OLD MUTUAL INVESTORS will have had indirect exposure to Quilter for many years. Old Mutual’s managed separation process resulted in a core African life insurer, with its UK wealth business (Quilter) and the majority of its Nedbank stake being distributed to shareholders. As a result, investors are now able to own Quilter directly.

In the years leading up to the listing, Quilter management reshaped the business from a pan-European life insurer to a UK-focused wealth management business, with a sizeable presence across the wealth management value chain (advice, platform, multi-manager and discretionary wealth management). It retains a closed book of life business that is in run-off, the contribution of which will decrease in significance over time.

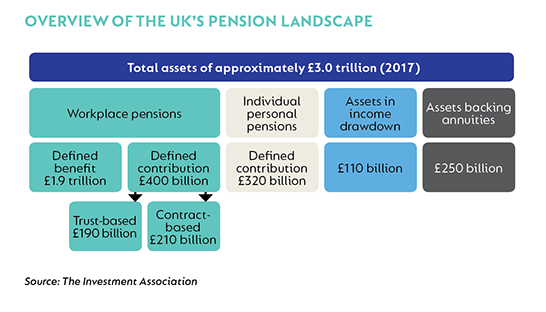

The UK pensions market is attractive and has undergone a seismic shift in recent years, following four notable milestones:

- The UK adopted the Retail Distribution Review (RDR) in 2012, which improved disclosure to clients, specifically on fees, and set very onerous requirements that advisors had to meet before being able to describe themselves as independent. It also shifted the industry in several ways – from a commission-based payment structure to one in which the client pays the advisor directly, and with increased advisor qualification requirements, thereby increasing the burden of being an independent advisor. This led to a drop in the number of advisors, from 27 000 in 2009 to 24 000 in 2016, and a switch from independent to restricted advice, and drove industry consolidation. These changes benefitted larger advice firms, of which Quilter is one.

- In 2012, the UK government also introduced pension auto-enrolment, compelling employers to enroll employees in a pension fund. While the initial impact has been minor, this will, over time, improve long-term savings rates and wealth accumulation. It essentially creates a wave of potential future clients for Quilter and its peers.

- In 2015, the UK Chancellor of the Exchequer, George Osborne, announced ‘pension freedom’, which removed the requirement to buy an annuity at retirement. Consumers could now withdraw their pensions in cash and/or make use of flexible drawdown products. Data from the Financial Conduct Authority (FCA) show that the annuity/drawdown sales mix in 2014 was 81% and 19%, respectively, which evolved to 24% and 76%, respectively, by 2017. As Quilter did not offer fixed annuities, this change represented a massive tailwind to the group and its peers.

- Meanwhile, the UK is shifting away from a defined benefit-dominated market to a defined contribution market. As it stands, 83% of UK workplace pensions are defined benefit funds, accounting for £1.9 trillion of UK retirement savings. Around 88% of these funds are closed to new members, with employers opting to offer defined contribution funds instead. In addition, many companies are opting to remove the funding uncertainty that comes with a defined benefit fund by encouraging members to transfer their pension pots into defined contribution funds. While Quilter and its peers do not offer defined benefit fund solutions, they do offer defined contribution fund solutions (directly in the case of a self-invested personal pension [SIPP] and indirectly in the case of defined contribution fund pots being consolidated in the future). The companies also offer retirement solutions in the form of drawdown products for fund members when they do retire.

If we consider Quilter’s core addressable market to be defined contribution funds, SIPPs and drawdown products (they do also participate in discretionary savings), it amounts to c£830bn. According to our assessment, this is likely to expand threefold in the next decade. Quilter’s own net flows target over the medium term is 5%, which we believe could be conservative. So far, it has averaged 7% per annum over the last three years.

QUILTER IS WELL PLACED

Quilter is well placed to take advantage of the supply/demand mismatch created as a result of the introduction of pension freedoms (which are increasing the demand for financial advice) and the RDR (which is reducing the supply of this advice). Alongside industry peer St James Place, Quilter is the only player to offer every key component of an integrated wealth manager at scale. It also has the second-largest advisor force, the second-largest advice platform and a credible and well-performing multi-manager, and includes the fifth-largest discretionary wealth manager in the country.

SELF-HELP OPPORTUNITIES

Due to its acquisitive history, Quilter remains an inefficient business, although we believe these inefficiencies are being addressed. Over the past decade, Quilter has sold out of most of its European life businesses, bought advice businesses and a discretionary wealth manager, and sold its single-strategy asset manager. While this has set the group up strategically, the company has yet to optimally integrate these businesses. This is, however, likely to be addressed soon, given that the key component parts of the value chain are now in place and that the board has prioritised costs, integration and efficiencies. A further benefit of a more cohesive business is integrated flows, which occurs when a client makes use of more than one part of the value chain, allowing for greater margin retention by Quilter. Integrated flows have grown from one third of flows in 2015 to half of flows in 2017.

Quilter currently operates off an ageing, proprietary back-end investment platform that has seen no operating leverage, with costs and headcount moving in lock-step with new assets being placed on the platform. Positively, the company is currently in the process of transitioning to a new, third-party investment platform that is expected to show operating leverage, given that the platform provider is responsible for regulatory developments and that the fee reduces as the business scales.

Many investors will recall that this is not Quilter’s first attempt to re-platform. Its much-publicised first attempt with International Financial Data Services, which cost £330 million and was subsequently terminated, remains fresh in investors’ minds. We believe Quilter has taken the lessons from the first attempt to heart. We take comfort in the fact that the new provider, FNZ, is used by a number of players in the industry and is held in high regard. Quilter has also strengthened its IT team, and appointed a non-executive director with IT and system migration skills to the board.

With a focus on costs and a successful re-platforming, we see scope for margins to improve meaningfully off the current profit-before-tax margin level of 29%.

Quilter is a cash-generative, capital-light business. We find it surprising that they only target a dividend payout ratio of between 40% and 60% and sit on a Solvency II cover of 1.95 times.

Our view is that, after the successful re-platforming, management and the board have scope to improve the payout ratio while reducing the amount of capital retained to run the business. This should go some way towards driving the share’s rating higher.

EARNINGS GROWTH

We expect earnings growth to be muted in the short term as Quilter’s tax rate normalises and their closed life insurance book runs off. This masks a strongly growing core UK wealth business, which should grow earnings at double-digit rates over the medium- to long term, on the back of strong net client cash flows and positive operating leverage. This is an attractive growth rate in hard currency.

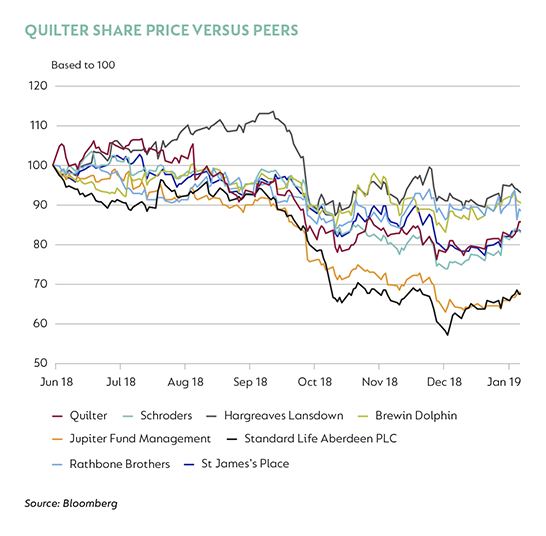

WHAT GAVE RISE TO THIS OPPORTUNITY?

Apart from the risks associated with re-platforming, Brexit concerns also appear to have placed pressure on Quilter and its peers. Our view on Brexit’s impact on Quilter in the longer term is fairly benign. Brexit might impact flows if money sits on the sidelines while uncertainty abounds. However, we think the longer-term structural tailwinds will ultimately reassert themselves. To the extent that the pound weakens, this will likely benefit Quilter, given that its fund range is largely global equities. Operationally, the vast majority of operations and clients are UK based, so the impact here should be muted.

CONCLUSION

Quilter operates in a market with structural tailwinds and is well positioned to take further market share, driving good earnings growth. Its business model possesses attractive fundamentals, being cash generative and capital light. The share price offers more than 50% upside to our assessment of fair value, trades on 10.5 times our assessment of normalised earnings, and offers a 5% dividend yield and is, in our view, an attractive proposition.

Disclaimer

South Africa - Personal

South Africa - Personal