PERFORMANCE AND FUND POSITIONING

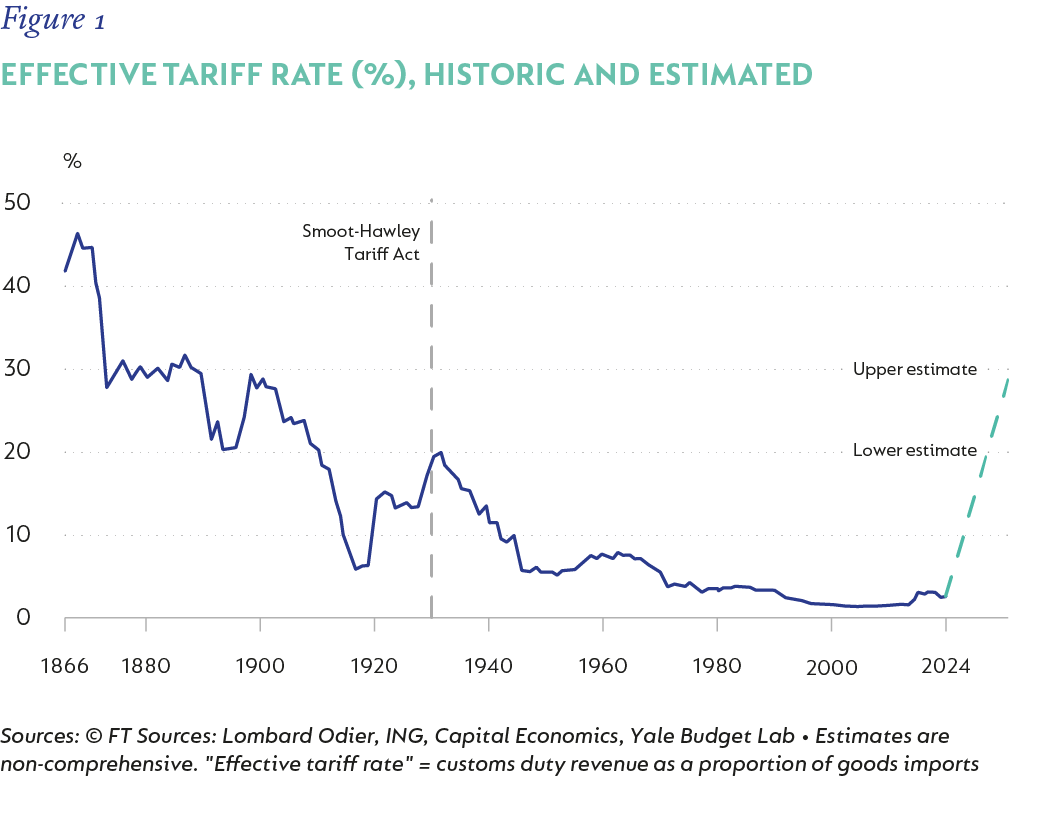

The Fund increased by 4.04% in USD in the first quarter of 2025 (Q1-25). This was a pleasing result considering a tepid start for global markets with the MSCI World down 1% in USD over the same period. Since quarter end, there have, however, been aggressive stock moves as the Trump administration announced tariffs which would take the weighted average tariff rate to its highest in more than 100 years:

At the time of writing (8 April), global indices have moved as follows year-to-date (YTD), which compares to the Fund:

As is often the case in times of market stress, the correlation of returns has largely trended to 1 due to synchronised selling and a general risk-off environment. Whilst this is painful in the short term, it provides opportunity for long-term investors as the impact from tariffs will not be the same for all companies. There also remains uncertainty as to what level these tariffs settle at, and if they are just part of some plan to drive negotiation, but this uncertainty makes running a business very difficult and will most likely negatively impact companies’ investment decisions. It also most likely filters into consumer confidence, creating an environment embroiled in uncertainty which can drive negative macro-related outcomes-at the end of the day, an economy is driven by people and their decisions.

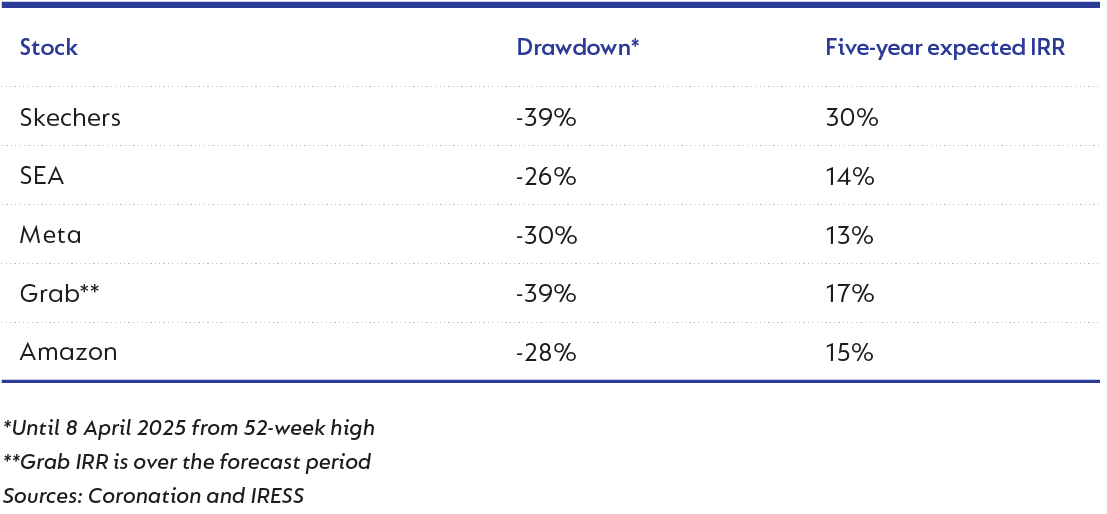

The Fund has performed better than most equity indices, which is a function of lower equity exposure and the positive effect of our put options. However, we have begun to remove some selective put option protection, but the cover remains very high relative to history: 9% effective exposure and 19% nominal exposure. This should protect the Fund in the event of further equity market declines in an uncertain environment. In addition to reducing some put protection, we have also selectively added to equities with the most notable as follows:

Market stress that results in share price declines is a painful experience in the moment. The counter is, it often presents opportunities for stock pickers, with the implication being that prospective returns for the Fund appear incredibly attractive today. To put this in context, the weighted average equity upside of the Fund is 90%, with the weighted equity five-year expected IRR being 23%, supported by attractive valuations as the weighted equity free cash flow (FCF) yield for stocks owned is just under 7%. These metrics compare very favourably to the history of the Fund. Using the rand-denominated fund’s long-term track record (expressed in USD) as proxy*, over the past three years, the Fund has generated a positive return of 4.3% per annum (p.a.), 6.4.% p.a. over five years, over 10 years a return of 4.4% p.a. and, since inception 26 years ago, 8.2% p.a.

During the quarter, the largest positive contributors were AngloGold (+56%, 0.92% positive impact), Rolls-Royce (+36%, 0.57% positive impact) and Just Eat Takeaway (+52%, 0.48% positive impact). The largest negative contributors were Skechers (-15%, 0.45% negative impact), TSMC (-16%, 0.37% negative impact) and Delivery Hero (-15%, 0.33% negative impact).

2025 started with an aggressive rally in equities which tapered off later into the first quarter and then got hit hard in the first 10 days of the second quarter – the Trump administration had touted business-friendly policies but with the imposition of tariffs, and the manner in which they were calculated, this appears to be quite reckless and has resulted in a wave of uncertainty across the global economy. Rebuilding global supply chains is not something that can be done in the short term, and the probability of tariffs remaining at their current communicated levels is another risk factor, as it seems like this could be changed based on various negotiations taking place between countries. Either way, the range of outcomes for the global macro-outlook has broadened materially, which brings risk but also opportunity as stocks are being sold indiscriminately.

The Fund ended the quarter with 73% net equity exposure, roughly 500bps lower than the prior quarter. At the time of writing, this equity exposure is now 71% but went as low as 66% as our put protection brought down equity exposure, shielding the Fund somewhat from the full extent of equity market declines. As mentioned above, we removed some put protection and began adding to selective equities as certain businesses appear attractively valued post an aggressive sell-off.

The Fund continues to hold bond exposure, which now sits at just over 8% at the time of writing, split between sovereign and corporate bonds. We have reduced bond exposure as equities have become relatively more attractive. The biggest reduction in this bond exposure was the sale of our South African government bonds on concerns that the GNU coalition is not functioning as well as hoped, with the culmination of this coming out through the budget approval process, which has a direct impact on the country’s fiscal situation. As it stands, the budget outcome is disappointing, and it seems like the major structural reforms required are being met with roadblocks. We have, however, increased our bond exposure to Brazilian government bonds, which now represent 4.3% of the Fund at the time of writing and yield ~15% in Brazilian real. Brazil’s fiscal situation is troubled, and this is compounded by a lack of real reform by Lula’s government, which has dipped in approval ratings and could result in a government change at the next election. Notwithstanding these risks, we believe that you are being compensated by the high yield on offer, and whilst we are acutely aware of the exchange rate risk associated with Brazilian assets, we first purchased this bond after the currency had weakened more than 20% vs the US dollar, resulting in the Brazilian real being one of the worst-performing Emerging Market currencies in 2024. Another major risk factor to owning bonds is inflation, which for now appears well controlled in Brazil and is sitting at just under 5%, with Brazil being a relative tariff “winner” with only 10% levied. Outside of the Brazilian government bonds held, we continue to hold a collection of foreign corporate credit, which in aggregate is providing us with a weighted yield in hard currencies of just over 7%, which remains attractive. We have limited exposure to real estate, with the balance of the Fund invested in cash, largely offshore.

OUTLOOK

The new calendar year is shaping up to be a very volatile one with the Trump administration driving an increasing level of uncertainty in the global economy. They appear as though they want to make material changes to the global landscape and America’s role in it, which like any major change comes with material risk, with the initial evidence suggesting that the level of analysis and appreciation for a complex global system is being overlooked. Whilst the US fiscal situation of running perpetual deficits needed to be addressed, and this appears to be a major goal of the administration, the strategy in reining in these deficits appears chaotic, which naturally increases risk. Notwithstanding this increased risk, periods of dislocation, like we have seen in the past 10 days, provide opportunity. Thus, we remain excited about the prospects of the Fund as we continue to uncover and own attractive stocks and bonds. Whilst at times asset prices and their underlying fundamentals detach, they generally align long term. Things can change quickly and thus our focus remains on uncovering attractively priced assets compared to trying to time markets, a core principle of Coronation and how the Fund has been run since its inception 26 years ago.

*Note that this is a new fund and, as such, does not yet have a track record for the relevant periods. As it is the dollar-denominated version of the same investment strategy deployed historically in the management of the rand-denominated Coronation Global Optimum Growth [ZAR] Feeder Fund, we show the track record of the latter portfolio, converted to US dollars, to indicate historical results achieved by the Strategy.

South Africa - Personal

South Africa - Personal