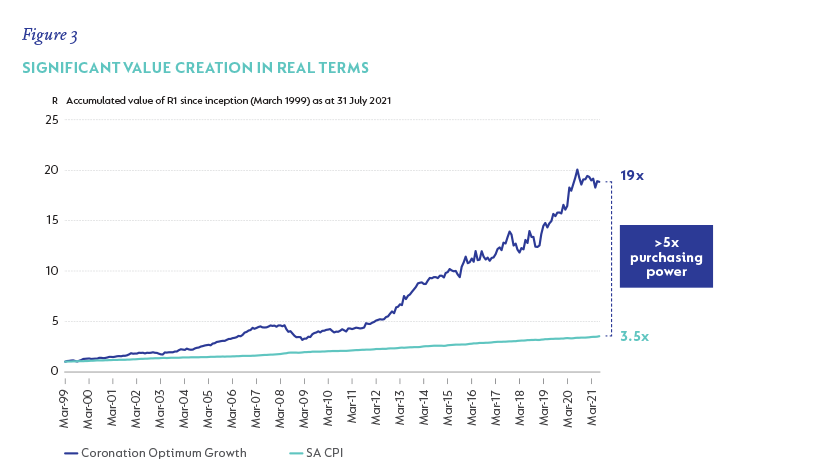

Our proven multi-asset capabilities across global markets have generated significant value for investors over the long term, as demonstrated by the track record of Coronation Optimum Growth (Figure 3). Having pioneered the uniquely flexible worldwide multi-asset mandate 22 years ago, the Fund is an aggressive long-term portfolio that invests in the best opportunities selected from local, emerging and developed markets. Key highlights as at end July 2021 include:

- For every R1 invested at inception, you would have R19 today compared

to R3.50 needed to keep up with inflation – resulting in a five-fold

increase in purchasing power over that period. - ranked first or second in its Morningstar category over all longer-term

periods of 10, 15 and 20 years, while outperforming more than 90% of all competitors over the last 5 years. (Source: Morningstar)

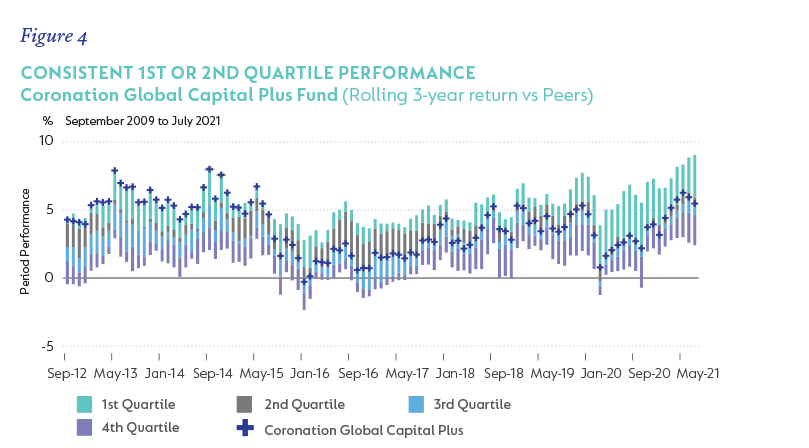

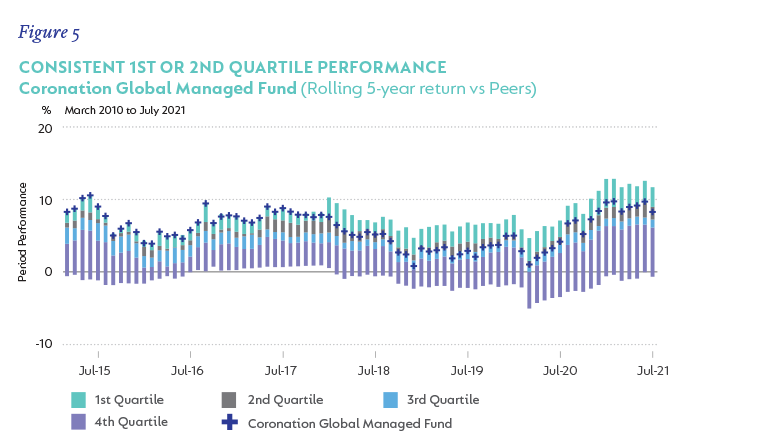

The breadth and depth of our investment team’s expertise is also evident in the more than 10-year track records of our pure global multi-asset funds among international peers (see Figures 4 and 5).

South Africa - Personal

South Africa - Personal