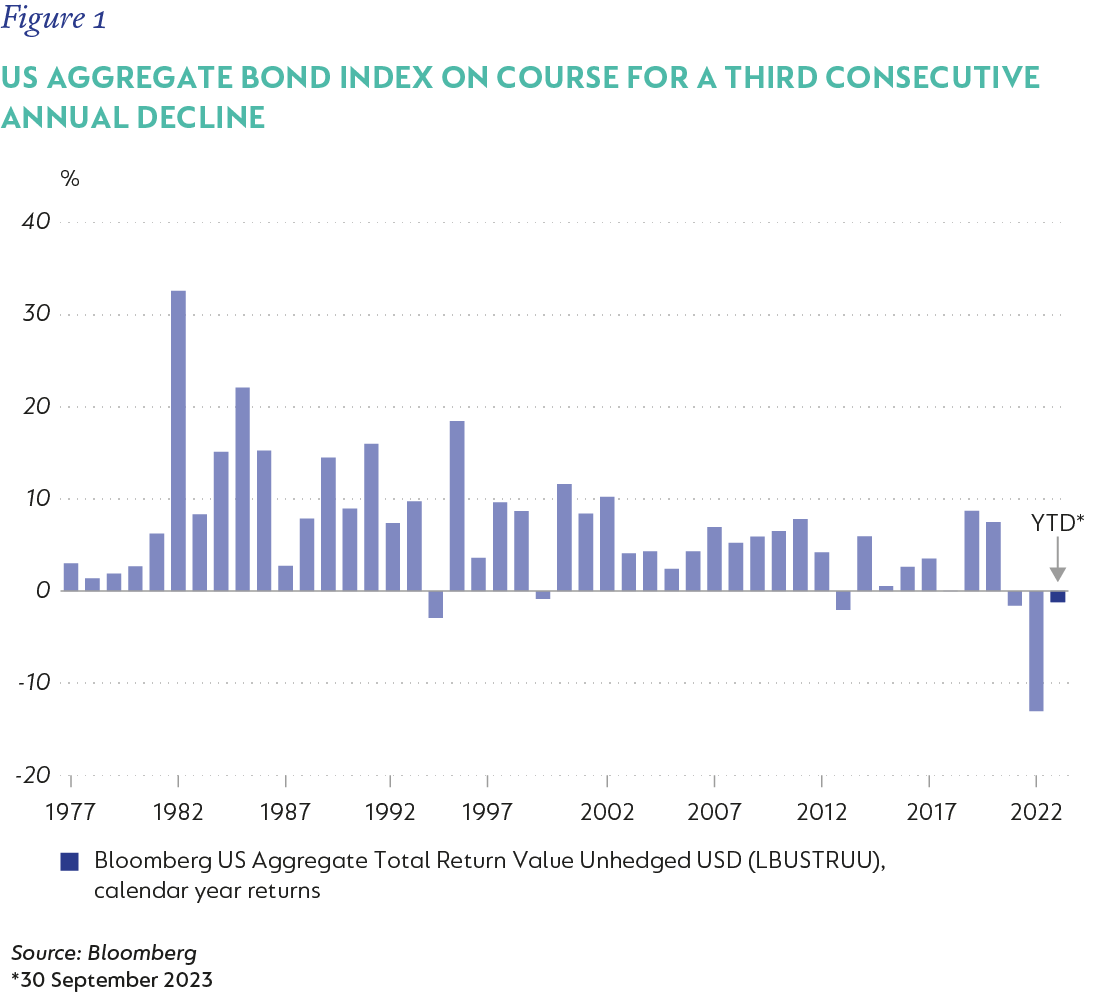

After two consecutive quarters of gains, equity markets were weaker in the third quarter (Q3-23) of the year, declining by 3.4%. Interest rates continued to rise, causing a further sell-off in the global bond index. In fact, global bonds underperformed global equities this quarter, and the bond index is currently on course for its third consecutive annual decline after dropping 5% in 2021 and 16% in 2022. Going back to 1990 (when records began), the index has never before suffered two consecutive years of declines. This is also true for the US Aggregate Bond Index, which has more comprehensive data going as far back as 1976.

The Fund’s return was behind the benchmark in the quarter (by 50 basis points [bps]).

The portfolio’s short-dated cash holdings were the main positive contributor to returns in the quarter. Cautious fixed income positioning contributed to strong relative returns, with the Fund’s fixed income holdings returning -0.9% compared to the index’s 3.6% decline (as measured by the Bloomberg Barclays Global Aggregate Bond Index). The Fund’s equity holdings underperformed the index.

At quarter-end, the portfolio was positioned as follows:

- 61% effective equity

- 5% in real assets (listed infrastructure and property)

- 7% in high yield fixed income

- 8% in inflation-linked assets (primarily US Treasury index-linked bonds)

- 9% in investment-grade fixed income instruments

The remaining 10% was invested in short-dated US T-Bills and other assets.

As interest rates have risen across the curve, the duration of the fixed income portfolio has started to creep up (through our buying of instruments with longer-dated maturities). The main driver was long-dated inflation-linked bonds issued by the US Treasury, priced at a real yield of nearly 2.5%, essentially locking in a return of inflation plus c.2.5%.

The gravitational pull of higher interest rates has also impacted assets like infrastructure and REITs, and we have used this weakness to add exposure to some of our existing positions as well as new names. One new purchase in the quarter was National Grid - the largest owner and operator of electricity transmission and distribution infrastructure in the UK and in Massachusetts as well as New York in the US. It was formed through privatisation of the British industry in 1990; originally owned by 12 regional electricity companies, National Grid was listed on the London Stock Exchange in 1995. The business operates overwhelmingly in jurisdictions with clear long-term decarbonisation ambitions and a stable regulatory environment. National Grid will invest c.£40 billion in infrastructure over the next five years, resulting in annual growth in its asset base of approximately 8% to 10%, while earning a double-digit return on its investment. Given the regulated nature of the business, it has a high degree of visibility for this growth. At the same time, the company has a long history of outperformance against its regulatory targets, which results in higher returns to shareholders and lower bills for customers.

Despite the significant acceleration in investment requirement, National Grid has ample balance sheet capacity and can fund its growth while maintaining a very generous dividend (currently 6% dividend yield). The stock is not dearly priced either. At c.14 times price-earnings multiple, or a 25% premium to the value of its regulated assets, National Grid trades at a discount to historical levels and well below the market. Given the structural nature of the energy transition and the grid’s critical enabling role therein, we see a very long runway for continued reinvestment in growth, offering shareholders a double-digit long-term rate of return with a relatively low correlation to equity markets.

Within our equity holdings, detractors were spread across various sectors, including consumer staples, railroads, food delivery businesses and companies exposed to China. In all instances, we continue to hold these names, and in some cases have increased exposure.

Capri Holdings was a top contributor for the quarter following the announced acquisition by peer Tapestry, owner of the Coach brand, in an all-cash deal valuing Capri at an enterprise value of $8.5bn or $57 per share. In previous commentaries, we have written about Capri, which owns three founder-led luxury brands in Versace, Jimmy Choo and Michael Kors. We were attracted by the significant growth runway of the Versace brand alongside the stable cash flows from Michael Kors. In our view, the market had largely ignored Capri and it was trading on a trough multiple of around 6x earnings. Tapestry clearly recognised this deep value. The proposed deal was announced on the 9th of August, sending the Capri share up 55% in a single day. We subsequently exited our position.

Uber and Doordash have been positive contributors this year, up over 80% and 60%, respectively, year to date. We built positions in both at very attractive levels after a bruising 2022, which saw these two companies, and many other longer-duration names, sell off as rate hikes commenced in developed markets worldwide.

Doordash is the leading on-demand delivery platform in the US, with a share of around 60% of the growing online food delivery market. It also has an increasing presence in Canada, Europe and Australia. The business exploded during the pandemic but has continued to grow fast off this base (organic orders +20% y/y in the second quarter) while showing significant improvements in profitability. Earnings in the core US food delivery business are now positive and growing. We continue to like Doordash for its best-in-class management team, exceptional execution, fortress balance sheet (net cash of $3.8bn), continued strong growth and ongoing profitability gains in an industry that is becoming more rational post a “growth at all cost” approach taken by many businesses during the pandemic.

Uber’s fundamentals also continue to improve, with robust revenue and earnings growth recorded in its rides and eats segments. The company recently reached the important milestone of GAAP profitability on the back of 70% adjusted EBITDA growth in the second quarter. We continue to believe there is a long runway for growth in both the rides and eats segments. Similar to Doordash, we also see the potential for significant ongoing margin improvements on the back of internal cost efficiencies, more rational end markets and growth in high-margin advertising. In a world of higher rates, leading operators with strong balance sheets become harder to displace.

Thank you for your support and interest in the Fund.

South Africa - Personal

South Africa - Personal