Investment views

Addendum 1: Stress testing worst-case scenarios

- assessing asset class performance in weak state regimes

EGYPT

Egypt is a contested investment proposition. Central to understanding the difficulties in which it finds itself involves tracing the over-reliance on a heavily managed exchange rate for far too long. Naturally, Egypt’s developmental standing is complex and multifactorial, but the country’s fixed/quasi-fixed exchange rate has been key to many repeated cycles of escalating imbalances, the subsequent loss of central (and commercial) bank reserves, foreign currency rationing, and the typical ending of a forced devaluation of the Egyptian pound (EGP).

Given the scale of prior imbalances and the extent of these devaluations, the consequences have almost always been damaging inflation spikes and the fracturing of real economic activity, along with all the attendant peripheral, often intangible, but cumulatively consequential side effects of a wrenching macroeconomic stress event.

So where does Egypt stand today? On rocky ground, is the regrettable answer. From a structural perspective, the country remains in a fragile position. External vulnerability is high, and, with structural twin deficits (fiscal and current account) and extremely high external debt levels, sourcing sufficient external funding is a key priority. Yet the government has been resorting to fiscal monetisation[1] and sustained high government deficits. The result has been substantial growth in the domestic money base, nowhere near matched by a commensurate increase in an external buffer (i.e., foreign exchange reserves). Hence, even with the recent devaluation of the currency, it isn’t necessarily the case that it is especially cheap and invulnerable to further depreciation pressure.

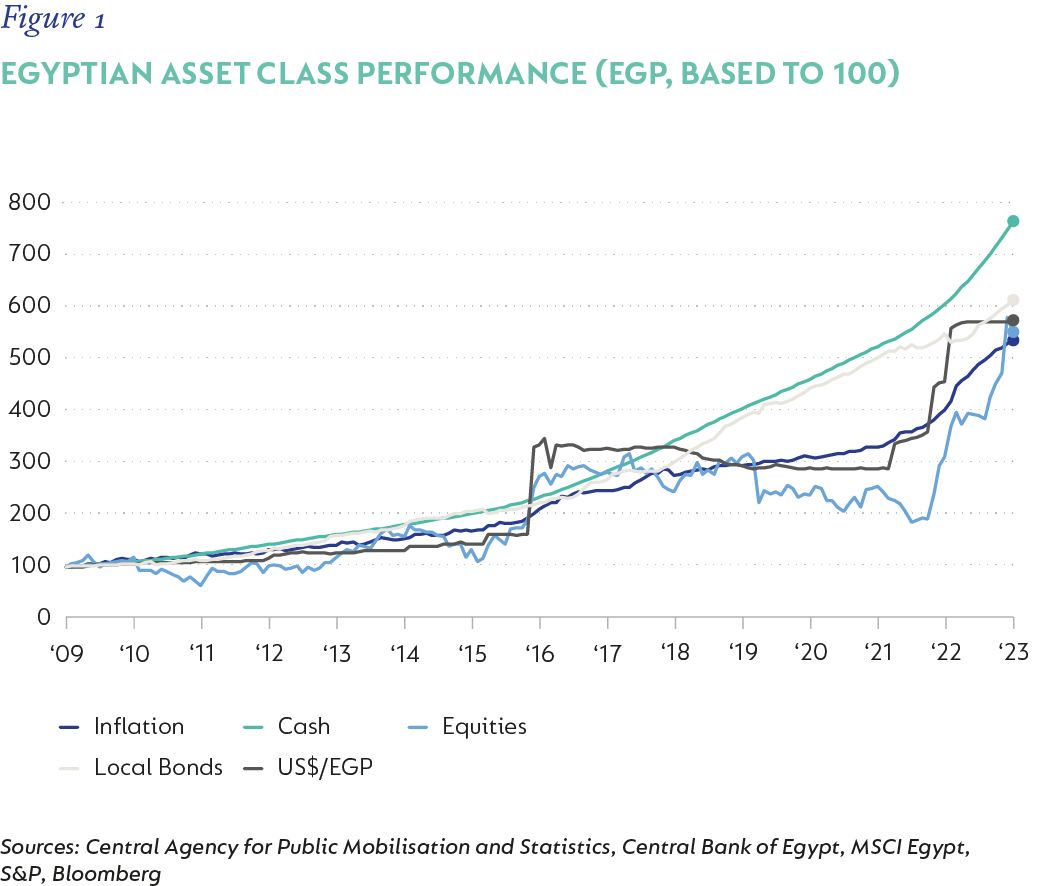

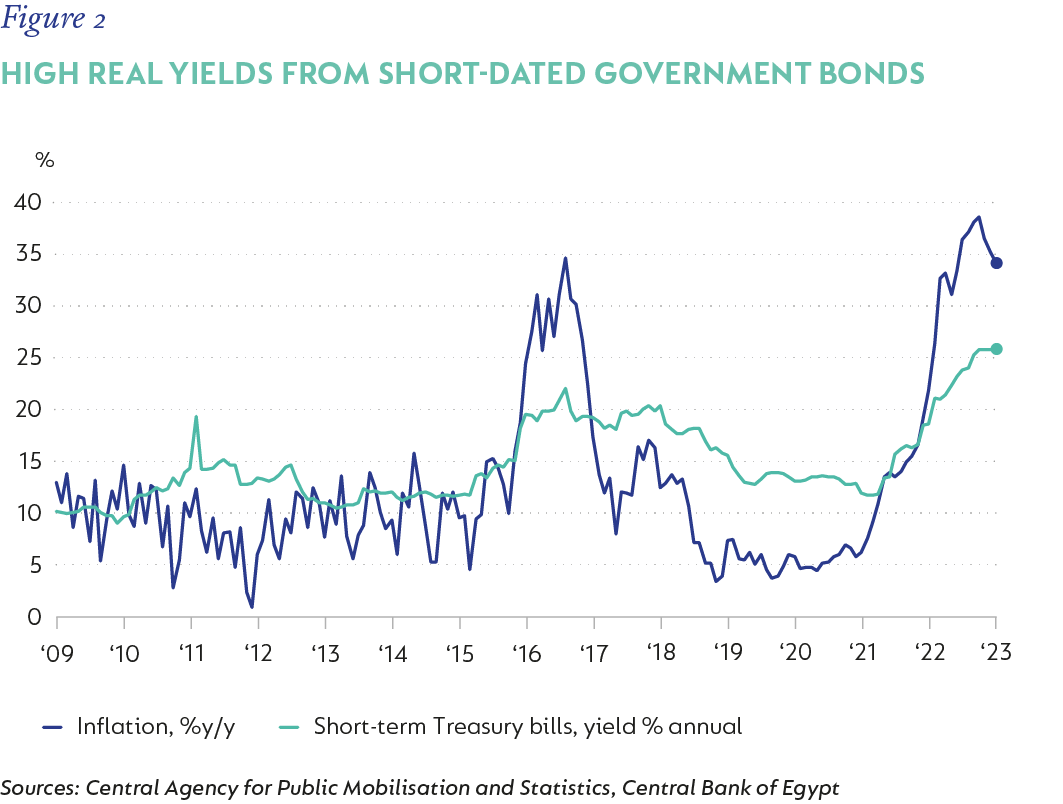

This backdrop goes most of the distance in reconciling the relative asset class performances produced in Egypt over recent years (Figure 1). First and foremost has been the nearly unbroken dominance of short-dated interest-bearing assets. Egypt has required the provision of a very high real short-term interest rate – especially after the devaluation of 2016 – as a necessity to offset the continued strain of a large external financing imbalance (Figure 2). Yet, the country remains exceptionally vulnerable and increasingly so.

Macroeconomic imbalances continue to grow and, while further currency debasement has been avoided thus far, the potential for this hasn’t been higher than it currently is. Indeed, without a different approach by the Egyptian authorities, the relative advantage in capital preservation held by short-dated fixed income instruments will likely be reversed in a dramatic and conclusive fashion.

[1] Central bank financing government debt and boosting money supply

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal