MARCH MARKED THE 20th anniversary of the Coronation Optimum Growth Fund. It is the least constrained fund in our range, with the ability to invest anywhere in the world and in any of the listed asset classes. This rand-denominated fund is benchmarked against a combination of shares and bonds (70% shares and 30% bonds) as well as local and global assets (50% SA assets and 50% global assets) and benefits from our wide research coverage across local, developed and emerging markets. It therefore is a sound multi-asset class solution for long-term investors not subject to retirement fund investment restrictions, and who are looking for a larger exposure to offshore assets but still require their fund manager to decide on the allocation between domestic and foreign assets.

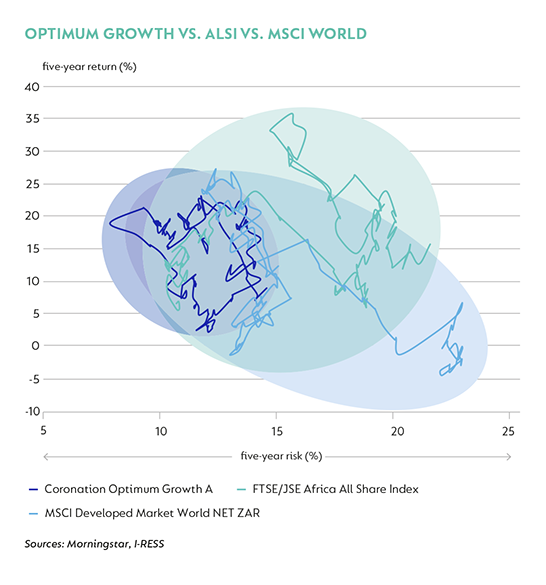

The graph below represents a risk-return snail-trail plot that shows how the return and associated risk of the fund and the indices used for comparison, changed over time. As investors prefer higher returns and lower risk, an investment that shows a skew in favour of a top-left position on the chart can be deemed to be superior to investments with a bottom-right skew.

YOUR RETURNS

The A-class of the fund returned 14.3% p.a. (or 8.2% p.a. after inflation) since launch, which is in line with the local equity market but nearly 1.5 times the return produced by global shares. Over two decades this translates into an increase in purchasing power of 4.25 times and 2.4 times the end capital of an equivalent investment in the MSCI Developed Market Index. The benefit of wider diversification is reflected in the outcome that this return was achieved at significantly less downside risk than both the local and global equity markets, as illustrated in the chart below. Over the past five years, the fund has generated a return of 10.7% p.a. and over the past 10 years, 16.0% p.a.

During the first quarter of 2019 the fund appreciated by 16.9% as global equity markets rallied and selected shares performed well. The largest contributors over the quarter was British American Tobacco, up +32% in US dollars, making a positive impact of 1.1% on your portfolio. Other stocks that boosted performance were Airbus, (+38% making a 0.9% contribution); Chinese retail giant, JD.com (+36%, 0.9% contribution), tobacco manufacturer, Philip Morris (+34%, 0.8% contribution), and Chinese education group, New Oriental Education (+62%, 0.8% contribution). There were no detractors of more than 0.5%.

PORTFOLIO POSITIONING

As at the end of March 2019, 75% of the fund’s portfolio was allocated to equities. This was up from 66% at the start of the year, largely due to market moves. Of this, approximately 55% is invested in developed market shares, 5% in South African shares and 40% in other emerging markets. Large holdings include 58.com, Alphabet, Blackstone Group, Diageo, JD.com, Heineken and Charter Communications, in addition to the shares listed above.

Our negative view on global bonds remains largely unchanged, although we did buy short-dated US Treasuries (around 3% of the fund) late last year when US government 10-year bond yields were north of 3%. The fund’s position in L Brands (owner of Victoria’s Secret) corporate bonds remains (1.7% of fund) and is now yielding 6.8% compared to our initial purchase yield of 7.3%. In total, bonds make up 4.7% of the fund. The fund also has around 4% invested in global property: largely in Unibail (European and US Retail property) and Vonovia (German residential). Lastly, the fund has a physical gold position of 2.5%. The balance of the fund is invested in cash, largely offshore.

OUR SHOPPING BASKET

We bought a selection of new shares in the quarter, with the most significant being a 2.0% position in global luxury goods giant Moet Hennessy Louis Vuitton (LVMH), with a selection of premium brands under its label, obviously Louis Vuitton (circa 50% of group profits) and Moët & Chandon, as well as Hennessy, Christian Dior, Fendi, Bulgari and Tag Heuer. Interestingly, over 40% of sales come from emerging markets and the Chinese consumer alone (purchasing at home as well as while travelling) is responsible for well over 50% of incremental growth.

LVMH has an enviable track record, with its earnings-per-share having compounded at about 12% annually over the past 20 years. and today is well-placed to reap the rewards of the growing emerging market middle and upper class, and the wealth effect. The barriers to entry possessed by the true global luxury brands (Hermes, Louis Vuitton and Gucci) are among the highest in any industry in our view: in the case of Louis Vuitton, a 150-year history and investment in the brand for a start. The resilience of both the top line and profitability of the Louis Vuitton brand, in particular during tough economic periods is also unparalleled. In 2009, post the Global Financial Crisis, sales of the LVMH Fashion and Leather Division, which is dominated by Louis Vuitton, grew by 2% and earnings before interest and taxes (EBIT) grew by 3%. In 2002 (post-September 11), the Fashion and Leather Goods Division experienced 16% sales growth (following double-digit sales growth in 2001 as well) and 5% EBIT growth.

Notes:

Benchmark: Composite (35% JSE Capped All Share Index, 15% All Bond Index, 35% MSCI All Country World Index, 15% Bloomberg Barclay's Global Aggregate Index)

Highest annual return 51.1% Jan 2013 - Dec 2013; Lowest annual return (31.5%) Mar 2008 - Feb 2009

Inception date: 15 March 1999

South Africa - Personal

South Africa - Personal