Investment views

WeBuyCars

Newest domestic IPO set to drive sustainable growth and performance.

The Quick Take

- The unbundling and listing of WeBuyCars presents an attractive opportunity for new shareholders to gain direct access to a growing domestic company

- Their superior business model should make WeBuyCars a long-term winner

UNBUNDLING AND LISTING OF WEBUYCARS

The JSE has been plagued with an accelerating trend of delistings over the last few years, which is why we were excited about the recent unbundling and listing of WeBuyCars (WBC). The public market now gains direct access to an attractively-valued South African (SA) business with a long runway of growth, characteristics that are in short supply in our local market. Coronation played an integral part in the unbundling, subscribing for shares in WBC while it was still unlisted and participating in the pre-IPO book build, in order to help facilitate the overall transaction.

WEBUYCARS OPERATIONAL PERFORMANCE

WBC, founded in 2001 by brothers Faan and Dirk van der Walt, was started with the idea that the best-used vehicle stock is in the hands of private individuals. They built a business around customer-to-business sourcing and focused on massively improving the experience for vehicle sellers. WBC still acquires vehicles almost exclusively from private sellers, and this sourcing capability is a critical part of its moat. The company has expanded its footprint to include 15 vehicle supermarkets, 74 buying pods and more than 340 buyers across SA. It has also built a very strong and trusted consumer brand, which now attracts nearly two million unique monthly visitors to its website and mobile app.

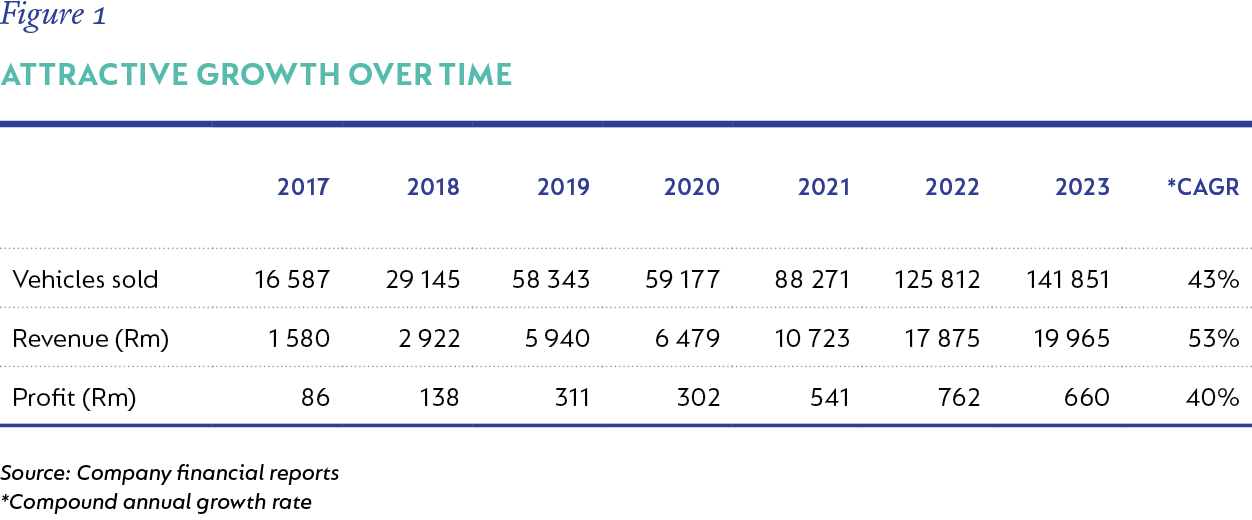

Since 2017, WBC has gone from selling less than 1 400 vehicles per month to more than 13 000 (February 2024). Figure 1 shows that growth in profits has followed suit, compounding by 40% from 2017 to 2023. The WBC management team has communicated a medium-term sales target of 23 000 vehicles per month. While we don’t know how big WBC will ultimately become, there are no signs to indicate their market share growth is stalling.

WBC achieved the above success and potential by acting as a market maker that provides trustworthy, convenient service and near instant pricing and liquidity in what is traditionally a low-trust, illiquid sector. Its national footprint and fast response times enable nearly anyone to sell their vehicle in a matter of hours. Being able to price thousands of vehicles accurately and quickly is a key competitive advantage, as it provides pricing transparency in an opaque market. WBC has built a rich proprietary database of used vehicle prices and constantly uses new data points to refine its algorithms. Its systems are processing between 70 000 and 80 000 incoming leads per month from private individuals interested in selling their vehicles, giving WBC best-in-class visibility of the overall market.

Besides better pricing capabilities, WBC also leverages its scale benefits to improve its customer offering. By using large warehouses closer to industrial areas, it provides its supermarkets with the capacity to display between 500 and 1 500 vehicles on average, while operating with a substantial cost advantage to traditional dealerships. Sharing the benefits of its economies of scale with consumers should ensure better pricing for both sellers and buyers through reducing the bid/ask spread for used vehicles, and encouraging higher sales velocity.

Velocity is key to the WBC business model, not only to turn its own stock faster but also to encourage and facilitate the whole domestic used-vehicle parc[1]. to turn quicker. Using insights gained from their website and physical supermarket visits, they can accurately gauge consumer demand for various vehicle makes and models. This enables them to purchase the right inventory mix for optimal stock turn. Their data analytics also help them to dynamically shift their customer mix between private individuals and vehicle dealers. While sales to dealers don’t have any additional margin from financing or insurance products, the benefit is a very quick stock turn. At an industry level, vehicles currently change ownership every three to five years, but by lowering the friction (financial costs and hassle factor) of buying and selling used vehicles, WBC could be a catalyst in decreasing this holding period. A shorter holding period will mean an increase in the overall velocity of used-vehicle sales and more opportunities to generate a margin over a vehicle’s useful life. In support of this thesis that they can earn a margin multiple times on the same vehicle, 12% of vehicles recently sold by WBC have already previously been traded on its platform.

As part of its drive to increase finance and insurance penetration, WBC provides on-floor access to all the major financiers and has also partnered with OUTsurance and Netstar to provide insurance and tracking solutions. WBC can help finance providers enrich their data models to enable them to finance vehicles that traditional banks are not usually comfortable taking on as collateral. By illustrating that depreciation curves for certain makes and models diverge from those reflected in industry data[1], WBC can help lenders to provide finance to previously underserved market segments. It does this through its partnerships with Capitec and Gomo (a Transaction Capital business funded by Standard Bank). All of these initiatives serve to boost WBC’s profitability.

INDUSTRY TRENDS

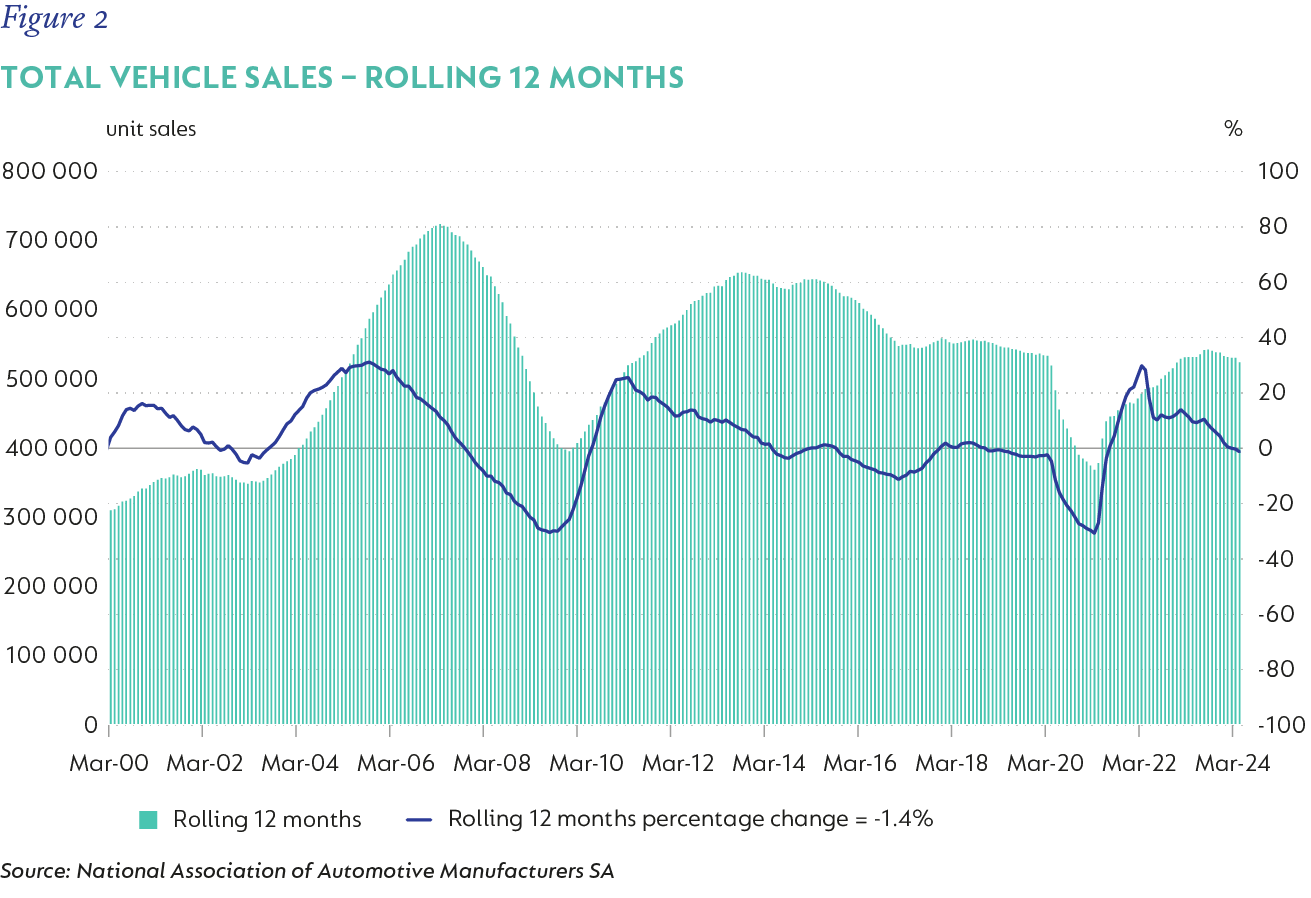

There are 12.9 million vehicles in the SA vehicle parc, of which 11 million are registered as passenger or light commercial vehicles (eNaTIS). There are 500 000 - 550 000 annual new vehicle sales in SA (National Association of Automotive Manufacturers SA) and roughly 1.2 -1.4 million used vehicle sales (eNaTIS and Lightstone). New vehicle sales have been under continuous pressure in SA (Figure 2), with higher interest rates and depressed consumer affordability being two key drivers.

This has led to an increased appetite for well-priced used vehicles. WBC does not focus on the premium end of the market, but on these older and more affordable vehicles. The average selling price and age for a vehicle traded by WBC were R141 000 and nine years, respectively. This segment of the market is the least competitive and heavily fragmented, with most of the larger dealership groups focused on used vehicles between one and five years old. In time, we see WBC also gaining market share in these newer used vehicles as its national scale and sourcing efficiencies lead to a continuously improving proposition for consumers.

In sharp contrast with the weak new vehicle sales statistics above, WBC has increased its monthly volumes almost tenfold from 2017 to 2024, proving once again that winning businesses can do well – even in a stagnant economy.

CONCLUSION

We think that the competitive advantage period for WBC will be significantly longer than what is currently being priced in. It is the leader in its industry with no sizeable peers. WBC shows promise of attractive organic growth, both by growing its market share and potentially expanding its overall market. As the scale of WBC’s operations increases, its moat grows and its low cost advantage improves. We forecast that unit economics and overall margins will further improve as a result. Its unique positioning will continue to deliver robust growth in free cash flow per share for years to come and, at only an 11 times price-to-earnings multiple, investors don’t have to pay much for this potential.

[1] TransUnion

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US reader

This article was initially published on 24 April 2023 and revised on 3 May 2024 to enhance clarity.

South Africa - Personal

South Africa - Personal