Business & Industry views

Notes From my Inbox

Over the years, I’ve come to view complaints as opportunities rather than obstacles. - Guy Winch, from The Squeaky Wheel

INTERNATIONAL INVESTING AND EXCHANGE CONTROL

Over the past year, investors in our multi-asset funds, such as Coronation Balanced Plus, benefited from high levels of exposure to international assets. When government announced in February last year that retirement funding portfolios could increase their international asset holdings from 30% to 45%, we made use of the opportunity by taking advantage of attractive valuations as global markets sold off. Our international funds also benefited from a strong performance recovery over the 12 months, as our proprietary research gave us the conviction to hold, and in some cases increase, our exposure to many shares that fell out of favour when the market fixated on inflation and interest rate hikes during 2022. At the time, many of these shares were trading at a fraction of their fundamental valuations and share prices have since recovered strongly from the lows.

Unfortunately, there is some bitter with the sweet. Exchange control rules have forced us to temporarily close our onshore (rand-denominated) international funds for certain types of new investors. On the positive side, recent innovations in the foreign exchange services available to South African investors have made it possible for us to significantly reduce the minimum investment levels in our offshore (foreign currency-denominated funds), as we report in detail here. The onshore and offshore fund ranges offer access to the same investment strategies, research process and portfolio management teams.

INVESTMENT VIEWS

Every quarter we publish in-depth research summaries covering specific areas of investment research to provide insight into how we think when allocating your capital. This quarter, portfolio manager Nicholas Hops reviews the investment case for local gold shares and explains why, after a strong run, we believe that they are overvalued at current price levels. Emerging markets analyst Chenghuan Deng provides a reminder about how quickly consumer behaviour can change in digital markets. He shows how Shein conquered the US low-cost fast fashion market over the past three years and how Temu may be poised to do the same for a wider range of consumer goods. He also considers the sustainability implications of this change in consumer buying behaviour. Economist Marie Antelme and Head of Fixed Income Nishan Maharaj have contributed their quarterly in-depth views into the economy and fixed income space, with a focus on inflation and its impact on the outlook for South Africa. The ongoing policy uncertainty combined with sticky inflation has led to a trend of derisking in client portfolios, which in itself, can pose a massive risk to potential returns in the portfolios of retirees. We’ve also included an article that looks at how retirees can ensure they have appropriate levels of risk in their portfolios.

If you are looking for a more comprehensive review of the positioning and outlook for your funds, please read the quarterly fund commentaries.

TRUST IS EARNED™

When we adopted “Trust is Earned™” as our motto more than a decade ago, we knew that it would result in some barbs down the line. Every time we miss an expectation, whether it is disappointing short-term investment performance produced by one of our strategies, or delivering an unsatisfactory client service experience, we know that we may be asked whether the behaviour in question was consistent with building trust. But this was rather the point. Investing is an intangible endeavour, where clients will only know the outcome after the fact, often decades into the future. We could think of no better three words to constantly remind our team that we only have a reason to exist if we are deserving of our clients’ trust. We view any complaint about whether we live up to our maxim as an opportunity to take action to improve the standards of our delivery to you.

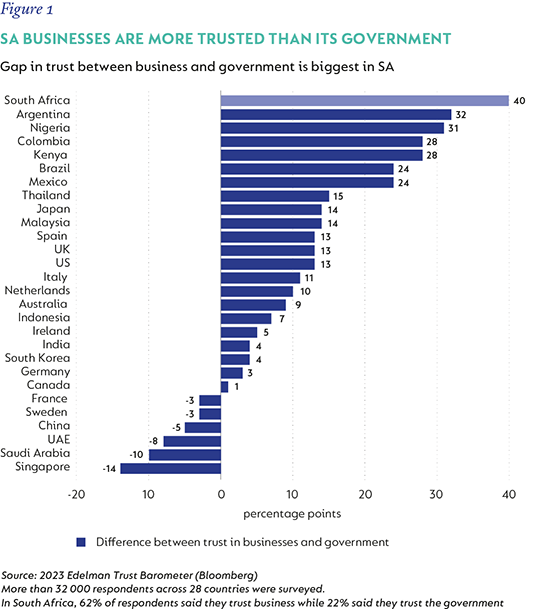

Communications firm Edelman recently released their annual Trust Barometer. I last wrote about this in 2020, noting that the private business sector is globally more trusted than governments and the media. While survey respondents were not convinced that businesses are always ethical, the vast majority viewed them as competent. Figure 1, taken from the 2023 survey, shows that not much has changed since then, with the business sector still more trusted than governments in most countries. Notably, this trust gap is the biggest in South Africa, with 62% of respondents trusting business compared to only 22% trusting government. Once trust is lost, it is very hard to restore.

I hope you enjoy the winter edition of Corospondent.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal