The Fund declined by 4.1% in US dollars in the third quarter of 2023 (Q3-23). Despite this quarter's decline, the Fund's overall improvement in short-term performance remains intact, with its 12-month return sitting at 16.2% in USD. While giving back some of the previous gains is disappointing, we remain excited about the Fund’s prospects as we feel the combination of assets owned remains extremely attractively priced.

FUND POSITIONING

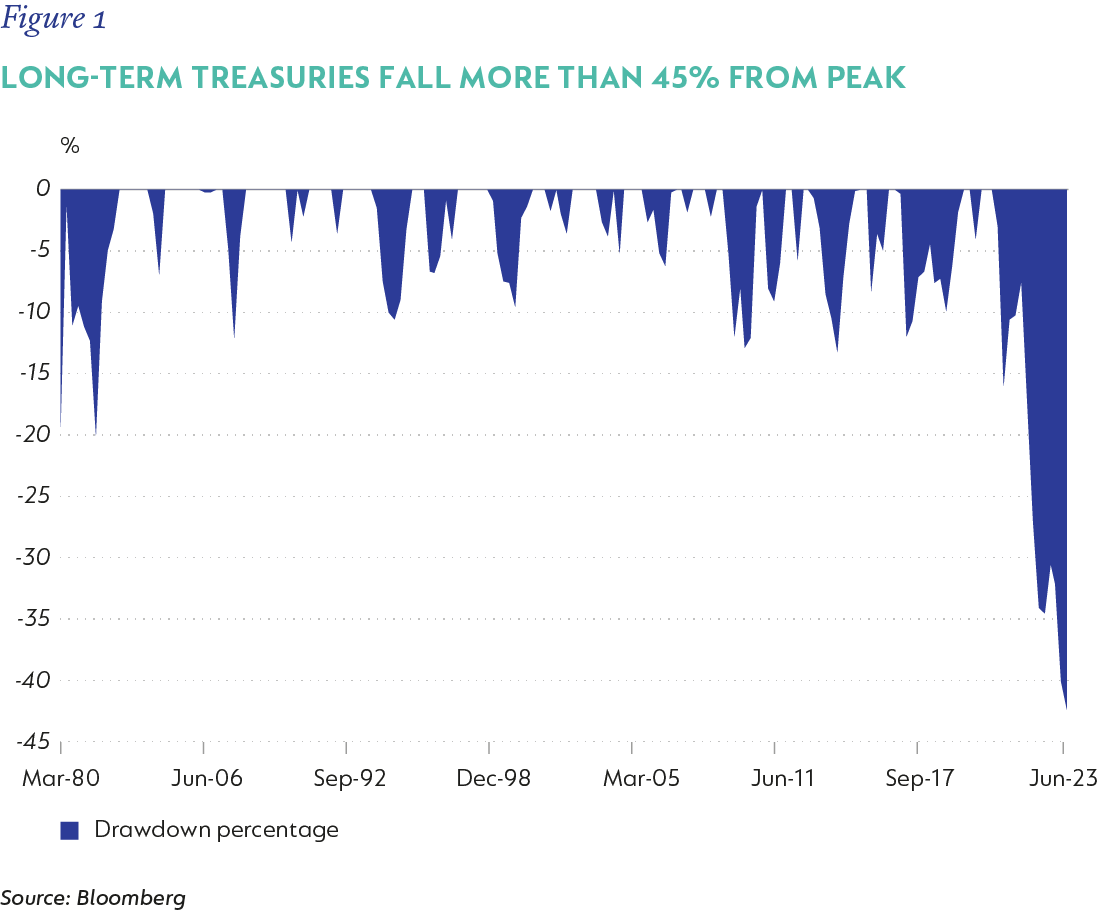

During the quarter, we continued to observe stress in bond markets. This intensified as interest rates rose from their previous ultra-low levels. The stress is best contextualised by the following drawdown recently observed in long-term (30-year) US Treasuries (USTs) and compared to previous drawdowns.

USTs had been viewed as a low-risk asset class; however, if you had bought them at their peak, you would have lost nearly half your money as of today. This is an important reminder that risk is not determined by the nature of the asset but rather by the price you pay – assets perceived as low risk can in fact be very risky if you pay the wrong price as was the case with long-term USTs.

Determining where interest rates settle is not straightforward, but it remains important to consider that the last 10 years were most likely an anomaly compared to longer-dated history. We believe the normalisation of interest rates will continue to create volatility and have a real impact on businesses that are leveraged. Considering this, the Fund has limited exposure to companies with high levels of gearing and where we do own companies with gearing, their debt has generally been termed out, allowing them to de-gear as free cash flow is generated without having to rely on expensive debt markets to refinance any maturing debt.

The volatility being observed in global markets, whilst uneasy in the short term, is presenting us with extremely compelling long-term opportunities, and the Fund's weighted average equity upside is currently 75% - one of the highest levels since inception nearly 24 years ago. Beyond this, the weighted equity five-year expected internal rate of return (IRR) is 20% and the weighted equity free cash flow (FCF) yield for stocks owned is just over 6%. Using the rand-denominated Fund’s long-term track record (expressed in USD) as proxy*, the Fund has generated a positive return of 1% per annum (p.a.) over the past five years, over 10 years a return of 2.3% p.a. and, since inception 24 years ago, 7.7% p.a.

During the quarter the largest positive contributors were Capri (+43%, 1.19% positive impact), Magnit (1.09% positive impact), and Yandex (0.36% positive impact). The largest negative contributors were Delivery Hero (-35%, 0.55% negative impact), JD.com (-13%, 0.48% negative impact) and Naspers/Prosus (-12%, 0.47% negative impact).

Capri was the subject of a cash takeover bid during the quarter for a 59% premium to the 30-day volume weighted average price. While we think this bid undervalues the business and is a good deal for Tapestry, who is acquiring the business, the board has approved the deal, and thus the likelihood of it going through is high. Therefore, we sold Capri to zero and re-deployed a portion of the proceeds into Tapestry, on which we elaborate below.

The positive contributions from both Magnit and Yandex were due to capital being recovered from our Russian holdings, which were previously written to zero. Prior to the Russian invasion of Ukraine just over 3% of the Fund was invested in Russia, and we have managed to recover just under 50% of this value in hard currency with this capital being externalised from Russia. While not the perfect outcome, we were happy to have realised value from a significantly complex process.

The Fund ended the quarter with 76% net equity exposure, in line with that of the prior quarter.

As alluded to above, the stress in bond markets is presenting some interesting credit opportunities that we are actively monitoring as yields are getting to levels, which in our view, compensate you for the risk taken. We have already acted on some of these opportunities, and the Fund now has ~11% exposure to sovereign and corporate bonds - a much higher-level compared to the past, as we believe yields have now begun to rise to levels that appear attractive. The current weighted yield for the collection of bonds held is ~7%, or 9.3% when excluding the short-term (two-year) USTs that are seen as an alternative to cash. This level of yield, in hard currency, is far more attractive than what we have observed in the past decade.

We have limited exposure to real estate, with the balance of the Fund invested in cash, largely offshore.

Notable increases in position sizes (or new buys) during the quarter were Tapestry (clothing retail), Reckitt Benckiser (consumer goods) and St. James’s Place (wealth management).

Tapestry is the owner of Coach, Kate Spade and Stuart Weitzman, and as mentioned above has bid to buy Capri at what we deem to be an attractive price, with this acquisition being funded by debt and cash. Capri’s main brand Michael Kors plays in a similar category (mid-to-high-end luxury handbags) to Coach, and thus transaction synergies (of >$200m versus a pro forma group EBIT of ~$2bn) should be realised. Tapestry has also effectively managed the channel exposure of Coach by significantly reducing its exposure to the wholesale channel, especially department stores, a journey that Michael Kors is also on, but which should be further accelerated under the stewardship of the combined entity’s management team. The combined entity trades on a pro forma 6x price-to-earnings (PE) multiple or 15% FCF yield, which is incredibly attractive. In the unlikely event that the deal isn’t consummated, the Tapestry standalone valuation is attractive, with the business trading on a 7x PE multiple.

Reckitt Benckiser is a consumer goods company that sells iconic brands such as Dettol, Gaviscon and Neurofen. The business has recently underperformed after receiving a Covid-induced boost in their hygiene business, with these sales now normalising. They have also been experiencing input cost inflation, necessitating price increases that have hurt volumes across various divisions. The business has also experienced management changes (including a new CEO), which should drive positive change. Therefore, while the business is currently underperforming, we perceive this to be cyclical as opposed to structural, with the valuation being much more attractive today compared to the past, thus providing a margin of safety. The business now trades on 16x forward earnings, with earnings expected to grow by high single digits after the 2023 reset. Along with a 3.5% dividend yield, this should provide a fairly dependable double-digit hard currency IRR.

St. James’s Place is a wealth manager based in the UK that is well entrenched with a respected brand. It has £154bn in assets under administration spanning 860k clients, which are sourced via a 4 500-person tiered financial advisor network. In the UK, there remains an advice gap, and thus St. James’s Place is solving a real need. The business has recently sold off after making some downward fee adjustments, with the market concerned this process is not yet complete. Management, however, was proactive in their approach to these adjustments, and they do not feel there are significant further adjustments needed; thus the current earnings power of the business should be sustained at current levels. Considering the business now trades on 11x earnings and a 6% dividend yield with expected earnings growth to remain in the double digits, supported by structural growth due to the advice gap. This is compelling in our view.

OUTLOOK

The chance of a recession in the US and parts of the EU and UK, the consistent geopolitical tension globally, persistently high inflation and elevated interest rates are just some of the notable risks present which will most likely drive continued market volatility. We remain aware of these risks, and they are factored into our portfolio construction, but the primary focus remains bottom-up analysis of individual businesses. Against this uncertain backdrop, we remain excited about the outlook for the Fund, which has been built bottom up, with a collection of attractively priced assets to provide diversification to achieve the best risk-adjusted returns going forward in a variety of future scenarios.

*Note that this is a new fund and, as such, does not yet have a track record for the relevant periods. As it is the dollar-denominated version of the same investment strategy deployed historically in the management of the rand-denominated Coronation Global Optimum Growth [ZAR] Feeder Fund, we show the track record of the latter portfolio, converted to US dollars, to indicate historical results achieved by the strategy.

South Africa - Personal

South Africa - Personal