Although markets were volatile, the news headlines frequently grim, and the general economic mood quite wary, the first quarter of 2023 was a good one for most asset classes. The global equity index (MSCI All Country World Index) advanced 7.3% while the global bond index increased by 3.0%, both building on last quarter’s gains. The Fund outpaced its benchmark, increasing by 6.4%.

At quarter-end, the portfolio was positioned as follows:

- 63% in effective equity

- 3% in real assets (listed infrastructure and property)

- 7% in high yield fixed income

- 10% in inflation-linked assets (including 2.5% in gold)

- 9% in investment-grade fixed income instruments

The remaining 8% was invested across a range of other assets.

We outlined the meaningful change in fixed income markets, and how the Fund responded, in the prior quarter’s commentary (Q4-22). This quarter, the most notable changes in positioning have been a reduction in effective equity exposure, a reduction in gold ETF holdings, and an increase in fixed income holdings.

Over the last year, real asset exposure has also more than halved from over 7.5% to 3% of Fund with one of the biggest sales being VINCI, the French concessionaire and construction company. VINCI operates toll roads and airports on behalf of various governments and has benefited from the post-pandemic recovery in travel. We have owned VINCI since 2020 and it has been a contributor to our performance over the period. While we still like VINCI for its highly visible, inflation-linked cash flows, the expected return has reduced as the stock has appreciated. We have therefore reduced the position size in favour of more attractive relative opportunities.

Given the sharp rally in risk assets since the October 2022 trough, the range of macroeconomic risks facing investors, and the fact that implied volatility (a key input in pricing options) was low, we took the opportunity to purchase put protection for the Fund in February 2023. These options provide full downside protection on 6% of the Fund until March 2024 if the S&P 500 level drops below 3 950. While we are highly cognisant that insurance comes at a cost, we consider the all-in expense of 0.4% (or 40 basis points [bps], equivalent to c.3bps per month until expiry) to be a fair trade-off.

In terms of specific stocks, Meta was a top contributor for the quarter, gaining 76%. This performance was driven by two important factors. Firstly, the Family of Apps, which include Facebook and Instagram, reported strong engagement metrics which are important indicators of Meta’s ability to surface ads and generate revenue. Instagram continued to narrow the gap with TikTok, and the core Facebook Blue app proved similarly resilient.

Secondly, management’s focus has pivoted towards efficiency across the business, culminating in a near 25% reduction in the workforce. Like many of its peers, Meta recruited heavily during the pandemic years in response to a buoyant external environment for digitally enabled technology businesses, resulting in a bloated cost base and creeping inefficiencies. The reduction in cost and layers of bureaucracy should lead to improved profitability and faster decision making.

One remaining source of debate is the heavy ongoing investment in Reality Labs. With much of the investment targeted at foundational technology innovation in, as yet, commercially unproven AR/VR (augmented reality/virtual reality), the payoff profile remains uncertain.

Despite the sharp rerating, we believe the valuation remains compelling. With little in the Meta share price for Reality Labs, the division provides an element of optionality to the investment case. Excluding the losses from Reality Labs, the core business trades on roughly 12 times 2024 earnings, which should grow at a double-digit rate for the next few years, while cash generation should improve due to a normalising capex cycle (after heavy investment in data centres).

Our position in Charles Schwab was a detractor over the quarter, with US banking stocks declining 20% during the three-month period as a flight of deposits culminated in the failure of Silicon Valley Bank (SVB), prompting fears of a systemic crisis.

While not a traditional bank, Schwab has grown from its roots as a low-cost brokerage into a broad financial platform, offering a wide range of investment and related financial services. However, nearly half of Schwab’s revenue is derived from the net interest spread it earns on customers’ uninvested cash balances. Ordinarily these cash balances are relatively stable, as customers typically keep some cash on deposit as a function of their broader investment activities. We believed that as interest rates rose, Schwab would be able to realise higher net interest margins, which in turn would drive revenue and earnings growth. For a while this was true.

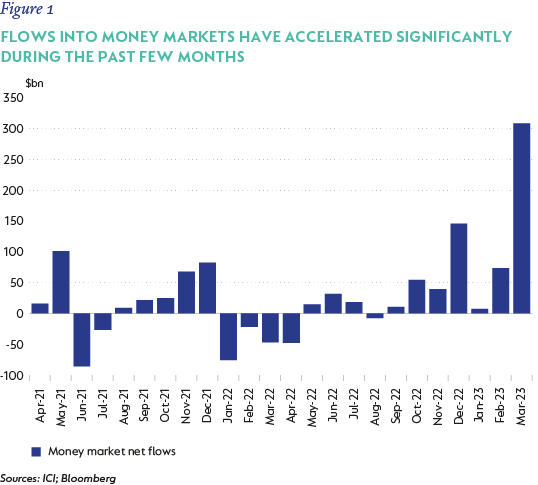

However, given the unprecedented speed at which the US Federal Reserve has raised rates, customers have increasingly shifted these lazy cash balances to money market accounts (and elsewhere) offering higher returns. This trend accelerated in the wake of the very public failures of SVB and Signature Bank in March.

Consequently, where Schwab was initially a beneficiary of rising rates, it is now a victim. The asset base on which to earn a spread has shrunk and may continue to do so. Similarly, Schwab’s cost of funding is likely to rise faster than its assets reprice, as rates paid on deposits will need to be higher to remain competitive, and more expensive longer-term funding may be required to better match the duration of its investment portfolio.

We have therefore re-assessed our estimate of Schwab’s normalised earnings power, and no longer believe the stock to be sufficiently undervalued given the heightened degree of uncertainty; we exited the position during the quarter.

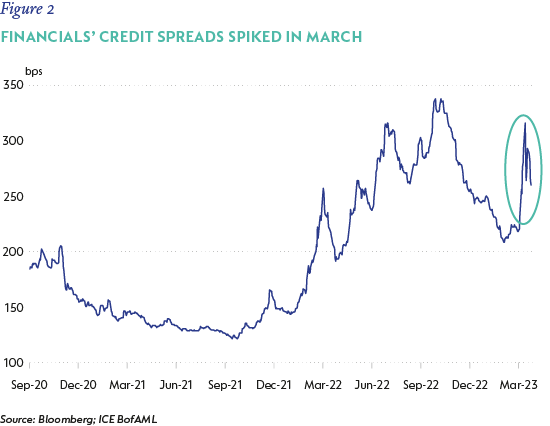

At the same time, global credit markets were impacted by the stress in the banking sector. However, the subsequent strain seen across many other regional US banks contrasted markedly with the banking crisis that preceded the Global Financial Crisis in 2008/09, which was characterised by poor asset quality and the uncertainty around who was exposed to credit losses.

Indeed, despite lingering fears of contagion, there is a growing consensus that the failures of SVB and Credit Suisse (two most prominent events) are outliers, rather than representative of systemic fractures within the US and European banking sectors. In this light, the re-pricing of financials across both markets appears excessive, and presents an opportunity to accumulate exposure to high-quality issuers that have been maligned because of turmoil within the broader sector. Consequently, we have added both subordinated and senior bank debt, in both GSIPs (Globally Important Systemic Banks) and regional leaders.

We remain disciplined in our approach, conducting deep fundamental bottom-up research across the capital structure, and responding to opportunities as and when they arise. In the fixed income space, the stress in the US regional banking sector and Credit Suisse’s failure have created opportunities as credit spreads have widened further. In equity markets, despite aggregate market levels not looking particularly attractive, we are still finding certain stocks that offer attractive returns for investors with a long-term time horizon.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal