Investment views

China: Select opportunities in a changing landscape

While we are cognisant of the risks, we believe a handful of carefully chosen businesses in China currently offer compelling returns for long-term investors.

The Quick Take

- Chinese equities have sold off heavily after the National Congress of the Chinese Communist Party

- Xi Jinping’s tighter grip comes on the back of increased regulatory activity and the continued zero-Covid policy

- The developments over the last two years have profound implications for global investors

- Although the landscape has changed, a number of businesses offer highly attractive opportunities for long-term investors

The future of China and the implications of President Xi Jinping’s unprecedented third term in office have been a critical theme of debate since the close of the five-yearly National Congress of the Chinese Communist Party. Notwithstanding the universal expectation that Xi’s re-election was inevitable, given his control of the party, Chinese equities sold off heavily on the first day of trading.

We believe that the severe negative reaction was due to the almost complete purge of alternative viewpoints within the Politburo, with only loyalists making the cut to the top seven. While the country prides itself on economic competence, Li Qiang, who oversaw Shanghai’s heavily enforced – and sometimes shambolic – lockdown earlier this year, was rewarded with a position so senior he could be Prime Minister next year. As a result, investors have sold out of China en masse, with the broad MSCI China Index down by a third over five years and around 45% since peaking in the first quarter of 2021. This has reduced China’s weight in the broader MSCI Emerging Markets Index to just under 30%, down close to 10% from peak levels in late 2020.

It is not surprising then that many investors are questioning whether China is still investable, especially given the recent experience of Russia’s invasion of Ukraine.

We are of the view that while the risks of investing in China have increased significantly over the past two years, a number of companies in China still present attractive investment opportunities. Even the assessment of Li Qiang should stretch beyond just his handling of the Shanghai lockdowns, with his longer-term career more reflective of an astute technocrat that has broadly supported the private sector. As with all other emerging markets, investment opportunities in China need to be weighed up against the risks and issues present in the country as a whole. Below, I explore possible areas of investment and our returns expectations going forward.

CERTAIN BUSINESSES WILL THRIVE

Aside from the recent leadership developments, the other key issues in China over the past two years have been (mostly negative) regulatory changes and China’s insistent adherence to a zero-Covid policy. The regulatory changes have, for the most part, been aimed at stamping out what the state viewed as harmful practices: excessive spending on school tuition, precarious gig economy employment, and anti-competitive behaviour by large established players are typical examples. Investors (including us) have been unpleasantly surprised by the scale of the interventions and the heavy market reaction suggests many global investors today believe that China has permanently reduced the potential of the private sector to deliver the returns to which they had become accustomed.

While this is certainly the case for many businesses operating in China, we believe that it is equally plausible that certain companies will benefit greatly from having a level playing field. One such business is JD.com, an Amazon-like business, which we believe is likely to be better off over the longer term as a result. This is because the larger incumbent, Alibaba, can no longer force suppliers to deal exclusively with only one party. In addition, JD.com employs most of its staff permanently, with all the associated costs of employment, setting it apart from platform-style businesses such as Meituan, who treat workers as “independent contractors”. This positions companies like JD.com and others to likely benefit from China’s thrust to provide better quality employment and reduce inequality. While there are many companies which are net-losers as a result of all these regulatory changes, our job as an active stock picker is to find the winners trading at attractive valuations for inclusion into a diversified portfolio, and our research focus is heavily focused on achieving this.

Our global emerging markets portfolio has significant indirect portfolio exposure to China through positions in Prosus/Naspers. These are attractive partly for their underlying investment in Tencent, the largest Chinese technology group with strong gaming, social network, advertising, cloud and fintech businesses. Tencent has historically been astute in its management of government affairs and has, so far, only been moderately affected by regulatory developments. Although a large part of the group’s current profits come from gaming, with many other parts of the business still in the investment phase, less than 5% of its domestic gaming business is reliant on minors, an area where regulation has gradually tightened. Instead, a growing portion of gaming earnings come from offshore and are not affected by domestic regulatory measures.

The other key attraction of our Prosus/Naspers investment case is the large discount to the underlying net asset value at which they trade. Not only can investors currently access Tencent at a 15% discount to its market value (which we believe is depressed), but investors also get the balance of the group’s digital investments outside of China, which we believe are worth close to €42bn (40% of Prosus’ market cap), essentially for free. We believe that given the latest efforts of management to close the shares’ discount, including an open-ended buyback funded by incremental sales of Tencent shares, the potential return of this investment is large.

SECTORS WE ARE AVOIDING

China’s continued zero-Covid stance has equally baffled investors. While the rest of the world has largely adapted to living with the pandemic through a combination of vaccines and a better understanding of the virus, China’s extreme reaction to even low levels of potential exposure to Covid is, in our view, equivalent to playing whack-a-mole with its population. Even though we firmly believe this stance to be untenable in the long run (at some point, even a country with a vulnerable elderly population will find the economic cost of lockdowns too high), we don’t pretend to have any special insight into when the country will open up. For this reason, we believe the best approach is to construct a balanced portfolio consisting of high-conviction bottom-up ideas, which in several cases would also benefit from China opening up but are not heavily reliant on unimpeded mobility of the population for their success. The direct exposure to companies heavily reliant on reopening is in the low single digits as a percentage of the portfolio.

Other sectors we have typically stayed clear of, with few exceptions, are state-owned enterprises, financials, property and basic materials. These are areas we have often avoided in China and the state’s stated goal of “Common Prosperity” (a policy aiming to reduce inequality) has only made us more cautious about the potential profitability disruptions and other risks that companies in these sectors may face going forward.

EXTREME PESSIMISM CREATES SELECT BUYING OPPORTUNITY

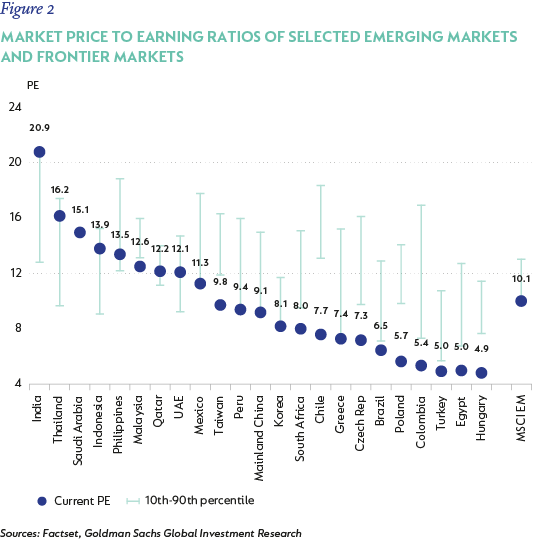

With the exceptions above in mind, it is important to note that many other companies in non-affected sectors in China continue to operate reasonably smoothly. Many are trading at valuations well below their own historical average and those of their emerging market peers. Figure 2 shows that market darlings like India and Saudi Arabia are trading close to the top end of their historical trading range, while the opposite is true for China. We would agree that a discount to historical levels is justified given the political developments and the current Covid stance, but pessimism does seem to be at extreme levels, and we believe that this could present very good buying opportunities.

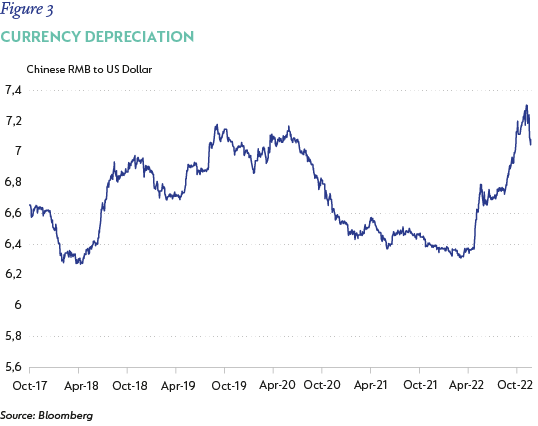

One underappreciated source of reduced risk for investors is the currency. After finally allowing the RMB to appreciate against the dollar (due to concerns by the US of unfair competition and potentially punitive tariffs), China’s currency reached a high of around 6.1 to the dollar in 2013. It has subsequently depreciated by over 20% (Figure 3). Within the emerging market universe, currency depreciation is often a big factor in realized USD returns. One often makes great returns in local currencies only to see these depreciated away when measured in dollars, which is the pricing currency of the index. Given the currency’s negative moves, we are of the view that it does not represent a big risk factor going forward, at least not relative to many other emerging market currencies that also tend to weaken against the dollar over time.

CONSIDERING TAIWAN

The final area to explore is Taiwan. China has consistently maintained that Taiwan is part of China and will be incorporated with the mainland, but the timing of this has been left open-ended.

We are mindful of the implications of the legislative changes in Hong Kong that effectively ended the “one country, two systems” mechanism of managing non-mainland provinces. It seems unlikely that Taiwan will consent to be ruled by mainland China with promises of de facto autonomy when Hong Kong’s autonomy has largely disappeared. This was previously viewed as the most likely way for Taiwan to come under mainland “rule” without reducing the freedoms and autonomy enjoyed by the island. Without the option of a version of “one country, two systems” to entice Taiwan, China may take the view that only unilateral (military) action is appropriate to achieve its goals. This would have very negative consequences for the whole world. Unlike Russia, whose main contribution to the world economy in recent years has been energy, both China and Taiwan are integral to the world’s supply of all types of goods. The scale of disruption to life as we know it would be very significant.

However, it is also important to keep in mind that China’s communist party (the CPC) ultimately derives its domestic legitimacy from being able to manage the aspirations of its people to be wealthier and more secure with each passing generation. Invading Taiwan is likely to undermine this goal significantly. This does not mean that it will not happen. Considering the apparent strong ideological commitment of President Xi Jinping to ‘reunification’ with Taiwan and the lack of alternative viewpoints in the senior leadership of the CPC since the recent politburo personnel changes, we feel the risk of an invasion has grown.

For this reason, we approach our Taiwanese exposures with caution, particularly since it is one of the largest weights in the emerging markets index and extensively owned by investors around the world. In the Coronation Global Emerging Markets Fund, for example, the exposure to Taiwan is currently around 6% (materially below the index exposure of 14%), consisting of only select names. Two-thirds of the Taiwan position is in the world’s leading manufacturer of chips for computers – TSMC. As chips have become more technically complex to manufacture, TSMC has outperformed all its peers to the extent that it now has captured the majority of the market for the most cutting-edge chips (those with the most transistors crammed into every wafer). TSMC trades at 11 times forward earnings, a third of the valuation it reached two years ago despite improving its competitive position consistently since then.

When combined with the direct and look-through exposure to China (which is in the low twenties), we have under 30% exposure to the region. This is below the index weight of around 43%, reflecting our view on the risks, but still quite a material portion of the Strategy’s capital, reflecting the opportunity we see in select names.

While we are cognisant of the meaningful changes in the Chinese landscape, we remain confident that our long-term thinking and rigorous research enable us to identify businesses that can thrive in evolving situations and build portfolios that will ultimately deliver attractive returns for our clients over meaningful long-term periods.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal