The Adidas three stripes logo is a familiar sight to sports and fashion lovers the world over. While the brand can be traced all the way back to a German shoe factory owned by the Dassler brothers in the 1920s, Adidas was officially created in 1949 by Adolf (Adi) Dassler. (After a falling out, his brother Rudolf formed Puma.) The company has a long, successful history and is now the largest sportswear manufacturer in Europe and the second-largest globally. Popular products include the Boost running shoe and the Copa Mundial football boot, which is the bestselling football boot of all time.

In this article we discuss the global sportswear market and why we believe the investment case for Adidas presents a compelling opportunity for our funds.

GLOBAL SPORTSWEAR

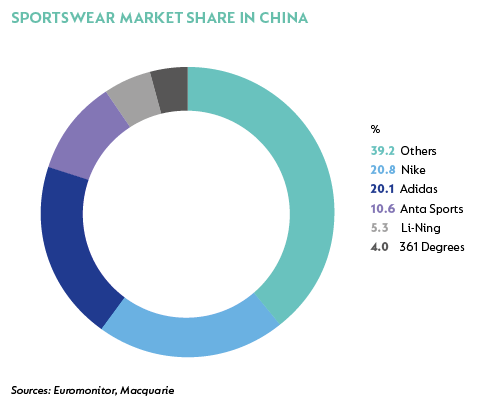

There are a number of reasons why we consider the global sportswear market to be attractive. It is relatively fragmented, with the largest player,Nike, holding just over 24% market share and Adidas holding around 14%. A fragmented market allows strong brands such as these to gradually increase their share over time with better innovation, superior distribution channels and clever marketing. Customers also tend to be relatively brand loyal, allowing strong brands to enjoy pricing power and healthy gross margins.

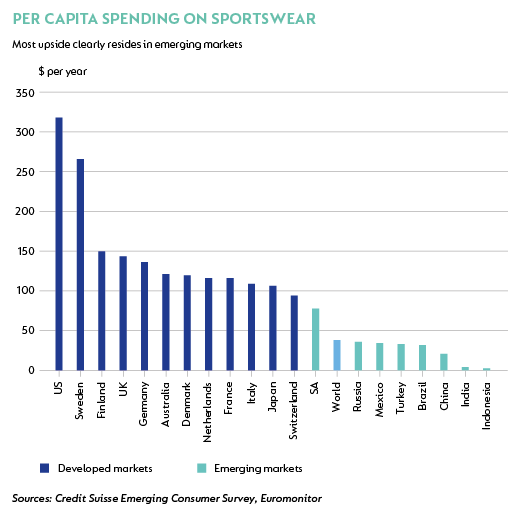

Sportswear is estimated to be a $350 billion annual industry today. The market has grown strongly for many years, having experienced over 7% annual growth since 2009. This is more than double global GDP growth rates over the same period. Despite this impressive performance, there is still a significant runway for growth as emerging market consumers significantly underspend on sportswear relative to their developed market counterparts. Rising emerging market income levels mean growing numbers of middle-class consumers with more discretionary spending and greater participation rates in sports and leisure activities.

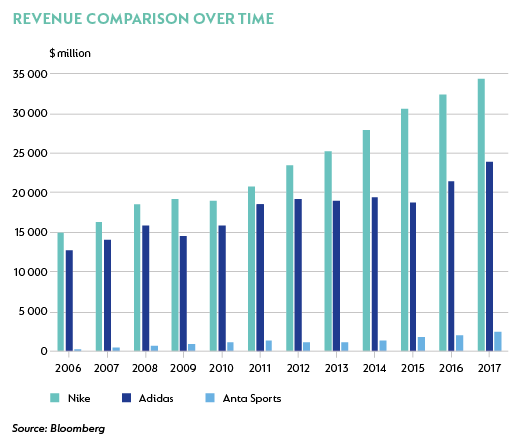

China is expected to be a significant growth driver going forward, powered by a growing middle class and a new national fitness plan with ambitious targets for national fitness levels and increased sports participation. In 2015, the size of the Chinese middle class reached 109 million adults, surpassing the US for the first time. China also has 425 million Millenials, who have grown up with social media and put a premium on looking good. A good physique is now associated with virtues such as perseverance and self-discipline. According to the China Business Research Academy, gym membership in China doubled between 2008 and 2016. The number of yoga practitioners has more than doubled over the same period. Running is also gaining significant popularity. The sportswear market in China has consistently grown at double-digit growth rates over the past five years but is still less than a third of the size of the US sportswear market. Nike, Adidas and local Chinese company Anta Sports have strong positions in the country and stand to benefit from a market that we expect will continue to grow at a healthy pace.

Sportswear brands have benefited significantly from ‘athleisure’ trends and the casualisation of work attire over time. Adidas in particular has done very well partnering with global celebrities such as Kanye West and Pharrel Williams, with new limited edition designs that have created much hype for the Adidas brand and positioned its sneakers and clothing as high-quality, aspirational products in the consumer’s mind.

ADIDAS GETS ITS BOOST

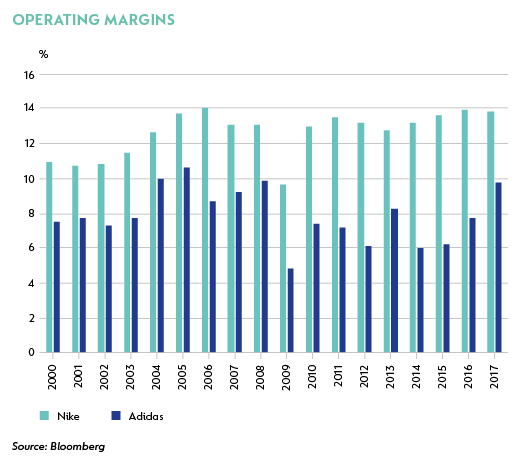

Over longer time periods, Nike has outperformed Adidas from a sales growth and margin perspective, to the point where we believe Adidas was underearning relative to its potential. In 2015, a new game plan was announced at Adidas called ‘Creating the New’,which is being driven by a new management team. Current CEO Kasper Rorsted has enviable credentials and from 2008 to 2016 was responsible for the impressive turnaround of another underperforming German business – chemical and consumer goods company Henkel. He did this by focusing the product portfolio and instituting a new entrepreneurial, performance-driven culture at the company. There are early signs of him adding similar value to the Adidas business.

The new game plan is focussed on three strategic pillars – speed, key cities and open source. First, Adidas is focussed on increasing the speed of its supply chain and production processes to be at the cutting edge of new fashion trends and improve the availability of product. Secondly, recognising that this is where new trends develop, the company has focused it sales and marketing activities on six of the world’s most influential metropolitan centres – New York, Los Angeles, London, Paris, Shanghai and Tokyo. Thirdly, ‘open source’ describes a new drive of inviting athletes, consumers and partners to collaborate with its brands. This has resulted in successful new products sold under the Adidas YEEZY and Adidas Originals names.

On the back of these initiatives, sales have grown at healthy double digits over the past three years and operating margins have increased from 6% to 10%, which represents a 55% increase in margin. Growth has been broad based, with the company’s three major regions (North America, Europe and China) growing significantly. Despite impressive recent financial performance, we believe there are still improvements to come. In spite of steady advances over the last decade when the company set out to narrow the gap between Nike and itself, operating margins are still significantly below those of its main rival (see the graph below) and management is focused on further expanding margins over the foreseeable future. This will be driven by a number of factors, including increasing the share of direct-to-consumer sales, which consist of physical Adidas store sales and ecommerce. Sales through these channels result in higher gross margins as they capture the retail markup in addition to the wholesale margin they would otherwise have earned. As a key strategic focus area for management, ecommerce is expected to grow strongly going forward, and will allow Adidas to gain the above-mentioned retail markup with less of the associated cost that goes with running physical retail infrastructure. Other initiatives to improve margins include driving more full-price sales with the company’s ‘speed’ initiatives, and further cost-saving projects. Adidas also owns the less significant and underperforming Reebok brand, which we believe the management team will turn around over time.

CONCLUSION

Our investment team has closely followed both Adidas and Nike for a number of years. Due to similarly compelling investment cases, we have owned both companies at varying sizes in our funds over time. We also like the fundamentals of Anta Sports, a homegrown Chinese sportswear company that we have analysed in detail in the past but have chosen not to own due to a high valuation and an insufficient margin of safety. All three stocks have done well over the past five years, beating the broader market comfortably.

Adidas is a world-class premium sports brand, with strong market positions in attractive, growing categories and across geographies. We are encouraged by the the fact that the business now has a strong management team with a good track record that is doing the right things to improve the operational performance of the company. After reducing its debt levels over recent years, the company also has a strong balance sheet and is committed to returning excess capital in the form of dividends and share buybacks. A recent pullback in the share price in late 2017 meant that the stock was trading on 20 times earnings, at a material valuation discount to Nike and with a better earnings growth profile due to its low margins. This provided us with an opportunity to build a meaningful position in our funds.

South Africa - Personal

South Africa - Personal