Investment views

Bond outlook

Global bond rout puts local bonds under pressure amidst a deteriorating fundamental backdrop.

The Quick Take

- Developed market bonds have fared poorly over 12 months, especially when compared to emerging market peers

- SA’s fiscal position remains precarious in the face of monetary policy uncertainty, sluggish policy implementation and the looming election

- A potentially game-changing US recession is not yet off the cards, but policymakers retain a hawkish stance

- Global bonds should provide investors with some comfort in tumultuous times

Global markets received a rude awakening towards the end of the third quarter of 2023 (Q3-23). The rise in oil prices to above US$100 per barrel, inflation prints pointing to a slower deceleration in core inflation and increased central bank rhetoric of keeping rates higher for longer caused a surge in global bond yields. Stubbornly-wide budget deficits, already-high debt loads and an almost doubling of funding costs also added further fuel to the bond sell-off. Emerging markets, although slightly better placed due to higher embedded risk premium, did not escape unscathed and moved weaker in sympathy with the global bond and risk sell-off.

South African (SA) bond yields were 65 basis points (bps) higher than at the end of the last quarter, resulting in a negative FTSE/JSE All Bond Index (ALBI) return of -0.33% over the quarter. This was behind the 0.8% return from inflation-linked bonds (ILBs), which afforded some protection due to elevated real yields. However, the ALBI has still significantly outperformed ILBs both year to date (1.47% versus 1.0%) and over the last 12 months (7.24% versus 3.0%). Despite underperforming cash over the last quarter (2.0%) and year to date (5.7%), bonds have still eked out a return in line with cash over the last 12 months (7.3%). Globally, developed market bonds continue to lag the performance of emerging market bonds. Over the last quarter, with the 75bps rise in US 10-year treasury yields, the FTSE World Government Bond Index (WGBI) was down 4.3% compared to the JPMorgan Emerging Market Bond Index (EMBI), which was down 2.6%. Over the last year, the outperformance is even starker at 8.6% (EMBI) versus 1.04% (WGBI).

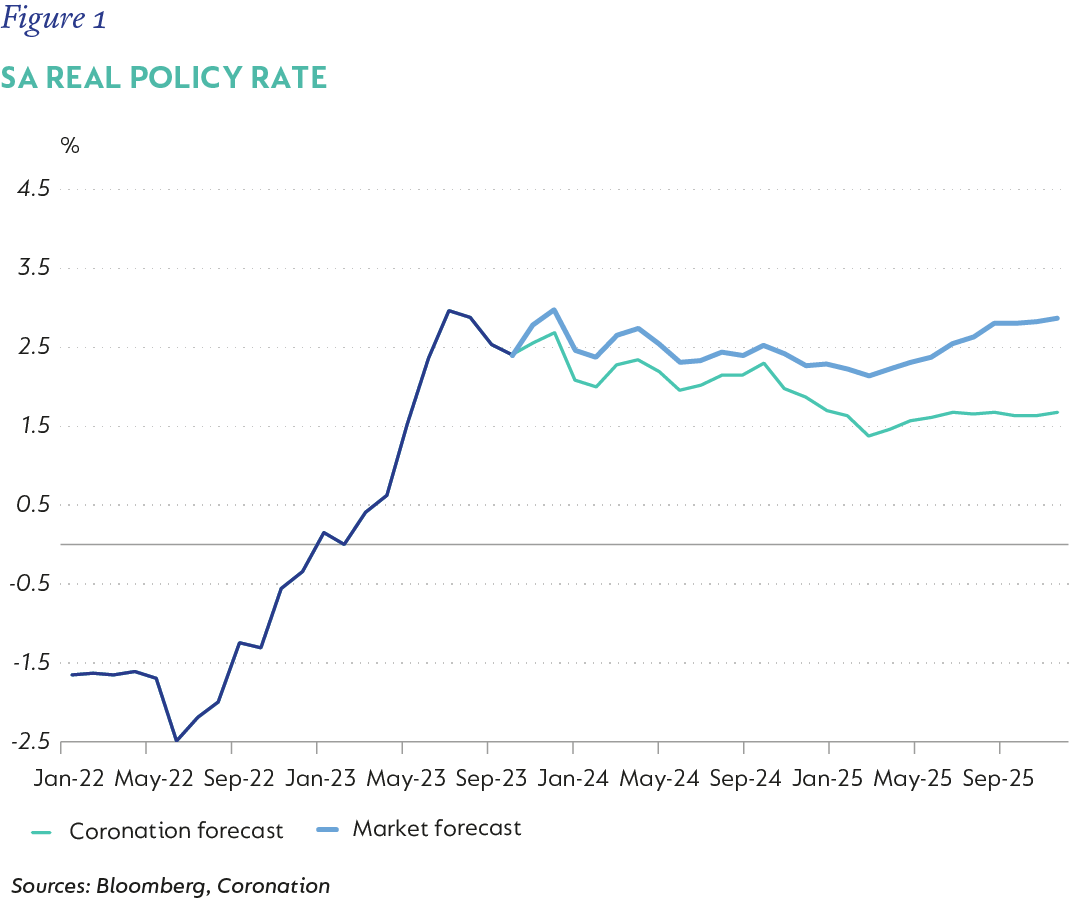

SA remains very poorly positioned amidst this global repricing due to its weakening fundamental backdrop. Firstly, on the inflation front, despite our inflation remaining within the target band, we believe that we have passed the low point in inflation. Going forward, due to the mounting risk of higher food inflation due to the now confirmed El Niño, higher administered prices and normalising Covid-related components of inflation, we believe inflation will remain sticky around 5.5% over the longer term in South Africa. This, combined with the South African Reserve Bank (SARB)’s stated intention of maintaining a higher real policy rate to attract capital amidst a deteriorating fiscal backdrop, suggests limited scope for easing in 2024. We see 50bps to 75bps of rate cuts, with these commencing only towards the tail end of 2024, taking the nominal repo to 7.5% by the end of the first quarter of 2025. This might seem conservative, but current market pricing suggests no rate cuts at all on the horizon, with a real policy of 2.5% to 3.0% versus the SARB’s guidance of 2.0% to 2.5% (which is what we factor into our analysis – see Figure 1). This does suggest some inflation premium remains priced in the shorter-dated bond yields.

LIMITED OPTIONS

Fiscally, SA remains in a tight spot. Revenue is expected to deteriorate due to lower growth this year and pressures on expenditure remain high. The government is effectively funding itself at between 8.5% and 9.5% (a combination of short- and long-term borrowing), while nominal growth is, at best, 6.0%. There are only three ways out of this crisis:

- Austerity: we could enter into a period of extreme austerity by cutting spending or placing a limit of spending proportionate to revenue. This seems highly unlikely since unemployment is so high, fixed expenditure (wages, grants, interest costs) is at 64% of total expenditure and we are heading into an election year.

- Kickstart growth: we could increase the nominal growth rate by increasing the real growth, but this would require real growth in the 3.0% to 4.0% range (assuming inflation at 5.5%), so that you are at least growing in line with your cost of funding. This is entirely possible, but would require drastic and swift action, which seems unlikely in the short term from the current administration.

- Reduce costs: we could bring the cost of funding down, either by changing the mix of funding or by utilising resources that could favour a compression in the funding cost.

A combination of the last two would be optimal, but the process around it needs to start now, otherwise SA faces the harsh reality of a forced debt restructuring as budget deficits remain stubbornly around 6.0% of GDP and our debt load flirts with the prospect of being 90% of GDP.

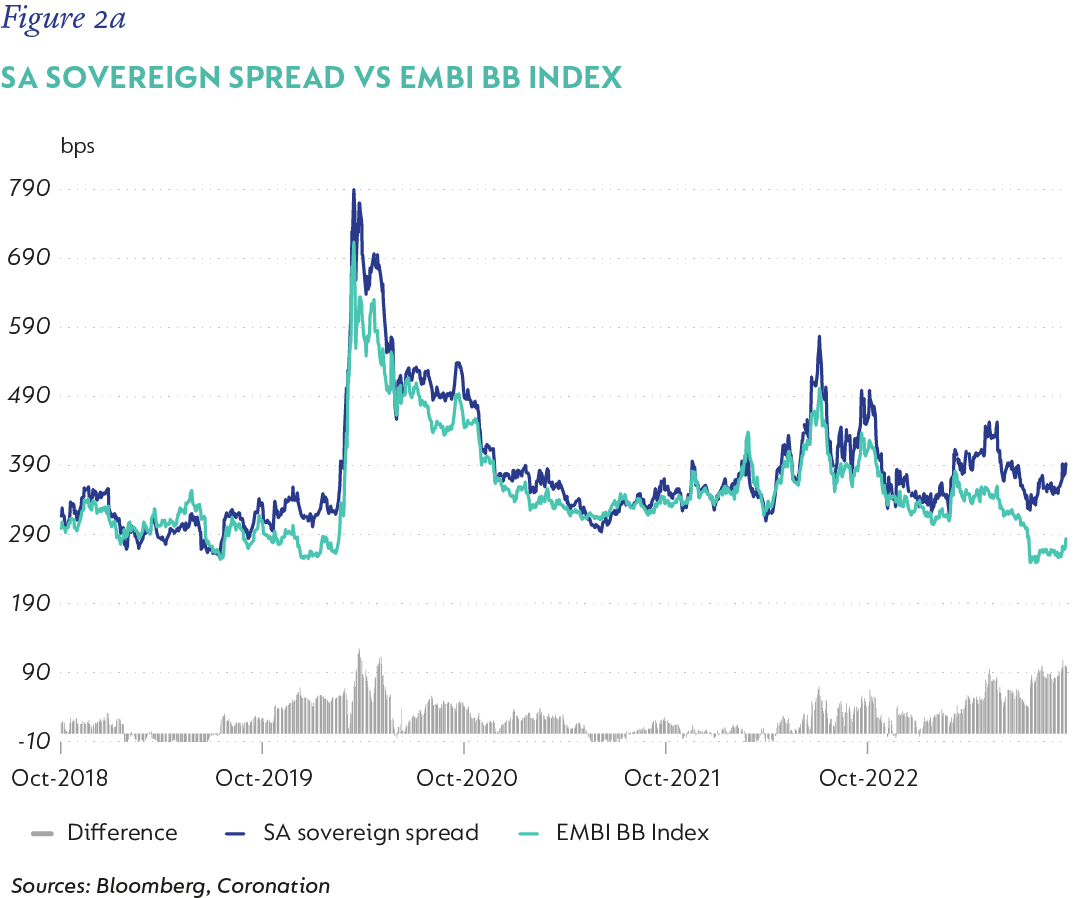

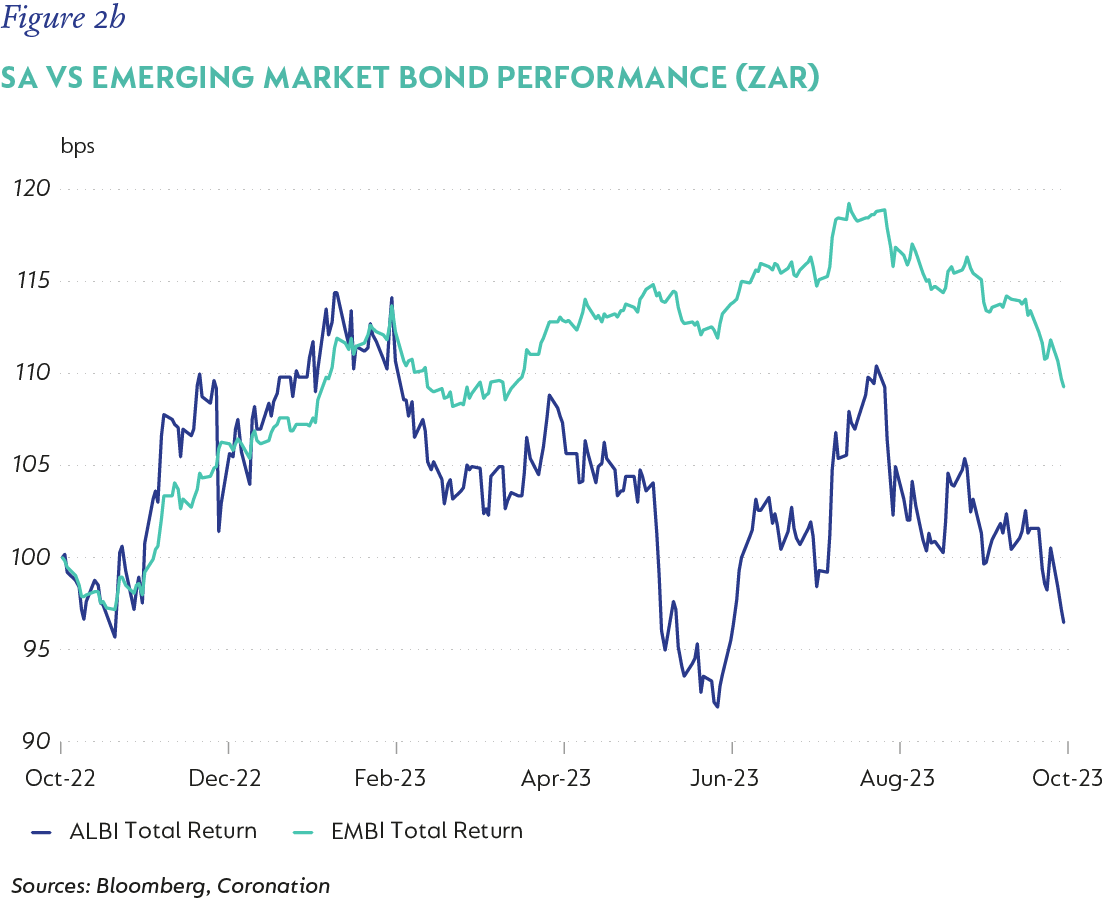

The pricing of SA assets has over the recent past both through performance relative to other emerging markets and increased required risk premium, priced a large portion of this fiscal deterioration in. This is indicated in Figures 2a and 2b, which show the SA sovereign spread remaining wide relative to the BB peer group and the relative performance of SA local currency debt relative to its emerging market peers over the last 12 months.

The global risk-free rate has and will continue to be a key driver of not only emerging market bond yields but also local bond yields (clearly evidenced by the behaviour over Q3-23). It is therefore important for local bond investors to understand the risks that are currently embedded in the global risk-free rate and the path thereof. We believe there are three important points to consider. Namely, the possibility of a US recession in the next 12 months, what this could mean for bond yields given their current implied real rates, and the risk characteristics of the asset.

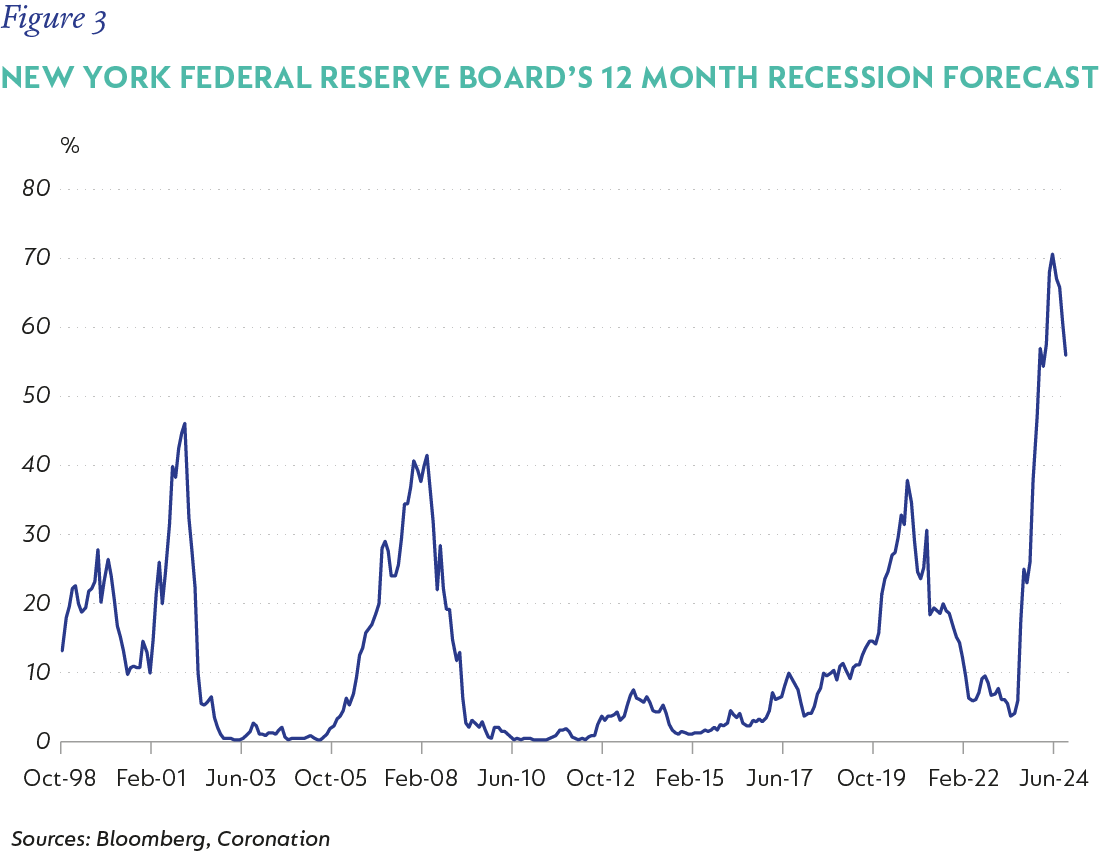

The probability of a US recession has come down quite significantly over the quarter, but still remains quite high (Figure 3). In addition to this, the recent rise in long-term bond yields combined with tightening credit conditions would further increase the probability of recession through the increased cost of capital. The impending recession might not be as severe as previous experiences of 2001, 2007 or 2020, but should be sufficient to turn the rate cycle in the US, hence providing some top side support to US bond yields over the next 12 months.

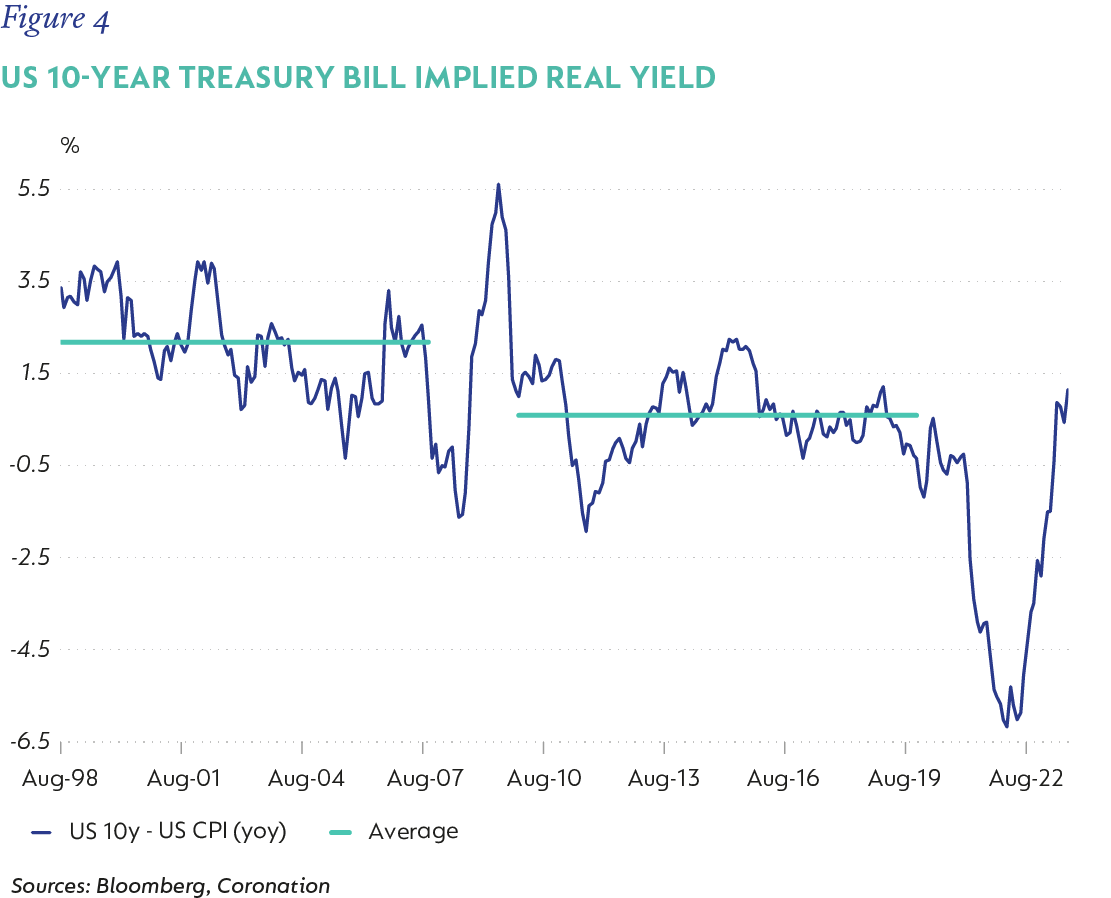

US inflation has come off considerably over the last year to current levels of 3.6%. It is expected to further decelerate, albeit at a slower pace, to an average of 2.5% in 2024. At current inflation, the implied real rate on offer in US 10-year bonds is just above 1.0%, due not only to the decrease in inflation, but also due to the move higher in yields over the last quarter. Prior to the Global Financial Crisis (GFC), the implied real yield averaged 2.0%, while in the last decade (prior to Covid), it averaged 0.6%. If current levels on the US 10-year bond are maintained and inflation declines to the expected 2.5% average in 2024, this would further push up the implied real yield to well above the pre-GFC average (Figure 4). Given the higher debt load in the US and the expected fiscal contraction, it is unlikely that real yields in excess of 2.0% can be sustained in the US long bond and one would expect the new long-term average to be somewhere in the range of 1.0%-2.0%. This further suggests that US 10-year bonds are approaching what could be interpreted as cheap valuations relative to longer-term expectations.

US BONDS, STILL A SAFE HAVEN?

The US dollar and bond yields have long enjoyed the status of being safe-haven assets. There has been quite a bit of conjecture over the recent past around these assets losing this status. It is true that central banks are diversifying reserve holdings, and that, at the margin, the US dollar is a smaller proportion of the total, but it still constitutes by far the largest proportion of foreign assets held by most governments/central banks. The US dollar is the unit of exchange in economic transactions far in excess of those that involve the US directly. This is unlike any reserve currency of the past. The implicit institutional underpin to a reserve currency is important. The US dollar’s role is underpinned by the understanding that the US Treasury, and its financial, legal and regulatory institutions will honour the transaction. It is possible that the same faith in alternative institutions has not yet been established. It is thus unlikely that these assets will lose their safe-haven status over the medium term.

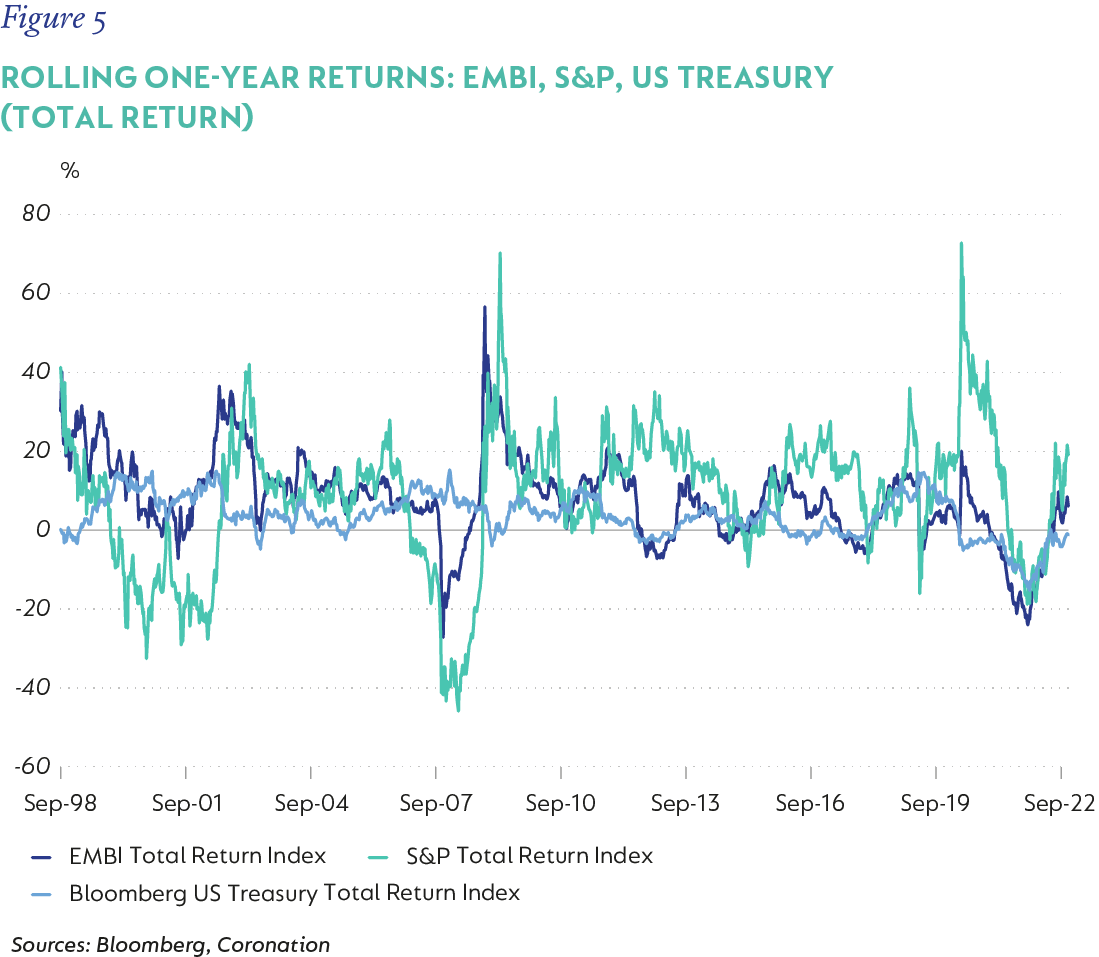

Figure 5 shows the rolling one-year returns of the S&P index, JPM EMBI Index and US Treasury Index. The key thing to point out is that, in times of high stress and volatility, US bonds offer more protection than “risky” assets. It thus points to a favourable risk/reward proposition through its lower correlation to risk assets, especially if valuation offers a decent margin of safety.

The high probability of a US recession in the next 12 months, high embedded real premium in US bond yields and their favourable risk/reward proposition driven by their safe-haven status, suggest that we are approaching, if not already at, a fairly attractive valuation in the US long bond.

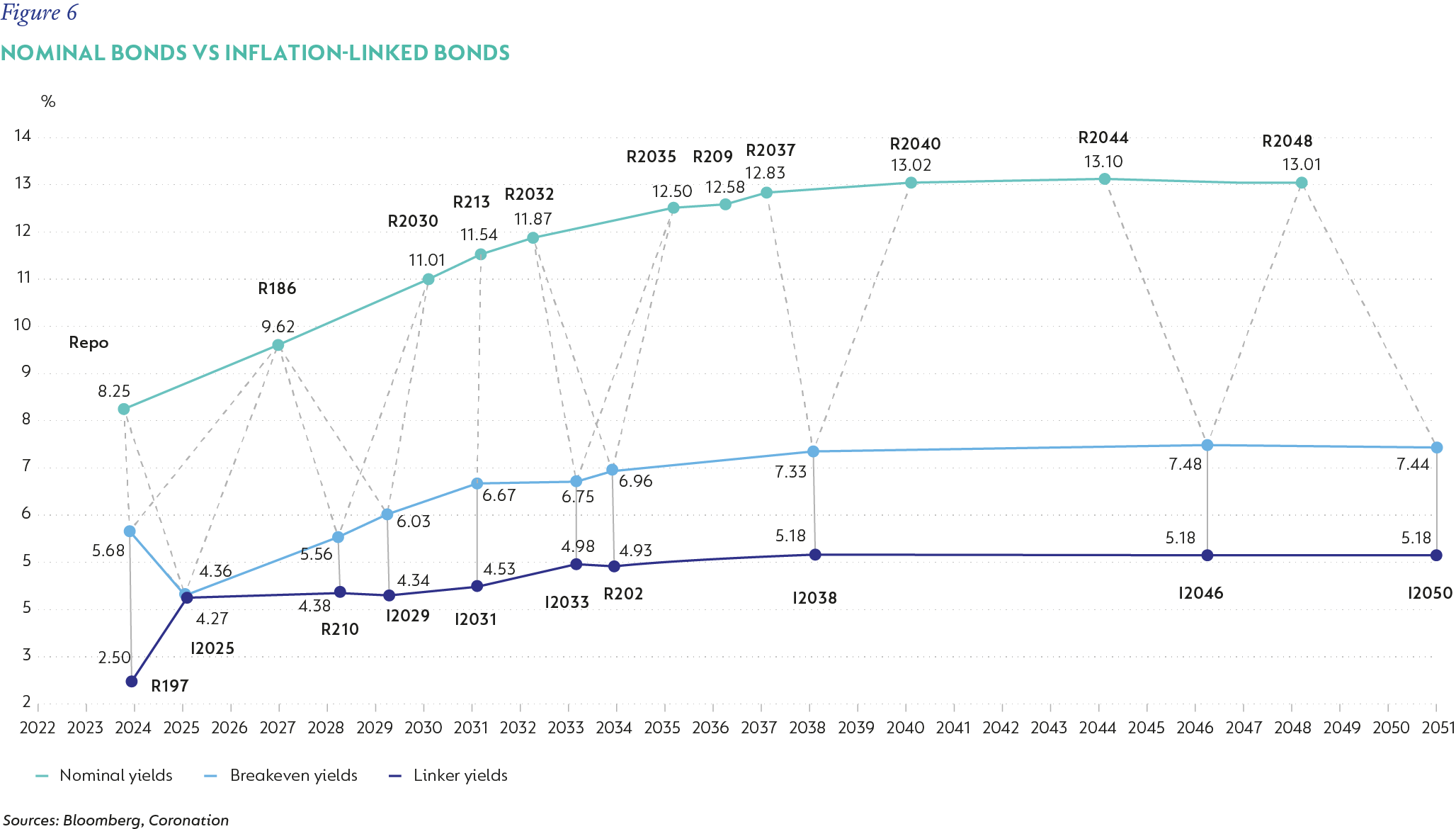

ILBs have offered protection to investors over the last quarter. However, current breakeven inflation across the ILB curve averages between 5.5% and 6.0%, which is well above even our own expectations for inflation over the medium term (Figure 6). It is only the short-dated ILB (I2025, 1.3 years to maturity) that flags as cheap from a valuation perspective. Risks on the inflation front still remain elevated, however one has to acknowledge that valuation has shifted more in favour of nominals. As such, although we still believe ILBs warrant a position in bond portfolios due to their inherent inflation protection, some moderation of that allocation in favour of nominal bonds is prudent at this stage.

SA REMAINS CONSTRAINED

SA’s fundamental outlook continues to be plagued by inflation that will remain above the midpoint of the target band, a deteriorating fiscal outlook and very little confidence in the current administration’s ability to correct the trajectory. Local assets have continued to trade poorly, with the risk premium embedded in local bonds remaining elevated. The recent turmoil in global bond markets has added a further spanner in the works as the prospect of higher rates for longer and a deteriorating debt outlook weighs on bond yields. However, the current valuation of global bond yields suggests an increased margin of safety, which could provide some comfort to global bond investors. This, combined with the healthy risk premium on offer in local bond yields, should offer some support to our local bond market.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal