunities available across different asset classes. A multi-asset fund has a broader mandate and more tools at its disposal with which to achieve your desired result.

You can access your money but it’s a pot of savings best left invested

When you invest tax free, you can withdraw your cash whenever you like. But you can’t ‘replace’ the money you withdraw with a new investment. So be mindful that all amounts you invest count towards your annual (R36 000) and lifetime (R500 000) tax-free limits regardless of any withdrawals you make.

A TFI is money you ideally want to leave invested for as long as possible, as its one of the best ways for South Africans who have extra money to save outside of their retirement fund to build up a nest egg for the future.

So, get going early with investing tax free this new tax year

To start making the most of your annual tax-free allowance, you can invest in a TFI via a monthly debit order or you can make lump-sum investments from R5 000 to R36 000. If you have an existing tax-free savings account with a bank, you can switch it to a TFI at no cost.

This article featured as a Business Day Opinion Piece by Pieter Koekemoer on 28 March 2021

South Africa - Personal

South Africa - Personal