Demonstrating the long-term power of tax-free investing

With the tax year drawing to a close at the end of February, remember to take advantage of your R36 000 tax-free investment allowance. Our analysis shows that if you start early and invest the maximum allowed every year, you could double the returns from the same taxable investment over the long term.

By staying the course, we believe that you can harness the full power of tax-free investing – what we call the ‘first in, last out’ approach. By ‘first in’, we mean that you should prioritise taking advantage of your annual tax-free investment allowance as early as possible when you start investing so that you can reap the benefits of compound growth.

We recommend that you be ‘last out’ of your tax-free investment, because remaining invested for as long as possible further accentuates the compounding of returns not reduced by tax. We also know that leaving your money invested over multiple decades enables it to withstand the effects of short-term market volatility. Over the long term, the ups and downs of markets smooth out, and history has shown that the overall trend in the value of your investment is upwards.

The rewards of being ‘first in, last out’

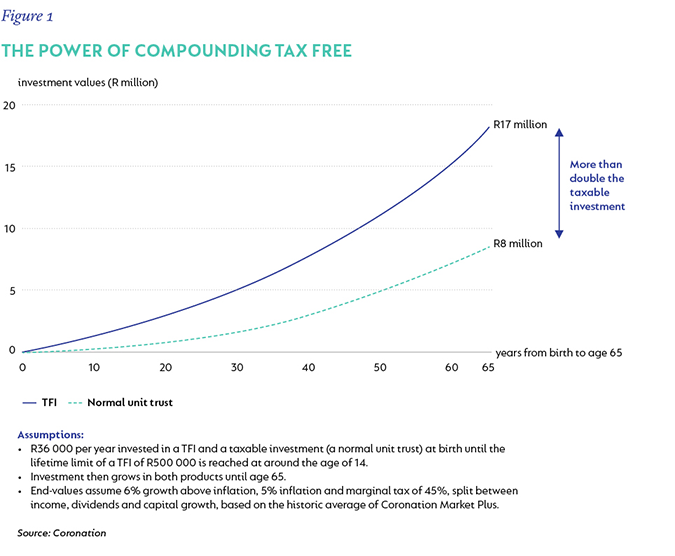

The following illustrative example highlights the long-term benefits of adopting a ‘first in, last out’ tax-free investing strategy. Imagine that you invest the maximum annual amount (R36 000) in a tax-free investment for your child from birth. If you continue doing so, you will reach the lifetime limit of R500 000 before your child turns 14. The longer you decide to keep the money invested, the more the benefits of compounding and the greater the extent to which your tax-free fund outperforms the same taxable fund.

Our analysis, based on certain assumptions (see figure 1), shows that if you keep the money in the fund until your child turns 18, the value of the tax-free investment will be 22% greater than the equivalent taxable investment. By age 30, this difference widens to 42% and, by age 65, the investment would be double the value of the same taxable investment. These results show that by resisting the temptation to disinvest from the fund, the nest egg being built up would keep your child in good stead by either financing tertiary education, buying a first home or ideally investing in their retirement, depending on when your child decides to disinvest.

This theoretical exercise also shows the incredible power of compounding over long periods of time. Investing R500 000 spread out over 14 years and then doing nothing for 41 years result in an investment worth R17 million in today’s money by the age of 65. That is enough to fund a retirement income for life of more than R80 000 a month, again in today’s money. Our hypothetical (very patient) tax-free investment beneficiary would therefore never have to contribute to retirement while working, effectively freeing up 10% to 15% of annual income that would normally have been required to fund retirement income if you start contributing in your early 20s.

Once out, always out when you make withdrawals

While you are free to access your tax-free investment at any time, it’s well worth resisting the temptation, because you cannot top-up the fund again. The South African Revenue Service only considers the amounts invested into the fund and disregards any withdrawals when determining your tax-free investment limits.

While the last couple of years have been financially challenging, as always, the best advice is that no matter the external circumstances, start investing now with what you have and reap the rewards in the future. The example above is a keen reminder of the benefits of compounding and how much more your capital grows when not eroded by taxes. So, take the leap before the 2022 tax year ends on 28 February, and remember you have 22 tax-free Coronation funds from which to choose.

NOT YET A CORONATION TAX-FREE INVESTOR?

You can start investing with us via a monthly debit order from as little as R250, or you can make lump-sum investments from R5 000 to R36 000. If you have an existing tax-free savings account with a bank, you can switch it to a tax-free investment at no cost. To select the funds that suit your needs, speak to your financial adviser if you have one, or visit our fund selection guidelines.+

South Africa - Personal

South Africa - Personal