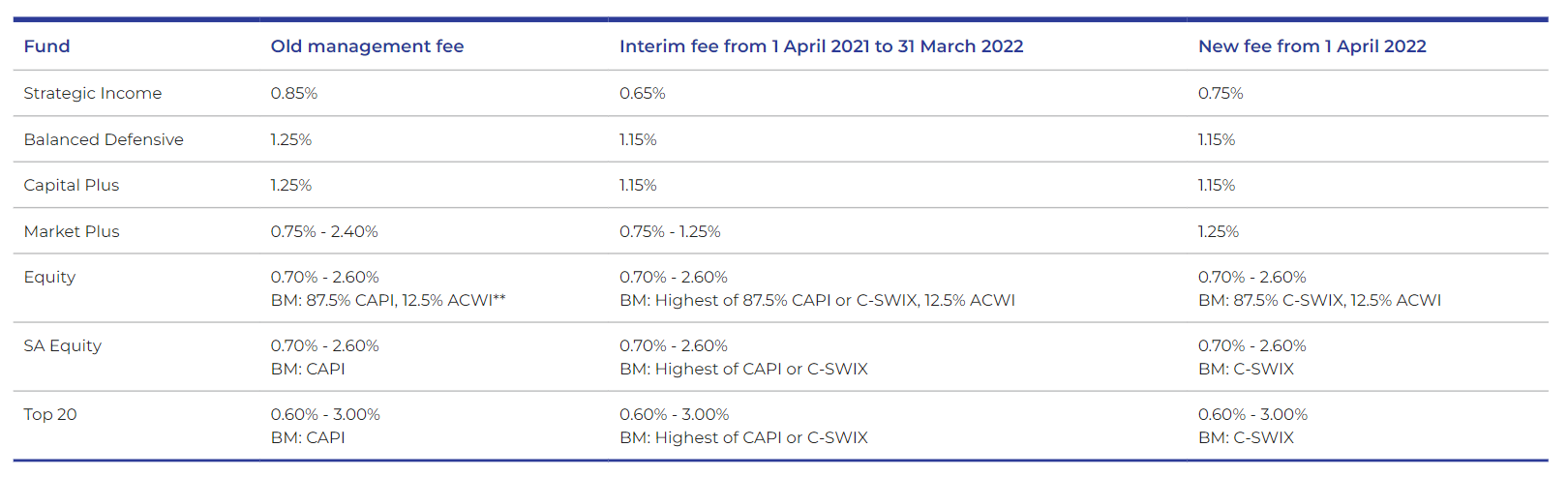

Fee and benchmark change details*

Fee reduction: Coronation Capital Plus and Coronation Balanced Defensive funds

The annual management fee charged in our lower risk multi-asset class funds has been permanently reduced from 1.25% to 1.15%, effective 1 April 2021.

Fee reduction: Coronation Strategic Income Fund

The annual management fee charged in our managed income fund has been permanently reduced from 0.85% to 0.75%, effective 1 April 2021.

Partial fee holiday: Coronation Strategic Income Fund

In addition, Strategic Income’s annual management fee will be reduced by a further 0.1% to 0.65%% for the twelve-month period between 1 April 2021 and 31 March 2022. From 1 April 2022, the management fee will revert to 0.75%.

Change to fixed fee: Coronation Market Plus Fund

The current performance-related fee applicable to Coronation Market Plus, our higher risk multi-asset class fund aimed at long-term discretionary investors, will be aligned to the fixed fee applicable to Coronation Balanced Plus, our multi-asset class fund aimed at long-term retirement-funding investors.

The historical performance fee methodology results in a fee of 1.25% when the portfolio’s performance equals that of the benchmark (net of fees), with a minimum fee of 0.75% and a maximum fee of 2.40%. The new fixed fee will be 1.25%.

From 1 April 2021 to 31 March 2022, the lowest of the current performance-related fee and the new fixed fee will be accrued daily. From 1 April 2022, only the new fixed fee will apply.

SA equity benchmark change

Our local equity benchmark will change from the FTSE/JSE Capped All Share Index J303TR (CAPI) to the FTSE/JSE Capped Shareholder Weighted All Share Index J433TR (C-SWIX), effective 1 April 2021.

This will impact performance reporting for the Coronation Top 20, Coronation Equity, Coronation SA Equity, Coronation Balanced Plus and Coronation Market Plus funds, as the relevant component of benchmark returns will be spliced between the previously applicable index values and the new index returns from 1 April 2021.

Note that we will continue to use the FTSE/JSE All Share Index J203TR (ALSI), the reference index for the South Africa – Equity – General Category as specified in the ASISA Fund Classification Standard for compliance monitoring purposes, as required by Board Notice 90 of 2014 to the Collective Investment Schemes Control Act.

Change in performance fee and performance discount methodology: Coronation Top 20, Coronation Equity and Coronation SA Equity funds

In line with the above, the benchmark used for calculating the outperformance fees and underperformance discounts applicable to the Coronation Top 20, Coronation Equity and Coronation SA Equity funds will also change. All other aspects of the performance fee methodology applicable to these funds, as set out in the relevant fund fact sheets, remain unchanged.

From 1 April 2021 to 31 March 2022, the lowest of the performance-adjusted fee calculated using CAPI or C-SWIX as the benchmark (or the SA equity component of the benchmark in the case of the Coronation Equity Fund) will be accrued daily. From 1 April 2022, only the performance-adjusted fee calculated using C-SWIX as the benchmark (or the SA equity component of the benchmark in the case of the Coronation Equity Fund) will apply.

Summary of fee changes

Index methodology: Comparing the ALSI, the C-SWIX and the CAPI

The FTSE/JSE index series contains both headline and capped indices representing the broad market of ordinary shares listed on the JSE. The headline indices such as the ALSI comprise the full market capitalisation of all eligible shares listed on the JSE main board, while the capped indices cap weightings of the largest shares in the index at 10% to reduce concentration risk.

Both C-SWIX and CAPI are capped indices of all eligible listed ordinary shares. The two indices use different definitions of free float to calculate the weighting of dual listed shares. While the CAPI weighting is based on total free float, including, in some cases, outstanding shares owned via foreign exchanges, the C-SWIX adjusts the free float to only reflect the proportion of a constituent company's share capital that is held on the dematerialised South African share register maintained by Strate.

Until C-SWIX was introduced in November 2016, CAPI was the only capped broad market index provided by the JSE. Since then, C-SWIX has become the most widely used benchmark in the industry, as it more accurately reflects local ownership of companies listed in Johannesburg.

* Note: All annual management fees quoted exclude VAT and refers to the A-classes of the respective funds. All the fee and benchmark changes, with the exception of the permanent 0.1% reduction to the management fee of the Coronation Strategic Income Fund, also apply to the D-classes and P-classes of the affected funds.

** MSCI All Country World Index Net Return.

South Africa - Personal

South Africa - Personal