Economic views

Choppy waters

Mounting risk to the fiscal health of indebted emerging markets will require careful navigation

- Policy rate normalisation in a post-pandemic world will require skill to navigate

- Emerging markets in particular are much more indebted than before

- History shows that debt waves and financial crises are empirically linked

- Firm commitments to sustainable fiscal policy are essential to navigating away from the fiscal cliff

MARKETS AND POLICYMAKERS are – rightly – grappling with the implications of the surge in inflation experienced in 2021. Most recent Federal Reserve Open Market Committee (FOMC) minutes suggest a more hawkish outlook for US interest rates than we have experienced in more than a decade.

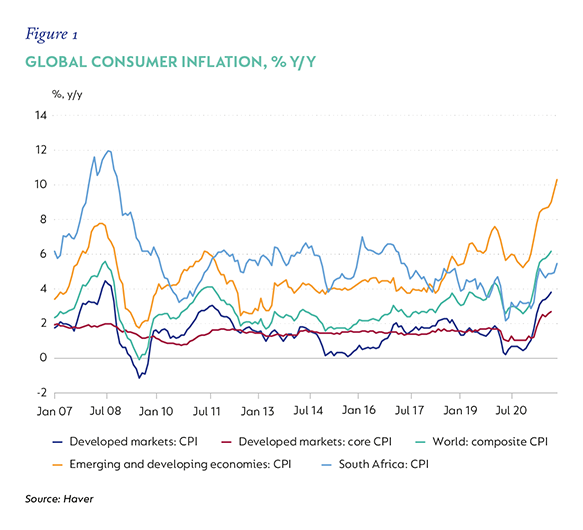

Globally, central banks are likely to remain reluctant to aggressively tighten policy settings in the short term. This is because they are still unsure of the trajectory of inflation from here and are wary not to derail an equally uncertain recovery, which may mean that persistent price pressures are more likely to see normalisation cycles prolonged and extended in time (Figure 1).

The implications for growth and asset prices are likely to be painful. But the test will be navigating higher interest rates in the significantly more indebted post-pandemic world, especially for emerging markets.

Global debt stock since 2010 has risen at an extraordinary pace, across all economic agents and all regions, to unprecedented peacetime levels. The pandemic-induced recession in 2020 led to the largest single-year surge in global debt since that time. History tells us that more than half of the periods of aggressive debt accumulation since the 1970s have ended in some form of crisis. While the pandemic – and policy responses that were mobilised globally – were exceptional, and worked to mitigate its economic impact, the resulting very high levels of debt materially increase economic fragility.

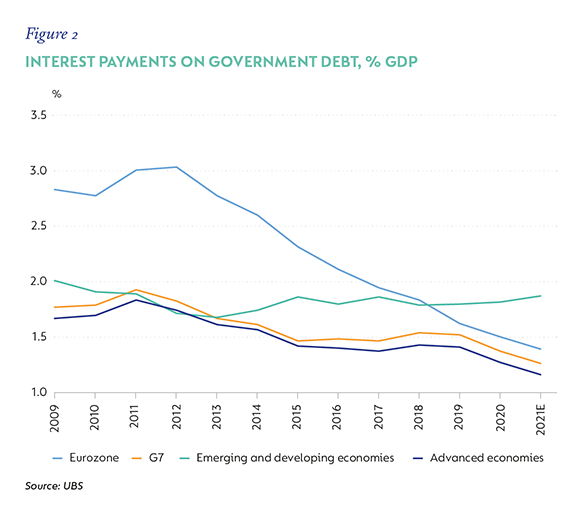

For a long time, policymakers have managed to keep the cost of borrowing low, both through very low policy rates and through various unconventional policy tools deployed to meet mandates with policy rates at zero or below. The result has been that governments have been able to fund persistent deficits without debt becoming unsustainable. This is less true for emerging markets where the large accumulation of debt has seen rising debt costs, despite low rates. Nonetheless, we have become comfortable with the idea that advanced (and some emerging) economy governments can continue to spend because central banks will continue to provide costless liquidity. This may no longer be the case (Figure 2).

DEBT CYCLES ARE COMMON

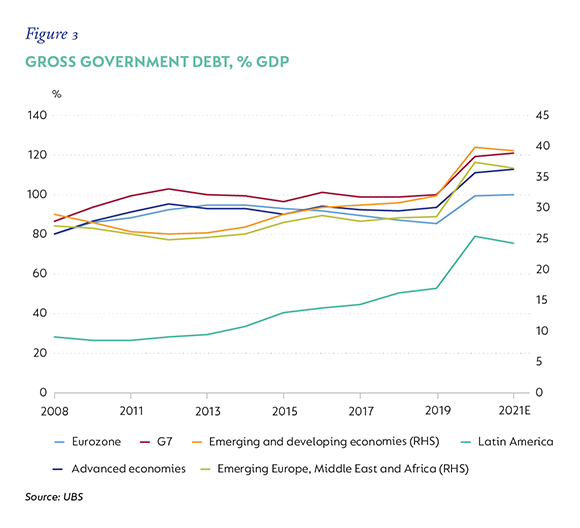

The World Bank has identified 519 periods of debt accumulation since the 1970s, mostly in emerging markets. The detailed ‘Global Waves of Debt’ study* finds that, within these, there have been four distinct debt cycles in the past 50 years; the fourth and latest has been accumulating since 2010. Previous debt waves have generally been concentrated in specific regions (1970-1989, in Latin America, the Caribbean and parts of sub-Saharan Africa; 1990-2001, in East Asia and the Pacific; 2002-2009, in Europe and Central Asia). In contrast, the latest debt cycle shows rising debt stock – both private and public – across all emerging and developing economies (EMDEs). This is the biggest, fastest and broadest wave of debt accumulation, even before the pandemic (Figure 3).

All waves share several common features. Importantly, they all began during periods of prolonged low interest rates and were facilitated by changes in financial market conditions, whether in practice or prompted by regulatory changes that promoted an acceleration in borrowing. All three previous waves also ended in financial crises of some kind and in all cases the crisis was prompted by a shock that resulted in a sharp increase in borrowing costs.

EMPIRICAL LINKS BETWEEN DEBT ACCUMULATION AND CRISES

High levels of debt carry significant risks. First, debt is much harder to refinance during periods of financial stress, as borrowing costs rise. Secondly, high levels of debt carry broader and far-reaching economic risks. In the case of government debt, rising borrowing costs can crowd out more productive private sector investment, undermining long-term growth. As servicing costs increase, fiscal resources are redirected from other areas of spending, and service delivery and infrastructure investment fail, also undermining growth and adding to longer-term liabilities. As this continues, the cycle becomes unsustainable.

When large amounts of public debt are held by foreigners, a weaker fiscal position may prompt selling, in turn raising the risk of materially higher inflation. Domestically, an increase in government debt held by local financial institutions could see rising systemic risk as asset quality deteriorates.

WHAT THE GLOBAL FINANCIAL CRISIS DID – LOW RATES AND INFLATION

Sharply lower interest rates and low inflation have been dominant features of financial markets over the past decade. These have underpinned low borrowing costs and rising asset prices across classes and maturities. The sustained drop has also raised conjecture that ultra-low rates create room for governments to spend much more than deemed prudent to stimulate growth, while not being overly concerned about taking offsetting steps to lower debt levels.

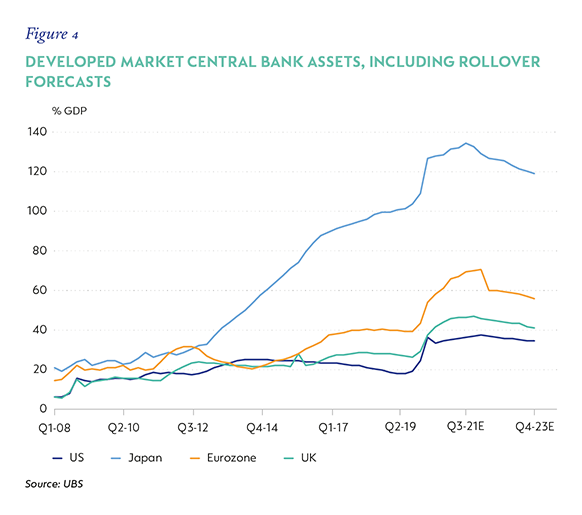

An important ingredient in this was the utilisation of unconventional policy tools by advanced economy central banks – specifically the Federal Reserve Board (the Fed) and the European Central Bank (ECB) – in a manner that was more effective and less risky than many initially feared. Specifically, the management of long-term interest rates through the expansion of central bank balance sheets to encourage borrowing and help raise inflation towards targeted levels did not lead to runaway inflation or financial instability.

As a knock-on, a global search for yield during periods when risk was perceived to retreat helped lower the borrowing costs for many emerging markets too. Since 2010, EMDE total public and private debt has risen on average almost seven percentage points (ppts) of GDP per annum. While much of this is accounted for by rising debt in China, given its sheer size, as well as aggressive leveraging in 2009-2010 and 2012-2016, debt has risen in 80% of EMDEs over this period, and by at least 20ppts of GDP in more than a third of these.

WHAT COVID-19 DID – LOW RATES, RISING INFLATION

The impact of Covid-19 has been to materially accelerate these dynamics. Governments deployed an estimated 4% of global GDP in fiscal support in 2020 and withdrew only about 0.3% in 2021. Significant market disruption provided the space and need for interventions by central banks to support dysfunctional markets. Where possible, they slashed policy rates, and where not, materially extended asset purchase programmes. For the first time, a broader base of emerging markets also utilised unconventional monetary policies, and asset purchases were more common in 2020 and into 2021 in these markets too.

In 2020, global gross government debt registered its fastest-ever single-year increase since 1970, to the highest level since the end of World War II. Total debt was 300% of GDP, while government debt accounted for almost a third, at 97% of GDP. In advanced economies, government debt stood at 120% of GDP, and in emerging markets at 63% – the highest since 1987. The period following the Global Financial Crisis saw fiscal policy take low rates as a baseline and a signal to accumulate debt was amplified by the growth shock.

However, 2021 brought new challenges. The massive supply shock was followed by a low rate, fiscal stimulus-induced demand shock, which has led to a significant surge in inflation. Ex-ante, it is very hard for policymakers to know which shocks are transitory and which are permanent, and uncertainty about the drivers of inflation initially saw policymakers dismissive of the risks.

The December minutes of the FOMC meeting clearly articulate a change in sentiment. The Fed will wind down its asset purchase programme by the end of March and will raise interest rates shortly thereafter. A new signal that it plans to start shrinking its balance sheet suggests that the ‘costless’ stimulus of more than a decade is ending (Figure 4).

EXCEPTIONALISM

The long period of low interest rates, especially relative to growth, allowed developed economies to sustain high, but relatively stable, levels of debt to GDP, despite the jump in 2020. Importantly, the relatively robust developed market post-pandemic recovery, with strong demand and relatively healthy private balance sheets, has already improved recovery debt ratios. These countries will face their own refinancing challenges as policy rates rise, and much will depend on clear communication of policy direction. In some cases, relatively short average term to maturity (US) may see debt reprice fast. In others, unfunded contingent liabilities are a hidden risk, despite a longer-term maturity profile (UK). Importantly, questions of fiscal or financial dominance – about how far and how fast monetary policy will be able to normalise in the face of a growing long-term inflation threat under such a debt overhang – remain unanswered.

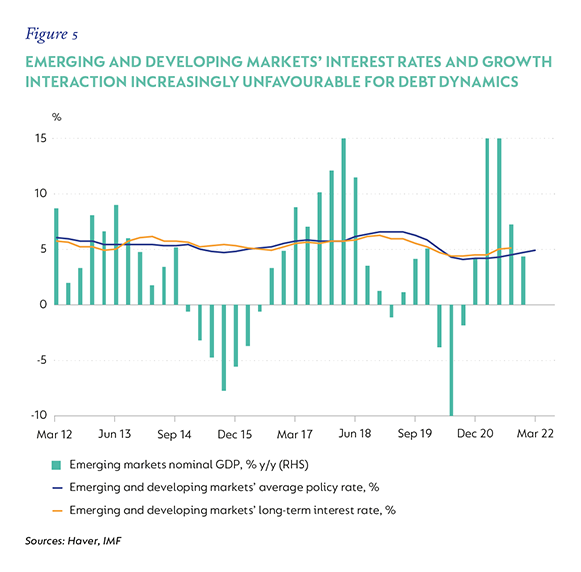

The problem is that advanced economy debt calculus does not transfer well to EMDEs. Despite globally low interest rates and relatively strong GDP growth (debt-positive r-g dynamics), rising primary expenditures have led to higher debt in EMDEs over the past decade, with a jump in 2020-2021. Also, while growth was relatively strong in emerging markets, it was slower and disappointing even before the pandemic. We don’t really know what the lasting cost of the pandemic will be on emerging market growth, in part because global policy support remains in place. As this is rolled back, the scarring will be clearer, but early indicators are that longer-term growth will be lower, just as interest rates start to rise. So EMDEs face the triple challenge of low growth, rising interest rates and large, persistent deficits against a large existing stock of debt (Figure 5). In many, this is likely to become quickly unsustainable and global incidence of emerging market debt traps is likely to increase.

WHAT DOES THIS MEAN FOR SOUTH AFRICA?

South Africa (SA) has trod the same debt accumulation path as the rest of its emerging market peers, perhaps even more enthusiastically than some, over the past decade. Government debt has risen from a nadir of 23.1% of GDP in the third quarter of 2008 to an estimated peak of 71.2% in the second quarter of 2020. In the depth of the pandemic, estimates for the debt trajectory varied wildly, but all saw an ongoing sharp increase in the debt stock in coming years as low growth, high borrowing costs and large primary spending continue to accumulate.

Luckily, this has not been the way things turned out. Stronger-than-expected growth and a large revenue windfall – mostly related to commodity-related revenues – materially improved the realised deficit and saw a boost to nominal growth, even as interest costs remain stubbornly high. We expect debt stock at the end of the fiscal year 2021/22 to be 70.1% of GDP, from 70.7% in 2020/21.

While starting positions do count in fiscal arithmetic, the dynamics between interest rates and growth matter too. SA’s nominal average funding rate remains high at 6.8%, despite low global yields, and nominal growth has been slowing. Our fiscal baseline sees a moderation in the primary deficit towards a surplus by 2025/26. Assuming this holds, SA will still need to impose a fiscal adjustment of about 2% of GDP to stabilise debt in the short term and a consistent 0.5% to 1% thereafter – a painful adjustment from the current position needed over a long period of time. The alternative is the growing risk of a debt trap, an unsustainable situation where the country is unable to service debt without ‘exceptional financing assistance, or default’, as broadly defined by the IMF.

SA also has large contingent liabilities, which cannot be ignored. Eskom is the most immediate risk, with government-guaranteed debt of c.5% of GDP. The debt solution needed urgently to ensure that the State-owned electricity provider can legally separate into viable entities will probably add to the sovereign’s debt stock. Should government take this debt onto its balance sheet, average financing costs may rise from 6.8% to well above 7%, and debt will accumulate at a faster rate. Perhaps more importantly though, the burden of debt service costs will rise quickly, from 4.4% of GDP to above 5.0%, with upside risk. This would become SA’s structural headline deficit and implies ongoing large funding needs.

GOOD MEDICINE NEVER TASTES GOOD, BUT BAD IS MUCH, MUCH WORSE

A recent paper by the World Bank Group** examines methods by which countries have, or may in future, deal with extreme debt distress. Orthodox measures include deficit reduction through consolidation (both spending and taxes) and the privatisation of an array of national assets. Growth should play an important role here, but in practice growth seldom flourishes during times of fiscal austerity.

In SA’s case, however, efforts made to consolidate spending have been undermined by weak growth, and, more recently, a larger-than-hoped wage agreement in 2021/22, and by large and ongoing additional, costly, support for State-owned enterprises (SOEs). It is not clear that less spending on operational and investment budgets has undermined growth, although it seems likely that fiscal slippage and institutional decay associated with this strategy have undermined confidence and investment. As yet, any meaningful privatisation is an unlikely strategy, although a shift in thinking in this regard would be welcome.

Heterodox strategies include high inflation, which represents a painful tax on the poor, financial repression, and restructuring or default.

BREATHING ROOM?

The prospect of higher US yields creates a potentially challenging environment for indebted emerging markets. This will be exacerbated as global growth slows, especially from China as it battles to contain Omicron, with knock-on to supply constraints, commodity demand and an uncertain US Fed policy response. In EMDEs where growth has been reasonably good, large primary government spending has kept debt rising relative to GDP. Many EMDEs also have large financing needs in coming years, which amplify this risk. We should expect the incidence of debt distress – especially in emerging markets – to increase from here.

Worryingly, SA also faces many of these challenges. Growth has been weak for a long time, and the lingering effects of the pandemic, especially on employment, incomes and poverty levels will be felt for a long time, especially in the absence of a more aggressive contribution to growth from investment. We are concerned about the ability of the National Treasury to achieve its stated consolidation objective of a primary surplus by 2023/24, as the social cost of the pandemic is likely to remain high, and claims on revenue for transfers to households, wages, for debt service and persistently to SOEs (with more to come) remain politically challenging, even with the best intentions.

More encouragingly, revenue performance has been better than expected, and some capacity renewal at the South African Revenue Service suggests this may continue. It is unclear whether the political revelations of the Zondo Commission can assist in prompting political renewal and improving general levels of confidence; much will depend on the prosecutorial pipeline.

LOOKING AHEAD

Despite what feels like a mountain of risk, we still think that there are several important mitigating factors that should help SA navigate this uncertain territory, for now.

Globally, we think central bank policy normalisation will start in a slow, cautious and well-communicated manner. Both the Fed and the ECB have wider mandates than just the inflation target, and there will probably be some caution about derailing large fiscal packages aimed at supporting a growth recovery. This may change as longer-term inflation outcomes become clearer.

SA should be cushioned by its strong external position on the back of high commodity prices, with a current account surplus of 3.6% in the third quarter of 2021, and positive trade data in the fourth quarter. Further, foreign positioning is considerably lower than in the past, which should limit the risk of aggressive foreign selling – both to the currency and to yields.

Low inflation should underpin both the rate at which policy rates normalise and the risk priced into the longer end of the yield curve. The very steep yield curve, which we believe embeds considerable risk premium, is already a reflection of these risks. A more creative issuance strategy by the Treasury may also alleviate some long-term yield pressures. The IMF has warned that governments in precarious fiscal positions need to maintain a strong commitment to sustainable, well-communicated fiscal strategies in the uncertain wake of the pandemic to avoid crises.

SA will also need to clearly articulate additional spending, critically conclude an affordable wage settlement and actively pursue long-promised growth strategies to successfully weather the storm. +

*The World Bank, Kose, Nagle, Ohnsorge and Sugawara, “Global Waves of Debt, Causes and Consequences”, 2019.

**World Bank Group, Policy Research Working Papers. Kose, Ohnsorge, Reinhard and Rogoff, “The Aftermath of Debt Surges”, September 2021.

Disclaimer

South Africa - Personal

South Africa - Personal