The second quarter of 2023 built on the gains of the first three months of the year, with global equity markets advancing 6.2%. This brings the year-to-date (YTD) gain to 13.9% (as measured by the MSCI All Country World Index). However, global bond markets lagged, returning -1.5% for the quarter. This was largely driven by developed market risk-free yield curves shifting upwards. The Fund has delivered a solid six months in absolute terms, advancing 9%, and also outpacing its benchmark.

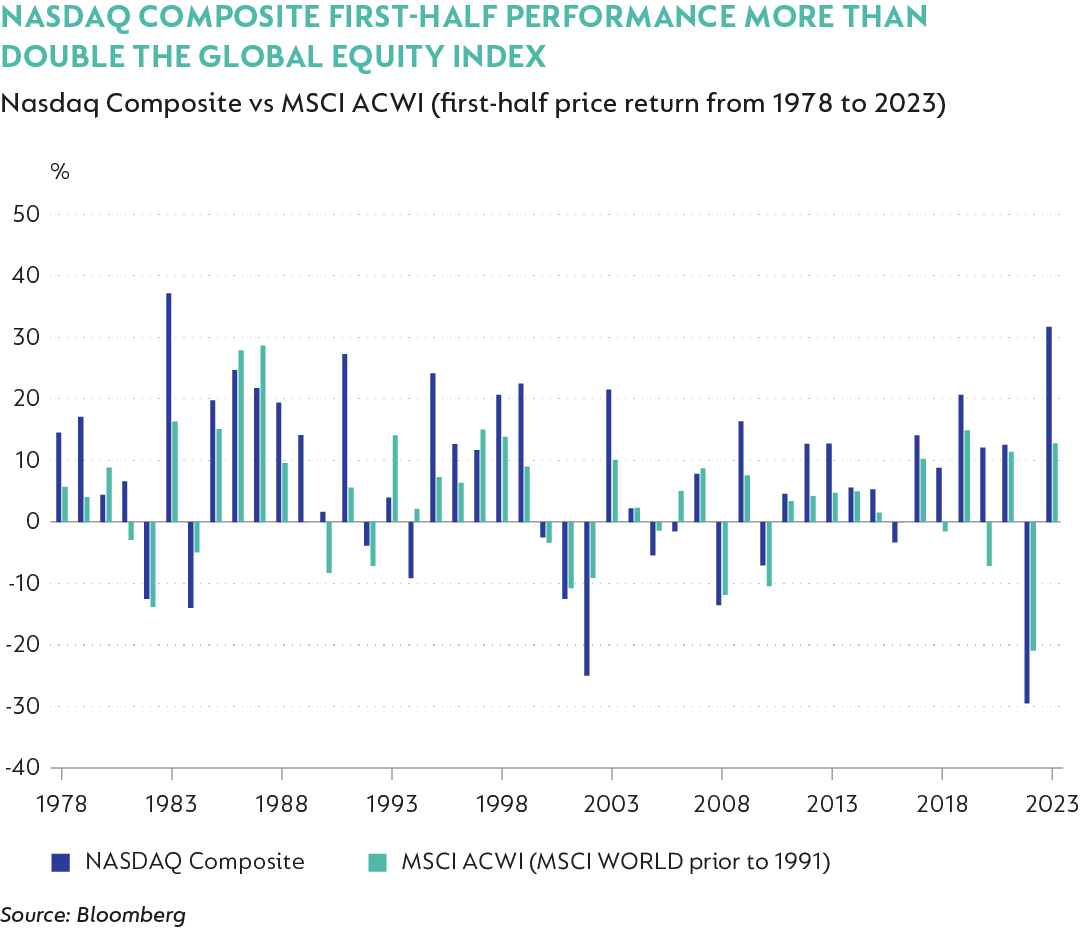

As is sometimes the case, index level data can obscure what is happening under the surface. And this year investors needn’t scratch too deep to understand what is driving returns. A small group of US mega caps (aka “The Magnificent Seven” of Nvidia, Meta, Tesla, Microsoft, Apple, Amazon, and Alphabet) have driven a narrow market and accounted for a large portion of total returns. Indeed, the Nasdaq Composite Index is on pace for its best first half in 40 years, up c.32%, more than twice the return of the global equity index as is clear from the graph below.

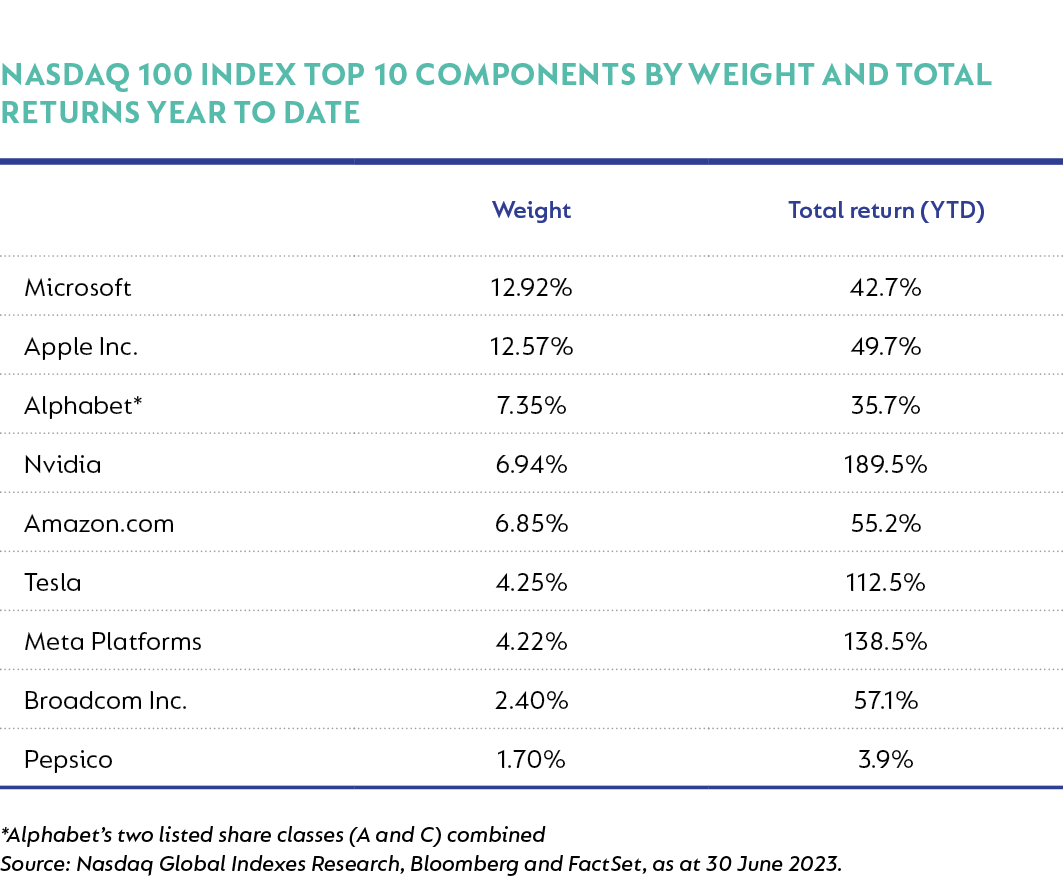

The Nasdaq 100 Index (which comprises the 100 largest stocks in the Nasdaq) performed even better, up nearly 40% YTD. All this pales, however, when compared to the 91% average return of “The Magnificent Seven” – a staggering 6x higher return than the market. The outperformance of the largest stocks has left the Nasdaq looking distinctly concentrated, with over 25% in two stocks, and a third of the index in three, and “The Magnificent Seven” accounting for 55% of the index.

At quarter-end, the portfolio was positioned as follows:

- 63% effective equity

- 4% in real assets (listed infrastructure and property)

- 5% in high yield fixed income 8% in inflation-linked assets (primarily US Treasury index-linked bonds)

- 9% in investment-grade fixed income instruments

The remaining 11% was invested in short-dated US T-Bills and other assets.

In terms of the opportunity set, we believe the narrowness of the equity market has amplified stock-picking opportunities. From high quality consumer companies like Heineken, to quality compounders (that may not be household names), such as Interactive Brokers, our portfolio is comprised of a range of diverse and undervalued businesses. Two lesser-known companies – Applied Materials (+50% YTD) and LAM Research (+56% YTD) - were top contributors for the quarter.

Applied Materials and LAM Research are two of the largest producers of wafer fabrication equipment (WFE) in the world. These producers supply the equipment and services that are used by semiconductor manufacturers (such as TSMC, Intel, and Texas Instruments) to produce the microchips that power the modern economy. WFEs are incredibly complex, specialised (and expensive) machines; once a tool is adopted for a process, it is very hard to switch suppliers as it would affect the entire production line. As a result, the industry has very high barriers to entry, and is highly consolidated - the top five players have not changed over the last two decades, with combined market share increasing from 50% to 70%. Within specific process steps (such as lithography, deposition and etching), market concentration is even higher.

The WFE industry is closely linked to global semiconductor demand. Over the last decade, semiconductor demand has grown at a mid-single-digit compound annual growth rate, largely due to rising smartphone penetration. The WFE market has grown even faster (at low double digits) due to rising capital intensity. In order to continue shrinking the size of, and increasing the number of transistors on, a microchip, significantly more complex manufacturing techniques are required with each subsequent generation (or node). These have included the introduction of vertical stacking of transistors (increasing the need for deposition and etching tools) and extreme ultraviolet lithography.

We remain constructive on long-term demand growth for WFEs, driven by new applications with much higher semiconductor content such as AI, electric vehicles, and renewable energy. Additionally, greater diversity in end demand should also help to reduce industry cyclicality. However, after the strong rally in the share prices of Applied Materials and LAM Research, we have trimmed these positions, and rotated capital into ideas that we think offer better risk-adjusted returns.

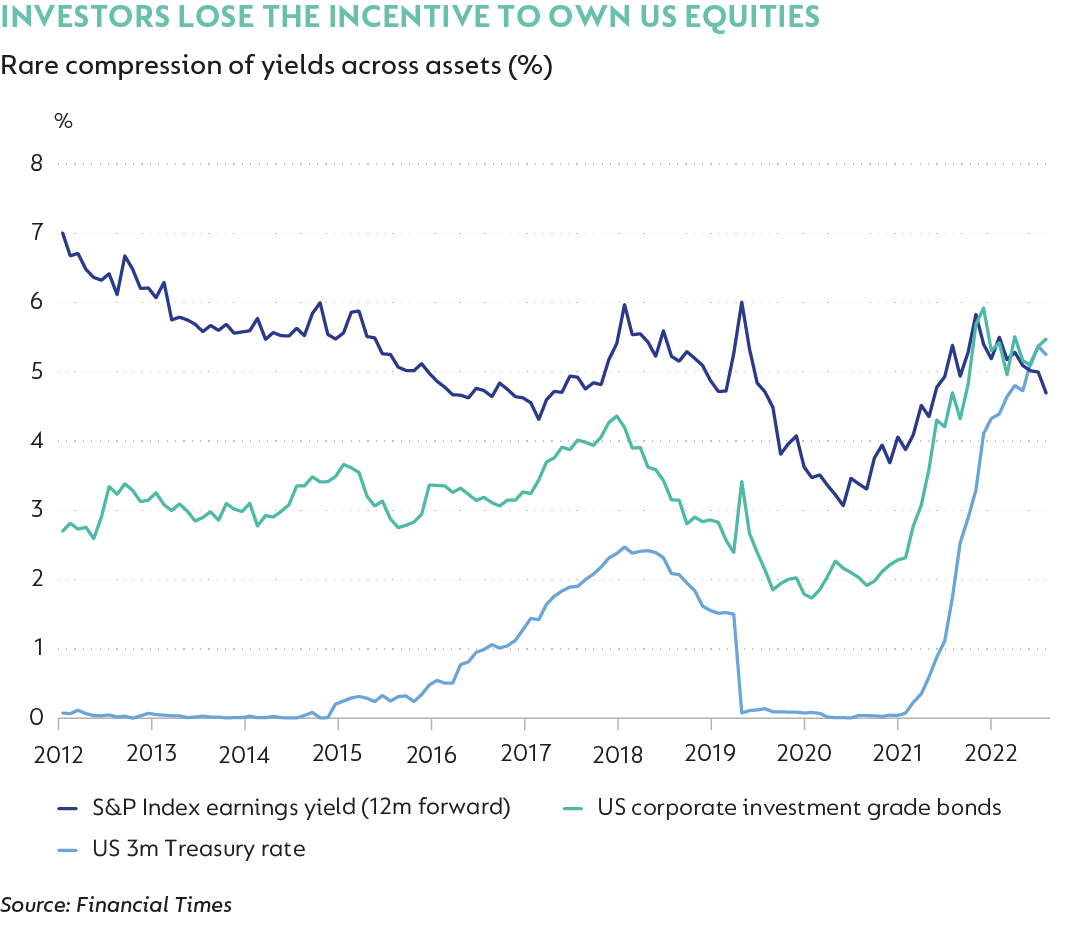

From an asset allocation point of view, it is also encouraging to see a diverse opportunity set emerge across a range of asset classes. In our Q4-22 quarterly commentary, we outlined the changes in fixed income markets and how the Strategy has responded. The yields available are neatly summarised in the chart below.

Thank you for your support and interest in the Fund.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal