Economic views

South Africa’s at risk of falling into a debt trap

Let us not waste another crisis

- A crisis is an opportunity to turn poison into medicine, and it takes discipline not alchemy

- SA’s fiscus requires the most urgent attention; it’s almost as if we’re back to square one

- The remedies that were available to SA in the 1990s have all but dried up

- The increased attractiveness of other emerging economies is not helping the situation

CRISES FORCE US to re-evaluate, to think differently, and to seek solutions that challenge the status quo. They are circumstances where all paradigms are up for debate and there is greater latitude to question leadership and existing norms.

In South Africa, we are not responding to the current crisis. Not limited to Eskom, the economic and fiscal ramifications of weak growth have become critical. GDP growth has averaged 0.8% over the past five years (2019 estimate) and is unlikely to come in much above 0.3% in 2019.

This compares to a post-democracy, pre-Global Financial Crisis average of 3.6%. Importantly for the fiscal position, current nominal GDP growth is running at 4.7%, compared to 12% over the same period.

FISCAL WOES TOP AGENDA

The biggest economic casualty has been the country’s fiscal position that had improved from a very low base in 1993/1994, a condition not very different to the one we’re in now, to one of notable strength in early 2009. This has since reversed due to several interconnected and reinforcing causes, namely low nominal growth; failing confidence and investment; increasingly complicated economic policies; institutional decay and State Capture; and, definitely not least, the prevailing and intensifying crisis at Eskom. These events have combined to enforce the reality that South Africa remains one of the world’s most unequal economies with respect to both income and wealth. This is a gap that is exacerbated by diminishing resources with which to address this compound crisis.

This is not the first time we have been here. Some of the metrics are different, some of the causes and consequences are too, but in 1993/1994, South Africa was struggling out of a three-year recession, exacerbated by a prolonged drought.

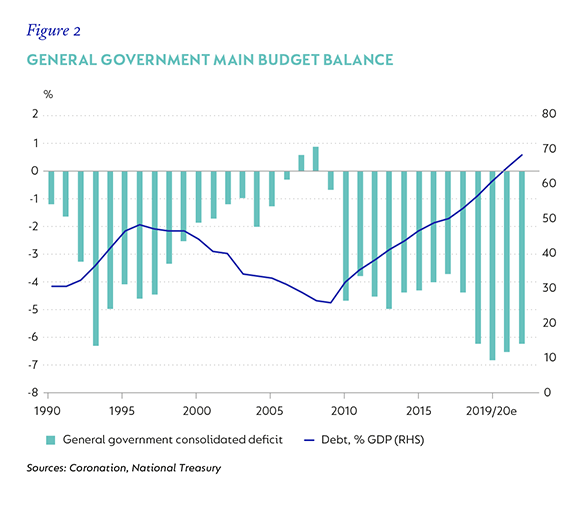

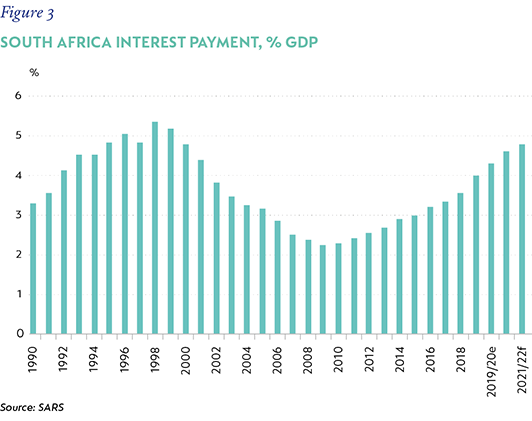

The fiscal position was under strain as a combination of weak growth and a sharp escalation in expenditure saw the deficit balloon to -6.3% of GDP, from -1.2% three years earlier. Debt jumped from 30.5% of GDP to 36.9%, heading up, and debt service costs climbed steadily to above 5% of GDP.

In 1993, the South African Reserve Bank (SARB) published a paper[1] titled, “Is South Africa in a debt trap?” The parallels to today are sobering. While the paper concluded that it was impossible to assess categorically that the country was in a debt trap, by most indicative measures, the economy was close to this critical position.

BACK TO THE FUTURE

The details beg further analysis, and comparisons to today’s position are worth highlighting – both the risk and the potential for remedy. To start, it is important to describe two important concepts. First, ‘sustainable debt’ is debt that stabilises or diminishes relative to output (GDP) over a reasonable forecast horizon. The official forecasts published in the October 2019 Medium-Term Budget Policy Statement (MTBPS) see gross government debt rise from an estimated 60.8% in the current fiscal year to 71.3% in 2022/2023, in the absence of any remedial interventions. This trajectory is unsustainable.

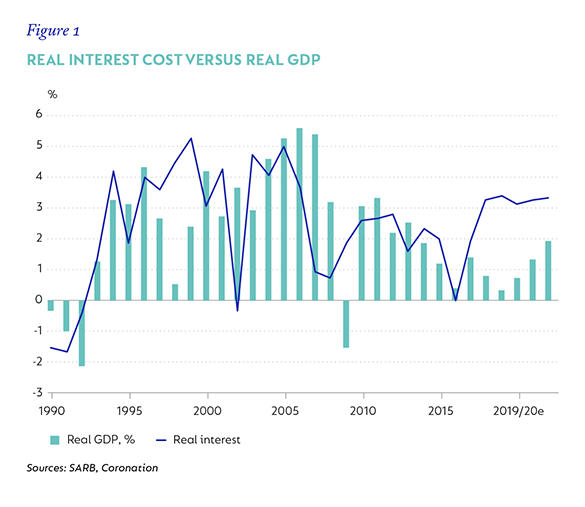

The second is a ‘debt trap’ – this happens when real (nominal) interest payments exceed real (nominal) GDP growth over a sustained period of time. This results in an ‘explosion’ in the government debt-to-GDP ratio, which can no longer be prevented because of limited remedial capacity. Essentially this means that the State cannot effectively raise revenue or cut expenditure in a politically practicable manner, and this dynamic creates a self-perpetuating and compounding increase in government debt.

The SARB paper compared the domestic data at the time to International Monetary Fund debt sustainability criteria, which state that government debt will continue to rise if the ratio of the primary balance to GDP is smaller than the ratio of government debt to GDP, multiplied by the real cost of debt (interest rate) minus real GDP growth rate. The rationale is that a government cannot indefinitely run deficits if the real rate of growth is below the real cost of financing its debt.

The study found that while the government was able to finance its deficit in a sustainable manner at the time, it raised serious concerns about the risk of the economy falling into a debt trap. Importantly, the risk of interest-cost growth relative to GDP (see Figure 1) could be a key driver of debt accumulation. The fiscal assessment can then be summarised as follows:

- The large deficit, although partly reflecting cyclical factors, was high relative to potential GDP, making a recovery harder to realistically forecast. In the 1970s, when the deficit had ballooned before, potential growth was estimated at nearly 4%. In 1993 this was closer to 1% to 2% – slightly above the 1.1% that the SARB currently estimates for 2020, implying an increasingly unsustainable position.

- The increase in debt stock, albeit from relatively manageable levels, implied a further rise in the interest burden on tax revenue, which would persist should growth remain low.

- Low domestic savings could raise borrowing costs, crowding out the private sector and widening the current account deficit.

- Concerns about public willingness to fund increased borrowing, and at what cost, implied further upside risk to long-term interest rates.

- Lastly, the report raised the possibility that, as the debt burden increased, “authorities will be unable to prevent the financing of their budgetary deficits by means of an increase in the money supply and monetary base of the economy”. Under such circumstances, the SARB warned, government debt will increasingly have to be monetised, destroying the ability of the Central Bank to contain inflation.

POINT OF NO RETURN?

There are clear parallels with South Africa’s position today. The recent deterioration in the government deficit to an estimated 6% of GDP (6.2%: 2019/2020 MTBPSe), ceteris paribus, is well in excess of potential growth. The expected increase in debt stock and the concomitant debt service burden suggest a return to interest payments of close to 5% of GDP. There is some upside risk to this estimate should borrowing costs rise off the currently low (global) base.

Ongoing government dissaving has, and will continue, to put pressure on the current account, making the fiscus and currency vulnerable to a sudden stop in funding flows. Lastly, it could be argued that the relative underperformance of South African fixed income to that of other emerging markets in a very supportive global environment already reflects the early onset of a ‘loss of faith’ in government’s ability to implement sufficient remedial fiscal and policy action to avoid a debt trap.

With debt service costs already the fastest growing expenditure item over the medium-term expenditure framework, with tax revenue as a percentage of GDP at already high levels and stagnating growth, there are enough red flags to raise grave concerns about South Africa’s ability to avoid a debt trap.

A LEAF FROM HISTORY

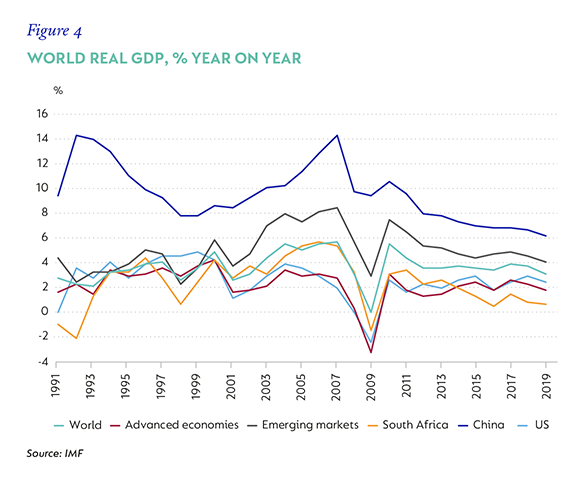

In the early 1990s, and even more visibly from the early 2000s, a combination of nominal growth recovery and institutional reform enabled the government not only to avoid a debt trap, but also to rehabilitate the fiscal position to one of outright health. Despite the emerging market crises between 1997 and 2000, South Africa managed to capitalise on a steady improvement in global growth, materially boosted by the growth acceleration in China.

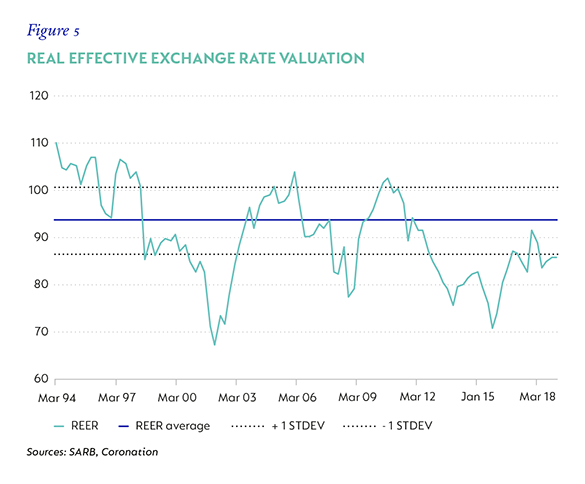

The domestic currency crisis in 2001 added momentum to the recovery, because it left South Africa with a severely undervalued currency. The boost to domestic terms of trade saw export prices rise meaningfully. This prompted a recovery in manufacturing production and an improvement in employment, and provided government with much-needed revenue windfalls.

During this time, South Africa also enjoyed several positive institutional changes, which not only facilitated an improvement in growth and thus revenue collection, but also in confidence and in policy implementation:

- The Constitution was gazetted on 18 December 1996.

- The National Treasury presented the first MTBPS in December 1997, preparing the way for the first multi-year Budget determination in February 1998.

- The SARB implemented inflation targeting, announced in September 1999 and starting in 2000.

- Mr Pravin Gordhan was appointed as Commissioner of the South African Revenue Service in 1999.

In line with global inflation, spurred by the recovering exchange rate and facilitated by the new SARB mandate, domestic inflation (and borrowing costs) fell from 14% in 1993 to -0.7% in 2004. The now more disciplined fiscal process, improved activity and the associated revenue benefits all helped to reduce the inherited fiscal deficit and debt stock.

The fiscal deficit narrowed from -6% of GDP in 1994 via -7.0% in March 1997 to a small surplus of 0.3% in June 2002, with a full windfall from the weaker rand, high inflation and very high rand-based commodity prices. Some stimulus in 2003/2004 saw the deficit widen in the wake of slower growth in 2002, notably lower revenue, expanded social security and a big allocation to the contingency reserve out of the fiscus. With the narrowing of the deficit thereafter, government gross debt fell from 48.8% of GDP in June 1997 to a nadir of 26% in 2008/2009.

OUT OF RESERVE

Returning to the present day, the drivers of growth that saved South Africa from a debt trap in the 1990s have largely been drained. Their replenishment would require an innovative shift in domestic economic policy, or a recovery in global growth and commodity prices, and preferably both. It is possible that the currently elevated terms of trade and an uptick in global growth in the second half of 2020 will provide a catalyst for an acceleration in domestic growth momentum. But the structure of the economy has also changed, and mining and manufacturing are considerably smaller components of gross value added – together now 19% from 29% in 1993/1994, which limits the ability to fully capitalise on this improvement.

Early data for the fourth quarter of 2019 (Q4-19) suggest tentative signs of stabilising domestic output, with an annual rate of about 0.4% in reach for the year as a whole.

However, the onset of loadshedding in early December, with the unprecedented escalation to Schedule 6 and the persistence of a diminished energy availability factor, will also compromise this nascent recovery. A number of mining companies closed early, and there is anecdotal evidence that small and medium enterprises have battled to sustain business activity as a result.

More broadly, domestic sentiment was hit hard and confidence remains weak. The clear risk is that considerably weaker Q4-19 growth will bleed into 2020 as power uncertainty persists, dragging our 2020 outlook to 0.9% (1.1% previously) on the back of the ongoing inadequate energy availability factor.

With real GDP growth of less than 1% and real debt service costs heading for 5%, the interest burden is set to reach almost 15% of total expenditure. Unless the gap narrows, interest cost and debt will compound, and the rising debt burden will increasingly limit expenditure on all other essential goods and services.

IS IT TERMINAL?

The economy is in crisis. There really isn’t the luxury of time. Until government creates policies that welcome innovation, innovation will not come. South Africa no longer has relative economic advantages to offset its challenges in attracting new investment, driving employment and enhancing productivity.

There are lots of emerging market alternatives that need skills and foreign savings, and which create policies to facilitate their participation. The progress of countries like India, China, Pakistan and Bangladesh in the World Bank Ease of Doing Business measures shows us this. South Africa’s performance, which has deteriorated by 52 places, from 32 in 2008 to 84 currently (where the lower the rank, the better the score), speaks for itself.

A country that used to contemplate which policies could be used to best attract investment and was able to direct revenue to the most economically vulnerable, is struggling to grow. A fiercely developmental economic agenda is at odds with economic innovation and growth. Redistribution is not growth, but without growth, redistribution can only be limited. With growth, it could be limitless.

POWER STATEMENT

The near-term answer may lie in a bafflingly overlooked commitment by the government in an opinion piece by President Cyril Ramaphosa that was published in December last year. ‘A new era in energy generation’[2] opens with the progressive statement that, “In the wake of the hugely damaging power shortages of the last two weeks, government has agreed – in keeping with the Integrated Resource Plan (IRP) 2019 – to allow users to generate power for their own use and to accelerate the purchase of power from independent producers. In effect, the path has been cleared for the expansion and diversification of energy production on a significant scale”.

This powerful commitment flies in the face of ongoing uncertainty and criticism that there is no ability or willingness to re-think private power generation in South Africa.

Stabilising energy availability; providing room for scheduled maintenance; and sending a signal, not only that there is a plan to manage the Eskom crisis (at least to stabilise chaotic load shedding), but also that government is willing to re-evaluate, to think differently, and seek solutions that challenge the status quo, despite inertia, vested interests and factional resistance, would be a grand step in the right direction to structural reform of the economy.

But words aren’t enough, we need to see these commitments come to life.

Disclaimer

SA readers

Global (ex-US) readers

US readers

[1] E.J. van der Merwe, “Is South Africa in a debt trap?” South African Reserve Bank Occasional Paper No 6, May 1993

[2] Daily Maverick Opinionista, “A new era in energy generation”, Cyril Ramaphosa, 18 December 2019. www.dailymaverick.co.za/ opinionista/2019-12-18-a-new-era-in-energy-generation/

South Africa - Personal

South Africa - Personal