INVESTOR NEED: LONG-TERM GROWTH

Domestic general equity funds

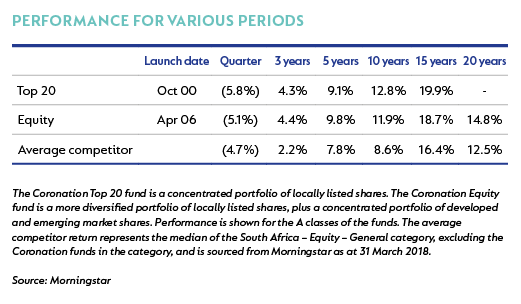

The JSE had a poor quarter, with the FTSE/JSE Capped All Share Index declining 6.0%. The weakness was driven by industrials (-8%) and property (-20%), with the latter being impacted by the collapse in the share price of the Resilient group of companies on the back of allegations of share price manipulation. While our equity funds had no exposure to the Resilient counters, exposure to industrial shares such as Naspers and British American Tobacco (BAT) detracted during the quarter. The funds added significant value relative to the average competitor over all meaningful periods.

The financial sector continued its rally post the ANC elective conference, with banks (+4.2%) and life insurers (+1.2%) ending the quarter in positive territory. While the share prices of most South Africa-specific banks are up 30% to 35% since December 2017, Investec is flat despite a significant portion of its earnings deriving from South African financial services. We took the opportunity to build a decent-sized position, as we think its recently announced new leadership will be able to significantly unlock the value present in the business.

The resources sector declined by 3.8%, with platinum stocks (-21%) in particular having another terrible quarter. We continue to maintain reasonable exposure to resources based on our assessment of their long-term value. Our preference for Anglo American (+10%) over BHP Billiton (-3%) – based on a more attractive commodity mix and valuation – continued to contribute to performance for the quarter. However, our platinum exposure, mainly through Northam, has detracted.

The Equity fund’s 21% weighting in global and in particular, selected emerging market equities, added significantly to performance over the past year and quarter respectively. Three of the fund’s largest international holdings, 58.com (+9%), Booking Holdings (+14%) and Vostok New Ventures (+9%) delivered strong performances.

The volatility in global markets has created opportunities for us to capitalise on compelling investment opportunities in some of our global diversified holdings. The significant de-rating of shares like BAT and Mondi allowed us to add to these positions at very attractive prices. The combination of cheap multiples and cash-generative business models will deliver substantial shareholder value in future.

Other portfolio changes included a further reduction in our Naspers position on the back of a very strong run in Tencent’s share price. We also sold most of our position in Discovery – again on share price strength. We further exited our position in The Foschini Group (TFG) as the business was trading above our assessment of fair value.

We currently have limited exposure to the South African clothing retailers given their stretched valuations. At this point our preferred domestic equity exposure are the defensive counters such as hospitals (Netcare and Life Healthcare) and food retailers (Pick n Pay and Spar) where we believe valuations are still attractive.

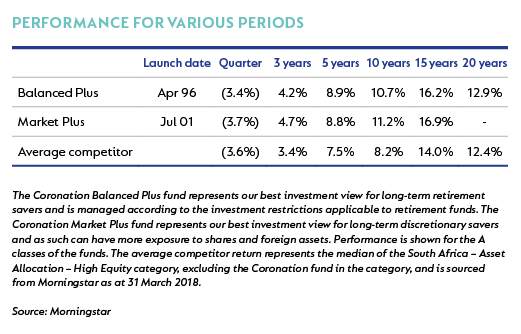

Multi-asset class funds

The funds added significant value relative to the average competitor over all meaningful periods. The regulatory allowance for offshore exposure increased during February to 30% and 40% for Balanced Plus and Market Plus respectively. Although we currently hold below the maximum, over the longer term, significant offshore exposure remains a meaningful contributor to the funds’ performance.

This past quarter's heightened volatility in global markets were driven by concerns around the impact of rising global bond yields and more recently the growing risk of a US/China trade war. Against this backdrop, the MSCI All Country World Index ended the quarter down 1.0% in US dollars (-5.4% in South African rands). Emerging markets continued their recent outperformance, returning +1.4% for the period relative to developed markets, which returned -1.3%.

We have taken some profits on our offshore equity positions and added opportunistically to domestic shares, thereby marginally increasing our domestic equity exposure.

We continue to avoid owning global bonds given our expectation that bond yields will move higher. The global economy is experiencing a synchronised recovery, with signs of inflation returning. This, coupled with central bank policy rates that we believe are still too low for a non-crisis global economy and US president Donald Trump’s tax package – which will provide further economic stimulus – makes it appear almost inevitable that interest rates will eventually have to rise to more normal levels. This will have knock-on implications for the pricing of all risk assets and we would temper expectations around global equity market returns relative to the strong dollar gains we have experienced in recent years.

Locally, the good news post the ANC’s elective conference in December has continued. The decisiveness of president Cyril Ramaphosa's cabinet reshuffle, together with a sound 2018/2019 Budget, was rewarded when Moody’s maintained the country’s sovereign rating at Baa3, which keeps it in the Citigroup World Government Bond Index. Although we have yet to see better sentiment translate into improved corporate earnings, we are confident that the economy is once again heading in the right direction.

Given the improved political and economic outlook, the rand continued its December rally. Domestic bonds also had a very strong quarter, with the All Bond Index (ALBI) ending up 8.1%, making South African government bonds one of the best-performing assets globally this quarter. Our low exposure to domestic fixed rate bonds detracted from performance over this period. However, we believe that South African fixed income assets are currently fully priced and are reflecting much of the good news for the local economy. Furthermore, local bond yields provide very little cushioning against a further increase in global inflation and a rise in developed market bond yields. We therefore continue to maintain very low exposure to fixed rate bonds. This is partly offset by our overweight position in listed property, especially the A property shares, which we believe offer very attractive risk-adjusted returns.

In this uncertain world, our objective remains building diversified portfolios that can absorb unanticipated shocks. We will continue to focus on valuation and seek to take advantage of attractive opportunities that the market may present to us, and in so doing generate inflation-beating returns for our investors over the long term.

INVESTOR NEED: INCOME AND GROWTH

Multi-asset class funds

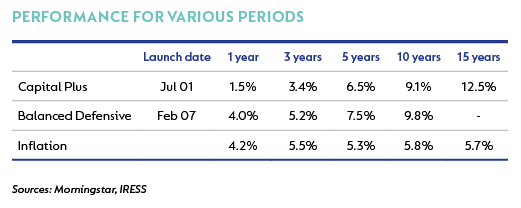

Our absolute return portfolios have the dual mandate of beating inflation over time and protecting capital in the short term. While the funds have delivered on their capital protection objective, they failed to achieve their return targets (inflation plus 3% and 4% respectively) in the recent past, which has been disappointing. Longer-term returns, however, remain ahead of benchmark.

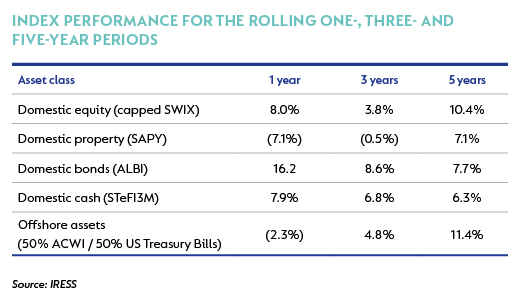

Given this disappointing performance, we provide some context to the underperformance by unpacking the rolling one-, three- and five-year asset class returns. As is clear from the table below, it has been a tough investment environment where real returns across asset classes have been far lower than the historical trend.

Disappointingly, both funds’ domestic equity performance has lagged the index over the one- and three-year periods. It is important that returns are viewed in the context of the portfolios being constructed to outperform inflation and not the relevant equity benchmark. That said, the funds' defensive positioning has detracted from performance, as have the large holdings in dual-listed rand hedge stocks.

Domestic property exposure has generated alpha relative to the South African Listed Property Index (SAPY) over all periods. However, returns for both the funds and the sector did not beat the respective inflation-plus targets.

Our domestic bond portfolios have, despite their conservative duration positioning, either matched or outperformed the performance of the ALBI over all periods.

Offshore assets have been a drag on performance over the rolling one- and three-year periods. The continued strengthening of the rand relative to major developed market currencies has been a headwind to the funds’ performance. In hard currency, the funds’ offshore allocations have generally lagged global equity markets given the more defensive nature of these portfolios, with only 50% to 55% of the respective portfolios’ offshore assets allocated to equities.

Over the quarter, we took advantage of the market sell-off, increasing the funds’ allocation to domestic equity through the purchase of index futures and adding to our positions in BAT and Investec. We trimmed our holding in Naspers and exited positions in TFG, Mr Price and Coronation on the back of strong share price performance and reduced margin of safety.

We also reduced the funds’ allocation to domestic property by trimming positions in Growthpoint, Hammerson and Redefine into strength. We further reduced exposure to local government bonds as, in our view, valuations are not attractive on a risk-adjusted basis.

No meaningful changes were made to the funds’ offshore asset allocation. We believe the funds’ offshore allocation remains appropriate given the benefits of diversification, value in the underlying offshore assets and our expectation of future rand weakness.

In an incredibly uncertain world, we continue striving to build diversified portfolios that can absorb unanticipated shocks. We will remain focused on valuations and seek to take advantage of whatever attractive opportunities the market presents to generate inflation-beating returns for investors over the long term. While we are cognisant of the fact that we have not delivered inflation-beating returns in the recent past, we remain confident that the positioning of the portfolio and our investment approach for the income-and-growth funds should deliver inflation-beating returns consistent with the portfolio’s long-term track record.

INVESTOR NEED: IMMEDIATE INCOME

Income fund

In addition to rallying 50 basis points (bps) post the ANC elective conference, local bonds continued to revel in the ‘new dawn’, with the benchmark bond rallying another 50 bps to end the quarter at 8.0%. The ALBI returned 8.1%, driven primarily by bonds with maturity of greater than 12 years (constituting 60% of the ALBI), which returned 10%.

The outlook for the local economy is much better. Subdued inflation should allow the South African Reserve Bank room to ease rates a little more. In addition, lower inflation and positive sentiment should help increase consumer spending and provide a decent underpin for growth. This could lead to new investment by corporate South Africa into inventory renewal and long-term projects, which could also add more upside to the growth outlook. The pace of changes made by the new leadership has been impressive, but most of the easy wins have already been realised. What lies ahead is a much tougher battle. South African bonds have ridden the wave of optimism on the back of the new dawn. However, at current levels, most of the good news (if not more) has already been priced in. The risks from global monetary policy tightening (higher policy rates and a reduction in quantitative easing) could have negative consequences for South African bonds (which have a very limited buffer to withstand these shocks). We therefore choose to be cautious of South African bonds at current levels, looking instead for more attractive levels before moving to neutral or overweight positions.

We remain confident that the listed property sector in South Africa offers selective value. The fund maintains holdings in counters that offer strong distribution and income growth. In the event of a moderation in listed property valuations (which may be triggered by further risk asset or bond market weakness), we will look to increase the fund’s exposure to this sector.

We remain vigilant of risks emanating from the dislocation between stretched valuations and the underlying fundamentals of the South African economy. The fund’s current positioning reflects this caution. The fund’s yield of 8.8% remains attractive relative to its duration risk. We continue to believe that this yield is an adequate proxy for expected fund performance over the next 12 months.

South Africa - Personal

South Africa - Personal